IRS's Cybersecurity Program Is Falling Short, TIGTA Says - Lauren Loricchio, Tax Notes ($):

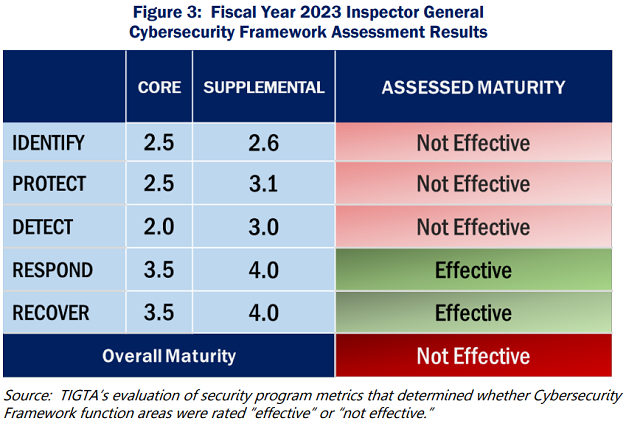

An IRS watchdog found the IRS’s cybersecurity program to be lacking in several areas, potentially putting taxpayer information at risk.

...

“The IRS needs to take further steps to improve its security program deficiencies and fully implement all security program components in compliance with FISMA requirements; otherwise, taxpayer data could be vulnerable to inappropriate and undetected use, modification, or disclosure,” TIGTA said in the report.

From the report:

Not entirely reassuring.

The Internal Revenue Service reminds eligible contractors who build or substantially reconstruct qualified new energy efficient homes that they might qualify for a tax credit up to $5,000 per home.

The actual amount of the credit depends on eligibility requirements such as the type of home, the home's energy efficiency and the date when someone buys or leases the home. This important credit was expanded as part of the Inflation Reduction Act of 2022.

TIGTA to IRS Hiring Team: Don’t Be So Stingy - Jonathan Curry, Tax Notes ($):

The IRS has the authority to use special pay incentives to entice new recruits or to keep employees on the rolls — now it needs to start using it, according to the Treasury Inspector General for Tax Administration.

The big increase in IRS funding enacted last year will greatly increase IRS hiring demand, but the report highlights problems in using the funding:

IRS policy allows the agency to provide special payments in appropriate circumstances, like when it’s having difficulty recruiting or retaining candidates for a position or group of positions without the help of additional incentives. In those cases, the IRS can provide special payment incentives for recruitment, relocation, and retention, or through critical position pay authority (CPPA).

Between fiscal 2019 and fiscal 2022, the IRS issued nearly 1,500 special payments, totaling $1.5 million, but most were made to employees to cajole them into returning to the office during the COVID-19 pandemic. Only 31 payments were used for more traditional hiring and retention purposes. Those payments ranged from $200 to $64,000 and added up to about $619,000.

In a world where tax pros are in high demand, the IRS will need to be more nimble to get its share.

7 in 10 say they’ve heard little or nothing about Inflation Reduction Act since passage: poll - Alex Gangitano, The Hill:

Seven in 10 Americans in a new poll say they’ve heard little or nothing about the Inflation Reduction Act nearly a year after President Biden signed Democrats’ massive climate and tax bill into law.

Only 27 percent of Americans said they know a great deal or a good amount about the legislation touted by the administration as a major accomplishment, according to a Washington Post-University of Maryland poll released Monday.

Tax nerds are well-represented in that 27 percent. This shows how things that are huge news in D.C. can fail to register elsewhere.

States’ Sales Tax Holidays Expand, Forcing Retailers to Scramble - Angélica Serrano-Román, Bloomberg. "With the new law it passed in May, Florida now has seven sales tax holidays. The state expanded existing holidays for school supplies, disaster preparation, gas stoves, energy-efficient appliances, and home hardening, while introducing two new concepts: “Freedom Summer,” a monthslong tax break on sporting goods, outdoor equipment, and amusements, and “Tool Time,” covering items typically found in hardware stores."

Update on states moving ahead with PTETs - Eileen Reichenberg Sherr, Journal of Accountancy:

A PTET is a state or other jurisdiction's mandatory or elective entity-level income tax on partnerships and/or S corporations. Under Notice 2020-75, the IRS stated that the payment of a PTET to domestic jurisdictions is deductible in computing the entity's nonseparately stated income or loss and is not taken into account in applying the cap to an individual partner or shareholder in the entity.

As of May 31, 2023, 36 states and one locality had enacted a PTET, including seven states in 2023, in four of which a PTET is effective retroactively to 2022 — Indiana; Iowa (with its Department of Revenue on May 22, 2023, requesting comments on needed guidance by June 7, 2023); Kentucky; and West Virginia — while Montana and Hawaii's PTETs are effective in 2023 and Nebraska's PTET is effective retroactively to 2018.

A home energy audit could produce lower utility bills and a tax credit - Kay Bell, Don't Mess With Taxes. "Uncle Sam will even help you pay for it. A home energy audit is one of the myriad clean energy tax credit possibilities in the Inflation Reduction Act."

IRS Moves to Add Monetized Installment Sale Transactions to Listed Transactions via Proposed Regulations - Ed Zollars, Current Federal Tax Developments. "The IRS also argues that the seller should be treated as having received payment at the time of the sale, given these facts."

What You Need To Know About Electric Vehicle (EV) Tax Credits - Kelly Phillips Erb, Forbes. "Generally, to qualify, you must buy a qualifying EV for your own use primarily in the U.S. Your income level also comes into play, since your modified adjusted gross income (AGI) may not exceed $300,000 for married couples filing jointly ($225,000 for heads of household and $150,000 for all other filers). You can use your modified AGI from the year you take delivery or the year before, whichever is less."

What should and shouldn't be Included on the 2023 Form 1099-K - Wolters Kluwer Tax And Accounting. "Taxpayers should expect a Form 1099-K if they received (1) payments with payment cards, including credit cards, debit cards, and stored value cards (gift cards); and (2) payment of over $600 with a payment app or online marketplace."

Are Pass-Through Entity Taxes Worth The Hype? Liz Pascal, I Tax School Blog. "Like many other things, it depends. They certainly offer a route to replace a valuable deduction mostly lost (at least for now) with the TCJA. But pass-through owners and their tax advisors are wise to look closely at the particularities of the PTET before electing in, especially if there are multiple state PTET elections at issue. Their value is not automatic and in some cases, will create more headaches and potential costs than they are worth."

Pillar 2 Can Increase Tax Competition - Martin Sullivan, Tax Notes.

The most prominent aspect of the pillar 2 global minimum tax is how it restrains large multinationals from shifting highly mobile income to tax havens. In second place, and of secondary importance is the proposed regime’s effect on tax competition. Whether you are friend or foe of tax competition, the minimum tax would eliminate government motivation to reduce multinationals’ effective tax rates to below 15 percent to attract investment.

But there’s something else you should know about pillar 2 that’s hardly ever mentioned. In some not uncommon circumstances, it can increase tax competition — that is, for countries with tax rates above the 15 percent minimum, it can provide an incentive to reduce taxes.

Related: Eide Bailly International Tax Services.

The Sixth Sense (of Commodity Prices) - Alex Parker, Things of Caesar. "Whatever other pros and cons apply to the arm's-length principle, its greatest virtue is that it's the rule which virtually all of the world's nations have agreed to. Would any other system reach that level of unanimity? But as more and more countries begin to question the standard's logic, and look for ways to either support it or work around it, that pillar of consensus begins to look more shaky."

U.S. Warns of Trade Fight Over Canada’s Digital-Tax Plan - Paul Vieira, Wall Street Journal. "Canada’s 3% tax on technology companies’ revenue from providing digital services to Canadian users or sales of Canadian user data would start Jan. 1, 2024, and would be retroactive to revenue dating to 2022. Canada’s finance minister, Chrystia Freeland, said last month that the tax is important for Canada’s national interest."

Extraterritorial Taxation: Is It All Our Fault? - Adam Michel, Liberty Taxed. "Historically, unilateral U.S. expansions of its tax base have spawned even more aggressive changes from other countries and the OECD. As Congress considers how to respond to the OECD’s proposals and reform our own domestic laws, Congress should lead by example. Moving to a full territorial tax system and increasing financial privacy protections will both make the U.S. a more attractive investment hub and disengage from the escalatory fight for other countries’ tax bases."

Circuit Court Sides With Receiver in Energy Tax Scheme Case - Mary Katherine Browne, Tax Notes ($):

The Tenth Circuit found that a court-appointed receiver was entitled to sue salespersons involved in a solar energy tax scheme under the Uniform Voidable Transactions Act (UVTA) and that disgorgement of their commissions was proper.

The court gave no points for effort:

The court also rejected the appellants’ argument that the good-faith defense should apply because they provided reasonably equivalent value through expended energy and time, noting that the time and efforts were spent to advance a tax fraud scheme.

Link: 10th Circuit opinion

Iowa man pleads guilty in federal court to failure to pay employment taxes and file federal return - IRS (Defendant name omitted). "As described in public court records, Defendant operated a concrete construction business within the Southern District of Iowa. During the fourth quarter of 2019, Defendant collected and willfully failed to pay more than $9,000 in employee Federal Insurance Contribution Act (FICA) taxes to the United States. Additionally, for the year 2020, Defendant willfully failed to file a federal tax return."

This Iowan did exactly what you would do to attract unwanted IRS attention. Not remitting payroll taxes triggers all sorts of IRS system alarms. Combine that with skipping 1040s, and you are well on your way to an IRS examination. Any time your tax planning involves federal sentencing guidelines, you may have done it wrong.

Don't tell the dog. It's International Cat Day!

Make a habit of sustained success.