Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

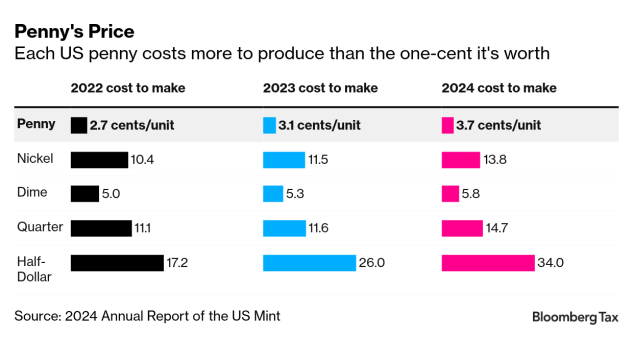

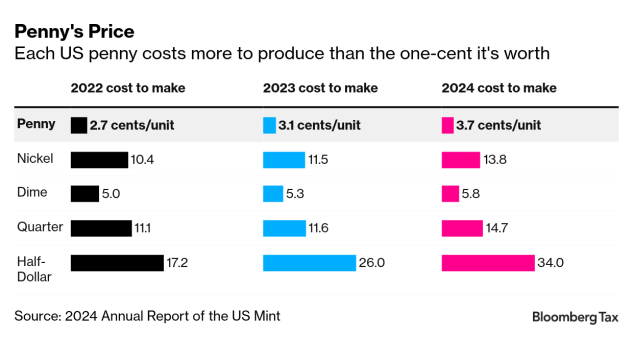

Penny's Threatened Death Drives States to Rethink Sales Tax Math - Michael Bologna, Bloomberg ($):

State tax administrators are preparing for a retail environment without pennies as cost-cutting momentum grows for the US Treasury to stop minting the zinc and copper coins.

...

At a minimum, the states will have to consider how to modify their tax compliance rules to adapt to cash transactions that will have to be rounded to the nearest nickel—a shift that could have implications for overall revenue collections, depending on the way the new rounding rules are structured.

Tax administrators also will have to determine whether cash and electronic transactions should be treated the same for tax purposes. And, tax agencies will have to figure out how to educate retailers and consumers about the coming changes, said Federation of Tax Administrators general counsel Brian Oliner.

La. Tax Dept. Looks At Taking On Remote Seller Audit - Paul Williams, Law360 ($):

The Louisiana Department of Revenue is interested in assuming audit responsibilities from the state's remote sellers commission, an official suggested Thursday, saying the department's more robust staffing may make it better positioned to enforce sales tax compliance from out-of-state businesses.

Louisiana's Sales and Use Tax Commission for Remote Sellers, the centralized sales tax filing entity for out-of-state businesses, "would require a significant audit team" to ensure that companies are properly remitting taxes as it continues to grow, Luke Morris, the department's assistant secretary of legal affairs, said at a commission meeting.

Georgia, Nebraska, Ohio Sanctioned by Sales Tax Uniformity Group - Michael J. Bologna, Bloomberg ($):

The Streamlined Sales Tax Governing Board leveled sanctions on Georgia, Nebraska, and Ohio Tuesday, finding the states weren’t in compliance with the group’s sales tax simplification pact and failed to remedy their conflicts.

The 24-state governing board examined a report of the compliance gaps within each state before voting unanimously to recommend penalties. Streamlined allows states to correct their compliance problems by amending their tax laws or adjusting their administrative procedures, but the report noted none of the states had changed their tax codes since a committee of the board recommended penalties in March.

SALT Proposed Tax Legislation

The U.S. House of Representatives on May 22 passed major tax legislation, the so-called “One Big, Beautiful Bill Act,” that would extend expiring provisions of the Tax Cuts and Jobs Act of 2017, while also adding new tax changes. The legislation passed by a single vote, 215-214, and will now be considered by the Senate under its reconciliation procedure. Both House and Senate Republican leaders have said they hope to pass final legislation, to be sent to President Trump for signature, by July 4.

Modification of SALT Deduction Cap

Traditionally, taxpayers could fully deduct their state and local taxes (SALT taxes) paid (assuming the taxpayers itemized, and subject to certain other limitations) on their federal tax return. A $10,000 limitation for SALT taxes was instated by the TCJA. In response, many states enacted “work arounds” to this limit, including the so called passthrough entity tax (PTET) regime.

The proposed legislation raises the SALT deduction limit to $40,000 for married filing joint filers for so called “specified taxes”, subject to taxable income phaseouts beginning at $500,000 for married filing joint filers. Even after the phase outs, a taxpayer is still entitled to a deduction of up to $10,000. Importantly, the term “specified taxes” is defined to include PTET payments, meaning these payments may not provide a full deduction for higher income taxpayers. These rates will increase slightly over the next 10 years, and will become permanent from 2035 onward.

State-By-State Roundup

Alabama

Alabama Decouples From Federal Research Cost Capitalization Rules- Cynthia Fagelman, Eide Bailly.

Alabama recently enacted

H.B. 163, effectively decoupling Alabama from the TCJA requirements to capitalize and amortize research and experimental costs. Effective for tax years starting on or after January 1, 2024, taxpayers will have the option to currently deduct R&D expenses or treat the expenses in the same manner as deferred expenses under Section 174 prior to the 2022 tax year for Alabama tax purposes.

At the federal level, there is optimism regarding the ability to currently deduct R&D expenses for tax years starting after December 31, 2024, but the current proposed legislation would only be a temporary fix for five years. Alabama is enhancing the incentive by decoupling with a permanent deduction and making the state more attractive for business owners.

For additional questions, please contact the

R&D tax team.

Arizona

Arizona Department of Revenue Issues Advisory Statement on TPT, Use Tax, and Sourcing - Sales Tax Institute:

The Arizona Department of Revenue has released an advisory policy statement dealing with “substantial nexus” and sourcing rules within the state. First, the statement clarifies that the Transaction Privilege Tax (TPT) is a tax on the privilege of doing business in Arizona that businesses can pass on to their clients, and that businesses do not have to be within the state to be subject to the TPT.

...

Once nexus is established, a business must consider sourcing. Arizona’s sourcing rules will help businesses determine the appropriate rate for each business classification and can be found at A.R.S. §§ 42-5034, -5040 with more guidance for retail, personal property leasing, or rental sourcing provisions offered in Arizona Transaction Privilege Tax Ruling TPR 20-2.

Arizona Bill Creates Procedures for Abandoned Digital Assets - Tax Notes ($):

H.B. 2749, signed into law on May 7 as Chapter 150, amends the state’s unclaimed property law by requiring a “digital asset” — including bitcoin and other cryptocurrencies — to be presumed abandoned if the initial owner of the asset fails to respond to a written or electronic notification after 3 years; the bill also requires holders of the abandoned asset to deliver it to the Department of Revenue within 30 days after reporting it as abandoned.

California

California FTB Updates Proposed Changes to Market-Based Sourcing Rule - Tax Notes ($):

The California Franchise Tax Board (FTB) issued another round of changes to the state's code of regulations regarding market-based rules for sales of products other than sales of tangible personal property; the amendments clarify four procedures applicable to when a service relates to real property, tangible personal property, intangible personal property, or individuals, based on public comments received from a public hearing that the FTB held. The FTB also modified the amendments' applicability date from January 1, 2025, to January 1, 2026.

Written comments regarding the new modifications made to the proposed amendments will be accepted until June 5.

Iowa

Iowa Bill Would Recoup Credits From Entities Making Mass Layoffs - Emily Hollingsworth, Tax Notes ($).

Iowa legislation heading to Gov. Kim Reynolds (R) would allow the state's economic development agency to claw back tax credits awarded to businesses that close or lay off employees en masse.

...

Under S.F. 657, the Iowa Economic Development Authority (IEDA) “may reduce or eliminate some or all of the financial assistance awarded” to an entity that closes its business or performs a mass layoff. State law defines a mass layoff as a reduction in employment force that affects 25 or more employees (not including part-time employees) and isn’t the result of a business closure.

Louisiana

Hilcorp Equipment Sales Tax Refund Denied by Louisiana Judge - Richard Tzul, Bloomberg Tax ($):

Hilcorp Energy Co. is barred from pursuing a sales tax refund on rented gas-lift compressor equipment because it didn’t pay the taxes under protest, a Louisiana tribunal announced Monday.

Louisiana prohibits a parish tax collector from returning money that was collected if the government misinterpreted the law, Tax Judge Cade R. Cole said, explaining that the appropriate remedy would be for the taxpayer to make the payment under protest, which the company failed to do.

Washington

Governor Signs Multiple Tax Increase Bills - Eide Bailly:

Washington Governor Bob Ferguson signed a two-year, $78 billion state budget that addresses a $16 billion shortfall primarily through a series of tax increases. The budget is projected to raise approximately $9 billion in new revenue by increasing taxes on gross receipts, capital gains, and gasoline, and by expanding the sales and use tax to cover a wide range of technology-related services.

Key legislation includes

- H.B. 2081: Increases the state’s business & occupation (B&O) tax to

0.5% for certain industries, and imposes a

0.5% B&O tax surcharge on businesses with

over $250 million in Washington taxable income, effective from

January 1, 2026, through December 30, 2029. It also clarifies that businesses can deduct investment income, except for banks, lending institutions, and securities businesses.

- S.B. 5813: Raises the

capital gains tax by adding a

2.9% surcharge on gains exceeding $1 million, and increases certain

estate tax deductions and exclusions.

- S.B. 5814: Expands the

sales and use tax to cover various

technology and service industries, including IT consulting, IT training and support, custom software and website development, staffing, advertising, investigation and security services, and armored car services.

These measures reflect a significant shift in the state’s tax policy, particularly targeting high-income earners and the tech sector to fill the budget gap.

Tax Bites: Tips, Tricks and Opportunities in SALT

Jennifer Barajas, Director, Eide Bailly:

Think Texas doesn’t have an income tax? True for individuals—but businesses aren’t off the hook. Enter the Texas Franchise Tax, also known as the “margin tax.” It’s not based on profits, but on a business’s taxable margin—a fancy way of saying “a business's revenue, minus allowable deductions.”

Fun Fact: The Texas Franchise Tax is technically a privilege tax—you’re paying for the honor of doing business in the Lone Star State. That's right! Important to note: If your business makes less than $2.47 million in annual revenue (as of 2024), you owe no tax—but you still have to file a report. So even if you’re not paying, you’re still playing.