Key Takeaways

- The GOP tax bill would retaliate against countries using the OECD system.

- It would apply automatically, without needing a declaration from the president.

- A self-executing rule could raise the stakes in the U.S./OECD standoff, by preventing Treasury from backing down.

- U.S. Treasury officials say a deal needs to be in place by the end of the year.

- The tariffs will offset any economic gains from the tax bill, a conservative think tank finds.

In the classic Cold War satire “Dr. Strangelove,” the U.S. finds itself up against a “Doomsday Machine,” guaranteeing an automatic, cataclysmic Soviet retaliation to any attack, even if the U.S.S.R. leaders try to stop it. Only by tying the premier and military’s hands, and removing the possibility of any wavering, could the Russians gain the ultimate leverage against their foe in a nuclear standoff.

Or so they thought. If you’ve seen the movie, you know it doesn’t go exactly as planned.

A new provision in the GOP tax bill works on a similar principle, kind of, creating automatic, self-executing retaliatory measures. In this case, it’s not missiles but tax hikes on companies based in countries which enact laws under the 15% global minimum tax which could tax U.S. income. And while not quite “doomsday,” the provision could cause significant economic harm to foreign investment in the U.S., according to representatives of foreign-based businesses who are opposing the provision.

By removing any discretion by the president or the U.S. Treasury secretary, would this law create irresistible pressure for countries to comply with U.S. demands and remove any overlap between the minimum tax, also called Pillar Two, and the U.S. tax system? Or could it backfire with further escalating trade wars?

The new law works by increasing existing taxes—including income tax as well as withholding taxes and the base erosion and anti-abuse tax on cross-border payments—for companies based in “discriminatory foreign countries.” If enacted, it would exist in the tax code alongside Section 891, a longstanding, never-used tool which Trump has already threatened to use to retaliate against countries using Pillar Two against U.S. companies.

But while 891 is triggered by a presidential finding of discrimination, the new law would require the Treasury Department to list discriminatory jurisdictions, under a broad definition, with the new tax imposing automatically against those countries, with rates steadily rising over time. And for extra measure, the new law also explicitly lists the under-taxed profits rule—the most prominent Pillar Two tax that could be used against the U.S.—as well as other laws that U.S. officials have opposed, such as digital services taxes and diverted profits taxes. So, in theory, companies would need to worry about these new tax measures, even without any action from Treasury.

In practice, there may be some wiggle room. The executive branch has exerted a lot of authority over the implementation of new laws over the years, and President Trump in particular has been accused of ignoring legal requirements when it suits him. Other countries may be skeptical that this law would truly force his hand, and prevent him from backing down.

This is also draft language in a version of legislation working its way through the House of Representatives. (It’s partially based on a bill from Rep. Jason Smith, R-Mo., the Ways and Means Committee chairman, though his language gave the president more discretion.) At the time of this writing, it has not yet been approved by the full chamber—and even if it does, the Senate will likely revise it heavily.

So this could be seen as more of a shot across the bow of countries participating in the Organization for Economic Cooperation and Development’s project, as the Trump administration also turns the screws on the rest of the world.

There’s another interesting point to note. The bill would apply to countries with discriminatory taxes that could affect U.S. taxpayers–not just when such taxation has already occurred. So partial safe harbors and exemptions in the Pillar Two system which would prevent U.S. taxation most of the time still might not stop the retaliation.

Only the total removal of any potential U.S. taxation would negate the threat–and this happens to be what the U.S. is currently demanding.

Noteworthy Items This Week

U.S. Pillar 2 Safe Harbor Must Happen by Year-End, Burch Says – Stephanie Soong, Tax Notes ($):

Concerns that a side-by-side system would give the United States a competitive advantage are questionable, Burch said. However, the United States remains committed to identifying arbitrage opportunities and addressing those concerns, she added.

IRS Urged To Scrap Biden-Era Economic Substance Ruling – Natalie Olivo, Law360 Tax Authority ($):

Chemical Businesses Urge Treasury to Retain US-China Tax Treaty – Jeffrey Hors, Bloomberg Tax ($):

Robert B. Flagg, the group’s senior director of federal affairs, wrote that the treaty is essential for companies’ operations since it provides a definition of permanent establishment, thus limiting China’s ability to tax US operations, along with rules for taxing operations in China and a mutual agreement procedure for settling disputes.

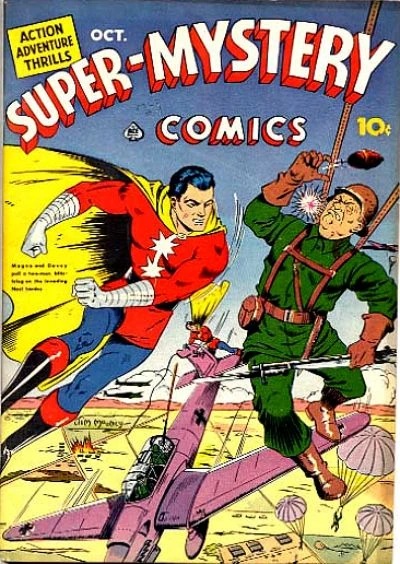

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Magno the Magnetic Man

Debut Year: 1940

Debut Publication: Super-Mystery Comics #1

Origin Story: After being electrocuted and brought back to life, he donned a superhero cape to fight the Axis during World War II.

Superpowers: His accident gave him the power to manipulate magnetism, including to fly and to draw or repel pieces of metal..

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.