Key Takeaways

- Global expansion involves complex business decisions.

- People, products, financial, legal, and tax structuring all contribute to successful global growth.

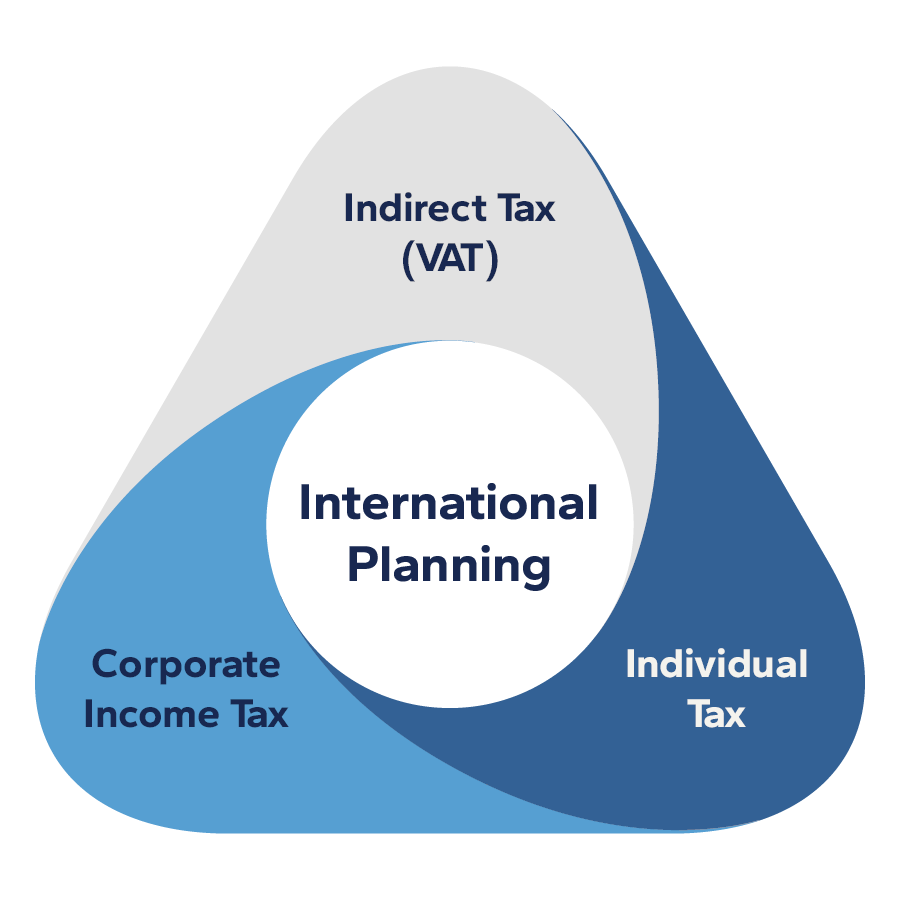

- Minimizing your international tax burden requires a review of a variety of factors including corporate income tax, indirect tax, and individual taxation.

In a post pandemic, digitally optimized world, international business does not seem to be slowing down. According to the International Monetary Fund, trade growth will accelerate to 3.5% in 2024. International business investments have recovered and are swiftly growing while cross-border M&A remains even.

While the economic environment seems ripe for international expansion, it’s important to ensure you’ve laid the groundwork to do so successfully. Over 50% of business leaders are evolving their talent model for the future of work and 67% are working toward improving operational efficiencies to remain profitable.

All this adds up to the need for a proactive international growth plan that involves a forward-thinking approach to people, products, taxation, and business solutions.

Products and Services

One of the first steps in global expansion is to determine what product or service you’ll be selling and how. For products, will the sales be distributed from the US or will a third-party distributor? Will your business set up its own distribution company? Can you provide services remotely or do you need to transfer or hire in-country?

Ask yourself: what portion of the supply chain do you intend to expand overseas?

People

Businesses need to make a variety of decisions related to the people involved, both within the existing organization and the new business. For instance, who will own the expansion process and what kind of international hirings will the company pursue? Will the company use independent contractors? If hiring in another country, who will ensure compliance with local employment laws?

Further, sourcing talent will be essential to consider. According to HLB, 35% of international business leaders see talent acquisition as their greatest weakness. Employers must look for competitive compensation packages, including commission, salary, pension, stock, and more. In addition, consider a variety of recruiting options and what roles are needed in both the short and long term.

Location

As you look to expand your business internationally, make sure to consider geographic location as part of the process. Access to customers, talent, and suppliers will help inform this decision. In addition, pay attention to currency, tax structures, and real estate availability.

Strategic Business Systems and Resources

Legal, regulatory, and financial factors all play a role in international growth.

Legal/Regulatory Concerns

Legal advice is needed in both countries to help streamline expansion and work through intellectual property protection, as well as business and patent registrations.

Other areas where legal advice may be necessary include:

- Product registration

- Entity selection and setup

- Employment agreements

- Immigration issues

- Customer and supplier contacts

- Import and export regulations

Financial and Currency Issues

There are also numerous considerations when it comes to financial obligations in international business structuring. A business must consider what currency it will do business in. This may lead to foreign currency conversion issues, international banking considerations, foreign exchange controls and other monetary issues.

You’ll also need to ensure your financial and business systems can handle international business transactions. Look for ERP and financial accounting systems that can handle multi-currency options, indirect tax, and consolidation.

Minimizing Tax Risks and Costs

International tax planning requires a comprehensive and proactive approach to potential tax issues across corporate income tax, individual tax, and indirect tax.

Corporate Income Tax

It is important to determine whether your activity will cause a taxable presence for the company in another country. The answer will vary by country and whether the U.S. has a treaty with that country. The standard activity threshold which triggers taxation can be low. If doing business in a jurisdiction that has a tax treaty with the U.S., the threshold for taxation may be increased. However, this is quickly changing in a digitally based economy.

A key factor in making this determination is identifying the activities that will happen outside the U.S. in both the short and long term. Where will activities like sales, services, or e-commerce occur?

Another important component is the structure of your business. Different structures result in different tax considerations for organizations.

Choosing the right structure for your organization is an essential component of international tax planning and can directly impact your business. For instance, a U.S. LLC may be viewed as a corporation in many other countries and create unexpected tax consequences. Following are a few structuring options with high level considerations:

- An international tax specialist can help you work through the implications of various structuring opportunities. Talk to our team today.

Indirect Tax

Indirect taxes are important to consider but if done correctly, should not be an economic cost for the business. These taxes create an administrative burden for the business as there is a cost of compliance. Think of indirect taxes like sales and use tax except it is administered differently and can apply to services. In Europe, this is known as a value added tax (VAT). In Canada, Australia, and India these are referred to as goods and services taxes (GST).

Lastly, businesses that import goods into another country may need to consider customs and duties tax obligations and filings.

Individual Taxation

Expansion into global markets also creates individual taxation issues for all employees. Companies will need to consider whether to hire local talent or ask current employees to relocate, or both. When it comes to considering employees, ask:

- What phase is the company in and how will it impact employment needs?

- What are the employee and employer withholding and reporting obligations?

- When should you consider a global mobility program?

Payroll will be different by country based on if it is a local employee versus an expatriate employee. This will also impact employment tax withholding, corporate income tax filing, and a variety of public reporting requirements.

- A global mobility strategy can help an employer seamlessly transition employees and their families to a foreign company while keeping the company in compliance. Learn more.

Take a Proactive Approach to International Expansion

In a business environment constantly in flux, many business leaders are turning an eye toward the future. In fact, over 40% of leaders are hoping to keep a long-term focus instead of surviving on short-term tactics. When done right, global expansion offers an incredible opportunity for innovation and growth. However, proactive strategies and decisions are required across all levels of the business, and understanding the role each of these pieces play in your overall global expansion plan is critical.

We’ll work with you to understand your unique situation and navigate the complexities of international expansion.

Expand Internationally

Implementation & Optimization

Plan and execute your technology implementation with expert advice and guidance.

Who We Are

Eide Bailly is a CPA firm bringing practical expertise in tax, audit, and advisory to help you perform, protect, and prosper with confidence.