Key Takeaways

- Personnel losses likely to reduce high-income taxpayer exams.

- Not everyone wants electronic refunds.

- IRS passthrough chief steps down.

- Ken Kies and the Malta scheme.

- Updates on the new tax law.

- Bad appraiser = $0 deduction.

- National Gummi Worm Day.

IRS Struggles to Prove Compliance With High-Income Audit Goal - Tyrah Burris, Tax Notes ($):

...

Because of the probationary termination notices and the first deferred resignation program initiated by the administration, the number of revenue agents has declined by approximately 31 percent, TIGTA reported. The agency also lost over 23,000 employees during the second resignation program.

TIGTA said that depending on the outcome of the staffing losses, it may be difficult for the IRS to continue the shift to examining high-income audits.

Link: TIGTA report

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

Trump Plan to End Paper Tax Refunds This Year to Hit Millions - Cole Reynolds, Bloomberg ($):

Individuals who could struggle to get electronic payments include those who don’t have enough money to open bank accounts or elderly people who aren’t comfortable using online payment systems. Numerous Native American communities submitted responses, arguing that electronic payments could be difficult for members of tribal communities who live in rural areas and without reliable internet access.

...

Other types of taxpayers could struggle, too. The American Institute of CPAs urged Treasury to exempt trust and estate income tax filings until tax forms for those groups can be updated with a place to enter direct deposit information.

Link: Executive order on paper checks.

Head of Passthrough Chief Counsel Office Departs IRS - Kristen Parillo, Tax Notes ($):

...

Given the IRS’s heightened scrutiny of passthroughs and wealthy taxpayers during the Biden administration, Erickson’s skill set was seen as especially useful by tax professionals who expected to see more guidance and enforcement initiatives concerning partnership structures and other passthrough issues.

But with the IRS facing significant budget and staff cuts under the Trump administration, tax professionals have questioned whether the IRS will be able to sustain some of the partnership initiatives launched in the last few years. In a partially redacted report released in May, the Treasury Inspector General for Tax Administration warned that IRS budget and staff cuts could limit the agency’s ability to effectively use artificial intelligence in selecting large and complex partnership returns for audit.

He Helped Big Companies Dodge Taxes. Now He’s Writing the Rules. - Jesse Drucker, New York Times:

...

More recently, Mr. Kies has worked to protect the strategy known as Malta Pension Plans, which wealthy Americans have used to cut their tax bills by moving assets into offshore vehicles.

In 2021, the I.R.S. added the tax dodge to its “dirty dozen” list, and its criminal division later issued summonses to people who may have used the deals, along with their tax advisers. In 2023, the Treasury Department issued a proposed regulation requiring users of the strategies to disclose them to the I.R.S. as so-called “listed transactions.”

Disaster Bill Update

Congress passes act allowing tax relief when a state declares disaster - Martha Waggoner, The Tax Adviser:

The Senate on Thursday passed H.R. 517, the Filing Relief for Natural Disasters Act, which passed the House in April. It now goes to President Donald Trump for his signature.

Disaster relief done — what next? - Bernie Becker, Politico: "Sen. Catherine Cortez Masto (D-Nev.), one of the measure’s sponsors, noted that only one county in Texas had received a federal declaration as of Thursday, while a state emergency had been proclaimed in more than 20 counties."

More on the new tax law

Americans’ New Tax Rates Depend on Who They Are and What They Do - Ben Steverman, Bloomberg via MSN:

A lucrative 20% deduction for pass-through business owners, introduced in 2017 and scheduled to expire, will remain in the code while continuing to exclude the wealthy in legal, financial, health care and other service industries.

IRS to Give Relief on Tips, Overtime Breaks in Trump’s Tax Law - Erin Slowey, Bloomberg ($):

- The tip and overtime breaks go into effect retroactively for 2025 and will expire after 2028. The IRS will provide transition relief both for taxpayers and for employers subject to new reporting requirements, the agency said.

- The law also requires the IRS to provide a list of occupations that traditionally receive tips by Oct. 2.

- The IRS said it will also provide transitional relief on “no tax on car loan interest” provision.

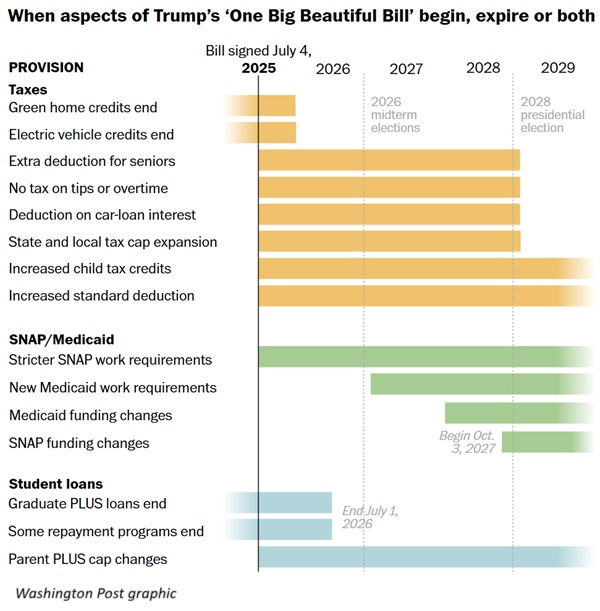

When will Trump’s ‘big’ tax law take effect? Here’s what to expect. - Amy Wang, Washington Post. "Key provisions in the president’s signature legislation will take effect at different times over several years."

Foreign Entity Tripwires Complicate Clean Energy Provisions - Jonathan Curry, Tax Notes ($):

In addition to accelerated phaseouts, six energy tax credits related to the Inflation Reduction Act now face restrictions based on whether the taxpayer is a specified foreign entity or foreign influenced entity.

Related: Eide Bailly Business Credits & Incentives Services.

Questions About The New Tax Bill? Taxgirl Has Answers - Kelly Phillips Erb, Forbes. "Warning: There are some answers that even tax lawyers like me can’t be sure of, until the Treasury and IRS issue regulations."

Regular-ish Tax Things

IRS’s Penalty Policy for Foreign Gifts Discourages Compliance - Michael Miller, Bloomberg Insights:

Years later, when he learned his accountant had erred, he promptly filed the delinquent disclosures and was penalized. The IRS determined that checking with his accountant twice just wasn’t good enough.

Related: Eide Bailly Foreign Trust & Estate Tax Compliance & Planning Services.

Preparing for the Journey From Status Quo to Better Tax Systems - Annette Nellen, Tax Notes ($):

- insufficient focus on what isn’t taxed compared with what is;

- overlooking design features that are contrary to principles of good tax policy;

- enacting tax cuts without accountability measures or data-driven justification;

- considering new taxes or higher rates while ignoring tax base flaws in existing taxes;

- confusion with tax and budget terminology;

- not keeping the tax system up to date and not considering relevant new ideas; and

- not addressing low tax literacy.

It's not just the general public - low tax literacy is normal among legislators.

Blogs and Bits

Elderly couple gets prison terms for $20M insurance scheme - Kay Bell, Don't Mess With Taxes. "The scheme included mispresenting policy applicants’ health, wealth, and existing life-insurance coverage."

Recent Developments: Interpreting the Johnson Amendment in Tax-Exempt Status Litigation - Ed Zollars, Current Federal Tax Developments. "Tax professionals who advise tax-exempt organizations are aware of the stringent rules governing political activity, particularly for entities described under Internal Revenue Code (IRC) Section 501(c)(3)."

Related: Eide Bailly Exempt Organization Tax Services.Supreme Court: Taxpayer's Refund Dispute with IRS Mooted When IRS Canceled Levy - Parker Tax Pro Library. "A dissenting opinion was filed by Justice Gorsuch who wrote that, given the majority's opinion, Code Sec. 6330 proceedings are essentially risk-free for the IRS because the IRS may pursue a levy and argue its case to the Tax Court and then, if the Tax Court seems likely to side with the taxpayer, the IRS can drop the levy and avoid an unfavorable ruling on the taxpayer's underlying tax liability."

Depreciation recapture can increase taxes on the sale of a residential rental property - National Association of Tax Professionals. "When a rental property is sold for more than its adjusted basis (original cost minus depreciation), the IRS may ‘recapture’ the depreciation deductions previously claimed. This means the taxpayer must pay taxes on the amount of depreciation claimed during ownership, up to a maximum tax rate of 25%."

Transfer Pricing for Government Contractors: Not Just for the Tax Department - Chad Martin, Eide Bailly. "It’s not just tax authorities who scrutinize transfer pricing policies."

How much do you want it to be worth?

Disqualified Appraisals Sink $62 Million in Easement Deductions - Chandra Wallace, Tax Notes ($):

Collins knew that the subject properties had been purchased during 2015 — shortly before the easement donations were made — for an aggregate total of less than $6 million, according to the opinion. Yet he submitted tax returns for the LLCs, based on Foster’s appraisals, that claimed the properties were worth $62.7 million.

This sufficed to show Collins had reason to expect that Foster falsely overstated the properties’ value, the court found.

The Tax Court didn't think much of the expert witness used to support the valuations. From the opinion in Rock Cliff Reserve LLC vs Commissioner (emphasis added, Expert name omitted, emphasis added):

Throughout his reports, Expert consistently avoided choosing sales of comparable properties near the properties he was appraising. He never provided a satisfactory explanation for this repeated, glaring mistake.

The Court does not assign any credibility to the reports produced by Expert.

If you donate appreciated property other than publicly-traded securities to charity, and you claim a donation over $5,000, you need a qualified appraisal. A bad appraisal takes your deduction to zero. Be careful.

What day is it?

It's National Gummi Worm Day, honoring an important part of a healthy breakfast.

Make a habit of sustained success.