Key Takeaways

- One provision in the OBBB will change the expense apportionment rules on foreign income.

- It will lessen the effects of foreign tax credit limits that had led to high overseas tax bills under the TCJA.

- The taxpayer-favorable change brings the U.S. system closer to the OECD standards.

- Revenue from Trump's tariffs could make them hard to reverse.

- France's digital service taxes faces constitutional challenge.

The One Big Beautiful Bill Act made several changes to the U.S. tax code’s international provisions—including new rates on offshore income and shifting the focus away from intangible assets.

There were other tweaks too, some of which business groups had been pushing for since the Tax Cuts and Jobs Act enacted most of these rules back in 2017. One key change is on how expenses are apportioned against foreign income. It’s a technical fix, but it could dramatically affect some companies’ overseas tax liabilities.

Prior to 2025, the tax on global intangible low-taxed income typically imposed a 10.5% tax on some types of offshore earnings. As it was pitched by the TCJA’s authors, it was a minimum tax that would prevent companies from placing income in low-tax jurisdictions. But it didn’t always work that way—due to foreign tax credit limits, the effective tax rate on income in the GILTI category could be much higher for some taxpayers. Those limits apply based on the proportion of income that was foreign, which is partially determined by how the tax rules allocate expenses.

Those limits aren’t going away, but changes enacted by the OBBB ensure that only expenses “directly allocable to such income” can be allocated to GILTI when calculating the FTC limits. (Which is now called “net CFC tested income” or NCTI.) Business interest or R&D costs–two items which could be formulaically apportioned to foreign income under prior law–are now expressly barred from applying to NCTI.

The expense allocation rules were a controversial subject during the initial implementation of the TCJA, and some business groups criticized the U.S. Treasury Department for allowing any R&D/interest expenses to be apportioned against GILTI. Some noted that the conference committee report passed alongside the law stated that the tax on GILTI would not be more than 10.5%. But while committee reports can sometimes be used in the interpretation of laws, they don’t carry legal force themselves, and Treasury declined to offer full relief on the issue. (They did eventually create a high-tax exception to GILTI for those paying 18.9% or higher on the income.)

While this is a taxpayer-favorable change, it actually brings the U.S. system closer to the Organization for Economic Cooperation and Development’s 15% global minimum tax, which did not have this issue. Other changes brought the U.S. closer to the OECD as well, including a hike in the offshore rate to 14%. But in other ways the OBBB moved further away, including by nixing a carveout for tangible assets.

Noteworthy Items This Week

However, the law also included a major catch for the Section 48E and Section 45Y provisions and other incentives that benefit from these longer timelines: a highly complicated web of restrictions to ban projects linked to foreign entities of concern, or FEOCs, from taking advantage of the incentives.

Trump’s Tariffs Are Making Money. That May Make Them Hard to Quit. – Andrew Duehren, The New York Times:

“I think this is addictive,” said Joao Gomes, an economist at the University of Pennsylvania’s Wharton School. “I think a source of revenue is very hard to turn away from when the debt and deficit are what they are.”

African Nations Say G7 Deal Shows Global Tax Rules Are Broken – James Munson, Bloomberg Tax ($):

Negotiators at the UN are seeking binding agreements on two broad issues: the taxation of cross-border services in a digitalized economy and the resolution and prevention of tax disputes.

French Digital Services Tax Comes Under Constitutional Scrutiny – Stephanie Soong, Tax Notes ($):

Those proposed tariffs — along with proposed tariffs on other countries with DSTs that the U.S. government deemed as discriminatory — were ultimately suspended under the so-called unilateral measures compromise in October 2021 against the backdrop of OECD tax reform negotiations. However, the second Trump administration has started using trade disputes to pressure countries into abandoning their DSTs.

It’s a choice between “freedom and serfdom,” Marcel Dettling says before tossing the treaty documents onto a bonfire.

The trouble for Dettling and Switzerland’s other EU naysayers is that the alternative vision of a nimble nation trading freely with the rest of the world isn’t looking so good anymore. On the day the video was released — Aug. 1, Switzerland’s national day — the White House delivered a bombshell by announcing the country would face tariffs of 39% on all exports to the US, among the highest anywhere in the world.

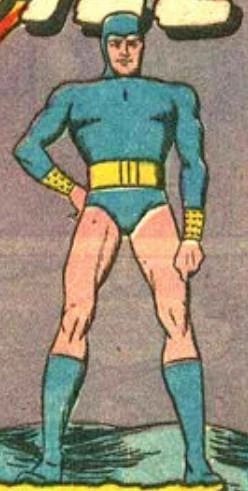

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Fireball

Debut Year:1941

Debut Publication: Pep Comics #12

Origin Story: A brave fireman who was left unconscious at a laboratory fire set by an arsonist, he was coated in chemicals that gave him power over flames.

Superpowers: He can control and absorb fire, even to melt bullets.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.