Key Takeaways

- Amount B’s new formula for routine transactions could survive despite larger OECD deal uncertainty

- Trump administration could determine Amount B’s fate

- New Treasury appointee signals potential cooperation with OECD

- Tariff unpredictability leading to supply chain shifts, delays

- Despite TCJA incentives, income from pharmaceuticals staying out of the U.S.

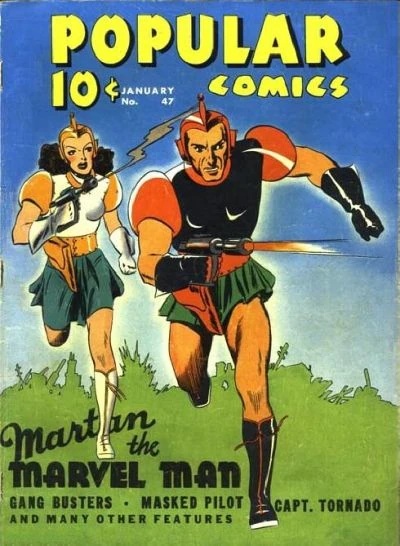

- This week’s obscure superhero: Martan the Marvel Man!

In its final days, the Biden Administration issued a flurry of U.S. Treasury Department regulations, especially on international tax issues. Among those was a notice to implement part of the Organization for Economic Cooperation and Development's Two-Pillar tax project. Specifically, the notice, 2025-04, concerned Amount B of Pillar One, a measure to streamline transfer pricing of routine marketing and distribution functions, in hopes of making them less expensive and time-consuming for tax authorities and taxpayers alike. The idea is that these relatively uncontroversial transactions ought not create significant headaches in tax compliance, and could be eased with formulas that both sides agree to.

Amount B was a small addition to the project which didn't garner nearly as much attention as the big-ticket items, such as the 15% global minimum tax and Amount A, a new taxing regime designed to include online-only transactions. But, strangely enough, it could prove to be the most enduring. While a multilateral treaty to implement Amount A has floundered and the U.S. and OECD remain at a standoff on the minimum tax (aka Pillar Two), aspects of Amount B are already becoming reality in practice for tax authorities around the world.

But how it will ultimately play out remains unpredictable, and subject to political dynamics in both the U.S. and the world.

Last week, the U.S. Council for International Business released a public comment letter to the Treasury regulations, urging the department to push for widespread adoption of Amount B. The National Foreign Trade Council followed with its own comment letter, which advocated for Amount B to remain an optional safe harbor for taxpayers, not an option which tax authorities could impose. Amount B uses a formula to determine arm's-length pricing for transactions like distribution.

Originally, Amount B was to be included in a multilateral instrument to implement all of Pillar One. But the OECD has yet to issue final text of the agreement--the final design of Amount B was one of the issues that couldn't be resolved. So that avenue is pretty much closed off. But the OECD also added the language to its own transfer pricing guidelines, which countries around the world follow to price intercompany transactions. Because it purports to follow the arm's-length rule--the global standard for cross-border income allocation--it could be used by tax authorities immediately. The OECD has also continued with implementation of the Amount B method, recently releasing a consolidated report and a fact sheet, and holding a technical webinar last month.

Of course, whether the U.S. will ultimately implement its own Amount B policy will remain up to the Trump administration--and how they might respond is anyone's guess. Given the importance of the U.S. in the global tax picture, how it proceeds could be pivotal in determining whether Amount B has a future.

Related: Eide Bailly Transfer Pricing Services

Some new administration staffing news…

President Trump will soon name Rebecca Burch, executive director of Ernst & Young LLP's Washington Council, to become deputy assistant secretary for international tax affairs, according to Bloomberg Tax. Burch's resume is similar to those who've served in this role in the past--her predecessors include Scott Levine, previously at Jones Day, and Michael Plowgian of KPMG LLP. In a prior administration this wouldn't be too much of a surprise, but with Trump it's actually eyebrow-raising. If they planned to wash their hands of the OECD or further negotiations over the Two-Pillar implementation, they might have gone with someone more partisan or ideological, or left the post vacant. The Trump administration’s approach to the OECD project is still very antagonistic, but this pick is a signal that will get noticed.

Tariffs

It hasn’t been a quiet week on the tariff front, to put it mildly. Here are some recent pieces which try to make sense of the global trade picture, and how it can affect international taxes.

Trump Criticizes Ireland Over ‘Massive’ Trade Imbalances - Jennifer Duggan and Kate Sullivan, Bloomberg Tax ($):

Tariff Shifts Creating Compliance Chaos For Energy Cos. – Keith Goldberg, Law360 ($):

Tariffs Prompt Chipmakers To Look At Manufacturing Moves – Kevin Pinner, Law360 ($):

And in their weekly Talking Tax podcast, Bloomberg Tax talks with Baker & McKenzie partners Summer Austin and Jennifer Revis about how to incorporate new tariff costs into supply chains, and how it can affect transfer pricing.

Other news from the last week—

EU Walking Tightrope Between OECD and U.S. Minimum Tax Rules – Elodie Lamer, Tax Notes ($):

Big Pharma Profits Stay Outside the United States – Martin Sullivan, Tax Notes ($):

Coca-Cola Gets Creative and Combative in Transfer Pricing Appeal – Ryan Finley, Tax Notes ($):

And finally, the Tax Foundation released a report by senior economist Alan Cole, arguing that Congress should make changes to the Tax Cuts and Jobs Act’s international provisions to make them more durable and accommodating to cross-border investment.

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Martan the Marvel Man

Debut Year: 1939

Creators: G. Ellerbock & William Kent

Debut Publication: Popular Comics #46

Origin Story: A scientist from the distant planet of Antaclea, Martan and his wife Vana came to Earth to help defend it from Martian invaders.

Superpowers: Aside from natural super-strength, Antaclean technology gives Martan and Vana powers ranging from flight and forcefields to telepathy.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

Make a habit of sustained success.