Key Takeaways

- Tax Moves at Year-end.

- Tips, Overtime reporting promise to vex employers in 2026.

- Crypto takes 2026 spotlight.

- Where is your tariff rebate?

- California wealth tax has billionaires pondering year-end moves.

- Brockman estate settles with IRS for $750 million.

- International Cello Day.

Tax Moves You Can Still Make To Trim Your Bill Before The Year Ends - Kelly Phillips Erb, Forbes:

And if you’re self-employed? If you have quick payers (lucky you), hold onto those invoices until after the new year. For most taxpayers, invoices that are paid in 2026 are taxable in 2026, even if the work was performed in 2025 (accrual taxpayers have a different result).

Accelerating deductions can also be helpful—that’s true for business owners, but also works for some other taxpayers. For example, paying expenses before year-end, like a state tax payment or property taxes due next year, may allow those deductions to be claimed sooner. (This assumes you itemize and benefit from deducting state and local taxes).

Dec. 31 life and financial moves that could affect your full year’s taxes - Kay Bell, Don't Mess With Taxes:

Uncle Sam’s tax collector also wants you to know that it considers you two married for the whole year. That means when you file your tax return next year, it must be as married filing jointly or married filing separately.

...

4: Harvest your capital losses. Many investors have made out quite well this year. Some, however, always find they have a dog or two in their portfolios. Now could be the time to finally sell those losing assets you’ve held for more than a year.

Last Minute Holiday Planning

How tax trackers influence wealthy Americans’ holiday plans - Amelia Pollard, Financial Times:

For millionaires and billionaires that declare permanent residency in low-tax jurisdictions but spend much of the year elsewhere, their location in December’s final days can be a determining factor for the size of their tax bill.

And with the full-on return of in-person work meetings and events since the Covid-19 pandemic, the wealthy have increasingly turned to a stable of tools, including the apps TaxBird and Monaeo, to help them make sure they spend less than six months and a day in high-tax jurisdictions such as New York.

Related: Eide Bailly State and Local Tax Services.

Thinking Ahead to 2026 and Beyond

Three Tax Resolutions to Protect Your Income in 2026 - Laura Saunders, Wall Street Journal:

These rules are so complex they often defy summary. But running afoul of them can incur tax or a 10% penalty, or both, so here are useful highlights. For exceptions and more nuances, see IRS Publication 590-B. Also consider getting professional advice, especially if large amounts are involved.

Rule #1 covers millions of savers and is fairly simple: Withdrawals from a Roth IRA can be completely tax-free and penalty-free if the owner has reached age 59½ and the owner has had a Roth IRA for at least five years.

Tips and Overtime Reporting Expected to Test Employers in 2026 - Trevor Sikes, Tax Notes ($):

...

“Employers should now configure payroll, timekeeping, and information return systems to capture and separately report cash tips, worker occupations,” and the Fair Labor Standards Act (FLSA) overtime premium on 2026 Forms W-2, Michael K. Mahoney of Ogletree Deakins told Tax Notes.

And then there's overtime:

The qualified overtime reporting for employers is a high-risk area for compliance because they must correctly include only the FLSA-required overtime premium and exclude nonqualified overtime premiums and compensation such as state-only premiums, collective bargaining agreement amounts, amounts paid because of company policy, or double time, Mahoney said.

Related: Eide Bailly Outsourced and Managed Services.

Capitol Hill Recap: Crypto in the Spotlight - Alex Parker, Eide Bailly:

...

This is one rare issue in DC with genuine bipartisan interest. But that doesn’t mean it isn’t controversial. In a Senate Finance Committee hearing on Oct. 1, some members expressed concerns that new rules could give crypto holders an advantage. Sen. Elizabeth Warren, D-Mass., said that some proposed “special rules” for cryptocurrencies all “tilted in the same direction.”

While Congress could be tied up in January with resolving the impasse over the expired enhanced premium tax credits, this is one issue that lawmakers may revisit before the midterm elections in November come into full swing.

Tariffs, or Why Your Order Came in Pieces

Customs Crackdown Leads to Blocked, Destroyed Imports - Esther Fung, Wall Street Journal:

Tens of thousands of imports have been blocked from entering the U.S. in recent months and stacked in vast warehouses. Many get to their destinations after buyers complete government paperwork. Yet some that can’t clear customs because of missing or incomplete information are returned—or destroyed.

The stranded parcels are casualties of shifting new U.S. tariffs, tougher customs enforcement and other import restrictions that carriers and consumers said are tough to navigate.

Where does Trump’s $2,000 tariff rebate promise stand heading into 2026 - Addy Bink, Nexstar Media via The Hill:

National Economic Council Director Kevin Hassett said over the weekend that he expects President Donald Trump to back legislation that would send out $2,000 tariff rebate checks to most Americans. Hassett noted that, as many have pointed out, it would ultimately be up to Congress whether those checks are dispersed. President Trump promised a payout for most Americans in a November Truth Social post.

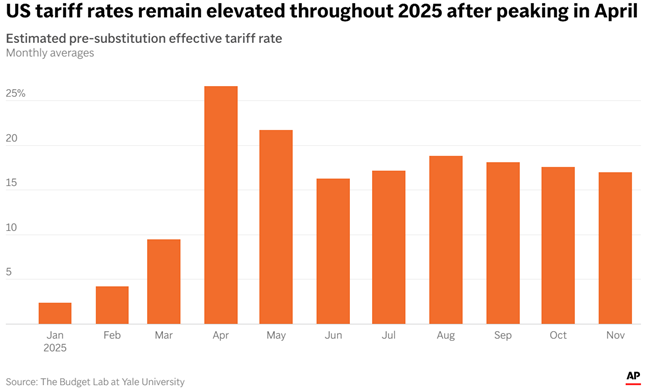

Trump overturned decades of US trade policy in 2025. See the impact of his tariffs, in four charts - Wyatte Grantham-Philips and Paul Wiseman, Associated Press: "In 2025, per data from the Yale Budget Lab, the effective U.S. tariff rate peaked in April. But it’s still far higher than the average seen at the start of the year. Before finalizing shifts in consumption, November’s effective tariff rate was nearly 17% — seven times greater than January’s average and the highest seen since 1935."

State Taxes - Revenue Shortfalls, Wealth Tax Talk in California, and Moving (your trust) to South Dakota

Fiscal Year 2026 State Tax Revenues Look Shaky, Experts Say - Michael Nunes, Law360 Tax Authority ($):

According to Kathryn White, director of budget process studies at the National Association of State Budget Officers, state tax revenues collected so far in the 2026 fiscal year have been muted compared with previous fiscal years. Individual and sales and use tax revenues modestly exceeded estimates across the states, but collectively corporate income tax collection has faltered.

...

In its November survey, NASBO found that nationwide individual income tax revenues are expected to increase 1.3% from fiscal year 2025, and sales and use tax revenue climbed by 2.9%.However, revenue from corporate income taxes is expected to decline by 5.2%.

A Wealth Tax Floated in California Has Billionaires Thinking of Leaving - Ryan Mac, Theodore Schleifer and Heather Knight, New York Times:

...

Other billionaires who appear to be making moves to decrease their presence in California include Mr. Page, 52, a longtime resident of Palo Alto. He has discussed leaving the state by the end of the year, according to two people briefed on the talks. In mid-December, three limited liability companies associated with Mr. Page filed documents to incorporate in Florida, according to state records.

The moves are being driven by a potential California ballot measure from the health care union, Service Employees International Union-United Healthcare Workers West, the people said. The proposal calls for California residents worth more than $1 billion to be taxed the equivalent of 5 percent of their assets.

Why Private-Equity Millionaires Love South Dakota - Miriam Gottfried, Wall Street Journal:

Much of that is in trusts aimed at allowing people to pass assets down to their heirs while minimizing estate taxes. Private-equity managers are setting up trusts primarily to save on state and local income taxes, with the benefit of also moving assets outside their estates that could later be taxable.

Related: Eide Bailly Wealth Transition Services.

Blogs and Bits

The Good, Bad, and Ugly of 2025 Gambling Tax Law Changes - Russ Fox, Taxable Talk. "The Ugly: The One Big Beautiful Bill’s provision limiting gambling losses to 90% will go into effect for 2026."

Trump Has a New Auto Loan Tax Break. Here’s Who Could Benefit. - Adam Sella, New York Times:

But he does not believe that it will move the needle when it comes to Mr. Trump’s goals for affordability and the domestic auto industry.

Beyond the Hype: 2025 Crypto & Digital Asset Tax Rules for Global Citizens - Manasa Nadig, The Buzz About Taxes:

...

The practical result is that taxpayers must track cost basis and proceeds for every taxable transaction, even small payments at the coffee shop or recurring “rewards” payouts.

Death and Taxes - Why Not Both?

Billionaire’s Estate Settles Tax Fraud Case for $750 Million - Kristen Parillo, Tax Notes ($):

The terms of the settlement were revealed in a stipulated decision entered December 23 in Estate of Brockman v. Commissioner by Judge Kathleen Kerrigan.

Brockman, a software company CEO who died in August 2022, filed the Tax Court case in January 2022 to contest an IRS deficiency notice asserting that he owed $1.4 billion in taxes, fraud penalties, and interest for tax years 2004-2007, 2010, and 2012-2018.

Neil Bass adds this in a LinkedIn post (my emphasis):

- If secrecy and offshore structures are involved, this stops being “tax” and becomes enterprise risk.

- Civil penalties are not a nuisance. They can be nine figures by themselves.

- “We’ll litigate forever” is a fantasy. The government plays longer.

- Estate planning is not a force field. The IRS can still collect from the estate.

If you advise founders, PE-backed companies, or high-net-worth families, this is the part to internalize: your best outcome is boring compliance.

Be skeptical of stories you might hear about "sophisticated planning" involving offshore trusts. "Hide the ball" crosses the line from tax planning to tax crime.

What day is it?

It's International Cello Day! Not everybody can grow up to be a bass.

Make a habit of sustained success.