Discover Why Companies Choose Eide Bailly for Energy Tax Incentives

Our Energy Incentive Program will help you maximize the full potential of available incentives in the New Climate Economy.

What Sets Eide Bailly Apart

We’re the #1 accounting firm offering energy credit & incentive services.

Clarity Through Complexity

A clear, phased approach to assessing and claiming energy deductions and credits.

Maximum Savings

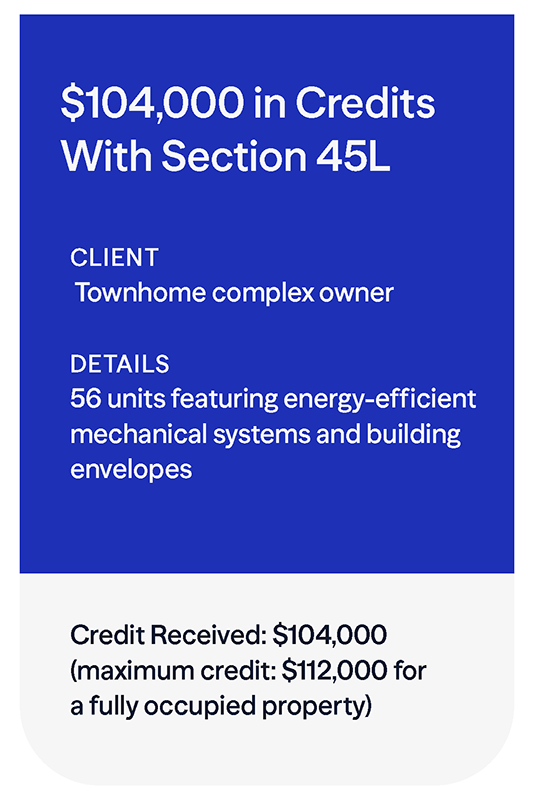

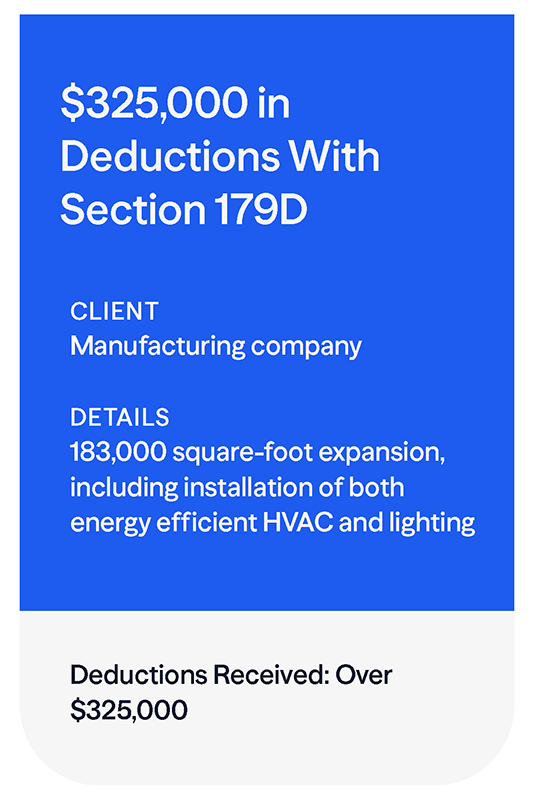

Millions of dollars saved for hundreds of clients.

Expert Guidance

Professional engineers, energy modelers, and HERS raters — all in-house.

Tax Incentive Services You Can Trust

As a Top 20 CPA firm with over 200 specialists in our National Tax Office, we bring practical tax expertise and forward-thinking guidance.

We’re recognized as a national leader

Smart, talented and genuine people work here, and together we help clients make smart business decisions and build a strong financial future.

- Top20CPA firm in the nation

- 3.5k+partners & staff

- 100+years in business

- 50+offices in the U.S. & India

Get started with your energy efficiency tax credits and deductions today.

We can help you assess your eligibility and then work with you to maximize the potential benefit of energy efficient incentives.

Energy Incentives Leadership

Kristin GustafsonPE, CEM, BEMP, LEED AP

Principal/Sustainability & Energy Incentives

A licensed professional engineer in all 50 states and certified building energy modeling professional with over 20 years of consulting experience, Kristin manages and coordinates 179D Commercial Buildings Energy-Efficiency Tax Deduction studies, 45L Residential Tax Credits and Clean Energy credits for renewables. Additionally, she helps clients with reporting requirements as they pursue their carbon accounting, sustainability, and ESG efforts.