Key Takeaways

-

IRS leaves withholding tables unchanged, delaying some tax benefits to 2026.

-

More on IRS disarray and Tea Party Scandal echoes.

-

Tariff day and how tariffs work.

-

Tariffs and car repairs, insurance.

-

Tariffs and transfer pricing.

-

Colorado trust promoter pleads guilty.

-

If you don't appreciate tarantulas, try frozen custard.

Programming note: Learn about how the new tax law affects fixed assets and capital expenditures (and get an hour of CPE) on Monday, August 11, at 2:00 p.m. Central by attending the Eide Bailly webinar New Tax Legislation: Maximizing Tax Benefits through Fixed Assets and Capital Expenditures. No charge, register here.

IRS Says It Will Not Change Withholding Tables Or Form W-2 In 2025, Despite The New Tax Law - Kelly Phillips Erb, Forbes:

The IRS has announced that, as part of its phased implementation of the new tax law, there will be no changes to withholding tables for 2025. The IRS added that there will be no changes to certain information returns, including Form W-2, Forms 1099, Form 941 and other payroll return forms for 2025. Employers and payroll providers should continue using current procedures for reporting and withholding.

According to the IRS, these moves are "intended to avoid disruptions during the tax filing season and to give the IRS, business and tax professionals enough time to implement the changes effectively.”

GOP Pins Midterm Hopes on Trump Tax Bill’s Front-Loaded Refunds, Delayed Cuts -

The IRS announced Thursday it won’t adjust income-tax withholding levels for the remainder of the year to reflect tax cuts in the law. The move will delay savings for most taxpayers but will enlarge refunds paid out early next year, months ahead of the midterm congressional elections in November 2026.

Inside the IRS

LB&I Chief Faces Scrutiny Over Passthrough Exam Unit - Benjamin Valdez and Kristen Parillo, Tax Notes ($):

..

Social media posts from Sen. Joni Ernst, R-Iowa, and advocacy groups have suggested that Paz and Kastenberg were sidelined because of their alleged roles in the IRS exempt organization scandal and for LB&I’s recently formed passthrough exam unit, which detractors argue is a vehicle to target conservative taxpayers.

The article puts the action in the contact of upheaval in the agency under President Trump:

The agency has also lost a quarter of its 100,000 employees under the workforce reduction efforts of the Trump administration, including through the deferred resignation program.

'Liberation Day' Tariffs Take Effect

How tariffs work, and who pays them, as Trump’s levies take effect - Shannon Najmabadi, Washington Post:

This means that in the longer term, the costs added by tariffs are often passed on through the supply chain to consumers. In some cases, this takes time. Businesses can be reluctant to increase prices if they believe that consumers will interpret it as price-gouging, Christiano said.

Some companies have been eating the costs from tariffs, but a growing number including Procter & Gamble and Nike have in recent weeks said they plan to raise retail prices.

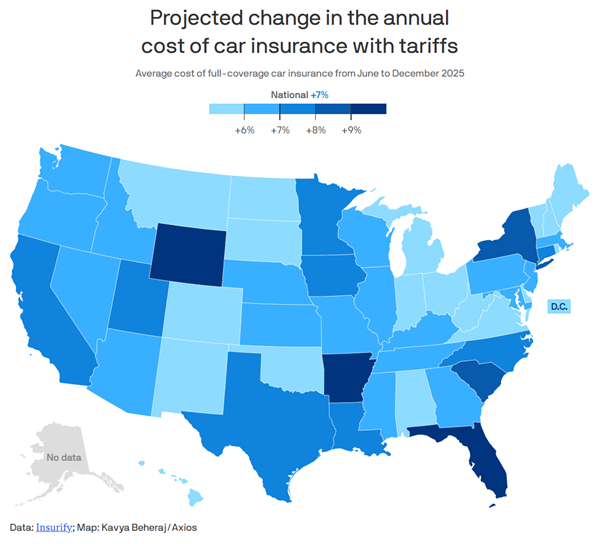

Tariffs could make your car insurance more expensive - Alex Fitzpatrick, Axios. "The nationwide average annual cost of full-coverage car insurance could rise by 7% between June and December if tariffs stay in effect, compared to 4% otherwise, per a new report from insurance-comparison platform Insurify."

Tariff Effects Can’t Hide Themselves From Consumers Forever - Stacy Vanek Smith, Bloomberg ($):

If the strong-arming had worked, the Import Price Index, which tracks what US companies pay for their imported goods, would be falling. But so far the index has been inching up. Interestingly almost the same thing happened during Trump’s first (much more modest) round of tariffs in 2017: Import prices stayed largely the same. Foreign companies aren’t paying for Trump’s tariffs. So who is?

Tariffs Spark C-Suite Deep Dive Into Intercompany Tax Strategy - Caleb Harshberger, Bloomberg ($):

At stake could be billions of dollars possibly lost to audits from newly invigorated teams at tax departments and customs agencies on the lookout for tariff-evading maneuvers.

Related: Eide Bailly Transfer Pricing Services.

New Tax Law Items

GOP Tax Law Gives Entrepreneurs Incentive to Be C Corporations - David De Jong, Bloomberg Insights:

- A 50% exclusion applies at three years of holding, increasing to 75% at four years and 100% at five years. No partial exclusion previously existed for holding qualified stock less than five years.

- An increase to $75 million indexed in the maximum aggregate gross assets allowed when stock is issued, an increase from $50 million.

- A maximum exclusion of the greater of $15 million lifetime indexed increased from $10 million (one-half for married filing separate) or 10 times the adjusted basis in the stock.

Related: Expanded QSBS Tax Breaks Boost Opportunities for Tech Companies.

Renewable energy winners emerge from Trump’s big tax bill - Martha Muir, Financial Times:

Trump Tax Law’s Clean Energy Credit Phaseouts, Explained - Erin Schilling, Bloomberg ($):

Hydrogen projects must begin construction by 2028 to receive a tax break.

Related: The Impact of New Tax Legislation on Energy Efficiency Incentives.

Reviewing the International Tax Provisions in the One Big Beautiful Bill Act - Alan Cole and Patrick Dunn, Tax Policy Blog:

One such addition was the removal of the qualified business asset investment (QBAI) from the global intangible low-taxed income (GILTI) and foreign-derived intangible income (FDII) calculations, a significant change to the US international corporate tax system, reorienting a system designed to encourage exports and building in America.

Related: Eide Bailly International Tax Services.

Blogs and Bits

Teachers' supplies for classrooms could provide tax savings - Kay Bell, Don't Mess With Taxes. "Taxpayers who can claim the educators expense tax deduction include anyone who is a kindergarten through grade 12 teacher, instructor, counselor, principal, or aide"

CEO Calls into Question His Status as a Responsible Person in Close-Call Decision - Parker Tax Pro Library. "While there was no doubt that the individual held the title of CEO, the court found that he had, by the barest of margins, made a showing that even as CEO, he may not have been a responsible person and thus may not have had actual authority to remit the money owed to the IRS."

If you are a "responsible person," you can be personally liable for your business's unpaid payroll taxes.

6 reasons why tariffs are a terrible way to raise revenue - Brian Albrecht, Economic Forces. "For productive efficiency, you should never tax intermediate goods. Unlike the first models, here the tariff destroys the production process itself, shrinking the entire economic pie before the government even gets a chance to tax the final slices."

Misplaced Trust

Man Pleads Guilty To Tax Evasion, Faces $50M In Restitution - Zach Dupont, Law360 Tax Authority ($, defendant names omitted):

A man accused of numerous financial crimes related to his operation of promoting abusive and illegal tax shelters pled guilty to three charges across two different cases in Colorado federal court on Thursday.

Defendant told U.S. District Judge Regina M. Rodriguez that he was guilty of all the government's accusations in the case, accepting a potential sentence of up to 151 months in prison and nearly $50 million in restitution, to be split with all others who are convicted.

Defendant faces two cases in the U.S. District Court for the District of Colorado. In 2023, Defendant and a Co-Defendant were indicted on allegations the pair, along with several others added as defendants later, promoted a tax avoidance strategy at hotel seminars where they charged business owners up to $50,000 and advised clients to fake their taxes by using sham trusts to hide business income.

The worst $50,000 they ever spent.

What day is it?

Happy National Tarantula Appreciation Day! "These beautiful, elegant, and hairy spider creatures are often misunderstood."

If you still can't appreciate big hairy spiders, it's also National Frozen Custard Day.

Make a habit of sustained success.