Key Takeaways

- Minnesota’s Paid Leave program begins on January 1, 2026, offering partial wage replacement for employees who need time off for family, medical, or safety reasons.

- The program applies to nearly all employees in Minnesota, including small businesses, nonprofits, and remote workers, with a few exemptions such as federal government and tribal employers.

- Eligible workers can receive up to 12 weeks of paid leave per event, with a maximum of 20 weeks per year.

Starting January 1, 2026, Minnesota will implement a comprehensive Paid Family, Medical, and Safe Leave (PFMLA) program, providing partial wage replacement for time off for family, medical, or safety reasons.

Eligible employees can access paid leave for:

- Bonding with a new child

- Caring for a family member with a serious health condition

- Managing their own serious health condition

- Safety leave for domestic abuse, sexual assault, or stalking

- Military-related leave

Who Is Eligible?

The PFMLA applies to most employees in Minnesota, including:

- All employers with one or more employees (no size exemption)

- Small businesses

- Nonprofits and religious organizations

- Agricultural employers

- Municipalities and local government entities

Remote, part-time, and seasonal workers are included if they work at least 50% of their time in Minnesota or live in Minnesota and don’t work 50% of their time in any single state.

Exemptions include:

- Federal government employers

- Tribal nations

- Self-employed individuals (unless they opt in voluntarily starting in 2025)

Minimum Wage Base Requirement

To qualify, workers must have earned at least 5.3% of the state’s average annual wage during the base period. The base period refers to the first four of the last five completed calendar quarters before the leave application. All wages from covered Minnesota employers during this time count toward eligibility.

Amount and Duration of Minnesota Paid Leave

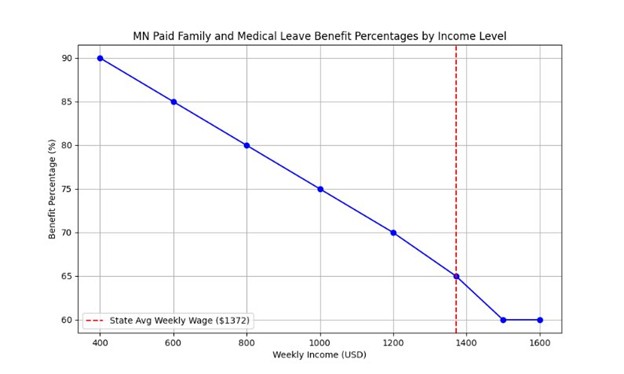

The program offers progressive wage replacement:

- Lower-income workers receive a higher percentage (up to 90%)

- Maximum weekly benefit is capped at 100% of the state’s average weekly wage (currently $1,423)

- Up to 12 weeks per year for a single event

- Up to 20 weeks total per year for multiple events

Benefit percentages decrease as income rises, ensuring greater support for lower-wage workers.

How Is the MN Paid Leave Program Funded?

PFMLA is a state-administered insurance program funded via payroll premiums. The initial rate is 0.88% of wages.

Additional considerations include:

- Small employers (those with fewer than 30 employees and lower average wages) may have their payment rate reduced by 50%.

- Premiums are split between employer and employee, but employers may choose to pay the full amount.

- Employers can opt out with a comparable private plan, which must be approved by the state and requires a surety bond.

Next Steps for the Minnesota Paid Leave Law

There are several steps employers need to take to comply with the new law, including:

- Notifying employees about the program

- Holding employees’ jobs during leave (FMLA-like protection)

- Maintaining reporting and compliance responsibilities, even if opting for a private plan

- Displaying the mandatory PFMLA poster as of December 1, 2025

For more details and official resources, visit the Minnesota Paid Leave website.

Frequently Asked Questions

If I am exempt from filing Minnesota State Unemployment, am I required to do Minnesota Paid Family Leave?

Yes, you are required to set up an MN Paid Family Leave account and report wages and premiums quarterly. There are a few exceptions: The program does not cover independent contractors, self-employed individuals, and Tribal Nations (they can opt in); federal government employees, postal workers, and railroad employees are not covered for their work at those jobs and cannot opt in; and those working in positions designated as seasonal hospitality employment are excluded from Paid Leave for that position (your employer will notify you if you're designated).

If the employer decides to pay the full premium, is this taxable to the employee?

Yes, the portion of the employee’s wages that the employer paid would become taxable to the employee.

If I am the owner of an S Corporation and exclude myself from Minnesota unemployment benefits, do I need to report my wages for Minnesota Paid family leave?

Yes. Wage-taking shareholders are considered employees of an S corporation (S‑Corp). The S‑Corp should set up a Paid Leave‑ONLY Employer Account at uimn.org and report shareholders’ wages.

Can I opt out of Paid Leave?

No.

Close the Year with Confidence

Client Accounting Services

Discover new ways to to improve operations and increase performance.

Who We Are

Eide Bailly is a CPA firm bringing practical expertise in tax, audit, and advisory to help you perform, protect, and prosper with confidence.