Key Takeaways

- New IRS commissioner Billy Long takes office this week.

- One issue he’ll confront is whether to reverse the prior administration’s approach to the economic substance doctrine.

- The doctrine allows the IRS to challenge transactions deemed to lack economic substance, a potentially powerful tool.

- A new trade deal with the EU leaves many lingering issues, including digital services taxes.

- The OBBBA creates a valuable new deduction for exporters.

EU Trade Agreement

President Trump announced Monday a trade agreement with the European Union, with EU officials agreeing to a 15% U.S. tariffs on most European exports. There will be a lot more to say once the details of the deal come out–but one thing to note is that it still leaves digital services taxes as an outstanding issue to be resolved, according to U.S. Commerce Secretary Howard Lutnick.

This isn’t too surprising, since the DSTs which many countries have enacted to tax online activities–especially activity from U.S.-based tech firms, U.S. officials claim–are not an EU policy, although they’re used by many EU member states. (The EU considered a DST but couldn’t reach consensus on the issue—the failed proposal became the model for many of the national laws.) While the trade agreement and the Trump administration’s agreement with the G7 and Organization for Economic Cooperation and Development over the 15% global minimum tax have both resolved potential trade disputes, the DST issue is still one which could provoke potential retaliatory measures or even a full-fledged trade war.

Noteworthy Items This Week

After months of negotiations and several warning shots from U.S. President Trump, the EU and the United States finally agreed on the main terms of a trade deal July 27. The new relationship includes three main pillars: a single 15 percent tariff ceiling for most EU exports, $750 billion in strategic purchases, and an additional $600 billion in anticipated private investments into the U.S. economy.

U.S. Exporters Get Welcome Surprise in Trump Tax Law – Richard Rubin, The Wall Street Journal:

Major capital-intensive companies expect significant benefits, said Pat Brown, a partner at accounting firm PwC who has been hearing from pleased clients. On the margins, they’ll have reasons to invest more in the U.S., especially combined with the new law’s faster write-offs for research, equipment and factory construction.

“This is like morning in America for these guys,” Brown said. “Just a completely different incentive structure from what they had previously.”

OECD Publishes Status Message Template for Global Tax Return – Lauren Vella, Bloomberg Tax ($):

The status template for the GLoBE Information Return allows tax administrations to report filing or record errors, including when there are fundamental issues with the quality of data sent between jurisdictions. The information return is a data intake form companies need to fill out to comply with the 15% global minimum tax.

Trump to End Tariff Break for Low-Value Goods, Hitting Travelers – Jennifer A. Dlouhy and Josh Wingrove, Bloomberg Tax ($):

The move, made in an executive order, will become effective on Aug. 29 and apply to all goods valued at or under $800 that previously qualified for the tax-free treatment, according to a White House fact sheet.

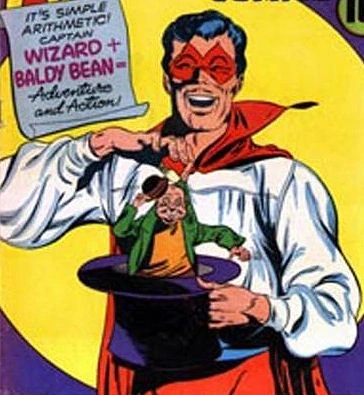

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Captain Wizard

Debut Year:1945

Debut Publication: Red Band Comics #3

Origin Story: A war veteran unjustly accused of murder, he was given a magic cloak by a mysterious magician giving him vast, mystical powers.

Superpowers: Aside from flight, invulnerability and super-strength, he can also instantly change into his costume by yelling "Abracadabra!"

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.