Key Takeaways

- Adopting AI and automation solutions is essential for unlocking workforce potential and driving organizational growth.

- Effective technology implementation directly impacts employee satisfaction, retention, and employer recommendations.

- Building a culture that empowers managers, supports skill development, and engages employees is key to attracting and developing top talent.

Every hour your team spends on manual tasks is an hour you lose on driving growth, innovation, and customer value. Here’s the truth: the way you implement and optimize technology will be a key differentiator in the race for top talent.

Organizations that embrace AI and automation aren’t just investing in technology — they’re redefining how work gets done.

Think technology doesn’t have an impact? Salesforce research shows dissatisfaction with technology makes employees twice as likely to leave and less likely to recommend their employer.

Here’s how to make workforce strategy a competitive advantage across your organization.

Operations: Build a Culture That Attracts and Develops Talent

Workplace culture is often a top reason employees leave (or stay). According to a Gallup study, last year employee engagement in the U.S. dropped to its lowest level in more than a decade.

To build a high-performing workforce, operational leaders must focus on creating an environment where top talent can thrive. That means:

- Empowering managers to lead with clarity and empathy.

- Providing growth paths that support skill development.

- Regularly engaging employees to understand roadblocks and opportunities.

When you streamline and centralize your roles, collaboration improves, productivity increases, and the workforce becomes easier to scale, especially during growth or transition periods.

Defining roles and responsibilities also helps in understanding where your people are experiencing bottlenecks. By refocusing your workforce on strategic, high-impact tasks, you foster innovation, retention, and job satisfaction — all while boosting operational output.

Enter automation and AI. The key to successfully implementing automation and AI is in developing a thoughtful strategy that considers your people, processes, and technology.

Remember: you shouldn’t select a technology first and then see what problems it can solve; you will be better served by deciding which problems you need to solve and then finding a technology that provides a solution.

You can automate any process, but you must consider whether the process is worth automating in the first place.

Automation in HR

For one client, our team was able to orchestrate the hiring process to flow seamlessly between departments using the software they already used daily. Their new automation functions as a “digital project manager” that is programmed to enhance the process and reduce inefficiencies. When someone is ready to hire a new role, they simply enter the required information in Microsoft Teams, which is then immediately transmitted to the HR department, who receives a notification about their next step. After those steps are complete, a notification is sent to the IT department signaling their upcoming tasks. This is all done by leveraging the software that the team already uses, so there’s no switching back and forth between systems.

- Maximize ROI by Optimizing Your Current Tech Stack. Watch On Demand.

Finance: Balance Headcount, Automation, and Outsourcing

For CFOs and controllers, AI can help automate repeatable tasks like report generation or vendor invoice processing. Similarly, outsourcing functions like project management or specialized IT roles can provide faster results without long-term cost commitments.

Cross-functional committees, such as automation or process improvement groups, often don’t include financial representation. Including finance in these conversations early can lead to more informed ROI calculations, better vendor decisions, and budget alignment from day one.

Technology: Develop a Workforce Skilled in AI and Automation

Technology leaders face a dual focus: support current operations while preparing for a future that includes AI, automation, and new digital tools — and it requires a different kind of workforce.

But many organizations are under-resourced. Key roles like business systems analysts or data engineers are either missing or overloaded. In one assessment, we found that 100% of interviewees expressed concern about overreliance on a single senior data engineer, a major risk to continuity and scalability.

You don’t need to build a tech dream team overnight, but you do need a plan to scale skills and spread responsibilities.

Start by identifying gaps:

- Do you have the right project management support for upcoming initiatives?

- Are your analysts empowered to support more than one application?

- Is your IT team included in your automation strategy?

Then, consider how to augment your team:

- Upskill employees in areas like data analytics and automation.

- Leverage vendor partners for high-skill needs or overflow work.

- Shift IT leadership from firefighting to strategy by offloading tactical work.

Industry Impacts

AI and automation also have significant industry implications. And while every sector is feeling workforce pressure, the right solutions vary by industry.

Automation in Construction

One of our clients faced significant challenges extracting data from their insurance claims management system and pushing information into their analysis system due to a lack of open API access. On top of that, each insurance carrier required special approval, creating additional roadblocks.

Our team built a solution where automation pulls data and documentation (like photos and work details) directly from their CRM — where their team is already managing mitigation work — and sends that information into the analysis system. This eliminates the need for duplicate data entry and ensures all employees can continue working in a single, familiar environment.

Automation in Healthcare

A managed care provider serving individuals with disabilities through both in-home and out-of-home care services would spend days submitting Medicaid claims one-by-one through state-run portals.

Our team built a custom robotic process automation (RPA) solution that utilizes their existing billing spreadsheet and submits each claim to the correct state’s Medicaid portal. Once the automation process is complete, they receive an email detailing the results of all submitted claims, including whether they were accepted, rejected, or if there are errors to be reviewed.

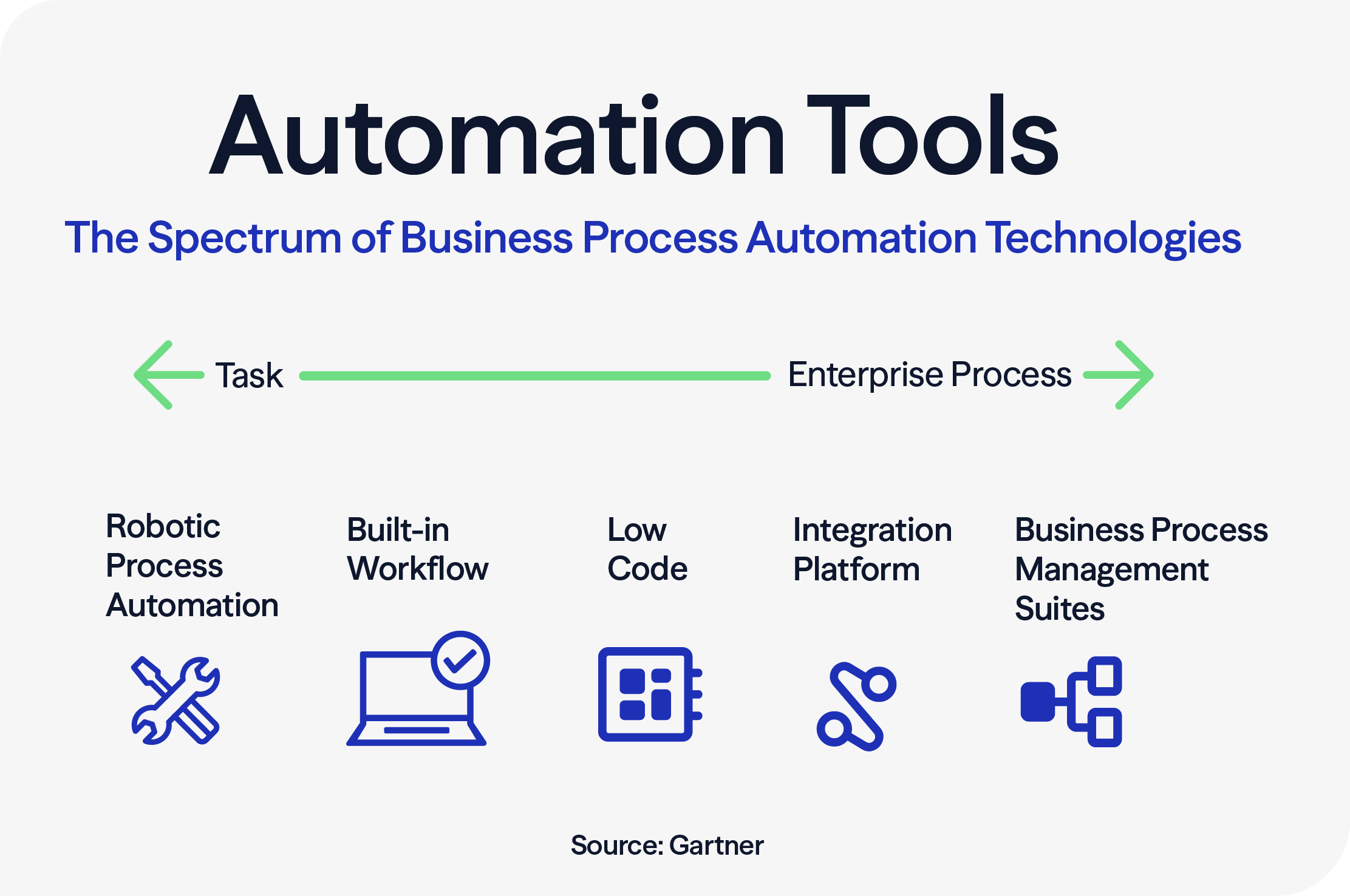

Additional Automation Use Cases

- Built-in workflow automation can streamline the approval process for expense reports. When an employee submits an expense report, the workflow system can route it to the relevant managers for approval, automatically notifying them and tracking the progress until the report is approved or rejected.

- Low code platforms can be used to automate the creation of simple mobile app interfaces. For example, a low code platform can enable a non-technical user to quickly build a basic mobile app for collecting customer feedback without writing extensive code.

- Integration platforms can automate the process of synchronizing customer data between a CRM system and a marketing automation platform. When a new customer is added or updated in the CRM, the integration platform ensures the same data is reflected in the marketing automation system.

- iBPMS can automate complex decision-making processes. For instance, in a loan approval process, an iBPMS can automatically evaluate an applicant's credit history, income, and other relevant data to make an informed decision on whether to approve or deny the loan application.

How to Know When to Invest in AI and Automation

To shape your digital strategy, review your team's capabilities, business structure, and technology stack.

- Identify organizational strengths and weaknesses.

- Assess team skills and staffing levels. Do they have the expertise and willingness to change?

- Evaluate processes and their technological efficiency. Are there manual tasks? How effective are current systems?

- Analyze current technology systems for gaps that impact business objectives.

- Ensure existing processes are necessary and valuable by asking: Is there a business need for the current method? What value does it add to the business or customers?

Not every initiative requires a massive overhaul. Recognize AI for what it is and where it can actually add value.

It’s important to remember that AI doesn’t have to be ground-breaking.

Quick wins — like streamlining invoice approvals or syncing customer data between systems — can deliver fast ROI and build momentum. But true impact happens when these wins are aligned under a broader modernization strategy.

Overcoming Common Challenges with AI and Automation

Currently, 61% of finance leaders report they’re in the early stages of exploring generative AI. Meanwhile, only 4% said they’re maturing and scaling their AI use. Why?

Where organizations struggle most is in developing a strategy, constructing a scalable architecture, and implementing a governance framework.

- Strategy: Many organizations struggle to define a comprehensive digital modernization strategy. They may not fully understand how technology can best support their long-term objectives, leading to a lack of clarity in their approach. If the strategy is disconnected from the organization’s core mission, it can lead to wasted resources and missed opportunities.

- Architecture: One of the biggest architecture challenges is integrating new digital solutions with existing legacy systems. Another top challenge is ensuring that architecture can scale to accommodate growing data volumes and user loads.

- Governance: Governance challenges often revolve around change management. Getting buy-in from employees and stakeholders, and managing the cultural shift that comes with modernization, can be difficult.

Investing in Your People Through Technology

An investment in technology is an investment in your employees — and in the future of your organization.

Eide Bailly helps organizations harness AI responsibly, aligning technology with strategy, data integrity, and human oversight.

- Take the AI Readiness Assessment.

Frequently Asked Questions About Workforce AI Adoption

How do I know if my business is ready for AI?

Determining your organization’s AI readiness starts with assessing your current processes, data quality, and team capabilities. Start with our AI Readiness Assessment to evaluate your data, processes, and strategy.

What’s the ROI timeline for AI adoption?

The return on investment for AI varies by industry and project scope, but most organizations see measurable benefits within the first 12–18 months.

Is AI secure for sensitive data?

With proper governance, encryption, and compliance frameworks, AI can be implemented securely, even for highly sensitive information.

How does AI impact workforce productivity?

AI and automation free employees from repetitive tasks, allowing them to focus on higher-value work and boosting overall productivity.

How can we help employees adapt to AI and automation?

Supporting your team through change management, clear communication, and ongoing training helps employees embrace new technologies and reduces resistance.

What skills are most important for the future workforce in an AI-driven organization?

Skills like data literacy, critical thinking, adaptability, and collaboration are increasingly valuable, alongside technical competencies in analytics and automation tools.

How do we ensure AI adoption aligns with our company culture and values?

Involving employees in the planning process, prioritizing transparency, and aligning technology initiatives with organizational goals help maintain a positive culture during digital transformation.

What are the best ways to upskill or reskill our workforce for AI?

Offer targeted training, encourage cross-functional projects, and partner with external experts to build AI and automation capabilities across your team.

How can we measure the impact of AI on workforce productivity and satisfaction?

Track key metrics such as task completion times, employee engagement scores, and turnover rates before and after AI implementation to assess improvements and areas for further support.

AI & Automation

Empower your team with AI and automation solutions built for growth. Unlock your full potential.

Data

Get insight at the speed of now with accurate, reliable data.

Who We Are

Eide Bailly is a CPA firm bringing practical expertise in tax, audit, and advisory to help you perform, protect, and prosper with confidence.