International Tax

Global expansion is full of complex decisions. Take the guesswork out of international tax planning with the help of Eide Bailly.

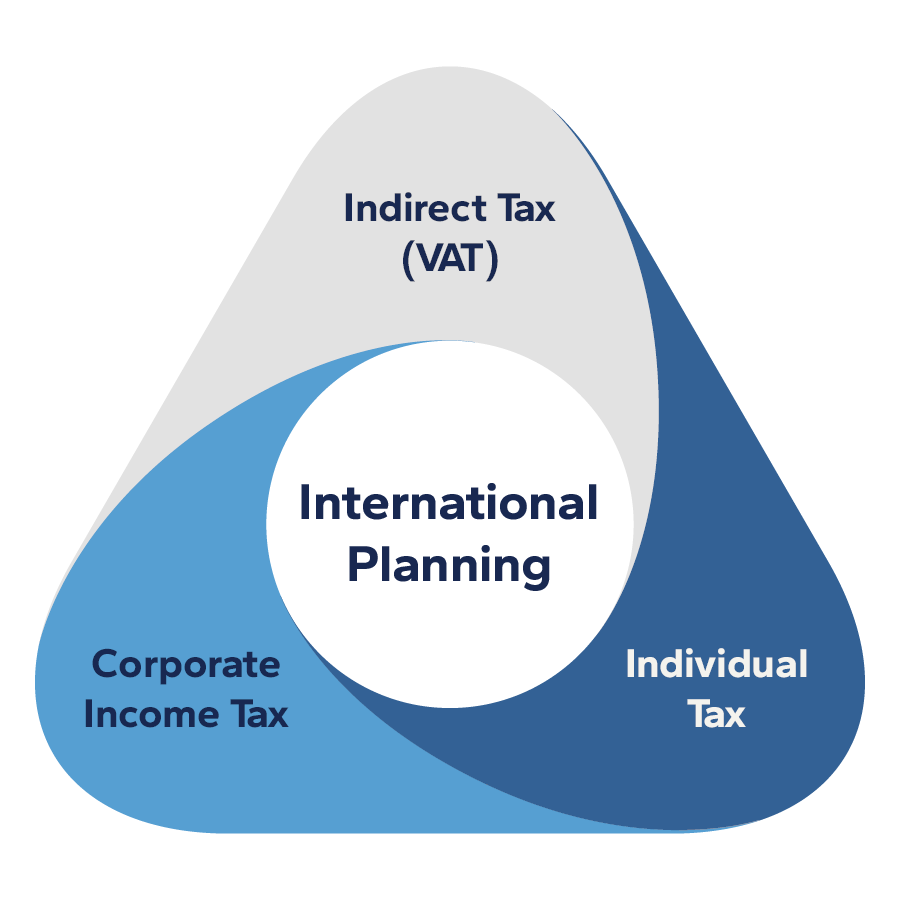

Doing business internationally can be complicated, and setting your business up for success includes being mindful of creating a tax efficient model at the outset. Whether you are just starting or have an established multinational business, an experienced advisor can help you make confident decisions in these areas. Specific expertise, including language fluency, in the countries where you operate and/or have sales can help ease the burden and the headaches of determining the right course of action.

Eide Bailly’s international tax professionals not only deliver exceptional service through their own expertise and experience, they also have access to a global network of CPA firms through our membership in HLB Global. We can tap into the knowledge of top accounting and tax professionals in the countries and cultures where you do business to help you achieve success.

What We Offer

International Business Structuring

US Inbound Services

Global Mobility Programs

Foreign Trust Compliance & Estate Tax Planning

Export Tax Incentives

Offshore Voluntary Disclosure

Transfer Pricing

China Help Desk

Stay Up to Date

Connect Your Business to the World with HLB Global

Navigate Tariffs with Confidence

Planning minimizes your global tax burden.

Eide Bailly is dedicated to helping businesses expand and grow internationally. We’ll help you manage the complexities and chart a path forward for your international operations.

International Tax Leadership

Shannon M. SmithCPA

Partner/International Tax Practice Leader

Jared G JohnsonEA

Principal/Global Mobility Practice Leader - International Tax

Aaron BoyerCPA

Partner