Key Takeaways

- Senate GOP leadership working on last holdout votes.

- House will have to digest big Senate changes.

- Rule arbiter removes proposed limit on state income taxes.

- Wind, solar farms see "existential threat."

- Litigation finance tax falls out of bill.

- Canada to lift digital services tax.

- Yoga mogul gets a 4-year stretch.

- National Creative Ice Cream Flavors Day.

Update, 11:23 CDT: Senate Passes Trump’s Megabill After All-Night Session - Richard Rubin and Lindsay Wise, Wall Street Journal. "Republicans squeaked President Trump’s tax-and-spending megabill through the Senate on Tuesday, capping a long night of dealmaking to win over holdouts, with a tie-breaking vote from Vice President JD Vance."

Earlier post:

Trump’s agenda teeters after all-night voting session - Andrew Desiderio, Jake Sherman, John Bresnahan and Diego Munhoz, Punchbowl News:

Senate GOP leaders were dealt a major blow by the parliamentarian in the early morning hours that moved Murkowski into the “no” column, causing a mad scramble on the Senate floor overnight.

Murkowski slams brakes on megabill - Lisa Kashinsky, Mia McCarthy, Jordain Carney, Calen Razor and Benjamin Guggenheim, Politico:

...

In a potential sign of just how dire Thune’s whip count was looking in the wee hours, the majority leader huddled in his office with Sen. Rand Paul, who’s long said he would be a “no” on the bill over its debt-ceiling hike.

Another big unknown right now is where Sen. Susan Collins will fall. The Maine senator reminded us less than two hours ago that she’s “said all along that I have concerns with the bill” and also reiterated, when prompted by reporters, that she would have preferred breaking out the tax portion of the policy package on a separate track. Certainly not helping win Collins over: Her bid to boost money for rural hospitals went up in flames.

Senate GOP closes in on passing Trump’s tax bill, but holdouts remain - Jacob Bogage, Theodoric Meyer and Marianna Sotomayor, Washington Post:

...

If the bill makes it through the Senate, the House will need to pass it again before sending it to Trump’s desk — and many House Republicans are unhappy with the Senate’s changes to the measure.

About a dozen members of the hard-line House Freedom Caucus — almost all of whom voted for the bill last month — are upset that the Senate version would add more to the federal deficit. Other House Republicans have balked at the Senate bill’s Medicaid funding cuts, which are deeper than the House version. They fear the cuts will hurt Medicaid recipients and lead rural hospitals in their districts to close, according to House Republicans who spoke on the condition of anonymity to detail private discussions with Republican leadership and their colleagues.

What Happens After the Senate is Done?

Tax Megabill Would Return to House Divided Over Senate Changes - Maeve Sheehey, Bloomberg ($):

...

Fiscal hawks, like those in the Freedom Caucus, are opposed to the Senate bill’s preservation of some of former President Joe Biden’s signature green energy credits. They’re also against the Senate’s treatment of nutrition programs and university endowments.

Pieces of the Bill

Comparing How the House and Senate Bills Deliver on Trump’s Agenda - New York Times. "Many of the tax cuts President Trump signed into law in 2017 are set to expire at the end of the year. Republicans in both chambers want to extend and expand on those tax cuts, but they differ on how to do that."

The article has a useful side-by-side chart comparing tax provisions of the House and Senate bills.

Solar, Wind Firms See Existential Threat in Senate Tax Bill - Michelle Ma, Bloomberg via MSN:

The bill would also roll back clean energy tax credits sooner than the House version of the package. It would require wind and solar projects to be fully operational by the end of 2027 to qualify for incentives. Many observers had expected the Senate to ease the phaseout — not accelerate it.

Litigation Finance Levy Cut From Tax Bill by Senate Referee - Ray Strom and Chris Cioffi, Bloomberg ($). "The proposal would have added a tax on litigation finance proceeds of 31.8%, down from 40.8% in an earlier version of the bill proposed by Sen. Thom Tillis (R-NC). The Senate parliamentarian ruled the proposed tax was not compliant with the expedited procedure Republicans are using to pass the legislation, according to a person familiar with the matter."

Congress Set to Expand Housing Credit Despite Data Shortcomings - Cady Stanton, Tax Notes ($):

...

Some research on the credit, including a 2009 University of Georgia study and a 2019 study of tax credit projects in Seattle, has found examples of cases in which the cost of LIHTC-funded units was inflated on average compared to similar projects.

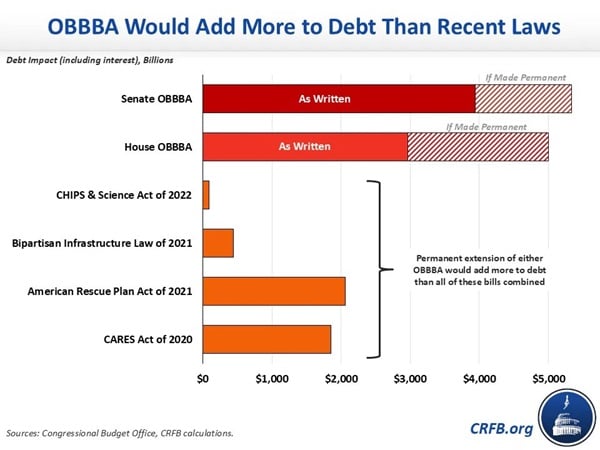

The Senate bill is as big as CARES, American Rescue Plan, Bipartisan Infrastructure, and CHIPS combined - Marc Goldwein, CRFB.org on X.

State(s) of the Bill

Where Things Stand on the GOP Megabill’s Most Contentious Proposals - Jasmine Li, Wall Street Journal:

The maximum deduction would begin phasing down once income passes $500,000. The income threshold would increase by 1% every year through 2029.

Senate Strips P.L. 86-272 Language From One Big Beautiful Bill - Amy Hamilton, Tax Notes ($):

Placing certain types of cookies on an in-state customer’s device or providing post-sale online support are among such examples cited in the Multistate Tax Commission’s 2021 updated statement of information on the application of P.L. 86-272 to modern business activities. The reasoning is that P.L. 86-272 protects the solicitation of orders for sales of tangible personal property — but that many internet-enabled activities neither constitute nor are entirely ancillary to the protected activity of soliciting orders for sales of tangible personal property. New York and New Jersey have adopted, and Massachusetts has proposed, formal revenue regulations that largely track the MTC’s updated guidance.

Related: Eide Bailly State and Local Tax Services.

Across the Borders

EU to Accept Trump Universal Tariff But Seeks Key Exemptions - Jorge Valero and Alberto Nardelli, Bloomberg via MSN:

The EU is also pushing the US for quotas and exemptions to effectively lower Washington’s 25% tariff on automobiles and car parts as well as its 50% tariff on steel and aluminum, according to people familiar with the matter.

Transfer Pricing in the Asset Management Industry: One Size Fits None - Chad Martin, Eide Bailly. "A 'cookie-cutter' approach to transfer pricing in asset management is a fast track to tax fights and bad outcomes."

UK Stands by Digital Tax After Canada Bows to Trump Pressure - Joe Mayes, Bloomberg via MSN:

The US wanted Britain to drop the tax as part of trade talks between the two countries and Prime Minister Keir Starmer’s government had been considering making changes, but the prospect isn’t on the table and hasn’t been for some time, according to the person, who spoke on condition of anonymity.

Related: Eide Bailly International Tax Services.

Blogs and Bits

July tax moves to make after America's birthday party - Kay Bell, Don't Mess With Taxes. "3. Increase your retirement contributions. Did your withholding review result in you getting a bit more in each paycheck for the rest of the year? Great! But don’t spend it. Instead, add it to your retirement savings."

Why You Should File Your Tax Return Even If You Can't Pay - Ronald Marini, The Tax Times. "The IRS imposes a much larger penalty for failing to file than for failing to pay."

The Pending Senate Budget Bill Is Even More Regressive Than The Finance Panel’s Version - Howard Gleckman, TaxVox. "But the current Senate version of the One Big Beautiful Bill Act (OBBBA) would distribute most of those additional tax cuts to the highest-income households. The main reason: the way it treats the state and local tax (SALT) deduction."

Bad Debt Deduction and Accuracy-Related Penalties: Key Takeaways from Anaheim Arena Management, LLC v Commissioner - Ed Zollars, Current Federal Tax Developments:

IRS takes yoga mogul to the mat

Yoga To The People Founder Gets 4 Years For Tax Evasion - Stewart Bishop, Law360 Tax Authority ($, defendant name omitted):

U.S. District Judge John Cronan sentenced [Defendant], 64, to 48 months in prison and ordered him to pay more than $2.7 million in restitution.

...

The government said the trio defrauded the IRS in part by accepting cash payments from yoga students, paying Yoga for the People instructors in cash and keeping the money "off the books."

The executives also refused to provide employees with tax documentation and did not maintain formal corporate books and records, prosecutors alleged.

Paying in cash and not withholding is a great way to assemble a group of potential informants.

What day is it?

It's National Creative Ice Cream Flavors Day. I like anything with chocolate and peanut butter, but there are other options.

Make a habit of sustained success.