Key Takeaways

- US middle-earners taxed much less than other countries.

- States consider OB3 conformity.

- Some states may stumble into taxing international income.

- Supreme Court decision on independent agencies may affect Tax Court.

- Tariff price boosts and farm bailout.

- Endowment tax biting Yale.

- Remit those payroll taxes.

- National Pastry Day.

Tax Levels Are Setting New Record Highs—But Not in the U.S. - Richard Rubin, Wall Street Journal:

Meanwhile, the average OECD tax take hit a new record, climbing to 34.1% from 33.7%, according to Tuesday's report. Denmark, France and Austria topped the list, with revenues above 43% of GDP.

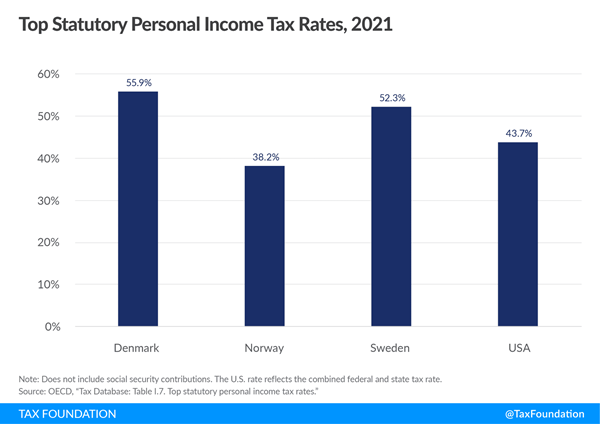

It's not that the U.S. doesn't tax the rich like everyone else. U.S. rates on top earners aren't too out of line with other developed countries:

It's that the U.S. taxes middle-income earners at much lower rates:

In 2025, the top statutory rates, and the income where they start to apply at current currency rates, are:

- Denmark: 55.9%, at $95,400.

- Norway: 39.6% at $139,300

- Sweden: 52.3% at $66,000.

- US (federal only): 40.8% at $626,350 (single filers, and excluding state taxes).

These other countries also impose value added taxes, which hit hard at lower incomes, at rates up to 25%. If you want public spending like Scandinavia, expect taxes like those in Scandinavia.

Congress: Nothing so far on ACA Credit extension

Republicans’ health care spiral - Laura Weiss, Andrew Desiderio, Jake Sherman and Max Cohen, Punchbowl News:

The tentative leadership plan seems to be to unveil some of the contours of the health-care proposal during the House Republican Conference meeting on Wednesday morning.

As of now, the House GOP health care effort seems to center around a bill that would expand HSAs, reform PBMs, institute risk pools for health insurance plans and put in place cost-sharing reductions, according to multiple sources close to the discussions.

The House GOP leadership still hasn’t decided whether their plan will extend the expiring Obamacare subsidies. This seems to be a sticking point at the moment. There’s a chance that the House GOP leadership bails on its plans to pass a bill if the Senate declines to move on a GOP plan.

The article doesn't give much optimism about anything happening in the Senate either.

States: Conform, or Not?

Decision time for states - Bernie Becker, Politico:

But that also means that states must decide how much to adopt big federal tax changes when they happen, as with this summer’s Republican megabill.

And so far, the early takeaway is that policymakers in state capitals are facing a tougher decision with the One Big Beautiful Bill Act than they did eight years ago, when Republicans passed sweeping tax cuts early in President Donald Trump’s first term.

Some States Will Tax NCTI Despite Prior Votes to Exempt International Income - Jared Walczak, Tax Policy Blog:

At the federal level, NCTI operates as a minimum tax, imposing compensatory US tax on income that is only minimally taxed abroad. The application of tax credits for foreign taxes paid ensures that the tax does not fall on businesses with foreign subsidies if those subsidiaries are subject to meaningful levels of foreign tax.

But states don’t provide foreign tax credits, so states that conform to NCTI will tax an apportioned share of all income of foreign subsidiaries of US parent corporations, no matter how significant their foreign tax liability, and even when that income has no association whatsoever with in-state activities. We have previously written about the many flaws of taxing NCTI at the state level, which states taxing GILTI are automatically in line to do.

Related: Eide Bailly State and Local Tax Services; Eide Bailly International Tax Services.

Tax Court Independence Questioned at Supreme Court

Liberal Justices Say an FTC Ruling for Trump Could Hit Tax Court - Justin Wise, Bloomberg ($):

The possibility of specialized Article I courts created by Congress losing their independence was driven by Justice Elena Kagan at Monday’s arguments over Donald Trump’s attempt to fire at-will members of the Federal Trade Commission and other regulatory bodies.

...

Conservatives seemed to side with the administration’s arguments that the president must have at-will removal power to retain meaningful authority over officials who perform executive actions.

But some conservative justices discussed how a ruling could be limited for legislative courts that engage in judicial functions. Justice Brett Kavanaugh raised the possibility of an exception for such bodies similar to one for the Federal Reserve Board of Governors.

Tariff Tuesday: Price Boosts, Farm Checks On The Way

‘Only so long’ before Trump’s tariff costs hit consumers, businesses warn - Daniel Desrochers, Politico:

That could come as soon as January, according to economists, as holiday discounts come to a close and retailers run low on inventory they secured at pre-tariff prices. Major retailers like Kohl’s, Abercrombie, Williams-Sonoma and Under Armour have all warned of price increases starting as early as late December or January.

White House Announces $12 Billion Aid Package for Farmers - Michael Smith, Tax Notes ($):

Rollins said $11 billion will be available for farmers, with an expected payout date of February 28, 2026. She added that the remaining $1 billion will be placed in a reserve while the administration evaluates the potential need for assistance related to specialty crops.

Trump threatens to raise tariffs on Mexico over Rio Grande water deliveries - Daniel Desrochers, Politico. "President Donald Trump on Monday threatened to impose a 5 percent tariff on Mexico, accusing the country of violating a decades-old treaty that grants U.S. farmers access to water from the Rio Grande."

AICPA: Simplify Pass-Through Reporting

PTEs need more notice of changes, more time to respond, AICPA says - Martha Waggoner, The Tax Adviser:

With the current tax system, there is one key item that would help pass-throughs and their owners: deferred deadlines, or at least automatic extensions that don't require a separate filing. That doesn't seem to be in the cards.

Yale: New Endowment Tax May Trigger Staff Cuts

Increased Endowment Tax May Force Yale Staff Layoffs - Kelsey Brooks, Tax Notes ($):

The increased tax will cost the university approximately $300 million annually, exceeding its financial aid budget for undergraduate students, according to the update.

Under the One Big Beautiful Bill Act (P.L. 119-21), private colleges and universities with a student-adjusted endowment of over $2 million will be subject to an 8 percent NII tax starting July 1, 2026.

Related: Eide Bailly Exempt Organization Tax Services.

First, Get a Billion Dollars

Tax Breaks: The How To Give Like A Billionaire Edition - Kelly Phillips Erb, Forbes:

Blogs and Bits

2 end-of-year retirement moves to consider: maxing out plan contributions; converting to a Roth IRA - Kay Bell, Don't Mess With Taxes. "If you haven’t reached the max in your 401(k), consider increasing your contributions before the end of the year. I know, most of us, regardless of age, don’t have enough wiggle room in our budget to contribute the maximum amounts. But if you can put in any additional money now, the power of compounding will help make your golden years shine."

Tax Court Exposes Conservation Easement Syndication Process - Peter Reilly, Your Tax Matters Partner. "This is one in a now long line of cases in which the Tax Court focus on valuation with due notice to what promoters actually acquire the property for is disastrous for easement investors."

Tax rules every house flipper and builder should know - National Association of Tax Professionals. "Real estate clients who flip houses or build new construction face complex tax reporting rules that directly impact self-employment tax, inventory accounting and cost allocations."

One I would add: Flippers don't get to defer income with like-kind exchanges.

IRS Provides Initial Guidance on Trump Accounts - Parker Tax Pro Library. "The notice addresses certain initial questions about Trump accounts, including account creation, the $1,000 pilot program contribution, and employer contributions; the notice also provides that the election to establish a Trump account will be made on forthcoming Form 4547, Trump Account Election(s), and an online tool is expected to be available at trumpaccounts.gov in the middle of 2026."

The Opposite of Excellence in Payroll Management

Dallas business owner sentenced to more than eight years in prison for failing to pay over withheld employment taxes - IRS (Defendant name omitted, emphasis added):

According to court documents and evidence presented at trial, Defendant was the owner and CEO of Pursuit of Excellence, a staffing company based in Dallas. From 2015 to 2017, she withheld payroll taxes from her employees’ paychecks but failed to remit more than $3 million to the IRS as required by law.

The pursuit of excellence apparently involves excellent accommodations:

Once you've withheld taxes from employee pay, it's not your money anymore. It can be tempting to "borrow" that cash to cover other bills, or just to have some fun. Don't.

What day is it?

It's National Pastry Day! Remember to share around the office.

Make a habit of sustained success.