The Trump administration has been

uncharacteristically quiet lately on Pillar Two, the 15% global minimum tax. But the

other international tax kerfuffle that could turn into a trade war, over digital services taxes, just got a push into the spotlight. Secretary of the Treasury Scott Bessent

recently told Europe that before even discussing a trade deal with the U.S., European Union nations would need to withdraw the "unfair" taxes, laying the gauntlet down on a contentious issue which has lasted through several administrations.

This elevation could be good or bad, from the point of view of companies who’ve either paid the tax on online activities, or set money aside for anticipated liabilities. On the one hand, it could mean this finally gets resolved, after years of stalling as Organization for Economic Cooperation and Development negotiations have run aground and the potential for retaliatory tariffs under Section 301 has hung in the air.

But conversely, including this in Trump’s highly divisive tariff fights could complicate the longstanding bipartisan consensus in D.C. against the unilateral tariffs.

The DSTs target revenue (not profit) from certain digital activities, such as online advertising or data collection from social networking. Countries which have enacted them claim they’re a stopgap measure until the global tax system can address inadequacies which allegedly allow income from savvy and largely online tech companies to go untaxed. But U.S. officials claim they’re targeting American companies in particular, since so many of the world’s largest tech giants reside in the U.S.

Pillar One, an OECD project which was negotiated along with Pillar Two, would have addressed the issue by capturing some of these transactions in a new taxing regime enacted by a proposed multilateral treaty. But with the U.S. opposed (and unlikely to ratify it through the Senate anyways), that solution is all but dead. In the meantime, the first Trump administration began investigations on instituting retaliatory measures—which President Biden suspended but didn’t totally cancel.

At one point in 2019, Trump famously

threatened to tax French wine, as France was one of the earliest countries to enact a DST. (They agreed to delay, and the U.S. ultimately included other iconic French products like makeup and handbags on the list of potential tariffs—but not all wine.)

Aside from France, Canada also enacted a DST, as well as other levies on digital companies. This has also been caught up in Trump’s threatened trade war to our erstwhile Northern ally.

As European countries search for ways to placate the U.S., this could be the beginning of the end for DSTs. On the other hand, with anti-Trump candidates winning elections around the world, maybe this is an issue that Europeans would rather fight on than back down.

The EU Tax Detente?

In a bit of a surprise, the European Union is

reportedly considering several options to respond to U.S.

demands over the 15% global minimum tax—including whether to change the treatment of nonrefundable tax credits, to extend the current safe harbor permanently, or to grant an overall exemption to the U.S. Any change of Pillar Two substantial enough to meet U.S. concerns would require the EU to amend its implementation directive, or at least change how it is applied. (That requires unanimity among all of the EU members.) So the EU is a crucial body for any Pillar Two negotiations, even if the primary discussions are still happening at the OECD. (A sometimes confusing dynamic.) Already, some EU countries are

balking at the proposals.

Other Noteworthy Items This Week

Trump’s statements point to a central riddle of his trade agenda—whether the point of higher tariffs is raising money or gaining leverage to strike better deals with trading partners, as some administration officials and congressional Republicans insist. But even if Trump left high tariffs in place, the revenue wouldn’t come close to the amount raised by income taxes for people making under $200,000.

EU Tax Observatory Urges More Talks on Pillar 2 Tax Incentives – Elodie Lamer, Tax Notes ($):

The observatory looked at 295 tax reforms over that period, during which 141 base-narrowing measures decreased companies' effective tax rate by 2.1 percentage points. “The large impact of base-narrowing reforms is partially softened by the adoption of many anti-tax-avoidance regulations often stemming from international agreements,” the observatory said in a policy note published May 6. The note builds on a previously released working paper on multinationals' declining tax rates and the role of tax reforms in those changes.

Glitch in Global Tax Rules Leaves Companies Guessing – Lauren Vella, Bloomberg Tax ($):

The global minimum tax rules aren’t clear on the treatment of a “return to provision,” or RTP—an accounting rule that requires companies to adjust their financial statements when they incorrectly estimate how much tax they pay.

Adjustments to the statements are typically made between when accounts are finalized and when tax returns are filed.

This poses a timing problem—and a potentially larger tax bill—for companies that are required to pay the global minimum tax based on financial statement income on an annual basis, because it could reduce their effective tax rate below 15%. The deadline for filing a global minimum tax return is 18 months after the year end.

Revenue Solutions to Avert U.S. Fiscal Calamity – Mindy Herzfeld, Tax Notes ($):

The one untapped pot of gold that the United States has not previously considered as a revenue source is the enormous profits generated by U.S. tech companies. The United States has been fighting a battle against other countries’ digital services taxes for the better part of a decade, so it may seem counterintuitive for a DST proposal to appear on a menu of U.S. revenue options. But Massachusetts Institute of Technology economists Daron Acemoglu and Simon Johnson, the 2024 winners of the Nobel Memorial Prize in economics, have proposed a flat tax as an excise tax on digital advertising revenue, set at a high rate on companies that generate revenues in excess of some low threshold (they propose $500 million) (Acemoglu and Johnson, “The Urgent Need to Tax Digital Advertising,” MIT Shaping the Future of Work Initiative (Apr. 2024) (reprinted from Network Law Review (Mar. 25, 2024))). Acemoglu and Johnson argue that the tax should be in the form of a tax on gross revenues rather than profits “because it is too easy for these multinational companies to hide profits in low tax offshore jurisdictions."

In announcing sweeping tariffs in early April, including a 10% baseline rate on all imports, Trump said the trade measures would lead to more domestic production and new investments in U.S. manufacturing. But in addition to the countermeasures and economic uncertainty that the tariffs have sparked, the goal of onshoring production may face an obstacle in the form of an international tax provision created during Trump's first term.

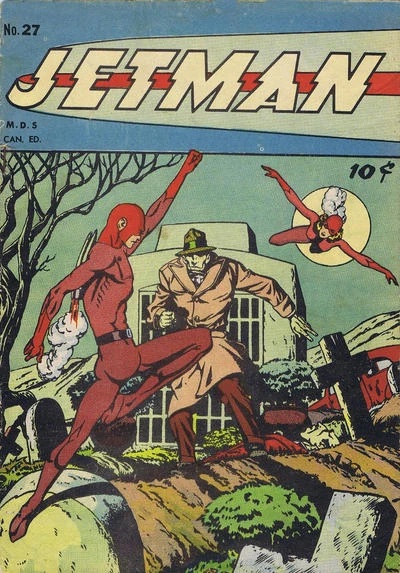

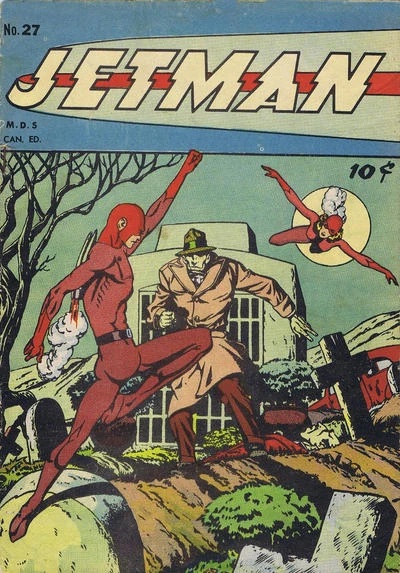

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Jetman

Debut Year:1945

Debut Publication: Jetman #1

Origin Story: Unknown--Jetman never had any actual stories, but rather appeared on covers of comics reprints featuring other superheroes. (A common industry ploy of the age.)

Superpowers: Flight, apparently. And an impressive kick.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.