Key Takeaways

- Sales Tax Audits Are Escalating

- California and Washington Pursue Wealth Tax

- Georgia Debates Lowering Income Tax or Property Tax

- Maine Proposes Mandatory Worldwide Combined Reporting

Welcome to this edition of our roundup of state tax developments. The State Tax News and Views is published biweekly. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance and incentive needs.

State Legislative Sessions Begin Their “Playoffs”

Colette Sutton, Eide Bailly

Thirty‑five states just kicked off their legislative sessions, and the field is heating up fast. Over the next few months, bills will be snapped into play, blitzed with amendments, tackled, and—if they can break through the defense—scored into law.

While fans are watching the playoffs and gearing up for the Super Bowl, we figured it’s the perfect time to draw a little inspiration from the gridiron. Let’s start with the "states" still in the playoffs—California, Colorado, Massachusetts (New England), and Washington. While the teams battle it out on the football field, these states are running their own policy plays off the field.

So, we’re calling our own timeout to see what they’re tackling this season in the world of state taxes.

CALIFORNIA

The Proposed California Wealth Tax Is Far Higher than 5 Percent - Jared Walczak, Tax Foundation:

One particularly momentous policy choice has the potential to strip the founders of some of the world’s largest companies of their controlling interests and force them to sell off a significant portion of their shares. This could send stock prices plummeting to the detriment of tech employees and investors of all stripes, including ordinary workers whose 401(k)s would take a beating if Silicon Valley founders had to offload their shares in a hurry.

COLORADO

Colorado Governor Says He Supports Another Income Tax Reduction - Emily Hollingsworth, Tax Notes ($):

[...]

And a bill enacted in 2024 (S.B. 24-228) temporarily set the income tax rate to 4.25 percent for tax year 2024; the rate reverted to 4.4 percent, the current rate, in 2025.

Polis called for further income tax cuts, saying, “Just as we came together during the special session to close corporate tax loopholes, I am hopeful that we can come together again to cut the income tax rate.”

Colo. House Bill Seeks Sales Tax Break For Data Centers - Paul Williams, Law360 ($)

H.B. 1030 would offer a 100% sales tax exemption for data center operators investing at least $250 million in data center infrastructure and creating full-time jobs with an average compensation of at least 110% of the average wage in the data center's county, among other criteria. Rep. Alex Valdez, D-Denver, filed the bill Wednesday.

MAINE

Maine Proposes Mandatory Worldwide Combined Reporting - Colette Sutton, Eide Bailly:

L.D. 1939, titled “An Act to Close Maine’s Tax Loophole for Offshore Profit Shifting,” proposes requiring large corporations—specifically those with more than $1 billion in gross revenues—to file mandatory worldwide combined returns for Maine corporate income tax purposes. The bill aims to curb offshore profit shifting by ensuring multinational businesses report worldwide income rather than limiting filings to U.S.-based operations. If enacted, the new requirements would apply beginning January 1, 2027, giving companies time to adjust.

The proposal has generated significant debate, with organizations such as the Council On State Taxation (COST) submitting opposition, citing concerns about the administrative burden, competitiveness, and the complexity of enforcing such a system in a state where no other jurisdiction mandates worldwide combined reporting. This bill was introduced during the previous legislative session and has been carried over to this year’s session, which began on January 7, 2026.

MASSACHUSETTS

The State of Use Tax Apportionment After Ellingson Drainage - Cameron Browne, Tax Notes ($)

The test requires that a state only tax the portion of revenue from an interstate activity that reasonably reflects the in-state component of that activity. [...]

Despite the Court’s decision to deny review of Ellingson Drainage, Pomp said the case has put the issue of use tax apportionment on everyone’s radar. And he noted there are other developing cases that are raising the same issue. “The Court has not seen the last of this,” he added.

[...]

In their September 15, 2025, joint statement, the ATA and TAM said that while most states exempt trucks, trailers, chassis, and containers, Massachusetts imposes use tax on the items if they were purchased out of the state and used in Massachusetts for more than six days during a calendar year.

WASHINGTON

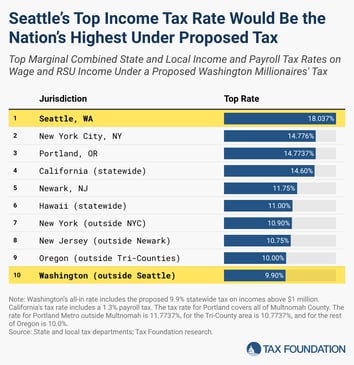

Proposed Washington Income Tax Would Yield a Top Rate of More Than 18 Percent - Jared Walczak, Tax Foundation:

Washington’s New Meal Assembly Tax Guidance - Eide Bailly, Colette Sutton

IT Company's Microsoft Services Are Taxable, Washington Court Says - Cameron Browne, Tax Notes ($)

In its December 22 decision in Valente Solutions LLC v. Department of Revenue, the Washington Court of Appeals rejected the company’s B&O tax refund, finding that the company failed to present evidence to prove that its main client, Microsoft, did not receive its services in Washington.

And for the rest of the states—whose football teams may be out of the running but whose lawmakers are very much still in the game—here’s a look at the big moves they’re making.

ARIZONA

Ariz. Bill Seeks Notice Before Some New Tax Dept. Stances - Zak Kostro, Law360 ($):

[...]

Notification would be required if a proposed new interpretation or application of a provision of Arizona tax law would "adversely affect taxpayers prospectively," the bill said, and the department would need to provide such notification before the proposed change were adopted.

GEORGIA

Legislative leaders float different visions for tax relief for the 2026 session - Alander Rocha, Georgia Recorder:

A special Senate committee voted 6-3, along party lines, to adopt its final legislative recommendations, which would waive income taxes for all Georgians on up to $50,000 a year for individuals and $100,000 for married couples starting in 2027.

IDAHO

Idaho’s Budget Balancing Act - Colette Sutton, Eide Bailly:

Idaho’s 2026 State of the State address highlighted the challenge of balancing the budget without raising taxes amid a nearly 14% revenue drop driven by prior tax cuts, rising costs, and projected deficits. At the same time, Idaho is weighing whether to conform to the federal One Big Beautiful Bill Act (OBBBA), which permanently reduces federal taxable income and could further shrink Idaho’s tax base if adopted. With OBBBA conformity listed as a key budget priority, state leaders must decide how much federal alignment Idaho can afford while managing the fiscal strain ahead.

MARYLAND

Maryland Reminds Taxpayers of New Surcharge on Capital Gains - Kennedy Wahrmund, Tax Notes ($):

Technical Bulletin No. 58, released December 29, 2025, explains that under the fiscal 2026 budget adopted in May 2025, individuals with a federal adjusted gross income above $350,000 must pay an additional 2 percent tax on net capital gains included in their Maryland AGI. The new surcharge applies to capital gains income in 2025 and later tax years.

The surcharge applies regardless of filing status and encompasses capital gain income received directly or passed through from passthrough entities and fiduciaries.

Maryland Governor Seeks to Extend, Expand Business Tax Credits - Kennedy Wahrmund, Tax Notes ($):

The proposal, announced January 9, is known as the Delivering Economic Competitiveness and Advancing Development Efforts (DECADE) Act of 2026 and would extend and revise several existing tax incentives aimed at encouraging business investment, research activity, and job creation in the state.

MISSOURI

Missouri Governor Wants Income Tax Phaseout on 2026 Ballot - Matthew Pertz, Tax Notes ($):

In his 2026 State of the State address, Kehoe urged legislators to begin the process of eliminating the income tax while finding new revenue avenues in untaxed services.

[...]

Kehoe said the current sales tax regime misses a lot of digital sales and subscription services that could supplement revenue while the income tax is reduced.

NEBRASKA

Nebraska Lawmaker Proposes Excise Tax on Social Media Companies - Emily Hollingsworth, Tax Notes ($):

L.B. 1025, introduced by Sen. Carolyn Bosn (R), describes the tax as an excise tax on the collection of consumer data from Nebraska residents. The bill was referred to the Revenue Committee January 15.

Nebraska Bill Proposes Income Tax Exemption for Tips - Colette Sutton, Eide Bailly:

Nebraska LB 932 would create a new state income tax exemption specifically for tip income. Under the bill, a taxpayer would be allowed to exclude up to $25,000 per year in tips from Nebraska taxable income. This exemption would gradually phase out for higher‑income earners: for every $1,000 that a taxpayer’s annual gross income exceeds $150,000 (or $300,000 for joint filers), the exemption would be reduced by $100. In effect, LB 932 is designed to provide meaningful tax relief to lower‑ and middle‑income tipped workers while scaling back the benefit for higher‑income individuals.

NEW HAMPSHIRE

New Hampshire Bill Would Reduce Business Enterprise Tax - Matthew Pertz, Tax Notes ($):

H.B. 155, first introduced by Rep. Joe Sweeney (R) January 6, 2025, was approved by the House in a 189–165 vote January 8, more than a year after its introduction. The bill would reduce the BET rate from 0.55 percent to 0.5 percent. If enacted, the new rate would take effect on December 31, 2027.

WEST VIRGINIA

West Virginia Governor Urges Income Tax Cut, Federal Conformity - Kennedy Wahrmund, Tax Notes ($):

Speaking to a joint session of the State Legislature on January 14, Morrisey urged lawmakers to approve a 10 percent reduction in the personal income tax, describing the proposal as a key strategy for boosting economic growth.

Time to grab your headset and step on the sidelines.

Tennessee is hosting a free webinar on January 27, 2026. During this webinar, Tennessee will explain their consolidated net worth election for franchise & excise tax, including eligibility, filing requirements, and how affiliated groups can compute their net worth base on a consolidated basis to simplify compliance. Find more information about the free webinar here.

SEASONED WITH SALT

Tax Tips, Tricks and Opportunities

Sales Tax Audits Are Escalating - Prepare Your Business Now - Scott McCrillis, Eide Bailly

States continue to adopt increasingly aggressive sales and use tax audit practices—a trend only accelerated in recent years by ongoing budget pressures, expanded economic nexus rules and the growth of complex multistate business models such as digital goods. Audit activity is becoming more frequent and broader in scope, with states targeting not only large companies but also small and mid‑sized businesses, remote sellers and marketplace facilitators. In addition to the scope of who gets audited, auditors are delving deeper into what constitutes a taxable transaction, often re-examining long-standing interpretations and aggressively challenging exemption claims. Auditors are increasingly less willing to negotiate with Taxpayers in the audit phase. They are more content to close contested audits and force Taxpayers into appeals processes to get potential relief.

Given this environment, companies must proactively plan and build stronger sales tax readiness. This includes establishing continuous monitoring of economic nexus thresholds, maintaining accurate address‑level sourcing systems to avoid punitive assessments, and routinely reassessing the taxability of digital goods, SaaS, and mixed‑service offerings. Strengthening documentation, modernizing compliance processes, and conducting periodic risk assessments can significantly reduce exposure before a state initiates an audit. Ultimately, sales and use tax is no longer a back‑office administrative task—it is a growing strategic risk area requiring the same attention as financial reporting, cybersecurity, or regulatory compliance. Engaging in regular internal reviews, seeking professional guidance, and preparing for the possibility of multistate audits are essential steps. By doing so, businesses can reduce the likelihood of costly surprises and position themselves to respond effectively if selected for audit.

Make a habit of sustained success.