Key Takeaways

- The House passed major tax legislation last week that would slightly tweak the international tax rates from the TCJA.

- These changes could be to meet revenue needs or satisfy procedural requirements in the Senate.

- Further increases could conflict with the Trump Administration's position on the OECD global minimum tax.

- Ex-pats hoping for some tax relief in the House bill were disappointed.

- A proposed 3.5% remittance tax has sparked strong opposition among some economists.

The “One Big Beautiful Bill Act,” which just passed the House of Representatives, makes significant changes to the domestic tax system, but leaves the 2017 Tax Cuts and Jobs Act’s international framework largely in place.

There are some areas where it touches on international taxes, though. There’s a provision to retaliate against countries using the global minimum tax against U.S. companies, for instance. It also negates scheduled increases in the tax rates on global intangible low-taxed income and foreign-derived intangible income. Those two provisions—both of which are aimed at the income earned through valuable intellectual property or other intangible assets by U.S. companies, GILTI for offshore holdings and FDII for those held domestically—were set to increase in 2026.

The bill would prevent those from going into effect—but it doesn’t preserve the current rates, exactly. Due to a last-second change to the bill, made hours before it was passed, the legislation would now slightly tweak the deductions for those categories of income, resulting in a GILTI tax rate of 10.66%, rather than the current rate of 10.5%, and a FDII rate of 13.335%, rather than the current rate of 13.125%. Under current law, GILTI would increase to 13.125% in 2026 and FDII would increase to 16.046% in 2026. There's a slight tweak to how the base erosion and anti-abuse tax is calculated as well.

That’s a tiny rate increase—according to a new report from the Joint Committee on Taxation, about an $8 billion difference over 10 years. That's barely enough to get noticed among taxpayers. The House has not yet issued a committee report or explanation of why it tweaked the rates, but according to reports it may have been to meet a revenue target or to satisfy Senate reconciliation requirements. (Under the Byrd Rule, all provisions under reconciliation must have a budgetary impact. Since the Senate will likely use a current policy baseline, keeping the rates exactly the same would not be considered a budgetary item, paradoxically.)

As this process has shown, Republicans are loath to even consider increases to the overall corporate or individual tax rates. But that doesn’t mean they’re against rate increases elsewhere, as this provision shows. And it doesn’t mean they’re opposed to tax policy changes which might increase taxation in other ways, such as a new limit on itemized deductions included in the bill. To meet revenue targets set by the initial budget resolution, tax-writers will look anywhere and everywhere.

In Hill lingo these are sometimes called “dials”—various policies which can be turned up or down depending on legislation’s revenue needs. As further costs come in or budget estimates increase, the dials can be turned up to cover the difference. An example from the 2017 Tax Cuts and Jobs Act was the deemed repatriation tax rate on offshore cash, which began at 12% in early drafts but increased to 15.5% in the final law. And it's why the GILTI/FDII rates were set to change in the first place—to get a little more cash.

It’s possible that the Senate could look at the GILTI and FDII rates as potential revenue sources to ease the reconciliation requirements. But there are some pretty strong disincentives as well. Any potential increases bring the GILTI rate closer to the 15% rate set by the Organization for Economic Cooperation and Development’s global minimum tax—something the Trump Administration has strongly opposed.

Neither the U.S. Department of the Treasury or the White House would want to muddle the messaging on that.

Noteworthy Items This Week

US Bill Fuels Speculation Canada Will Retreat on Digital Tax – James Munson, Bloomberg Tax ($):

The mechanism, known as Section 899, would raise taxes on individuals and businesses from countries with taxes the US determines are discriminatory or unfair, including digital services taxes. Canada should drop its DST before businesses are due to pay by June 30, Leslie Ivany, partner in international tax and transaction services at EY LLP, told a conference in Toronto Tuesday.

New Zealand Considered Trump Before Scrapping Digital Tax Bill – Stephanie Soong, Tax Notes ($):

IRS’s Win in Long Tax Court Battle Also Has Upside for Facebook – Michael Rapoport and Caleb Harshberger, Bloomberg Tax ($):

But the court also ruled that the IRS had used the wrong inputs in using its methodology to compute the company’s US tax bill. That means that Meta may end up paying a lot less than it would have otherwise, practitioners and other tax observers said.

”It’s a big win for Facebook in the scale of the penalty,” said Matthew Gardner, a senior fellow at the Institute for Taxation and Economic Policy.

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

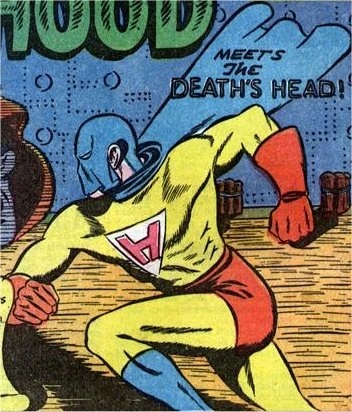

This week’s entry: The Hood

Debut Year: 1941

Debut Publication: Cat-Man Comics #5

Origin Story: An FBI agent who decided to take matters into his own hands and fight criminals under a secret identity.

Superpowers: No superpowers but his elite training and a striking yellow bodysuit.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.