Key Takeaways

- House bill would extend TCJA tax cuts.

- $40,000 SALT cap phases down to $10,000 for high incomes.

- EV credits, other energy credits face earlier termination.

- Senate changes likely.

- Taxpayer Advocate Service faces 25% personnel loss.

- High-end tax pro makes high-end bad tax moves.

- National Vanilla Pudding Day meets National Craft Distillery Day.

Publication note: Eide Bailly offices and Tax News & Views are closed Friday, May 22, and Monday, May 25, for the Memorial Day Holiday. Normal activity resumes May 26.

House Passes Trump Tax Bill After Last-Minute Changes - Richard Rubin and Olivia Beavers, Wall Street Journal:

The vote was 215 to 214, with one lawmaker voting present. The measure now goes to the Senate, where a similar tug of war could play out.

...

Broadly, the legislation combines a mishmash of Republican priorities into a single measure that carries the Trump agenda. It would extend expiring tax cuts for all income groups and create new tax cuts on top of that, such as a larger standard deduction, a larger child tax credit and versions of Trump’s campaign-trail promises to eliminate taxes on tips, overtime pay and Social Security benefits.

House Advances $3.8 Trillion Tax Bill; Faces Rewrite in Senate - Cady Stanton and Doug Sword, Tax Notes ($):

The legislation now heads to the Senate after the chamber returns from recess June 2, where multiple Republican senators have already indicated they intend to change multiple tax provisions within the package before sending it back to the House.

Trump Tax Bill Narrowly Passes House, Overcoming Infighting - Steven Dennis, Erik Wasson, and Maeve Sheehey, Bloomberg via MSN:

Late changes to the bill even included changing the name of new savings accounts for babies born in the next few years, to be seeded with $1,000 from the government. It’s now “Trump” accounts instead of “MAGA” accounts.

The Tax Foundation's Garrett Watson provided a summary of the changes made yesterday to the bill before passage on X/Twitter:

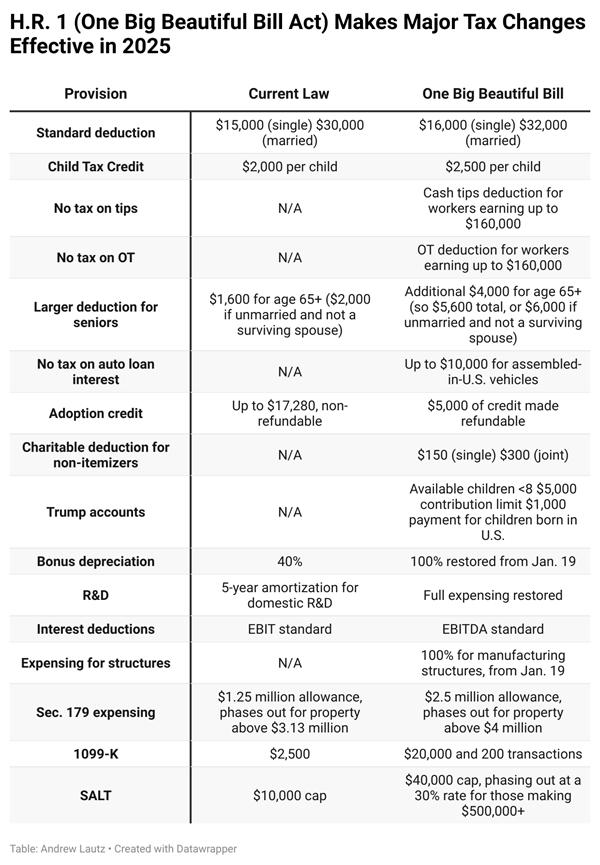

Andrew Lautz also chimes in on X/Twitter with a summary of the changes that are set to be effective for 2025:

Other coverage:

Here’s What’s in the Big Domestic Policy Bill to Deliver Trump’s Agenda - New York Times.

US House passes Trump’s showpiece tax bill - Alex Rogers and James Politi, Financial Times.

Here's what's in the GOP megabill that's just passed the House - Elena Moore and Claudia Grisales, NPR.

House Republicans pass Trump’s big bill of tax breaks and program cuts after all-night session - Lisa Mascaro, Kevin Freking, and Leah Askarinam, Associated Press.

House passes budget reconciliation bill with changes to tax provisions - Alistair Nevius, The Tax Adviser.

Big Bill Fallout

Tax News & Views International Weekly: Retaliation on Auto-Pilot - Alex Parker, Eide Bailly. "A self-executing rule could raise the stakes in the U.S./OECD standoff, by preventing Treasury from backing down."

Permanent Theft Loss Deduction Limit Could Hit Seniors Hard - Nathan Richman, Tax Notes ($):

But that’s even before considering the potential for income realized when taxpayers take money from retirement and investment accounts to give to the scammers — that income could easily push the taxpayers over the income threshold for the proposed senior deduction and start the phaseout of the benefit.

Trump Import-Tax Hike Counters Income-Tax Relief, Economists Say - Enda Curran and Jarrell Dillard, Bloomberg via MSN. "Trouble is, Trump is also raising taxes — on imported goods. That will likely erode households’ purchasing power and undercut the expansion."

Expats’ Push for Residency-Based Taxation Faces Uncertain Path - Jonathan Curry, Tax Notes ($). "Notably absent from the latest iteration of the House Republicans’ tax bill is a provision that would fulfill Trump’s vow, made the month before the 2024 presidential election, to end the “double taxation” of U.S. nonresident citizens. To backers of this policy change, the path forward now looks a little murkier, but opportunities remain."

Related: Eide Bailly Expatriate Tax Services.

In the IRS

Over 20 Percent of TAS Employees Have Taken Resignation Offer - Benjamin Valdez, Tax Notes ($):

Collins, speaking at a May 21 Council for Electronic Revenue Communication Advancement conference, said the “overwhelming majority” of TAS employees who have opted to resign were case advocates in the field who work with taxpayers and their representatives to iron out issues with the IRS.

“That is a huge hit,” Collins said. “We have offices that only have a couple people left.”

IRS Taxpayer Advocate Service Struggles as 400 Workers Depart - Erin Schilling, Bloomberg ($):

...

Collins said she is talking to Treasury Deputy Secretary Michael Faulkender, who is also serving as acting IRS commissioner, to allow for exceptions to the government-wide hiring freeze.

“Even if I get authorization to hire, it’s going to be a long time to get people in the door. You have to train them,” said Collins, who added any additional employees needed for the 2026 tax filing season would need to be hired now.

Acting IRS Commissioner Touts Accelerated Modernization Plan - Erin Schilling, Bloomberg ($):

“We don’t need more agents,” Faulkender said. “What we need is to get the IRS modernization project done.”

The IRS is working toward creating a modern application program interface on top of existing IRS systems, Faulkender told CNBC.

Appeals Improves Alternative Dispute Resolution Programs, But Barriers Remain - NTA Blog:

...

Although the recently enacted pilots demonstrate the IRS’s willingness and desire to make ADR more accessible to taxpayers, restrictions remain and opportunities for the IRS to further expand its availability are abundant. Notably, ADR options are not available to taxpayers subject to correspondence audit. These audits typically lack a single assigned examiner, making ADR impracticable in its current form.

This restriction generally makes ADR unavailable for low-income taxpayers. In FY 2019, more than half of taxpayers subject to correspondence audits had total positive income (i.e., the sum of all income before losses and deductions) below $50,000, and most of these low-income taxpayers claimed the Earned Income Tax Credit (EITC), a complex tax credit that hundreds of thousands of taxpayers rely on each year to help pay their basic living expenses. These taxpayers often don’t have the resources needed to vigorously dispute these correspondence audits, thereby risking the loss of this valuable credit that provides much-needed financial support – Congress’ purpose for designing the credit.

Related: Eide Bailly IRS Dispute Resolution and Collections Services

Democrats Grill Trump’s IRS Nominee On His Role Promoting Suspect Tax Credits - Kelly Phillips Erb, Forbes:

Long said he never worked directly with White River, telling Chairman Mike Crapo (R-Idaho) at the hearing that his work was limited to providing referrals.

Long confirmed that he had promoted the credit, but said he had believed it was real. He didn’t walk back the claim that they were real at the hearing, telling Wyden, “I think the jury’s still out on that. I know since 2022 they’ve been accepting them, so now they claim that they’re not.”

Blogs and Bits

Senate unanimously passes No Tax on Tips bill - Kay Bell, Don't Mess With Taxes. "The deduction would be retroactive to the start of the 2025 tax year, meaning it could be claimed on next year’s tax returns."

State Implications of the One, Big, Beautiful Bill - Jared Walczak, Tax Foundation. "We estimate that, if all states had conformity dates matching the proposed new law, these tax changes would reduce state income tax revenues by $3.3 billion in aggregate in tax year 2026, representing a 0.7 percent reduction in state-level individual income tax collections."

House Tax Bill Doesn’t Kill Green New Deal Subsidies Fast Enough - Adam Michel and Joshua Loucks, Liberty Taxed. "A recent Cato Institute paper confirms that the IRA’s energy credits are far more expensive than initially projected. Thanks to provisions like direct pay (cash payments in lieu of tax benefits), tax credit transferability, and emission level phase-out triggers, many of these subsidies now function like open-ended automatic entitlements. And that’s why over the next 25 years, the IRA credits are expected to cost up to $4.7 trillion."

House Tax Cuts Would Benefit Most, But Tilt To Highest-Income Households - Howard Gleckman, TaxVox. "The lowest-income 20 percent of households, those making about $35,000 or less, would get a tax cut of less than 1 percent, or about $160 on average. Including the loss of some Affordable Care Act health insurance premium subsidies, their tax cut would fall to only about $60. Those making less than $20,000 would pay $40 more in taxes after losing their premium tax subsidies."

Heal Thyself

Ex-Alvarez & Marsal CPA Sentenced To 20 Months In Tax Case - Kat Lucero, Law360 Tax Authority ($). "A former accountant at consulting firm Alvarez & Marsal has been sentenced to 20 months in prison and ordered to pay the Internal Revenue Service over $2 million for willfully not reporting his income and falsifying the returns in his mortgage application, according to a D.C. federal court."

This man was a tax expert in a number of accounting firms - making his troubles all the more amazing. From a Department of Justice press release (Defendant name omitted, emphasis added):

In February 2023, Defendant sought to obtain a $1.36 million bank-financed loan to purchase a home in D.C. and was working with a mortgage company to do so. After the mortgage company told Defendant that the bank would not approve the loan without copies of Defendant’s filed tax returns, Defendant provided the mortgage company with fabricated documents to make it appear as if he had filed tax returns and provided copies of tax returns for 2020 and 2021 that he never filed with the IRS. On these returns and other documents that he submitted to the mortgage company, Defendant listed a former colleague as the individual who prepared the returns and uploaded them for filing with the IRS. This individual did not prepare the returns, has never prepared tax returns for Defendant, and did not authorize Defendant to use his name on the returns and other documents that Defendant submitted to the mortgage company. Based on Defendant’s false representation, the bank approved the loan and Defendant purchased the home.

Cases like this are why more lenders insist on seeing IRS transcripts, rather than just copies of tax returns.

All in all, it seems like this man would have saved himself a lot of trouble by hiring a good tax pro to help him file his returns.

What day is it?

It's both National Vanilla Pudding Day and National Craft Distillery Day. Perhaps worthy holidays, but not for breakfast, thank you.

Make a habit of sustained success.