Key Takeaways

- Revamped Tax Foundation State Competitiveness Index drops.

- South Dakota, Montana, Texas and North Dakota make top 10.

- Minnesota, Washington, California make bottom 10.

- Ruling denying medical organization exemption threatens other 501(c)(4)s.

- BOI deadlines extended in hurricane zones.

- Taxes and the election.

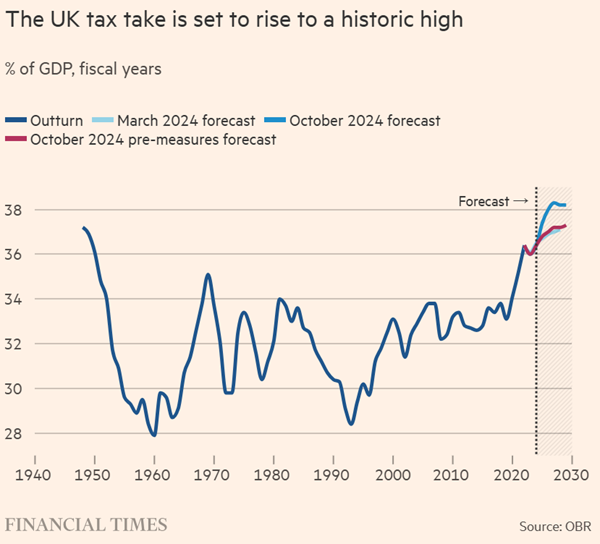

- UK budget features tax increases.

- Sometimes you don't want to bug the IRS.

- Happy Halloween. Also: Diwali, caramel apples.

Tax Foundation updates state tax index; Wyoming, South Dakota, Alaska lead, while New York, New Jersey, and California bring up the rear.

From the introduction to this year's index:

This does not mean, however, that a state cannot rank well while still levying all the major taxes. Indiana, for example, levies all the major tax types, as do all the other states that rank 11th to 16th: Idaho, North Carolina, Missouri, Arizona, Michigan, and Utah.

Related: Eide Bailly State & Local Tax Services

Court Ruling Threatens to Curb Billions in Political ‘Dark Money’ - Richard Rubin and Maggie Severns, Wall Street Journal:

The court said groups can’t qualify for tax exemption under Section 501(c)(4) of the tax code if they have a substantial nonexempt purpose. That is a much stricter standard than the one in Internal Revenue Service regulations, which say groups only need a primary purpose that qualifies for the exemption. That has been interpreted to allow tax exemptions for groups that spend 51% of their money on lobbying or other clearly allowed activities—and 49% on politics.

BOI reporting deadlines extended for certain victims of 5 hurricanes - Martha Waggoner, The Tax Adviser:

In the notices, FinCEN extended the filing deadlines for reporting companies that have an original reporting deadline beginning one day before the date the specified disaster began and ending 90 days after that date and are located in an area designated by the Federal Emergency Management Agency as qualifying for individual or public assistance and by the IRS as eligible for tax filing relief.

Taxes and the Election

GOP Plans Far-Reaching Tax, Budget Bill Tied to Election Sweep - Jack Fitzpatrick and Ken Tran, Bloomberg ($):

...

It would allow Donald Trump, if elected president, to shepherd his tax and major parts of policy agenda through Congress without Democratic votes.

It’s a path fraught with challenges. Whichever party controls the House will likely have a smaller majority than the 241 seats Republicans held in 2017, when they enacted a major tax overhaul through reconciliation. A Senate majority could also be slim. And the process includes plenty of restrictions. Reconciliation bills must be budget-oriented, affecting revenue, spending, or the debt limit — restrictions that frustrated Democrats who unsuccessfully sought to raise the minimum wage in 2021.

Harris Says She’ll Listen to Overseas Voters, But Doesn’t Endorse Tax Change - Richard Rubin, Wall Street Journal:

Campaign-trail tax proposals face difficult road to passage - Caitlin Reilly, Roll Call:

In addition to extending most of the expiring provisions, Trump has pitched new tax breaks, including exemptions for tips, overtime wages and Social Security payments, deductions for interest payments on car loans and state and local taxes, and lowering the corporate rate to 15 percent for domestic manufacturers.

Meanwhile, Harris has pledged to keep taxes the same level or lower for those making up to $400,000, which would mean a still-pricey, if slimmer, 2017 law extension. She’s also pledged to increase the child tax credit, and create new credits for first-time homebuyers and deductions for startup companies.

Commentary on candidate tax policies.

Harris’s America Forward Plan Should Cover Whole Economy, Not Just Favored Industries - Alex Muresianu, Tax Foundation. "Investment matters across the whole US economy, not just in semiconductors or clean energy. Under their current design, Harris’s policy raises a lot of questions."

Econ 101 is wrong about tariffs - Brian Albrecht, Economic Forces. "Recent research has convinced me that the Econ 101 story is generally too simple to apply in a modern economy. Pro-tariff politicians are right about that. But they have the direction wrong: tariffs are even worse than the textbook model suggests."

International Terminal

Eide Bailly's International Tax Team and our affiliates at HLB, the Global Advisory and Accounting Network stand ready to help with your worldwide tax planning and compliance needs.

Business and wealthy bear brunt of £40bn tax increases in UK Budget - George Parker and Sam Fleming, Financial Times. "UK chancellor Rachel Reeves has put a £40bn tax increase at the heart of a plan to fix the country’s “broken” finances and public services, with business and the wealthy bearing the brunt of the biggest Budget tax hike in a generation."

Britain’s Labour Party Bets on Big Taxes, Borrowing to Boost Economy - Max Colchester and Paul Hannon, Wall Street Journal.

Budget of the century… What really happened - Lisa Spearman, TaxPlus. "In perhaps the least surprising measure announced today, the rate of NIC [National Insurance Contributions, an employment tax] payable by employers will increase from 13.8% to 15% in April 2025, as expected. The additional reduction of the threshold at which employers start to pay NI from £9,100 to £5,000 annually was more of a surprise alongside the increase to the employment allowance."

European countries, trailing U.S. economy, hike taxes and trim spending - William Booth, Ellen Francis, and Kate Brady, Washington Post:

That comes after the new French government this month revealed austerity plans. The French economy got a bit of an Olympic boost, but the country is grappling with what the government has called a “colossal” debt burden and a spiraling deficit, one of Europe’s worst.

CAMT, GAARs and Tax Consistency - Alex Parker, Things of Caesar. "The 15% minimum tax (not to be confused with the 15% global minimum tax, an entirely different regime) is based on financial accounting data, rather than the tax code. It came about after various studies showed that many corporations paid little in taxes in years when their profits, as reported in financial statements, were large. From the (widely debated) assertion that this indicated these corporations were paying less in taxes than they should, the CAMT was devised as a backstop to ensure they still paid a minimum level of tax, even if they had been following the tax code."

Blogs and Bits

Inflation adjustments that will apply to Americans living abroad in 2025 - Kay Bell, Don't Mess With Taxes. "U.S. citizens who live and work abroad still owe U.S. taxes on their income. Thanks to Uncle Sam's reliance on a worldwide tax system at the individual level, the U.S. Treasury gets a piece of your earnings regardless of where in the world you make it."

Related: Eide Bailly Global Mobility Services

A Grave Error: Don’t Allow “Ghost Preparers” to Turn Your Taxes Into a Horror Story - Erin Collins, NTA Blog. "Many unsuspecting taxpayers are bewitched by deceptive preparers. Some of these preparers operate under cloak of darkness by refusing to sign their names to their clients’ returns. The IRS refers to them as 'ghost preparers,' a name befitting their ethereal nature."

Watch Out For "Corporate Transparency Act" Scams. - Adam Sweet, Ben Peeler, and Maggie Ochoa, Eide Bailly. "Many businesses are just learning about the need to report their ownership to the Treasury under the Corporate Transparency Act. While a lot of businesses haven't gotten the memo, scammers have."

IRS Just Launched Pass-Through Compliance Unit: Heightened Focus on Trusts Including Foreign Foundations - Virginia La Torre Jeker, US Tax Talk. "The new compliance unit will also examine multi-layered financial structures, often involving trusts alongside partnerships, to detect improper income shielding. By identifying arrangements that shift income or assets across borders, the IRS aims to hold taxpayers accountable for reporting and paying the taxes they owe."

Tax Crime Watch: LLC Unit.

Two Sacramento residents plead guilty to false income tax return scheme - IRS (Defendant names omitted, emphasis added):

The returns were filed in the names of Defendants and family members. The returns listed wages that the taxpayers had not earned and often listed the taxpayers’ employer as one of the various LLCs created by Defendants and their family members. Many of the returns also falsely claimed charitable contributions that were not actually made. Defendant 1 prepared and filed the false tax returns. Defendant 2 contacted the IRS to check on the status of the refunds claimed in the false tax returns.

Defendants agreed to pay restitution for the fraudulent income tax refunds that they received.

The idea of nagging the IRS to pay your fraudulent refund faster is a nice touch.

The Moral? There really are things an LLC can't do. Also, don't claim fraudulent refunds. If you do, don't jump up and down to get the attention of the IRS.

What Day is it?

It's Halloween, of Course. It's also the start of Diwali. And it's National Caramel Apple Day.

Make a habit of sustained success.