Key Takeaways

-

November 1 open enrollment window as possible shutdown winddown.

-

Too late to avoid rate hikes?

-

Treasury says it is exempt from shutdown firing prohibition.

-

Dems call for investigation of reports of IRS donor targeting.

-

The lobbying push against partnership exams.

-

US "tiptoeing away" from Trump tariffs?

-

International Tax Competitive Index: Estonia, Latvia again lead.

-

Al Capone anniversary.

-

World Statistics Day.

Yet another critical week for the shutdown as Nov. 1 looms - Jake Sherman, Andrew Desiderio and John Bresnahan, Punchbowl News:

But now, there’s a sense within the Senate Democratic Caucus that this deadline is in fact their off-ramp to end the shutdown. Democrats can argue it’s no longer feasible for Congress to address the expiring Obamacare subsidies legislatively. The goal here would be to make Republicans own the soaring premium hikes and health-care coverage losses that millions of Americans would experience.

If Democrats are willing to accept a political victory without a policy win, this is a critical moment for Schumer to figure out what this looks like — and how he shields himself from inevitable criticism from the left.

Capitol Hill Recap: The Coming Affordable Care Act Premium Hike - Alex Parker, Eide Bailly:

The current conventional wisdom in D.C. is that, with the Trump administration continuing to pay members of the military and law enforcement officers with reserve funds, the next major deadline that could force the warring parties to find an agreement will be Nov. 1.

That’s when open enrollment for 2026 begins in most states for the healthcare exchanges established under the Affordable Care Act. One of the Democrats’ key demands during this impasse is for the expiration of enhanced premium tax credits for the exchanges, currently set for the end of the year, be extended. The enhancement expands the eligibility of the credit and also increases the amount of the premiums it will cover.

Without access to the credits, millions of Americans will have to pay more to keep coverage, and they’ll likely first find out about this hike while shopping plans during the enrollment period—after Nov. 1.

Anxiety grows over ACA tax credits stalemate - Joseph Choi, The Hill. "For some in Idaho, where open enrollment began this Wednesday, the reality of the expiring tax credits is already here."

Tax Administration: Shutdowns and Firings

Treasury, HHS Say Court’s Firing Pause Doesn’t Apply to Them - Isaiah Poritz, Bloomberg ($):

Those workers weren’t represented by the federal unions suing to block the layoffs, so the restraining order doesn’t apply, the human resources heads said among dozens of sworn agency declarations submitted Friday.

Federal Courts To Scale Back Operations Amid Shutdown - Ryan Boysen, Law360 Tax Authority ($):

In a statement released Friday, the Administrative Office of the U.S. Courts said that as of Oct. 20, federal courts will "no longer have funding to sustain full, paid operations."

...

In a separate statement on Friday, the U.S. Supreme Court said it expects to run out of funding Saturday but will continue to "conduct essential work such as hearing oral argument" and issuing orders and opinions.

Tax Administration: Targeting and Not Targeting

House Dems Call For Probe Into Reported IRS Donor Targeting - Asha Glover, Law360 Tax Authority ($):

The Democrats, in a letter to TIGTA acting Inspector General Heather M. Hill, urged her to immediately investigate a Wall Street Journal report that a senior Internal Revenue Service official has identified potential targets for criminal investigations, including George Soros and other major Democratic donors.

Who’s Afraid of Passthrough Audits? - Kristen Parillo and Lauren Loricchio, Tax Notes ($):

The Alliance for IRS Accountability (AIA), a nonprofit led by a former Republican congressional staffer, registered as an exempt entity in Delaware in December 2024, just two months after the IRS Large Business and International Division announced that a new exam unit dedicated to passthrough entities had officially started operations.

...

The passthrough exam unit’s work has also attracted scrutiny from several business and industry groups, which sent letters to the IRS in April and May criticizing its audit strategy on partnership related-party basis-shifting transactions. Some of those groups also called on the IRS to disband the exam unit.

But some current and former IRS employees worry that the efforts to disparage the exam unit, along with the loss of partnership experts who have been forced out of or resigned from the IRS this year, will effectively kill the passthrough audit initiative before it’s had a chance to get off the ground.

Related: Eide Bailly Passthrough Entity Consulting Services.

Tariffs and Trade: New Truck Tariffs, New Carveouts, Backing Off

Trump Extends Auto Tariff Relief, Imposes Truck and Bus Duties - Jennifer Dlouhy and Skylar Woodhouse, Bloomberg via MSN:

The directive also prolongs through 2030 a tariff discount Trump already provided carmakers that produce and sell completed automobiles in the US, and sets in motion plans to apply the same offset for truck duties. Truck imports that qualify for relief under the US-Canada-Mexico trade agreement will be exempt from the charges, but not buses, the officials told reporters Friday.

The administration is also creating an additional carveout for companies that make engines for passenger vehicles as well as medium- and heavy-duty trucks in the US, which would be patterned on the existing offset program for completed vehicles, but will not take effect immediately.

The U.S. Is Tiptoeing Away From Many of Trump’s Signature Tariffs - Gavin Bade and Jesse Newman, Wall Street Journal:

The offer to exempt more products from tariffs reflects a growing sentiment among administration officials that the U.S. should lower levies on goods that it doesn’t domestically produce, say people familiar with administration planning. That notion “has been emerging over time” within the administration, said Everett Eissenstat, deputy director of the National Economic Council in Trump’s first term. “There is definitely that recognition.”

The move comes ahead of a Supreme Court hearing in early November on the reciprocal tariffs—a case that could force the administration to pay back many of the levies if it loses in court. The White House, Commerce Department and U.S. Trade Representative’s office didn’t respond to requests for comment.

Trump Says Threatened Tariffs on China ‘Not Sustainable’ - Lauren Dezenski and Josh Wingrove, Bloomberg via MSN. "Trump last week threatened an additional 100% tariff on Chinese goods by Nov. 1 and floated the idea of canceling the planned meeting with Xi, expected to be on the sidelines of the Asia-Pacific Economic Cooperation summit in South Korea later this month."

International Tax Competitiveness Index 2025 - Alex Mengden and Andrea Nieder, Tax Foundation:

Blogs and Bits

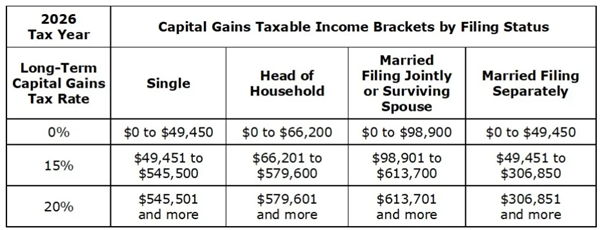

Less tax on more capital gains thanks to inflation adjustments - Kay Bell on Substack. "The rate depends on your overall income and filing status. The table below shows the inflation adjustments for the 2026 long-term capital gains tax rates."

A Couple in Their 80s Wants to Do Roth Conversions. Should They? - Demetria Gallegos, Wall Street Journal. "But a multimillion-dollar Roth conversion is a multiyear undertaking. That’s partly because whatever amount you convert is added to your taxable income for that year, and a miscalculation could put you into a higher tax bracket and even cause your Medicare premiums to go up."

Chicago Mayor: Stupid Tax Ideas as the City Stares into the Abyss - Mary Pat Campbell, Stump-Meep. "MAYBE DON’T RUN OFF THOSE TAX SOURCES."

Zohran Mamdani and the Tax-Hike Death Spiral - Allysia Finley, Wall Street Journal. "Mr. Mamdani would need state approval to raise income taxes in the city, and Gov. Hochul has been cagey about whether she would go along with his proposal to impose a 2% surcharge on income over $1 million. That would raise the top rate to 16.8%, by far the highest in the country."

Unmasking the Myth: Feel-Good Tax Policies as Tools of Economic Sabotage - Alan Dlugash, Tax Politix:

More recent examples of this include "no tax on tips" and "no tax on overtime," as well as the new deduction for auto loan interest. After almost 40 years, the 1986 tax reforms continue to unravel.

Tax Crime History: They Got Capone.

Al Capone Found Guilty Of 22 Counts Of Tax Evasion On This Day In 1931 - Kelly Phillips Erb, Forbes:

...

Capone's first prison stop after his conviction was Atlanta. Initially, he bribed prison officials to get what he wanted, just as he had done in Philadelphia. When officials found out what he had done, he was punished by being relocated to Alcatraz, the formidable prison built on a small island offshore from San Francisco, California. Alcatraz proved to be Capone’s undoing.

Alcatraz’ warden, James Aloysius Johnston, wasn't as easily swayed as those prison officials Capone had previously encountered. When Johnston asked Capone his name, the mobster allegedly responded, “You know who I am.” Johnston is said to have retorted, “Here you are now known as AZ-85.”

What day is it?

It's World Statistics Day. I'm sure the statistics would show that Tax News & Views readers are the best.

Make a habit of sustained success.