Key Takeaways

- Happy Birthday, Tax Reform Act of 1986.

- Think tank: campaign tax proposals would accelerate Social Security insolvency.

- Tax like it's 1899?

- USA moves up to #18 in international tax competitiveness index.

- Energy credit transfers: the audit risks.

- Are you too young for estate planning?

- Who watches the watch buyers?

- National Nut Day.

Today is the anniversary of the signing of the Tax Reform Act of 1986.

This bill, passed with the cooperation of both parties, broadened the tax tax base, eliminated loopholes and tax shelters, and dramatically lowered rates. It was a different world. Now we prepare for another massive tax bill in the world we have.

The tax lobbying bonanza - Laura Weiss, Punchbowl News:

There have been more than 100 registrations for lobbying on taxes since the start of July, according to congressional lobbying records.

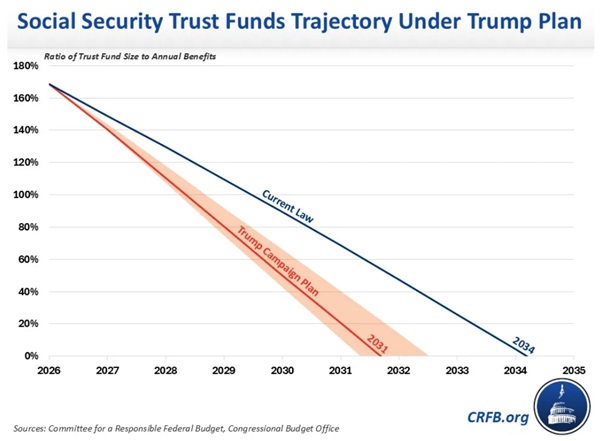

Social Security insolvency: six years, or ten?

Trump proposals could drain Social Security in 6 years, budget group says - Julie Zauzmer Weil Washington Post:

Social Security faces a looming funding crisis in an aging country, with trustees most recently predicting that the retirement and disability program’s trust fund will become insolvent in 2035. Many of Trump’s campaign proposals would accelerate that timeline, potentially by years, said the Committee for a Responsible Federal Budget, a nonpartisan group that opposes large federal deficits.

From the CRFB report:

...

Insolvency could occur earlier in 2031 or at some point in 2032 under our high- and low-cost scenarios, respectively.

Upon insolvency, the law calls for limiting Social Security spending to its revenue stream, which we've previously estimated would mean a $16,500 cut in annual benefits for a typical dual-income couple retiring in 2033. CBO estimates that benefits would have to be cut by 23 percent by 2035 under current law.

The baseline - insolvency in 10 years - isn't exactly encouraging to begin with.

How the national debt will play out - Arnold Kling, In My Tribe:

This crisis will produce intense political conflict. Old people will not like having their benefits reduced. Bond holders will not like having their savings stolen. Taxpayers will not like having their taxes raised. Things will get really ugly.

More Campaign news

Trump: We Could Tax Like It’s 1899 - Richard Rubin, Wall Street Journal:

“It had all tariffs. It didn’t have an income tax,” he said. “We have people that are dying. They’re paying tax and they don’t have the money to pay the tax.”

Beyond causing potential price increases on middle-income households, even extremely high tariffs wouldn’t come close to generating enough money to replace all other taxes.

Back to the future - Bernie Becker, Politico:

No, it goes further back. Consciously or not, Trump also would like to hook the tax code back to one of his heydays — the 1980s.

Advocacy Groups Criticize Harris and Walz on Donor Disclosure - Fred Stokeld, Tax Notes ($):

Representatives from 16 groups criticized Harris and her running mate, Minnesota Gov. Tim Walz, for backing a California law that required charitable organizations to provide the state with information they disclose on IRS Form 990 Schedule B, “Schedule of Contributors,” about donors’ identities. The groups included People United for Privacy, Tea Party Patriots Action, and Americans for Tax Reform.

We're Number 18! We're Number 18!

International Tax Competitiveness Index 2024 - Alex Mengden, Tax Foundation:

...

The US continues to phase out full expensing for plants and equipment. The US increased the relative attractiveness of its cross-border rules, as many other nations started to implement income inclusion rules and domestic top-up taxes within the global minimum tax process. The US rank improved from 23rd to 18th.

Related: Eide Bailly International Tax Services.

Energy Credit Sales

Due Diligence And How To Prepare For Tax Credit Transfer Audits - Marie Sapirie, Forbes:

...

However, there are several areas where the tax credit buyer is exposed to some operational risk: avoiding recapture and complying with the prevailing wage and apprenticeship requirements.

It's later than you think department

I’m Way Too Young for Estate Planning. Or Am I? - Julia Carpenter, Wall Street Journal:

For years, I thought only older people had to concern themselves with such a project. As a 30-something still renting, paying down debt and slowly growing my savings, I assumed I was far too young for estate planning.

...

But when my grandmother died earlier this summer, I started talking more with my parents about their expectations around death and inheritance, which then also prompted me to contemplate my own.

Related: Eide Bailly Wealth Transition Services

New Tax Gap estimate hits $696 billion - Kay Bell, Don't Mess With Taxes. "The IRS also emphasized that the new Tax Gap projections reflect the time period before the agency began increasing tax compliance work following passage of the Inflation Reduction Act in August of 2022."

Hurricanes Wash Up Scammers - John Richmann, Tax School Blog. "An important tool in the “due diligence” for generosity is the IRS’s Tax-Exempt Organization Search (TEOS) tool. Americans interested in contributing to hurricane relief can easily verify that a charity is legitimate and recognized as eligible for tax-deductible contributions."

IRS Further Postpones Due Dates for Taxpayers Affected by Terroristic Action in Israel - Parker Tax Pro Library. "Affected taxpayers have until September 30, 2025, to file tax returns, make tax payments, and perform certain time-sensitive acts listed in Reg. Sec. 301.7508A-1(c)(1) and Rev. Proc. 2018-58, that are due to be performed on or after September 30, 2024, and before September 30, 2025."

Changing a Previously Filed BOI Report - Thomas Gorczynski, Tom Talks Taxes. "Updated reports are required when there is a change to previously reported information about the reporting company or its beneficial owners."

Jefferson City man sentenced for $26 million bank fraud scheme - IRS (Defendant name omitted, emphasis added):

Defendant was sentenced by U.S. District Judge Roseann A. Ketchmark to a total sentence of 12 years in federal prison without parole.

Defendant received a total of $12,430,932 in PPP loans for his four businesses. In each of those loan applications, Defendant admitted, he failed to disclose his ownership in the other three businesses, and made materially false and fraudulent claims in the loan applications and supporting documentation...

Under the terms of his plea agreement, Defendant must forfeit to the government any property involved in, or derived from the proceeds of his bank fraud scheme, including a money judgment of $12,430,932, two properties in Jefferson City, one property in Valparaiso, one property in La Porte, Ind., four vehicles (a 2020 Chevrolet Silverado, two 2021 Chevrolet Silverados, and a 2019 BMW X5), a 2020 John Deer ZTrak, a 2020 John Deere Tractor, a Kubota Compact Track Loader, a Gents 43mm IWC Schaffhausen Perpetual Chronograph wristwatch, two Gents stainless steel Rolex Sea-Dweller self-winding automatic diver’s watches, and a Gents Citizen Eco-Drive Radio-controlled world time self-winding automatic watch with sapphire crystal.

Former NFL player charged with embezzling from commercial real estate projects - IRS (Defendant name omitted, emphasis added):

...

Defendant allegedly used some of these loan proceeds for his own benefit, rather than applying them to the Model Tobacco and Whitaker Park Projects as required. As alleged in the indictment, Defendant used some of the money he stole for the following personal purchases and expenses, among others:

Numerous purchases at luxury goods and fashion stores, including over $60,000 in payments to Lenkersdorfer Fine Jewelers to buy Rolex watches.

Some economics PhD candidate should study how much of the market for luxury goods is propped up by financial crime. When it's your own money, you're more likely to stick with Timex or Casio.

What day is it?

It's National Nut Day! The delicious snacks, not the candidates.

Make a habit of sustained success.