Key Takeaways

- IRS failed to protect confidential data in ICE disclosure.

- House rejects Canada tariff emergency, but not by a veto-proof margin.

- CBO report projects trillion-dollar interest bill.

- Michigan governor proposes digital ad tax.

- Financing that nice lake home the wrong way.

- Paczki Day.

Heads Up: HLB Group, Eide Bailly's worldwide accounting network affiliation, hosts a virtual webinar next week. Tariffs Update: Current State, Outlook, Success Stories and Mitigation Strategies, will take place a week next Wednesday. Tune in at 11:00 Central February 18. Registration at the link.

Confidential Tax Info Illegally Sent to ICE

IRS improperly disclosed confidential immigrant tax data to DHS - Jacob Bogage, Jeff Stein and Perry Stein, Washington Post:

IRS Erroneously Shared Taxpayer Info With ICE - Trevor Sikes, Tax Notes ($):

...

Under the memorandum of understanding and implementation agreement for the sharing of taxpayer information between the IRS and ICE, ICE requests must comply with section 6103(i)(2)(B), which says each request must include, among other information, the name and address of the taxpayer for whom the information is being sought.

IRS Mistakenly Shares Data on Thousands of Immigrants With ICE - Erin Schilling and Erin Slowey, Bloomberg ($):

But for less than 5% of those individuals, the IRS gave ICE additional address information, IRS Chief Risk and Control Officer Dottie Romo said in a declaration with the US District Court for the District of Columbia dated Wednesday.

President Trump is suing the IRS for $10 billion for improper disclosure of his returns. The annual IRS budget is approximately $11.2 billion, for comparison.

House Votes to End Tariff "Emergency" by Margin Too Small to Override Expected Veto

GOP-Led House Rejects Trump’s Tariffs on Canada - Gavin Bade and Olivia Beavers, Wall Street Journal:

Passage of the antitariff resolution sends it to the Senate, which must vote on the issue again despite approving a similar one on a narrow, bipartisan basis last year. If it passes the Senate—where it can advance on a simple majority vote, not the 60 usually required—the measure would move to Trump, who would almost certainly veto it.

The Republicans who voted with most Democrats to end the tariffs were Reps. Don Bacon of Nebraska, Kevin Kiley of California, Thomas Massie of Kentucky, Dan Newhouse of Washington, Brian Fitzpatrick of Pennsylvania and Jeff Hurd of Colorado. One Democrat, Rep. Jared Golden of Maine, a centrist, sided with most Republicans.

House Votes to Cancel Trump’s Canada Tariffs - Robert Jimison, New York Times:

...

But while fentanyl has flooded North America’s drug supply over the past decade, killing tens of thousands of people in the United States and Canada, less than 0.1 percent of the fentanyl arriving in the United States in 2023 came from Canada, according to data from U.S. Customs and Border Protection.

US House of Representatives votes to overturn Donald Trump’s tariffs on Canada - Lauren Fedor and Aime Williams, Financial Times:

“TARIFFS have given us Economic and National Security, and no Republican should be responsible for destroying this privilege,” he added.

So much for fentanyl.

Trump Tariffs Threaten to Offset Much of the “Big Beautiful Bill” Tax Cuts - Erica York and Alex Durante, Tax Policy Blog:

The tariffs offset a larger portion of the tax cuts for lower- and middle-income taxpayers than for higher-income taxpayers. Because several of the OBBBA’s tax provisions expire at the end of 2028, by 2034, the bottom quintile will actually see a net reduction in after-tax income under the OBBBA on a conventional basis, which would be exacerbated by the tariffs if they remain in place in 2034. Note also that these estimates do not include the distribution effects of the spending cuts, which would further reduce after-tax income for the bottom quintile.

CBO Reports U.S. Fiscal Situation Getting Even Worse

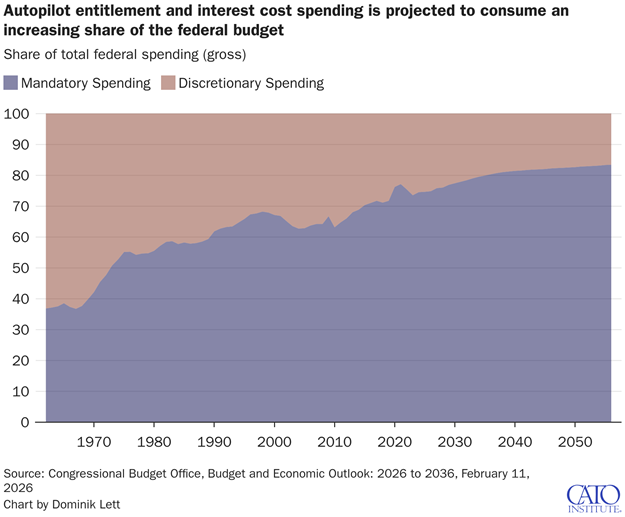

CBO Warns of Ballooning Deficits in Latest Fiscal Report - Dominik Lett, The Debt Dispatch:

...

In 2025, federal spending totaled $7 trillion, or 23.1 percent of GDP, exceeding the 50-year average of 21.2 percent. By 2036, spending reaches $11.4 trillion, or 24.4 percent of GDP. Autopilot mandatory spending—interest costs and mammoth programs like Social Security and Medicare—is almost entirely responsible for this growth. By 2036, Social Security, Medicare, Medicaid, and interest costs will account for 73 percent of total federal spending, consuming nearly 100 percent of all federal revenue.

US Budget Deficit Projected To Hit $3.1T By 2036 - Jack McLoone, Law360 Tax Authority ($):

"Our budget projections continue to indicate that the fiscal trajectory is not sustainable," CBO Director Phillip L. Swagel said in a statement released alongside the report.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually - Peter G. Peterson Foundation:

...

According to CBO’s report, Social Security’s OASI Trust Fund depletion date has been moved up, from 2033 to 2032. Accordingly, Senators elected this year will have to address the problem during their upcoming term. Medicare’s Hospital Insurance Trust Fund, however, will remain solvent through the 10-year projection window.

International Taxes: Substance and the Perfect Man

Tax News & Views International Weekly: Taxing on Substance - Alex Parker, Eide Bailly:

The regime, the Pillar Two 15% global minimum tax, is now moving forward with the U.S. impasse resolved. Since the beginning, its design has relied on economic substance, such as jobs in a country or "hard" assets. Factors such as payroll and the value of tangible assets were used not only for the measurement of taxable income, but to determine how it was distributed in some cases. The final agreement goes further, using similar metrics when evaluating which government tax incentives are exempt, and which can cause a company to ultimately pay more in Pillar Two tax.

If that's not your thing, Alex's Public Domain Superhero this week features the "World's Most Perfect Man," in case you want to set a standard.

Related: Eide Bailly International Tax Services.

State of the States: Conformity, Digital Ad Taxes.

States Say No Thanks to Trump Tax Cuts, Drawing Republican Fire - Andrew Duehren, New York Times:

Many of those changes cut taxes by reducing the amount of income subject to taxation in the first place. Most states use federal definitions of income as the starting point for their own income taxes, and so the federal tax breaks can also reduce the amount of money states can tax.

That means the tax law passed in Congress is hitting state revenues, prompting some states to proactively exclude the new federal tax cuts from their tax codes.

Michigan Governor Proposes New Digital Ad, Sports Betting Taxes - Michael Bologna, Bloomberg ($):

...

The proposed revenue raisers include a 4.7% excise tax on digital advertising revenue, levied on the portion of advertising receipts attributed to Michigan. Certain exclusions would be available for broadcast and news organizations. The proposal is expected to generate $282 million during the next fiscal year, which begins Oct. 1.

Taxes on digital advertising are rare, and states that have imposed them are mired in litigation.

Related: Eide Bailly State and Local Tax Services.

Blogs and Bits

Super Bowl LX’s super tax windfall for California is most extreme jock tax example - Kay Bell, Don't Mess With Taxes:

Per Walzack’s calculator, Darnold’s California tax bill is $202,102. So, Darnold’s Super Bowl winning bonus of $188,000 will go to cover most of that amount.

IRS passport ban upheld for $1.6M tax debt - Tax Coda. "The Tax Court upheld the IRS’s certification of a seriously delinquent tax debt, allowing the State Department to deny or restrict the taxpayer’s passport."

Deferring Tax Payments from the Sale of Farmland - Kristine Tidgren, Ag Docket. "The One Big Beautiful Bill Act (OBBBA), Public Law 119-21, 139 Stat. 72 (July 4, 2025), created a new election through which qualifying sellers of farmland can choose to pay their taxes on the gain in four equal installments, instead of all in the year after the sale."

Who Wants to go to Prior Lake?

Minnesota man indicted for filing and conspiring to file false tax returns requesting hundreds of millions of dollars in undeserved tax refunds from the IRS - IRS (Defendant name omitted, emphasis added):

The indictment alleges that the defendant’s tax returns falsely requested refunds of more than $ 90 million and that he conspired in the filing of additional false tax returns requesting tax refunds totaling more than $ 210 million. Defendant’s fraudulent claims allegedly totaled more than $ 350 million and resulted in the United States Treasury paying out more than $ 19 million in undeserved tax refunds. Defendant also allegedly used his fraudulent proceeds to purchase a $ 2.6 million house in Prior Lake, to invest in cryptocurrency and other projects, and for personal expenses.

During the course of the conspiracy, Defendant allegedly advised a group of sovereign citizens regarding trusts and taxes. He also provided them with tax forms and documents for tax filings. Sovereign citizens wrongly believe that certain laws, such as the federal income tax, do not apply to a person’s sovereign persona.

Spoiler: Those laws do apply, regardless of your "sovereign persona."

It speaks poorly of IRS procedures that $19 million of refunds were issued based on garbage tax protester filings. Fortunately the IRS blocked over 90 percent of the claims. It will be hard to recover all of that taxpayer money - though the Prior Lake house may show up on the IRS auction site sometime if you are looking for a nice new home.

The IRS will be going after those who received the refunds, plus interest and penalties. This is another tax scam that worked, until suddenly and spectacularly it didn't.

What day is it?

It's Paczki Day! "Similar to a donut, Paczki are a sugary pastry that combines glossy doughs with a delicious fruit filling. They’re known as a dessert that gets more-or-less splurged around lent, but Paczki Day isn’t just about the pastries alone." Perhaps, but they are enough for me.

Make a habit of sustained success.