Key Takeaways

- State revenue departments welcome Caitlin Clark.

- IRS still uncertain of scope of Littlejohn data theft.

- Biden announces tariff boost.

- Debt commission still resting.

- Corporate rate boost pushed. Good or bad idea?

- Kids to pay inheritance tax on house for dad's girlfriend in Nebraska.

- Public company CEO charged with disguising pay as "loans."

- Buttermilk Biscuit Day

Caitlin Clark’s Other Audience: State Tax Departments - Jared Walczak, Tax Policy Blog:

Now, if these were the rules for everyone, then so be it. But they’re not: athletes and entertainers face stricter requirements for paying nonresident income taxes than the rest of us do. We can debate whether that’s fair to begin with, but there’s at least very little doubt that the best-compensated athletes and performers can afford to have someone handle the paperwork.

Applying the more stringent rules to athletes with $75,000 salaries? That’s more tendentious.

Just as there is a big difference between the pay levels of Steph Curry and a WNBA rookie, there is a big difference between Taylor Swift and a traveling band couch-surfing their way through a tour. Yet the state, in its majesty, puts them in the same category for tax compliance. As the article says, "If states are to continue imposing special rules on athletes and entertainers, they could at least consider an income threshold."

Related: Eide Bailly State & Local Tax Services

IRS: Data breach mystery, tech funding uncertainty.

IRS Says It Still Doesn’t Know Full Scope of Littlejohn Breach - Benjamin Valdez, Tax Notes ($):

In a notice published May 10, the IRS said it doesn’t yet know the full extent of the data leaked by Charles Littlejohn, a former IRS contractor who released the tax information of thousands of wealthy taxpayers, including former President Trump and Jeff Bezos. Littlejohn was sentenced in January to five years in prison.

The notice adds:

We understand from TIGTA and DOJ that the government has recovered the taxpayer information that was in Mr. Littlejohn's possession.

The IRS has a strong interest in maintaining taxpayer confidentiality. If data leaks become normal, taxpayers will be less likely to be fully open with the agency, with predictably bad results.

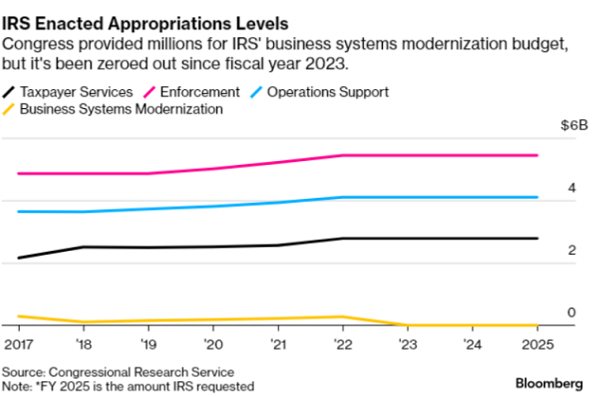

IRS Cash Is in Danger of Drying Up for Technology Upgrades - Chris Cioffi, Bloomberg. "Despite bipartisan support for the IRS to upgrade its tech to improve taxpayer services, Congress has provided zero annual funding for business systems modernization the last two years. The agency expects to rely on other funding sources for tech modernization if it doesn’t get additional supplemental funding, and is sounding the alarm that the squeeze—even with billions in one-time supplemental money—could lead to modernization efforts falling billions short."

The “Joy” of 1959 Technology - Russ Fox. "Betty made that estimated payment in early January, noting it was for the 2023 tax year. She used her social security number, so she did everything correctly. However, she didn’t reckon with the IRS’s antiquated technology: The main IRS computer system dates to 1959."

Trade Tax Boost

Biden Will Raise Tariffs on Chinese Electric Vehicles, Chips and Other Goods - Jim Tankersely, New York Times:

The president will also officially endorse maintaining tariffs on more than $300 billion worth of Chinese goods that were put in place by President Donald J. Trump. Mr. Biden criticized those tariffs as taxes on American consumers during his 2020 run for the White House.

FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices - White House Press Release. "The tariff rate on electric vehicles under Section 301 will increase from 25% to 100% in 2024."

Congress, debt, and tax policy

America's debt tops $34 trillion, but a commission to address it appears dead in Congress - Kevin Freking, Associated Press via Wahinton Post:

It’s well past time, the newly elected House speaker said in October, to establish a bipartisan commission to tackle the federal government’s growing $34.6 trillion in debt. “The consequences if we don’t act now are unbearable,” he said, echoing warnings from his predecessor and other House Republicans.

More than six months later, the proposal appears all but dead, extinguished by vocal opposition from both the right and the left.

Top W&M Dem on tax pay-fors and the corporate rate - Laura Weiss, Punchbowl News. The story quotes ranking Ways & Means Democrat Mike Thompson:

There are plenty of eyes right now on the corporate rate, particularly with comments from a top Republican tax writer indicating some interest in raising it.

The 20% QBI deduction for pass-throughs and proprietors was enacted largely to give businesses taxed on individual returns a rate cut paraleling the corporate cut.

A practical case for extending Trump’s corporate tax cuts - Nicholes Sargen, The Hill. "Considering the large federal budget deficits in recent years and the massive buildup of federal debt that has ensued, some may argue against maintaining the current tax rates. I share these budgetary concerns but believe the best way to address the problem of a revenue shortfall is for Congress to close tax loopholes in the next round of negotiations rather than to increase the marginal tax rate. This is especially true with the global minimum tax rate being set at 15 percent in 2021."

Blogs and bits

IRS issues last call to collect $1 billion in unclaimed 2020 tax year refunds - Kay Bell, Don't Mess With Taxes. "The Internal Revenue Service is about to turn out the lights on the 2020 tax refund party. The chance to get your part of more than $1 billion in unclaimed tax money ends on Friday, May 17."

D.C. Circuit Affirms Penalties for Failing to Report Foreign Bank Accounts - Parker Tax Pro Library. "The D.C. Circuit affirmed the Tax Court and held that a couple's amended tax returns, which reported foreign bank account information not disclosed on their original returns, were not 'qualified amended returns' under Reg. Sec. 1.6664-2(c)(3), and the couple is thus liable for accuracy-related penalties relating to the omission of the foreign bank account information on their original returns."

TDS Authorization Change - Tax School Blog:

Beginning April 8, 2024, tax professionals must call the Practitioner Priority Service (PPS) at 866-860-4259 to request transcripts to be deposited into their Secure Object Repository (SOR). While PPS has been the primary avenue for these requests, other IRS toll-free lines will no longer offer the SOR as a delivery method.

Additionally, tax professionals need to pass the current required authentication and also verify their Short Identification (ID).

Thanks, Dad!

Kids Must Pay Inheritance Tax on Dad’s Home Gifted to Girlfriend - Richard Tzul, Bloomberg ($). "Father Michael Hessler explicitly had language in his trust that deeded his home to his girlfriend Lori Miller and allocated all inheritance tax to be paid by what was left over in the trust, known as the trust residuary, the court said. Because Hessler bequeathed the trust residuary to his children, their portions in the residuary trust must pay inheritance taxes assessed on the girlfriend’s home and all remaining property in the trust, the opinion said, affirming a lower court’s decision."

Link: Court opinion.

Related: Eide Bailly Wealth Transition Services.

Loan, or compensation?

Former CEO and controlling shareholder of Fat Brands Inc., former CFO, and a tax advisor indicted in alleged scheme to conceal $47 million paid to CEO in the form of shareholder loans - IRS (Defendant names omitted):

...

Beginning no later than 2010 and continuing through early 2021, Defendant allegedly caused employees of FAT and FOG to compensate him by distributing to him approximately $47 million for his personal use and benefit. Defendant... and others miscategorized these distributions as “shareholder loans” and failed to disclose as reportable compensation to the IRS, SEC and the broader investing public, the indictment alleges.

Neither FAT nor FOG required Defendant to post collateral, make interest payments or observe any of the other commercial requirements and realities of true loans, according to the indictment, which adds that Defendant generally determined for himself the amount, timing and form of both extension and forgiveness of these “loans” without informing the directors of either FAT or FOG.

As is often the case, the IRS press release cites high living:

There are a lot of alleged violations, with all sorts of implications for the public company auditors and tax advisor involved - not to mention the potential for extensive fines and prison time. It can be tempting to just call an inconvenient cash payment to an owner or executive a "loan," but that doesn't make it one. Loans to insiders are an important tax and audit risk area.

What day is it?

It's National Buttermilk Biscuit Day. With or without gravy.

Make a habit of sustained success.