Key Takeaways

- Energy credits and house basis.

- Tax bill "speed bump."

- Clean vehicle limits clear committee.

- When employers ghost the IRS.

- International Tax Corner

- Piñata Day.

IRS Details Rules on Home Energy Efficiency Tax Breaks - Mary Katherine Browne, Tax Notes ($):

The government updated its fact sheet on energy-efficient home improvements under section 25C and residential clean energy property credits under section 25D. The credits became available under the Inflation Reduction Act.

From the Fact Sheet:

Guidance Addresses Tax Treatment of Rebates on Purchases of Energy Efficient Property - Parker Tax Pro Library. "According to the IRS, a rebate paid to or on behalf of a purchaser pursuant to either of the DOE Home Energy Rebate Programs will be treated as a purchase price adjustment for the purchaser for federal income tax purposes. Any such rebate is, therefore, not includible in the purchaser's gross income under Code Sec. 61."

Big Speed Bumps

Another Speed Bump for Tax Bill — It Pays for Itself - Doug Sword and Cady Stanton, Tax Notes ($):

Crapo emphasized that he hasn't discussed the concern that a precedent would be set by paying for the tax bill with House Republicans.

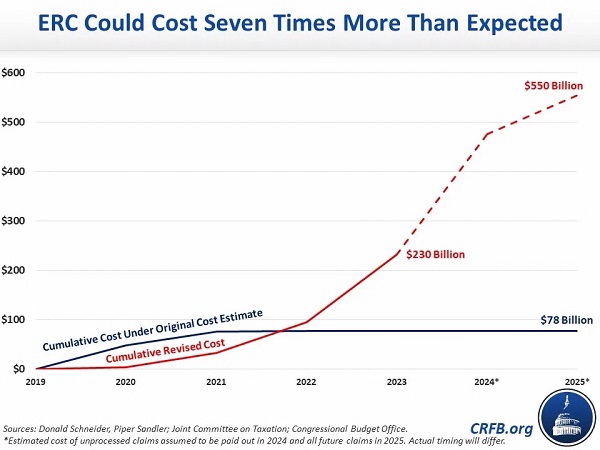

They are certainly right that the ERC wasn't paid for, anyway. As the Wall Street Journal has reported, "The credit, designed as a temporary $55 billion lifeline for struggling employers, has cost the government about four times that much—and counting."

Clean Vehicle Credit Limitations Advanced by House Panel = Cady Stanton, Tax Notes ($):

...

The legislation expands which entities associated with the production of vehicle batteries would be considered foreign entities of concern that are disqualified from the credit.

The result would be fewer vehicles qualifying for the credit. The new restrictions are unlikely to advance in the current Congress.

IRS news

Some Delinquent Employers Still Ghosting IRS - Benjamin Valdez, Tax Notes ($):

In a partially redacted report released April 17, TIGTA found that the IRS has seen some success in uncovering so-called ghost employers — which withhold taxes from employees but don’t file employment tax returns or make federal deposits — but could still improve its methods for identifying potential bad actors.

From the report:

If there is one thing the IRS should be really good at, it's this.

$22B In Earned Income Tax Credits Wrongly Handed Out - Jared Serre, Law360 Tax Authority ($). "The $22 billion in payments that either should not have been made or feature an incorrect amount accounts for a small percentage of the government's incorrect spending, which totaled an estimated $236 billion — a decrease of $11 billion from the prior fiscal year, according to the report, dated March 26."

IRS Free Filing Program With Industry Gets Bump - Kim Dixon, Bloomberg:

After years of languishing, taxpayer use of Free File was at an all-time high as filing season came to a close Monday.

Unlock Tax Savings with Section 45: Renewable Electricity Production Credit - Trina Pinneau and Ellen Thomas Evans, Eide Bailly. "The credit reduces a taxpayer’s federal tax liability by .3 cents ($.003) per kilowatt hour produced by the taxpayer. For tax years beginning after December 31, 2022, exempt organizations are eligible to participate and receive “direct pay” under Section 6417."

Blogs and bits

6 ways to use your tax refund - Kay Bell, Don't Mess With Taxes. "2. Pay off high-interest debt. Close on the heels of the RetailMeNot savers are the 33 percent of survey respondents who said they will pay down or off their debts. This could make a real difference to those who are looking at double-digit interest rates on unpaid credit card charges."

IRS Extends Certain Relief from Required Distribution Penalties for Inherited IRA and Retirement Accounts to Cover 2024, But Indicates the Penalties are Expected to Apply for 2025 - Ed Zollars, Current Federal Tax Developments. "Several advisors interpreted the amendments in the SECURE Act as superseding the necessity for distributions within the initial nine-year period, even if the decedent had reached their required beginning date before death. In acknowledgment of these interpretations, the IRS published Notices 2022-53 and 2023-54, exempting taxpayers from penalties for non-compliance with these distribution requirements for years 2021-2023, irrespective of whether the final regulations would uphold such obligatory distributions within the first nine years."

IRS Issues Applicable Federal Rates (AFR) for May 2024 - Bailey Finney, Eide Bailly. "The Section 7520 rate for May 2024 is 5.40%. Higher Sec. 7520 rates benefit Qualified Personal Residence Trusts (QPRTs) and Charitable Remainder Annuity Trusts (CRATs). Lower Sec. 7520 rates benefit Grantor Retained Annuity Trusts (GRATs), Charitable Lead Annuity Trusts (CLATs) and Private Annuities."

For Tax Purposes, Are Limited Partners Really Limited Partners? - Matthew Foreman and Vaghn Collopy, Falcon Rappaport & Berkman LLP. "Limited partners in state-law limited partnerships should not assume that because of their title or entity type, they may exclude their net earnings from self-employment taxes, as it could lead to an audit and the imposition of self-employment tax."

International Tax Corner

A Solution for R&D and Pillar Two? - Alex Parker, Things of Caesar:

The nonrefundable credit offers a dollar-for-dollar match for qualifying R&D spending, and it’s one of the most popular (and politically supported) incentives in the U.S. tax code. But it could be targeted by the minimum tax’s under-taxed profits rule, the enforcement mechanism to target companies based in countries (like the U.S.) that neglect to implement the new OECD rules. Under that regime, U.S. companies may see increased foreign taxes if the R&D credit brings their effective domestic tax rate below 15%.

...

There is an intriguing possible solution that has been floated by tax practitioners and may be in the mix at Paris negotiations, however.

Related: Eide Bailly International Tax Services.

Accidental Americans Learning They Are Citizens Face A Tax Dilemma - Virginia La Torre Jeker, US Tax Talk. "Accidental Americans are still subject to the gamut of U.S. tax and financial asset reporting laws but often do not understand their obligations. They must annually pay tax on worldwide income, are responsible for estate and gift taxes and must meet many tax information filings that the typical stateside citizen is not required to complete. Examples include reporting foreign financial assets such as overseas bank and brokerage accounts, special reporting of ownership in foreign corporations, reporting gifts or bequests from non-U.S. persons and more."

Related: Eide Bailly Global Mobility Services.

Canada Lifts Capital-Gains Tax to Finance New Housing Measures, Keep Deficit Steady - Paul Vieira, Wall Street Journal. "The capital-gains measure, unveiled in the country’s annual budget plan on Tuesday, represents one of the biggest tax increases in recent Canadian policymaking. The additional revenue helps the Liberal government meet their promise to limit the size of the annual deficit, and gives it more money for initiatives as Prime Minister Justin Trudeau aims to turnaround his government’s poor performance in public-opinion polls with an election over a year away."

Canada Proposes Top-End Tier To Boost Capital Gains Tax - Jack McLoone, Law360 Tax Authority. "Canada's government is seeking to introduce a new tier to its capital gains tax regime, increasing the portion of gains on which tax is paid to two-thirds from the current 50% for any capital gains more than CA$250,000 ($182,000)."

Adventures in Tax Court

Lawyer’s Tax Noncompliance Justifies IRS Levy, Tax Court Says - Kristen Parillo, Tax Notes ($). "The IRS didn’t abuse its discretion by sustaining a proposed levy action against a New Jersey lawyer who failed to make estimated tax payments and file tax returns for earlier years, according to the Tax Court."

From the opinion (taxpayer name and citations omitted):

Furthermore, AO Henry offered the alternative ground of Taxpayer's failure to make the required estimated tax payments as justification for rejecting his request for collection alternatives. The record reflects that AO Henry informed Taxpayer of this requirement on multiple occasions, and that he did not make the required estimated tax payments. The requirement of current compliance with estimated tax liabilities as a prerequisite for a collection alternative ensures that the current taxes are being paid and avoids the risk of pyramiding liabilities.

Most attorneys are careful to stay up to date with their tax filings. Some try to work around the IRS. It can go badly.

What day is it?

It's National Piñata Day! May your swings today all have good results.

Make a habit of sustained success.