Key Takeaways

- The U.S. and G-7 announced an agreement on the contentious 15% global minimum tax last week.

- The deal would avoid retaliatory measures between the U.S. and countries participating in the minimum tax system.

- Neither side has revealed much about how the agreement would work in practice.

- Treatment of tax credits could be crucial to narrowing the divide.

- While Canada has repealed its digital tax, so far no countries are following its lead.

The international tax world is still digesting last week’s news that the U.S. and the G-7 nations have reached an “understanding” on how the Organization for Economic Cooperation and Development’s 15% global minimum tax and the U.S. tax system can move forward “side-by-side.” The detente, once seen as a long-shot, may have avoided a trade war over international taxes that once seemed all but inevitable.

It’s a deal that could be affecting international taxes for decades to come. But as in all deals, the devil is in the details.

Those details were sparse in last week’s announcements from both U.S. Treasury Secretary Scott Bessent and the G-7. According to the latter’s statement, U.S.-parented groups would be exempt from the two primary taxing rules that countries have enacted to implement Pillar Two–the income inclusion rule (IIR) and the under-taxed profits rule (UTPR). The UTPR in particular had been a lightning rod for U.S. critics of Pillar Two, as it could potentially apply to the U.S. income of U.S. companies. In exchange, the Trump administration asked that a retaliatory provision, Sec. 899, be dropped from the tax legislation moving through Congress.

The deal would seem to satisfy the U.S. demand of separation and peaceful coexistence between the OECD system and the U.S. international tax regime, including the tax on global intangible low-taxed income (GILTI). But how would it work? Could an expansive safe harbor – currently seen as the most feasible way for countries to alter their Pillar Two tax laws – cover it? And, perhaps most importantly of all, would U.S. companies still need to file Pillar Two tax returns, which many companies say is more burdensome than paying the tax itself? (There are some remaining Pillar Two taxes not covered by the deal, such as the qualified domestic minimum top-up tax, a local tax that the U.S. stopped short of opposing outright.)

Crucially, the G-7 said the understanding would include new work on nonrefundable tax credits, one of the biggest unresolved issues between the U.S. and the OECD. Currently, non-refundable credits such as the one for research and development can trigger significant Pillar Two liabilities. But if other countries can agree to treat those credits the way the system treats refundable credits–which are recognized more as a subsidy than as a tax measure–it could remove much of the remaining divide.

There are still a lot of question marks. And, despite removing the Sec. 899 proposal, if the Trump Administration decides it doesn’t like the deal or believes other countries aren’t following it, Treasury could use existing laws such as Sec. 891 to retaliate.

Canada Digital Services Tax

And that wasn’t the only recent cease-fire declared in the international tax world. Canada on June 29 announced it would rescind its 3% digital services tax (DST) on online revenue, just days after Trump declared the U.S. was walking away from trade talks with Canada over the levy. U.S. officials have long maintained that DSTs discriminate against U.S. companies, since so many of the world’s largest tech firms are based in the U.S.

Some were surprised that DSTs weren’t included as part of the Pillar Two agreement, but they’ve really always been two separate issues. DSTs attempt to capture revenue from online markets that allegedly escape income taxation due to the lack of a physical presence, while Pillar Two is about tracking value generation from intangible assets that lay at the end of complex tax structures. Supporters of DSTs initially claimed they were a temporary patch to the global tax system until a broader fix could be negotiated. But as talks on a new global tax agreement (that’s Pillar One) have stalled, the DSTs have stayed in place.

And despite Canada’s decision, they’re likely to remain on the global tax stage for a while. The United Kingdom has refused to withdraw its own DST amid trade talks with the U.S., and most of Europe appears to be following suit. Trump–who once threatened to tax French wine and champagne over the issue–has his work cut out for him if he hopes to beat back the dozens of digital taxes already on the books.

Noteworthy Items This Week

The GLOBE rules, which consist of the IIR and the UTPR, are the main charging provisions under pillar 2. Most members of the inclusive framework on base erosion and profit shifting, including the United States, agreed in principle to the plan in October 2021.

EU Commission Doesn’t Foresee Need to Change Pillar 2 Directive – Elodie Lamer and Sophie Petitjean, Tax Notes ($):

She added that a safe harbor agreement was already valid for U.S. multinationals until the end of 2025. “So basically, what we are now going into with the new agreement with the United States will be a dedicated permanent safe harbor, which is still subject to OECD approval.”

US’s ‘Side-by-Side’ Deal on Global Tax Faces Arduous Road Ahead – Laura Vella and Somesh Rha, Bloomberg Tax ($):

U.N. Tax Convention Work to Focus on Cross-Border Taxing Rights – Sarah Paez, Tax Notes ($):

Registered businesses can use HMRC’s online service to administer the Pillar Two obligations in the UK, it said. HMRC expects more businesses to register over the next 12 months.

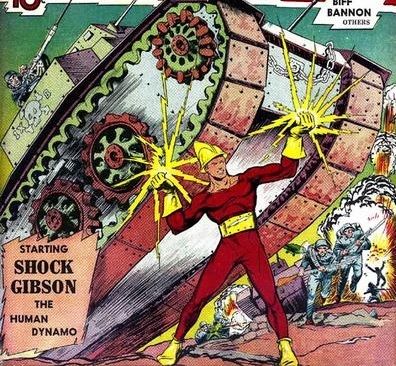

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: The Human Dynamo

Debut Year:1939

Debut Publication: Speed Comics #1

Origin Story: After lightning struck his lab, wealthy scientist Charles Gibson gained the power to conduct electricity, which he used to fight crime and the Axis during World War II.

Superpowers: Aside from being able to generate enough electricity to destroy a tank, he can also fly.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.