Key Takeaways

- Things people don't understand about the tax system.

- IRS electricity credit guidance "tech neutral."

- Last-minute change to C corporation return instructions.

- Court rulings help S corporations with valuations.

- State that don't tax retirement.

- Global minimum tax and US R&D.

- A candidate with (a tax) conviction.

- Expelling a teacher.

- Fakesgiving Day.

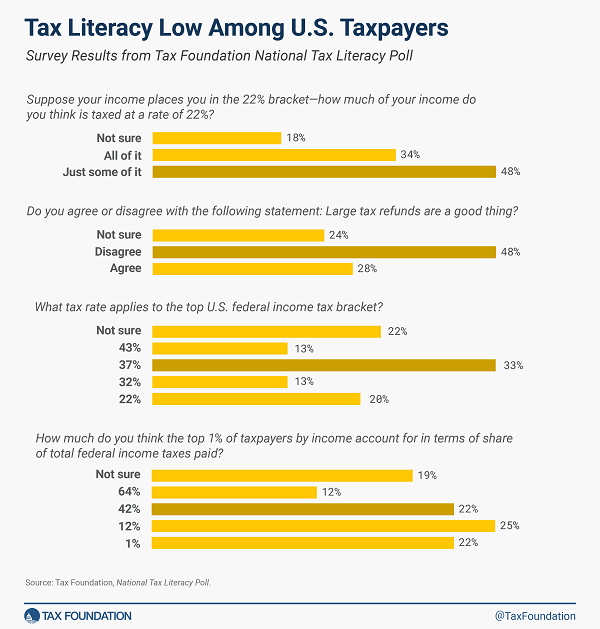

National Tax Literacy Poll: Understanding the Tax Code - Zoe Callaway, Tax Policy Blog:

We reported results that showed more than two-thirds of respondents did not know the top federal income tax rate and over half did not know how tax brackets work. The majority of respondents also answered incorrectly when surveyed about the value of tax credits versus tax deductions.

No matter how many of these answers someone gets wrong, their vote counts the same. That empowers politicians willing to play to the misinformed.

IRS wires electricity credits

IRS Guidance Amps Up Clean Electricity Tax Credit Flexibility - Mary Katherine Browne, Tax Notes ($):

Section 45Y is the "Clean energy production credit," while Section 48E is the "Clean electricity investment credit."

Treasury Details Which Tech Would Get Clean Energy Credits - David van den Berg, Law360 Tax Authority ($):

...

The proposed regulations also detail how energy storage technologies could qualify for the Section 48E clean electricity investment credit. They also clarified how low-output clean energy facilities claiming the credit can include costs for improvements needed for local transmission and distribution networks to connect facilities to the grid, Treasury said.

Industry Cautiously Optimistic for ‘Tech-Neutral’ Energy Credits - Alexander Rifaat, Tax Notes ($). "Industry groups welcomed the proposed regulations (REG-119283-23) released by Treasury May 29, which provide guidance on the section 45Y clean electricity production tax credit and section 48E clean electricity investment credit. The regs expand the number of technologies eligible for the credits as long as they have net-zero emissions."

Link: IRS press release

Related: Unlock Tax Savings with Section 45: Renewable Electricity Production Credit

Last-minute change in instructions; S corporation valuation

IRS Quietly Added Corporate AMT Compliance Mandate for Partners - Chandra Wallace, Tax Notes ($):

The IRS made the post-release change to Schedule K-1 instructions for partners on its website in an update April 9. The new instruction, titled “Partner’s instructions for Schedule K-1, Box 20, Code ZZ — CAMT,” mandates that these partners submit written requests to partnerships and that they “maintain a copy of the request and information received in [their] books and records.”

Funny thing to add on April 9 for returns due on April 15.

Gifting Company Shares Eased by Tax Court Ruling on Valuations - Erin Schilling, Bloomberg ($):

That changed with Cecil v. Commissioner , in which a judge accepted the “tax affected” value—or the value that considers how future cash flows are lowered by taxes—of an S corp because it included an additional calculation that considered the benefit of the S corp ownership structure.

Related: Wealth Transition Services; Business Valuation Services.

Blogs and bits

Five 529 plan facts to celebrate National 529 Day - Kay Bell, Don't Mess With Taxes. "The U.S. tax code is involved because 529 plans have several tax advantages. At the federal level, you don’t get a federal tax break on your Form 1040 for contributions to a 529 plan. But money you do put into a 529 grows free of any federal taxation. Even better, withdrawals also are federally tax-free when they're used to pay for qualifying college expenses."

It's True: These 13 States Don't Tax Retirement Income - James Brumley, Motley Fool. "In addition to the nine states that simply don't impose any income tax on anyone, four more states don't tax retirement income from 401(k) accounts, IRAs, and pensions, even though they do still tax ordinary work-based wages."

Prevent Employee Retention Credits From Scuttling a Merger Deal - Walt Cosby, Maslon via Bloomberg. "Buyers should conduct their own tax due diligence to verify the legitimacy of any ERC claims before finalizing the deal. Buyers ultimately may be responsible for any tax liabilities arising from erroneous ERCs claimed by the target company."

What is Cost of Goods Sold (CoGS) for tax? - Jeremy Wells. "So only businesses with physical goods or real property for sale, i.e. inventory, can incur costs of goods sold for federal tax purposes."

Yet many tax returns for other companies, including transportation and service businesses, show a "cost of goods sold" deduction. Sometimes this is a misclassification of legitimate deductions; yet it is often enough a place to bury questionable or imaginary expenses that the IRS has an "Inflated Cost of Goods Sold" compliance campaign in place.

Tax Court Rejects IRS's Treatment of Option and Sale Agreements as a Sham Transaction - Parker Tax Pro Library. "The Tax Court held that a corporation was not liable for a deficiency as a result of an option agreement and a subsequent sale of land because the transaction was valid and not a sham transaction that should be disregarded for tax purposes."

Economic theory and reality - Scott Sumner, Econlog. "Kevin Corcoran recently did a post discussing the distinction between being wrong in theory and wrong in fact. Here I am interested in another situation, the case where theory matches reality quite closely, but people are reluctant to accept the implications of that fact. For instance, basic economic theory suggests that higher tax rates ought to reduce hours worked. Europe has higher tax rates than America and considerably lower hours worked each year. But many people seem reluctant to accept the straightforward implications of those facts."

International Tax Corner

Nations Can Fight, But There’s No Flight From Global Minimum Tax - Alan Cole, Tax Foundation via Bloomberg:

For three of the world’s largest economies—the US, China, and India—the question of Pillar Two adoption remains a source of uncertainty for multinational enterprises. Many outcomes are possible, but they can be divided roughly into three categories: comply with Pillar Two, fight Pillar Two, or muddle through without either compliance or retaliation.

...

Compliance would involve adopting three taxes that comport with the Pillar Two goal of a 15% tax rate on corporate income. The first, known as a qualified domestic minimum top-up tax, or QDMTT, would apply to domestic income. Under a QDMTT, countries calculate the effective corporate tax rate using definitions set forth by Pillar Two rules, and “top up” the tax until the 15% target is reached.

Global Minimum Tax Incentive Rules Threaten US R&D Investment - Lauren Vella, Bloomberg ($):

The US credit—which is worth hundreds of millions of dollars of tax reduction for some companies—would subject US businesses to large amounts of top-up tax by foreign governments, even when operations are on US soil, practitioners and industry groups warn.

Keep It Simple - Leonard Wagenaar, Leonard's Tax Post. "The conventional wisdom after the P2 rules came out was that it would push everyone to adopt a QDMTT, so that each country would collect the minimum tax they needed for that jurisdiction to be outside the scope of that rules. And indeed, many countries adopted or are in the process of adopting a QDMTT, including countries with tax rates below 15% (meaning that QDMTT almost always applies for in scope MNEs). But that strategy means that MNEs still have to do full GloBE calculations for your country, creating a lot of compliance burden. So, are those countries really winning?"

Related: Eide Bailly International Tax Services.

Tax in the courts: a candidate with conviction, a teacher expelled.

Presidential Candidate Convicted For $15.5M Tax Fraud - Anna Scott Farrell, Law360 Tax Authority ($). "A minor candidate in the 2024 Republican primary, John Anthony Castro was found guilty on all counts of his indictment Friday after a five-day bench trial and now faces 99 years in prison for preparing false tax returns, according to the U.S. Department of Justice."

That probably does nothing for his chances at the upcoming convention. The Department of Justice press release has more:

A tad aggressive. Of course, his clients don't get to keep their taxes "saved."

Teacher schooled. A Georgia public school teacher has repeatedly failed his 1040 exam, according to a Federal Judge in Georgia. Now he may get expelled. From an recent court order (taxpayer name omitted):

The IRS computers noticed this when the wages on the 2021 1040 didn't match the school district's W-2. And this isn't the first time:

Plaintiff’s time has come. The Court will no longer tolerate his frivolous filings because they impair the Court’s ability to adjudicate the legitimate claims of other litigants. Accordingly, Plaintiff is ORDERED to SHOW CAUSE within FOURTEEN (14) DAYS of this Order why the following permanent injunction should not be imposed.

The injunction would bar the schoolteacher "from filing or attempting to file any lawsuit in this Court or any other federal court seeking to obtain a tax refund for a tax year in which [he] failed to report his wages as income." So, expelled.

The Moral? Tax protesting is a strange hobby, and it gets expensive, with the frivolous return penalties and all.

What day is it?

It's Fakesgiving - "In terms of the core elements that make up the holiday, it is hardly any different from the Thanksgiving holiday itself; a meal is prepared, family and friends are present, everyone gathers around a table and says what they’re ‘fakesful’ for, and generally everyone has fun and creates memories with one another."

Other than the airports aren't as busy and you don't get time off from work.

Make a habit of sustained success.