Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

State Tax Reform and Relief Trend Continues in 2023 - Katherine Loughhead, Tax Policy Blog:

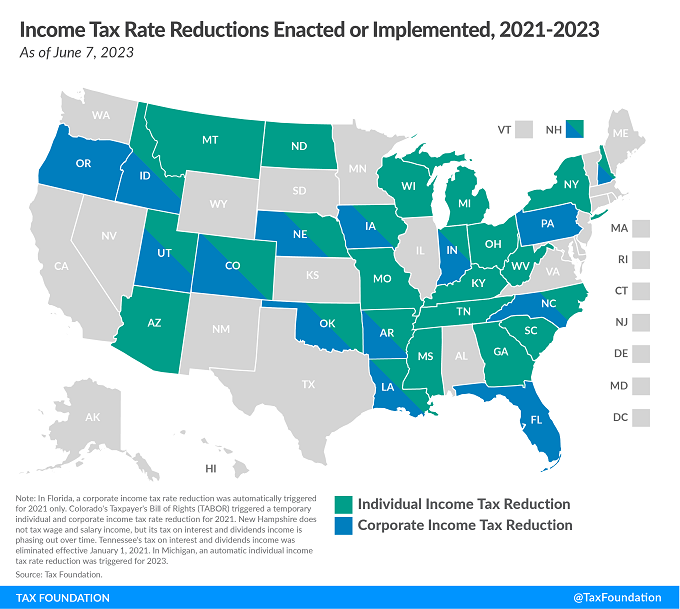

After the dramatic rate reductions and reforms in 2021 and 2022, many expected a lull in 2023. Those expectations have been shattered.

Eight states adopted individual income tax rate reductions: Arkansas, Indiana, Kentucky, Montana, Nebraska, North Dakota, Utah, and West Virginia. Additionally, Michigan triggered a potentially temporary rate reduction, while previously scheduled or triggered reductions also took effect in 2023 in Arizona, Idaho, Iowa, Missouri, New Hampshire (interest and dividend income tax), and North Carolina.

Income Tax Economic Nexus Is Open Question Post-Wayfair - Maria Koklanaris, Law360 Tax Authority ($):

After the U.S. Supreme Court's 2018 decision in South Dakota v. Wayfair set off a wave of economic nexus sales tax laws and then another of marketplace facilitator laws, many observers expected states would next turn to establishing thresholds for the corporate income tax. A few did, including Hawaii, Pennsylvania and Texas, and Louisiana has a pending bill to do so. All told, though, fewer than a third of states set forth specific dollar standards that tell businesses when economic nexus is triggered for the corporate income or franchise tax, relying instead on a vague so-called doing-business standard.

That makes it a challenge to determine which states a business must file income tax returns:

Similarly, the major cases from state high courts are all more than 15 years old. It is difficult to apply any of them to current conditions, since more than 30 states now use sales-factor-only apportionment, and another 10 consider other factors but put additional weight on the sales factor, said John Gupta, state and local tax practice leader at Eide Bailly LLP.

Related: Eide Bailly State & Local Tax Services.

How States are Taxing Electric Vehicle Charging - Dillon Fowler and David Epstein, Bloomberg. "Until now states have focused their legislative efforts on implementing or expanding excise taxes and fees to EV charging, but they are also increasingly turning to higher annual registration fees to generate revenue from EV drivers."

State-by-State News Roundup

Alabama

Alabama Tax Break for Overtime Pay Wins Statehouse Approval - Chris Marr, Bloomberg. "The legislation (HB 217) won final passage from state lawmakers Tuesday, when the House and Senate unanimously approved changes requested by Gov. Kay Ivey (R) to remove a $25 million cap on the total annual amount of the tax break and shorten the exemption’s lifespan before it expires."

California

California Offers Tax Deal for Micro-Captive, Easement Cases - Laura Mahoney, Bloomberg ($):

California taxpayers participating in syndicated conservation easements or micro-captive insurance companies have a four-month window to settle with the Franchise Tax Board and avoid some or all state penalties. The Internal Revenue Service considers both transactions possible illegal tax shelters.

Connecticut

Connecticut Lawmakers Approve Budget With Historic Tax Cut - Martin Braun, Bloomberg. "The income-tax cuts, capped at $150,000 for single filers and $300,000 for joint filers, reduces the rate for families to 2% on their first $20,000 in income and to 4.5% on income of as much as $100,000, down from 3% and 5%, respectively."

Link: House Bill 6941

Hawaii

Hawaii Conforms To Federal Code For Income, Estate Tax - Jaqueline McCool, Law360 Tax Authority ($). "H.B. 1100, signed by Democratic Gov. Josh Green on Monday, will update the state's tax code to conform to the IRC for income, estate and generation-skipping transfer tax laws amended before Dec. 31, 2022, according to the bill."

Hawai'i Enacts SALT Deduction Cap Workaround Effective for Tax Years Beginning January 1, 2023 - Melissa Menter, Eide Bailly. "Hawai'i's Governor, Josh Green, recently signed S.B. 1437 into law, adopting an optional pass-through entity level tax (PTET). The election to pay the entity level tax must be made annually. An owner may claim their distributive share of the PTET as a credit."

Illinois

Illinois Enacts Franchise Tax Break and Partnership Withholding Changes - Benjamin Valdez, Tax Notes ($).

Included in S.B. 1963 is a provision that eliminates the withholding exemption for investment partnerships. For tax years ending on and after December 31, 2023, investment partnerships are required to withhold income taxes from each nonresident partner, with an exception for partners that are federally exempt from tax and partners who are retired, according to the bill. The bill also modifies the definition of investment partnerships, specifying that no less than 90 percent of their gross income can consist of interest, dividends, and gains from sales of qualifying investment securities.

Iowa

Iowa Enacts Omnibus Bill, Economic Development Credit Changes - Emily Hollingsworth, Tax Notes ($). "Reynolds also approved S.F. 575, which changes some economic development tax credits, including extending the renewable chemical production tax credit from 2030 to 2037 and setting the maximum credit amount to $1 million for all eligible businesses, rather than businesses that have been in operation for less than five years; and extending for five years the period a state economic development authority board can certify an innovation fund for purposes of the innovation fund investment tax credit program. The program provides a tax credit equal to 25 percent of a taxpayer’s equity investment in an innovation fund certified by the board."

Other tax-related bills passed include SF 565, an omnibus bill that, among other things, excludes financial institutions from Iowa's composite tax return requirement for passthroughts beginning with 2023 returns; and HF 111, which provides an exception to real estate transfer taxes to trust distributions to beneficiaries.

Indiana

Indiana DOR Updates Bulletin on Sales Taxation of Nonprofits - Emily Hollingsworth, Tax Notes ($). "Sales Tax Information Bulletin No. 10 — which was issued June 3 and replaces an October 2022 bulletin — includes the new $100,000 sales threshold enacted under S.B. 417. Nonprofits that exceeded that threshold "in either the current or previous calendar year" are required to collect and remit Indiana’s 7 percent sales tax on tangible personal property sales, according to the bulletin."

Louisiana

La. Lawmakers OK Shifting Management Of Local Tax System - Maria Koklanaris, Law360 Tax Authority ($):

The state House on Tuesday gave final approval by a 103-0 vote to H.B. 558, authored by Rep. Gerald Beaullieu, R-New Iberia, after receiving amendments from the Senate. On Monday, the Senate passed the bill by a 38-0 vote, following original passage in the House on May 1 by a 100-0.

The bill would transfer oversight of the sales tax remittance system to the sales tax board. That would include tasking the board with design and implementation of a "single remittance system" that would allow taxpayers to remit state and local sales and use tax through a single transaction.

Louisiana's unique sales tax system is run on a local level. The National Taxpayers Union Foundation, which has sued to reform the system, says that it is "a red tape nightmare for businesses" where taxpayers "face rules and regulations from more than 11,000 local tax jurisdictions with which they must comply."

Louisiana Set to Phase Out Franchise Tax, Restore Gun Tax Holiday - Michael Bologna, Bloomberg ($). "For corporate taxpayers, the most significant changes would come under SB 1, which would eliminate the corporation franchise tax in stages beginning in 2025. Businesses currently pay an annual tax on net income at rates between 3.5% and 7.5%. The bill reduces the levy by 25% in years when collections exceed $600 million and creates a framework for killing the tax in four, five, or six years, depending on when the tax-cut triggers are met."

Minnesota

Minnesota’s New Retail Delivery Fee Takes Lessons From Colorado - Michael Bologna, Bloomberg ($):

Minnesota became the second state to fund its transportation infrastructure with a fee on the growing volume of packages delivered to the doorsteps of consumers under legislation signed by Gov. Tim Walz on Wednesday.

The Democratic-Farmer-Labor Party governor signed the omnibus transportation bill, HF 2887, one of many measures enacting the state’s $72 billion budget for fiscal years 2024 and 2025. The transportation bill raises additional revenue through several new taxes and a 50-cent fee on retail delivery transactions beginning next year. Colorado is the only other state to impose this fee.

What three of the Minnesota Legislature's biggest income tax changes mean for taxpayers - Tom Nehil and Briana Bierschbach, Star Tribune. "Now, income between $220,650 and $304,970 reduces a taxpayer's deductions by 3%, but any income above $304,970 reduces a taxpayer's deductions by 10%. The 80% of total deductions rule still applies. But there's also a new rule: for taxpayers with adjusted gross income in excess of $1,000,000, their deductions are simply reduced by 80% — no more math needed."

Nebraska

Nebraska Law Provides Tax Incentives for Semiconductor Production - Emily Hollingsworth, Tax Notes ($). "Under L.B. 92, signed into law June 6 by Gov. Jim Pillen (R), taxpayers that invest in a Nebraska-based semiconductor manufacturing project can claim credits, refunds, or incentives from the state’s economic development program, ImagiNE Nebraska. Applicants must meet the eligibility requirements set by the federal Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act of 2022 (P.L. 117-167), according to the bill."

Justices Send Nebraska Tax Sale Cases Back to State High Court - Perry Cooper, Bloomberg ($):

The cases sent back were filed by homeowners Kevin Fair and Sandra Nieveen, who challenged Nebraska’s law that allowed a private third party to seize Fair’s home worth $60,000 over a $588 tax deficiency and Nieveen’s home worth $61,000 over $3,796. The Nebraska Supreme Court upheld both sales.

The justices didn’t explain why they sent the cases back, but presumably it was to apply the court’s May 25 holding Tyler v. Hennepin County that local governments commit unconstitutional takings when they keep surplus proceeds after a homeowner’s property is seized and sold due to delinquent taxes.

Neb. Offers Tax Breaks For Food Donations, Biodeisel Sales - Jared Serre, Law360 Tax Authority ($). "L.B. 727, signed Tuesday by Republican Gov. Jim Pillen, willallow restaurants and grocery stores to claim an income tax credit equal to 50% of the value of the food donated, up to $2,500. The law also creates a credit for biodiesel fuel, allowing sellers to claim a 14-cent income tax credit per gallon of fuel sold beginning Jan. 1."

Nevada

Nevada To Prohibit Interest Payments On Some Tax Refunds - Jared Serre, Law360 Tax Authority ($). "S.B. 29, signed May 30 by Republican Gov. Joe Lombardo, amends the current state law to include the specific prohibition."

The bill relates to " Any tax which was over-collected by the taxpayer and which the taxpayer is required to refund to the person from whom it was collected."

Oklahoma

Oklahoma Tax Bills Become Law Without Governor’s Signature - Emily Hollingsworth, Tax Notes ($):

H.B. 1039 eliminates the annual corporate franchise tax for tax years beginning on or after January 1, 2024. The tax, which applies to corporations, associations, joint stock companies, and business trusts that do business in the state, is levied at $1.25 for each $1,000 of capital invested or used in the state.

H.B. 1040 increased from $12,200 to $14,400 the upper threshold for the 3.75 percent income tax rate for joint filers, heads of household, and surviving spouses. The top income tax rate of 4.75 percent would apply to those taxpayers' income over $14,400. The adjustment brings that threshold to exactly double the one for single filers and those who are married filing separately, as all the other joint filers' income thresholds already were.

Okla. Extends Tax Credit For Railroad Upgrade Costs - Zak Kostro, Law360 Tax Authority ($). "S.B. 17, which became law Friday without the signature of Republican Gov. Kevin Stitt, extends the credit sunset date from Jan. 1, 2025, to Jan. 1, 2030, according to a bill summary. The bill authorizes a credit equal to 50% of qualified railroad reconstruction or replacement expenditures, according to its text. A credit may be transferred at any time or carried over in the five years after the year of qualification, the bill said."

Oregon

Ore. Updates Conformity To Fed. Code For State Income Taxes - Zak Kostro, Law360 Tax Authority ($). "S.B. 141, which Democratic Gov. Tina Kotek signed Wednesday, updates Oregon's date of conformity to the federal code for state personal income tax and corporate excise and income tax purposes to Dec. 31, 2022, according to the bill text and a summary. Under the preexisting law, the state conformed to the IRC as amended and in effect on Dec. 31, 2021, according to the bill."

Texas

Abbott Signs Bill Replacing Expired Texas Development Incentive - Angélica Serrano-Román, Bloomberg. "The new plan (HB 5) replaces a program known as Chapter 313, which offered property tax abatements to renewable energy and manufacturing projects until it expired on Dec. 31, 2022. The revised plan excludes renewable energy projects, which previously accounted for almost two-thirds of the executed deals, and expands eligibility for industries such as semiconductor chip manufacturing."

Tax History Corner

They don't name taxes like this anymore. From the United Kingdom Encyclopedia of Law:

Financial pressure at the close of Edward III.’s reign (1377) led to the adoption of a tax of fourpence per head on all persons in the kingdom (mendicants and persons under fourteen years being excepted). This “tallage of groats,” which seems to be derived by analogy from the hearth money for Peter’s pence, was followed by the graduated poll taxes of 1379 and 1380. In the former the scale ranged from ten marks (£6:13:4) imposed on the royal dukes and the viscounts, through six marks on earls, bishops and abbots, and three on barons, down to the groat or fourpence payable by all persons over sixteen years of age. Such a form of taxation approximated—as Adam Smith saw—to an income tax, but it proved to be unproductive, only half of the estimated yield of £50,000 being obtained.

Have a groat great weekend!

Make a habit of sustained success.