Key Takeaways

- A proposed retaliatory measure was taken out of the Big Beautiful Bill, reassuring many in the international business community.

- But there are still potential areas of dispute for the global minimum tax.

- Trump has other tools he could use to retaliate if the global min tax agreement breaks down.

- OBBBA's foreign entity of concern rules add new complexity to supply chains.

- New tariff costs will require a second look at transfer pricing arrangements.

Many multinational businesses breathed a sigh of relief when proposed Sec. 899 was taken out of the One Big Beautiful Bill Act—following the announcement of an agreement between the United States and Group of 7 nations on the 15% global minimum tax.

Sec. 899 was a retaliatory measure that would have potentially imposed significant tax costs on companies from countries that enacted “unfair” taxes on U.S. companies, such as the under-taxed profits rule, one of the key enforcement provisions for the global minimum tax. Many foreign-based taxpayers doing business in the U.S. worried they would be caught in the crossfire of an escalating trade war over this issue.

U.S. Treasury Secretary Scott Bessent announced on June 26 a “joint understanding” between the U.S. and the rest of the G7 that would ensure that U.S. companies would not be subject to the UTPR. The G7 and Organization for Economic Cooperation and Development soon also confirmed the announcement, and Republicans removed 899 from the bill, claiming it was no longer necessary.

But while that largely removed the possibility of new retaliatory taxes over the global minimum tax, also known as Pillar Two, it’s not entirely gone. So far, none of the parties have released any further details about the “joint understanding,” which for now seems more like a high-level handshake agreement than a formal truce. There are still many questions about how this understanding could work in practice.

And, should the Trump administration decide that the deal isn’t being followed—or if it changes its mind about it—there are other tools it could use to retaliate in existing law. Those aren’t as tailor-made for the situation as the Sec. 899 proposal, but they could be even broader and more impactful.

One of those is I.R.C. Sec. 891, which President Trump has already threatened to use over Pillar Two. The 100-year-old, never-used law allows the president to double taxes on foreign-based taxpayers, if he finds that their home countries have imposed “discriminatory or extraterritorial” taxes on U.S. corporations or individuals. It’s unclear if this law is usable today, but it could be a blunt and potentially devastating instrument for applicable entities. One saving grace is that it would only apply at the president’s direction—the 899 proposal could have applied regardless of any White House or Treasury action, an aspect that raised significant concerns among businesses.

There’s also Sec. 301 of the 1974 Trade Act, which allows the president to enact retaliatory measures against countries with “unjustified, unreasonable, or discriminatory” policies that hinder U.S. commerce. Trump has investigated using that against digital services taxes, which lawmakers from both parties have been harshly critical of. Normally, officials are reluctant to use trade measures on issues of income taxation, but the lines have gotten blurrier in recent years.

All sides here have strong reasons to make this agreement work, and avoid further confrontation. But the trade tension that has escalated between the U.S. and the rest of the world during the Trump administration could always threaten to spill over into the global minimum tax negotiations—as one European Union minister recently suggested.

Multinational companies can welcome the good news about cooperation, but will also need to remain attentive to this process as it continues for the coming years.

Noteworthy Items This Week

“For tax years moving forward, you're going to have to analyze your ownership structure — even your debt structure, your contracting structure, your supply chains — because they’ve added this" limitation, Hall said. “So a lot of work is having to be done if you think you've got a foreign entity connected to you when you're claiming these credits.”

Moving On From Retaliatory Taxes – Mindy Herzfeld, Tax Notes ($):

How the Forthcoming Tariffs Will Impact Transfer Pricing – Aldo Engels and Jan-Willem Kunen, Bloomberg Tax:

Managing the TP impact of tariffs within the existing supply chain setup is critical to mitigate double taxation risk and ensure a defensible, consistent profit allocation in the face of external shocks.

EU Parliament Committee Approves Tax Simplification Proposals – Saim Saeed, Bloomberg Tax ($):

The committee also proposed to simplify tax declaration procedures for savings and investment accounts and to streamline the use of tax identification numbers to ease administrative cooperation and reporting, according to the release.

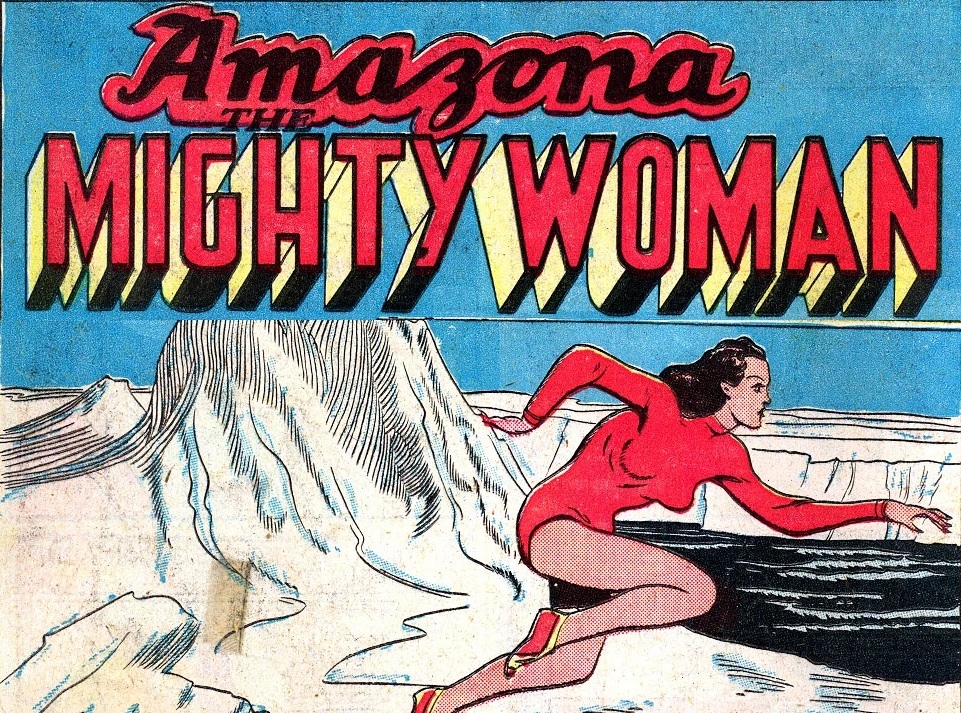

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Amazona: The Mighty Woman

Debut Year:1940

Debut Publication: Planet Comics #4

Origin Story: The last survivor of an ancient Arctic race of superbeings, she came to civilization after meeting an American explorer.

Superpowers: Aside from super-strength and agility, she can survive in frigid temperatures.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.