Key Takeaways

- Changes to SALT PTE Elections for Professional Services.

- 30-Day Safe Harbor in Alabama.

- Arkansas Adopts Market-Based Sourcing.

- Minimum Franchise Tax Due in California for Failure to Withdraw.

- Indiana Allows Credit for Taxes Paid by PTEs.

- Missouri and Texas Set to Exempt Capital Gains.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

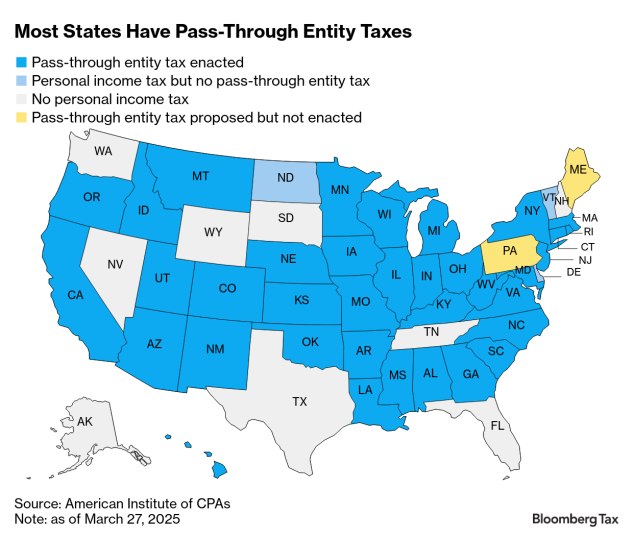

SALT Workaround Used by Doctors, Lawyers Axed in GOP Tax Bill - Michael Bologna, Bloomberg ($):

These tax strategies give partnerships and S corporations the option to pay state and local taxes at the entity level, instead of having individual members pay as they normally would, and thus help the individuals avoid the SALT limit.

Tax Exemption Case May Bring Sweeping Impact, Attys Say - Sanjay Talwani, Law360 ($):

Attorneys said the case before the justices, in which a group of Catholic charities are challenging the denial by the Wisconsin Supreme Court of tax exemptions for religious groups, could affect religious exemptions in several contexts. The attorneys spoke at a panel at the American Bar Association tax section's May meeting in Washington, D.C.

State-By-State Roundup

Alabama

Alabama Set to Enact 30-Day Mobile Workforce Tax Safe Harbor - Michael J. Bologna, Bloomberg ($):

Ivey is expected to sign HB 379, which creates a 30-day threshold before nonresident employees working in Alabama would be subject to the state’s income tax. The proposed law also relieves employers of tax withholding duties within the 30 days. In an increasingly mobile business environment, workers frequently cross state lines to meet with clients, sell products, or attend trade shows. Others live in different states than their employer.

Arkansas

Arkansas Modernizes Multistate Corporate Income Taxation, Adopts Market-Based Sourcing - Bloomberg ($):

California

A recent California case underscores the importance of formally withdrawing from the state when a taxpayer or entity is no longer doing business there. Failing to properly terminate business activities can result in ongoing obligations — even if operations have ceased. One key issue is California’s $800 minimum franchise tax, which applies to entities considered to be “doing business” in the state. While $800 may not seem significant at first glance, it can quickly snowball due to late filing penalties, interest, and compliance costs. Takeaway: If your business has stopped operating in California, ensure that all appropriate steps — such as filing a final return and formally dissolving or withdrawing the entity with the Secretary of State — are completed promptly to avoid unnecessary tax exposure.

California OTA: Art Company Owes Minimum Franchise Tax - Cameron Browne, Tax Notes ($):

Indiana

Ind. Allows Credit For Taxes Paid On Behalf Of Pass-Throughs - Zac Kostro, Law360 ($).

H.B. 1427, which Republican Gov. Mike Braun signed Tuesday, specifies that an electing entity or pass-through entity may claim a credit for taxes paid or withheld on the entity's behalf, according to a fiscal impact statement.

The bill also allows eligible entities to make elections to claim credits against certain state tax liabilities and provides requirements governing such elections, according to the statement.

Missouri

Missouri House Votes to Eliminate Income Tax on Capital Gains - Rudi Keller, Governing:

Missouri lawmakers are playing tax cut tennis, and on Monday the state House served its latest offering when it narrowed the differences with the state Senate in a bill that helps wealthy taxpayers and some who are at the bottom of the income scale.

New York

New York Boosts Payroll Tax For Large Biz, Cuts Income Tax Rates - Michael Nunes, Law360 ($):

…

Oklahoma

Oklahoma Governor Signs Law on Tax Protest Process, Tax Credit Denial Appeals - Bloomberg ($):

The Oklahoma Governor signed a law modifying provisions related to the tax protest process and tax credit denial appeals. The law clarifies procedures for taxpayers to protest tax assessments or denials of certain tax credits and appeal decisions from the Oklahoma Tax Commission. It also sets timeframes for protests, hearings, and appeals to become final. [H.B. 1279, enacted 05/03/25]

Texas

Texas Voters To Decide On Prohibiting Tax On Capital Gains - Zac Kostro, Law360 ($):

Washington

Tesla-Targeted Washington Tax Bill Draws Climate Impact Rebuke - Laura Mahoney, Bloomberg ($):

The bill on Gov. Bob Ferguson’s desk (S.B. 2077) would apply a tax for the first time to credits automakers earn for selling zero-emissions vehicles as the state phases out gas-powered vehicles. Washington, like California, has a market-based program allowing companies that sell more than enough vehicles to meet their ZEV goals to earn credits that they can sell to other companies that don’t.

Tax Bites: Tips, Tricks and Opportunities in SALT

Elizabeth Gray, Senior Manager, Eide Bailly:

Make a habit of sustained success.