Key Takeaways

- Tennessee Franchise Tax filers get refund claim opportunity.

- Caitlin Clark's tax admirers.

- Streamlined Sales Tax board addresses digital sourcing, nexus.

- State gross receipts taxes.

- California ponders NOL suspension.

- Colorado combined reporting change.

- Iowa enacts livestock gain break retroactive to 2023.

- Tax policy corner: tax breaks for smash hits?

- If you can read this, thank a taxer?

Thanks for visiting Eide Bailly State Tax News and Views. Consider Eide Bailly's fine state tax services team for your state tax planning and compliance needs.

Eide Bailly offices are closed next Friday, so our next SALT roundup will be May 31.

Tennessee Giving $1.6B In Corporate Franchise Tax Refunds - Sanjay Talwani, Law360 Tax Authority ($):

Tennessee Republican Gov. Bill Lee signed S.B. 2103 on Friday, changing the calculation of the state's franchise tax starting in the current tax year and allowing rebates of portions of three years of taxes already paid.

Everyone who has paid Tennessee franchise tax in the past three years needs to consider filing a refund claim.

Link: Tennessee Department of Revenue guidance on filing for Franchise Tax refunds.

Caitlin Clark’s Other Audience: State Tax Departments - Jared Walczak, Tax Policy Blog:

Now, if these were the rules for everyone, then so be it. But they’re not: athletes and entertainers face stricter requirements for paying nonresident income taxes than the rest of us do. We can debate whether that’s fair to begin with, but there’s at least very little doubt that the best-compensated athletes and performers can afford to have someone handle the paperwork.

Applying the more stringent rules to athletes with $75,000 salaries? That’s more tendentious.

Just as there is a big difference between the pay levels of Steph Curry and a WNBA rookie, there is a big difference between Taylor Swift and a traveling band couch-surfing their way through a tour. Yet the state, in its majesty, puts them in the same category for tax compliance. As the article says, "If states are to continue imposing special rules on athletes and entertainers, they could at least consider an income threshold."

It's not just athletes. Many states assert a right to tax individuals working a single day in a state, and their employers as well.

Related: Eide Bailly State & Local Tax Services

Streamliners

Streamlined Board Adopts Digital Sourcing Provisions - Emily Hollingsworth, Tax Notes ($):

...

The amendments provide that member states must assign the “lowest combined tax rate imposed in the nine-digit ZIP code” if there is more than one sales tax rate in the area. In contrast, if a five-digit ZIP code area has more than one tax rate, the state has the option to “assign the highest, lowest or blended rate based on the rates imposed in the five-digit ZIP code area,” according to the changes.

What is the Streamlined Sales Tax Governing Board? It is an entity formed by states to try to achieve uniformity in sales tax rules. 24 states are members. While member states cannot be forced to follow policy decisions, the point of the organization is for states to agree to such policies.

Sales Tax Group Addresses Digital Goods, Gun Safety Definitions - Angélica Serrano-Román, Bloomberg ($):

...

Business groups have opposed any requirement for sellers to request a full street address that includes the nine-digit ZIP code, citing data privacy and compliance concerns. Streamlined’s business advisory council also argued that states adopting the highest or blended rate should implement a refund mechanism for instances when a customer is overcharged.

Tax Pact Votes Down Nexus Recommendation For Gross Sales - Paul Williams, Law360 Tax Authority ($).

...

The board also adopted a best practice for states to provide remote sellers with at least 30 days to register and begin collecting sales tax after crossing their economic nexus thresholds, and approved two disclosed practices, all by voice votes. One disclosed practice would require states to say if remote sellers without taxable sales are required to register and file in their states, and say when such sellers must collect tax if they make a taxable sale.

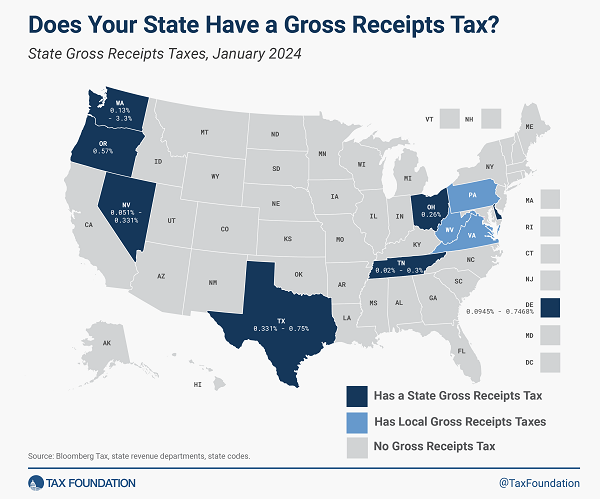

Gross Receipts Taxes

Gross Receipts Taxes by State, 2024 - Joseph Johns, Tax Foundation. "Gross receipt taxes are imposed along every step in the production process, which increases businesses’ tax burden through a harmful process known as tax pyramiding."

State-By-State Roundup

Alabama

Ally Financial Is Stuck With $4 Million Alabama Excise Tax Bill - Perry Cooper, Bloomberg ($). "Ally Financial, IB Finance Holding Co., and Ally Bank don’t meet the statutory requirements for filing financial institution excise taxes together, Judge Leslie H. Pitman wrote in an opinion posted Wednesday. That means Ally Financial’s losses can’t offset profits of Ally Bank for tax years 2011-2019."

Arkansas

Expedia, Other Sites Escape $34 Million in Arkansas Hotel Taxes - Perry Cooper, Bloomberg. as Hotel Taxes:

...

Online travel companies are racking up wins across the country in other disputes over hotel taxes. The Louisiana Court of Appeal, Mississippi Supreme Court, and Arizona Court of Appeals have all ruled recently that the companies aren’t subject to tax because they don’t actually furnish rooms to customers. But the Nevada Supreme Court ruled last year that the companies must face federal and state litigation over lodging taxes there.

California

Newsom Proposes to Suspend NOLs, Cap Business Tax Credits - Paul Jones, Tax Notes ($). "As Newsom seeks to address the deficit, he has pledged not to pursue any broad-based tax increases. But the May revision to his fiscal 2025 budget, released May 10, would temporarily curb the use of carryover NOLs by businesses with more than $1 million in California income and would limit tax credit usage to $5 million for tax years 2025, 2026, and 2027 for all businesses."

Net Operating Loss carryovers prevent overtaxing businesses as a result of fluctuating income. A business with $2 million in income in Year 1 and a $2 million loss in year two has made nothing, but is taxed as if it made $2 million, absent NOL carryforwards. California suspended NOL deductions in 2020, so there is precedent for the proposal.

Calif. Digital Tax Clears Key Hurdle, Will Go To Full Senate - Maria Koklanaris, Law360 Tax Authority ($):

S.B. 1327 narrowly cleared the Senate Appropriations Committee by a vote of 4-2. It reached that committee, which acts as a gatekeeper on which bills might get through the legislative session, after passing the Senate Revenue and Taxation Committee.

Colorado

Colorado Adopts Combined Reporting Rule Change - Emily Hollingsworth, Tax Notes ($). "H.B. 24-1134, signed by Polis May 14, will replace Colorado’s specialized reporting rule for combined returns with a more standard reporting practice. The bill will require all affiliates of a C corporation to be included in a combined return for corporate income tax purposes. Under the current rule — called the "3 of 6 rule" — only affiliates meeting three or more specific requirements must be included in combined returns. The new reporting rule, which takes effect for tax years beginning on or after January 1, 2026, is consistent with the Multistate Tax Commission's combined filing standards."

Colo. Lawmakers OK Agricultural Stewardship Tax Credits - Zak Kostro, Law360 Tax Authority ($):

The credits could be worth up to $150 per acre and up to $300,000 per farm or ranch annually, depending on the number of approved stewardship practices employed, according to the summary.

Illinois

Apple Forgiven Millions in Chicago ‘Netflix Tax’ Paid by Rivals - Michael Bologna, Bloomberg ($). "Apple Inc. received at least $13 million, and probably much more, in tax forgiveness from the city of Chicago after settling a lawsuit that claimed the city’s “Netflix tax” on streaming entertainment violated federal law, newly released documents reveal."

Iowa

Iowa To Give Tax Break For Gains From Livestock Sales - Jaqueline McCool, Law360 Tax Authority ($). "H.F. 2649, which Republican Gov. Kim Reynolds signed Wednesday, will allow some livestock sales to be excluded from capital gains. If half of a taxpayer's income is from farming, the capital gain from cattle or horse sales will be excluded, if the gain is held for two years, the bill's fiscal note said."

This bill revives a provision that had been repealed after 2022. It is retroactive to 2023.

Iowa Expands Withholding Guidance - Jamie Rathjen, Bloomberg. "A news release from the department restated that employers have two options for employees who have not filled out the 2024 version of Form IA W-4, Employee Withholding Allowance Certificate. Withholding can be calculated using either a $40 allowance or using a prior-year Form IA W-4 and multiplying the number of allowances claimed by $40."

Maine

Maine House Sustains Governor’s Veto on Income Tax Restructuring - Angélica Serrano-Román, Bloomberg ($):

Maine has three income tax brackets ranging from 5.8% to 7.15%, with the top rate applied to incomes over $61,600 for the 2024 tax year.

Missouri

BCLP Sues St. Louis Over City Taxes On Partners' Income - Kevin Penton, Law360 Tax Authority ($). "St. Louis is violating city, state and federal laws by seeking to collect a 1% earnings tax on 100% of the partnership income earned by all BCLP partners who are 'assigned' to the firm's St. Louis office, as opposed to collecting 100% of the tax only from those firm lawyers who actually live in the city, according to its Thursday petition in Missouri state court."

Nebraska

Kids Must Pay Inheritance Tax on Dad’s Home Gifted to Girlfriend - Richard Tzul, Bloomberg ($). "Father Michael Hessler explicitly had language in his trust that deeded his home to his girlfriend Lori Miller and allocated all inheritance tax to be paid by what was left over in the trust, known as the trust residuary, the court said. Because Hessler bequeathed the trust residuary to his children, their portions in the residuary trust must pay inheritance taxes assessed on the girlfriend’s home and all remaining property in the trust, the opinion said, affirming a lower court’s decision."

Link: Court opinion.

Related: Eide Bailly Wealth Transition Services.

New York

New York Never Sleeps When It Comes to Employment Taxes - Emmanuel Elone, Bloomberg ($). "New York state tax withholding applies if a nonresident employee voluntarily works in another state, not if the employer assigns the nonresident employee to work remotely outside of New York for the employer’s convenience. In practice, however, employers find it difficult to prove that nonresident employees voluntarily worked remotely outside of New York..."

Oklahoma

Okla. To Give Rebates To Pro Sports Teams That Create Jobs - Zak Kostro, Law360 Tax Authority ($). "H.B. 3959, which Republican Gov. Kevin Stitt signed Monday, expands a state program that provides cash payments to qualifying companies that create jobs in the state, according to a fiscal impact statement and summary. The bill allows professional sports teams from the NFL, NBA, NHL, MLB or MLS to receive quarterly rebate payments from the state Tax Commission for up to 5% of actual gross payments for league-related jobs provided by a team while the team is in Oklahoma, according to the summary."

South Dakota

Sales of Homemade Food Are Subject to Tax, South Dakota DOR Says - Emily Hollingsworth, Tax Notes ($). "Individuals who sell homemade food products are still required to have a sales tax license and remit any applicable state and local sales taxes, including the state’s 4.2 percent sales tax, the department said in a May 10 newsletter. Individuals can apply for sales tax licenses on the DOR’s website."

Vermont

Vermont Lawmakers Pass Property, Software, Rental Tax Boosts - Michael Bologna, Bloomberg ($):

Lawmakers passed H887, the so-called yield bill, which establishes the statewide homestead and nonhomestead property tax rates.

Tax Policy Corner

Does a Smash Hit Like ‘Lion King’ Deserve a $3 Million Tax Break? - Jay Root and Michael Paulson, New York Times:

...

And yet, the show was one of roughly four dozen productions that have received millions of dollars in assistance from New York State under a program designed to help a pandemic-hobbled theater industry in New York City.

The States That Still Publish 'Shame Lists' of Delinquent Taxpayers - Andrew Wilford, National Taxpayers Union Foundation via Tax Notes ($):

But while those consequences are expected, taxpayers in 15 states face another enforcement mechanism that they may not expect: public shaming. In those 15 states, state revenue departments publish and maintain up-to-date online lists of delinquent taxpayers. These lists generally include not just names but also delinquent taxpayers’ home addresses and amounts owed.

According to the article, the shame list states include states with Eide Bailly offices, including California, Colorado, Nebraska, and Oklahoma.

Tax History Corner

If you can read this, thank a taxer? Maybe. From Leonard's Tax Posts:

As Peter Frankopan puts it: “We have the needs of tax collectors 5,000 years ago to thank for the great works of literature that have been produced since: without accountants there would perhaps have been no Torah, Bible or Qur’an, no Shakespeare, no Babur-Nama and no Tolstoy.”

But also no Tax News & Views, so maybe it's a wash.

Make a habit of sustained success.