Key Takeaways

- 1040s can be filed today.

- Don't file until you have all of your stuff.

- Reaction to Pretti shooting may trigger shutdown.

- IRS faces challenging season even without a shutdown.

- Guidance on claiming overtime and tip deductions.

- State season also kicks off.

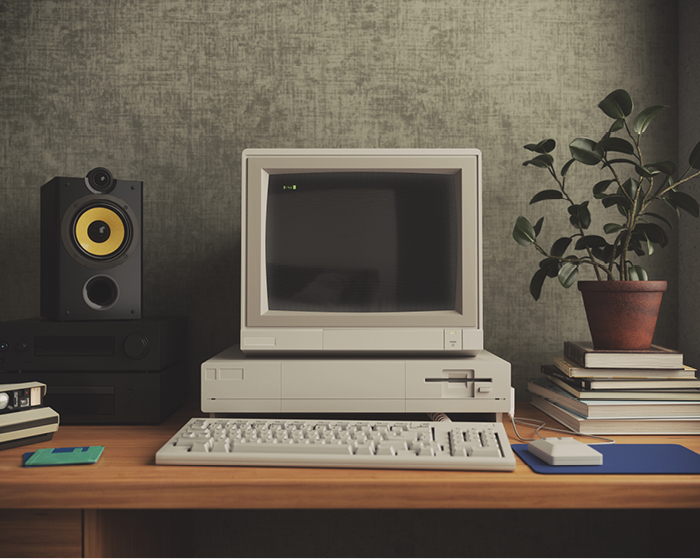

- Lotus 1-2-3 day.

Go! The tax filing season is officially underway today, with the IRS now accepting individual returns. Many taxpayers will get big refunds this year as a result of last year's tax bill, and the administration's efforts to delay the benefits until taxpayers file their 2025 returns.

But even if you are expecting a big refund, don't jump the gun. Make sure you have all of your information returns - 1099s, W-2s, K-1s - in hand. If you are a gig worker, be sure you have organized your income and expenses for the year. And if you pay estimated taxes, double-check to make sure you report the right amount of payments that you have made. These are all common issues that delay tax refunds.

The future of this filing season is in doubt. In the wake of the Alex Pretti killing in Minneapolis over the weekend, Congressional Democrats want to reconsider Department of Homeland Security Funding that was otherwise expected to be approved this week. This may lead to a partial government shutdown that will affect the IRS.

Shutdown Risk Rises as GOP Dismisses Threat to Block DHS Funds - Steven Dennis and Erik Wasson, Bloomberg:

While some Senate Republicans have insisted on a full investigation after Border Patrol agents killed Alex Pretti on Saturday, Republicans will still try to pass the full spending package that has money for Immigration and Customs Enforcement and the Border Patrol.

...

Senate Democrats, led by Chuck Schumer have insisted that DHS funding be split off until Congress can agree on new guardrails for immigration enforcement, after agents killed two US citizens so far this year in Minnesota.

The shutdown cometh - Andrew Desiderio, Jake Sherman and John Bresnahan, Punchbowl News:

It’s also less than a week before the deadline to fund the Department of Homeland Security and several other major departments and agencies, including the Pentagon. A partial government shutdown would begin on Friday night if the impasse isn’t resolved.

Saturday’s horrific shooting — and the Trump administration’s handling of the aftermath — galvanized Senate Democrats, who quickly united on a strategy to block the six-bill FY2026 funding package unless the DHS funding, which includes ICE, is stripped out and renegotiated. This would require the House to vote again. And that’s a serious problem since the chamber is on recess all week.

Democrats Demand Changes to Homeland Security Bill, Risking Another Shutdown - Siobhan Hughes and Lindsay Wise, Wall Street Journal:

Senate Minority Leader Chuck Schumer (D., N.Y.) said Sunday that Republicans should work with Democrats to instead advance the other five funding bills in the package while lawmakers rewrite the Department of Homeland Security measure. Democrats are demanding constraints on DHS’s immigration enforcement activities and more oversight.

...

Republicans control the Senate 53-47, but 60 votes are needed to advance most legislation.

For more on the potential impact of a shutdown on the IRS, read this X/Twitter thread by Andrew Lautz.

Not That A Smooth Season Was Guaranteed in the First Place

Tax Pros Warn Of Turbulent 2026 Filing Season Ahead - Asha Glover and Stephen Cooper, Law 360 Tax Authority ($):

The 2026 tax filing season opens Monday and runs through April 15. The Internal Revenue Service expects to receive about 164 million individual income tax returns, predicting that most taxpayers will file electronically, according to a Jan. 8 announcement. The agency is committed to improving on last year's tax filing season, delivering on the promise of the 2025 GOP budget law to drive economic growth for businesses and consumers, acting Internal Revenue Commissioner Scott Bessent and IRS CEO Frank Bisignano said ahead of the opening.

Those assurances aren't persuasive to several tax professionals, who expect problems given the agency's ongoing leadership changes, smaller budgets and loss of experienced staffers just as new provisions to the code from last year's tax law take effect.

I expect filing season to go relatively smoothly for taxpayers with simple returns that are filed accurately. For anything with a mistake, anything paper filed, expect delays.

I also expect a lot of confusion - and errors - to result from the differences between campaign promises like "no tax on Social Security" and "no tax on overtime" and the tax bill that actually passed.

Tips and Overtime: IRS Clarity; How To Claim

How to claim tax breaks on overtime, tips and more this filing season - Julie Weil, Washington Post:

...

When workers earn a bonus for working extra hours— the “half” part of those “time-and-a-half” earnings — that money won’t be taxed. The income limitation is the same as those on tips, but the total allowable deduction is capped at $12,500 for an individual and $25,000 for joint filers.

This deduction also requires taxpayers to have a Social Security number and to file jointly if married. It isn’t limited to specific named occupations, though not all workers are entitled to overtime pay under the Fair Labor Standards Act.

IRS Provides Clarity on Overtime Deduction for Federal Workers - Trevor Sikes, Tax Notes ($):

Federal workers should look at their Standard Form 50, “Notification of Personnel Action,” to see whether they are a Fair Labor Standards Act overtime-eligible employee, according to a fact sheet (FS-2026-1) released January 23.

...

Limiting qualified overtime to the FLSA and its premium portion of the “time-and-a-half” pay has raised concerns about money being left on the table for workers and has been criticized by groups such as unions, which often negotiate overtime standards that deviate from the FLSA’s requirements.

What's in the Funding Bills for IRS

Senate To Take Up Spending Bills With $11.2B IRS Funding - Asha Glover, Law360 Tax Authority ($):

The Senate returns to the Capitol on Monday after a weeklong recess, giving it just six days to pass six appropriations bills and avoid a government shutdown. The Financial Services and General Government and National Security and Department of State, and Related Programs Appropriations Act, or H.R. 7006, would fund several departments and agencies, including the Internal Revenue Service.

According to bill summaries provided by the House and Senate panels, the legislation would provide roughly $5 billion for IRS enforcement activities, a funding drop of $439 million from the previous year. The bill directs $35 million of the enforcement budget toward funding investigative technology.

Capitol Hill Recap: IRS Budget Continues to Slide - Alex Parker, Eide Bailly:

More on Filing Season: Refunds, Now and Later, and Pet Deductions

The New Tax Rules That Can Get You a Bigger Refund This Year - Ashlea Ebeling and Richard Rubin, Wall Street Journal:

...

The standard deduction for 2025 is $15,750 for single filers and $31,500 for married couples filing jointly. Last year’s tax law raised those by $750 and $1,500, respectively, on top of the Internal Revenue Service’s normal year-to-year inflation adjustments.

Taking the standard deduction is still the best option financially for nearly 90% of taxpayers. Still, this year’s changes might mean you would be better off itemizing your deductions.

Pets are family. But can you claim them as dependents on your tax return? - Michelle Singletary, Washington Post:

I certainly understand the reasoning. My 10-pound Yorkshire terrier mix is like having another child, right down to expense of hiring a babysitter when my husband and I travel. And the vet bills? Oh my!

Well, the owner of an 8-year-old golden retriever is trying to test the idea of a doggy dependent in a lawsuit filed against the IRS last year in New York. Amanda Reynolds of New York wants the agency to recognize her dog, Finnegan Mary Reynolds, as a dependent — specifically, as a “quasi-citizen entitled to limited civil recognition, including dependency status for tax purposes.”

If pets ever become claimable dependents, I'm getting an ant farm.

Do You Want Your 2026 Refund Now or in April 2027?

Why It Pays to Check Your Tax Withholding This Year - Ashlea Ebeling, Wall Street Journal:

Refunds on average are expected to come in $1,000 higher than usual this year, according to a study by investment firm Piper Sandler. Some taxpayers, especially upper-middle-income taxpayers with high state and local taxes, could see surprise refunds of an extra $10,000 or more. The average refund last year came in at $3,167.

That means people are paying in more in taxes via withholding than needed and could instead keep a bigger portion of their paychecks throughout the year.

It's State Tax Season Too

State Tax Playoffs: Legislative Sessions Kick Off a High‑Stakes Season - Melissa Menter and Colette Sutton, Eide Bailly:

While fans are watching the playoffs and gearing up for the Super Bowl, we figured it’s the perfect time to draw a little inspiration from the gridiron. Let’s start with the "states" still in the playoffs—California, Colorado, Massachusetts (New England), and Washington. While the teams battle it out on the football field, these states are running their own policy plays off the field.

Blogs and Bits

States enhance movie and TV tax credits to lure productions - Kay Bell, Don't Mess With Taxes. "Critics of the state film tax credits cite lax oversight. In many cases, they say production companies have received credits for which they were not eligible and/or tax credits that were higher than what was legitimately earned."

Lawsuit Settlement Form 1099 Requires Special Care On Your Taxes - Robert Wood, Forbes. "If you received a lawsuit settlement, you are likely to receive an IRS Form 1099, a reminder not to forget to pay your taxes. IRS Forms 1099 feature prominently in lawsuit settlements."

Tax Court Rejects Executor's Attempt to Reduce Value of Estate - Parker Tax Pro Library. "The court also found that the executor was personally liable under Code Sec. 6901 as a transferee because he transferred the residuary estate to himself, rendering the estate insolvent."

Related: Eide Bailly Wealth Transition Services.

How Not to Approach Tax Season

Man sentenced for eight-year tax fraud - US Attorney, Southern District of Texas (Defendant name omitted, emphasis added):

Defendant pleaded guilty April 23, 2025.

U.S. District Judge Sim Lake has now ordered Defendant to serve 21 months in federal prison to be immediately followed by one year of supervised release. At the hearing, the court heard how Defendant provided false wage and withholding information in his tax returns over a span of eight years to induce the IRS to pay him refunds. The fraudulent refunds were Defendant’s primary source of income during this timeframe, and he affirmatively sought to claim these refunds even after the IRS caught on to his scheme and placed a hold on payments.

In handing down the sentence, the court noted that Defendant’s conduct was particularly willful and involved year after year of false submissions. The court also stated that “eight years of continuous fraud cries out” for an appropriately significant sentence.

Defendant admitted that, for the 2013 to 2020 tax years, he filed false joint Form 1040 U.S. Individual Income Tax Returns and received inflated tax refunds to which he was not entitled. As part of the plea, Defendant acknowledged creating shell companies that issued W-2 forms to himself, falsely reporting hundreds of thousands of dollars in wages and significant tax withholdings each year.

In reality, he earned no such wages, and no taxes had been withheld. Defendant’s scheme resulted in a total tax loss of over $260,000 in fraudulent refunds.

Needless to say, he doesn't get to keep the refunds.

What day is it?

It's Lotus 1-2-3 Day, commemorating the release of the once-dominant spreadsheet program. Back before windows, paleolithic tax pros would eagerly type "123.exe" at the C prompt and get to work on spreadsheets that carefully minimized memory use. While working a particularly tricky project, we might hit "F9" and go to lunch, knowing that the spreadsheet might still be processing when we got back. Then we would make sure to use the correct setup string to get the results to print on a dot matrix printer.

Excel jockeys, you don't know how good you have it.

Make a habit of sustained success.