Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

Ranking Individual Income Taxes on the 2023 State Business Tax Climate Index - Janelle Fritts, Tax Foundation:

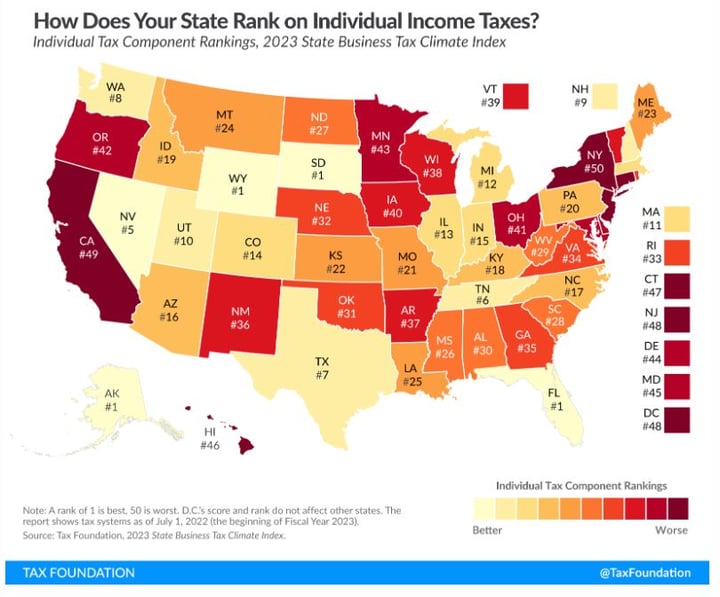

This week’s map examines states’ rankings on the individual income tax component of our 2023 State Business Tax Climate Index.

States that score well on the Index’s individual income tax component usually have a flat, low-rate income tax with few deductions and exemptions. They also tend to protect married taxpayers from being taxed more heavily when filing jointly than they would filing as two single individuals. In addition, states perform better on the Index’s individual income tax component if they index their brackets, deductions, and exemptions for inflation to avoid unlegislated tax increases.

State-By-State Roundup

Alaska

Alaska Bill Would Impose Income Tax On Some Residents - Jaqueline McCool, Law360 Tax Authority ($):

Alaska, which does not have a personal income tax, would impose an income tax on some residents under a bill introduced in the state House of Representatives.

H.B. 185, introduced Tuesday, would impose an income tax equal to the state's permanent fund dividend. The tax would apply only to individuals with federal adjusted gross income of at least $75,000 and to taxpayers filing jointly with federal adjusted gross income of at least $150,000. Dependents would be exempt from the income tax, the bill said..

California

Calif. High Court Denies Review Of Amazon Sales Tax Fight - Paul Williams, Law360 Tax Authority ($). "The California Supreme Court declined to review an appellate court's ruling that said small online sellers, rather than Amazon.com, are retailers who should be collecting billions in sales taxes from selling on Amazon's platform."

Colorado

Colo. Sets 20% Tax On Remote Tobacco Sales - Sanjay Talwani, Law360 Tax Authority ($). "Remote sales of cigars and pipe tobacco in Colorado would be subject to a 20% tax under legislation signed into law by Gov. Jared Polis."

Colo. To Keep Issuing Private Tax Letters - Jared Serre, Law360 Tax Authority ($). "Colorado will continue to provide private letter rulings and information letters to taxpayers under a bill signed by Democratic Gov. Jared Polis."

Iowa

Iowa House OKs Sales Tax Break For Some Affiliate Rentals - By Zak Kostro, Law360 Tax Authority ($). "Iowa would exempt certain leases or rentals between affiliates from the state's 6% sales and use tax under a bill unanimously approved by the state House of Representatives."

Indiana

Ind. Income Tax Owed By Out-Of-State Couple, Tax Dept. Says - Michael Nunes, Law360 Tax Authority ($). "The Department of Revenue, in a letter of finding published Wednesday, said while the couple had established domicile in another state at the end of 2018, a severance payment received in 2019 from the husband's former employer, located in Indiana, was still taxable. The establishment of a new domicile in another state, the department said, is not relevant as nonresidents are also required to pay tax on income sourced in Indiana."

Louisiana

La. City Can't Seek Fees From Netflix, Hulu, Panel Affirms - Sanjay Talwani, Law360 Tax Authority ($). "Netflix and Hulu cannot be sued by a Louisiana city seeking to impose franchise fees on the video streamers' delivery of services through the rights of way of internet providers, a Louisiana appeals court affirmed."

Michigan

Mich. Tax Tribunal Backs Walmart's 'Dark Store' Value Method - Jaqueline McCool, Law360 Tax Authority ($). "Walmart correctly valued one of its Michigan stores at $5 million by using a sales comparison approach and including the sales of vacant buildings in its calculation, sometimes called the 'dark store theory,' the state Tax Tribunal ruled."

Minnesota

The Faulty Revenue Estimate Behind Minnesota’s Consideration of Worldwide Combined Reporting - Jared Walczak, Tax Foundation. "As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus."

Missouri

Mo. Tax Dept. Says Drop Shipper Must Collect Sales Tax - Maria Koklanaris, Law360 Tax Authority ($). "An out-of-state vendor that sells items through third-party drop shipments to Missouri customers must collect sales tax, the state Department of Revenue said in a letter ruling."

New Jersey

2 NJ Churches Say County's Grant Policy Beset With Bias - George Woolston, Law360 Tax Authority ($). "Two New Jersey churches are challenging the constitutionality of a county's policy that prohibits the churches from receiving grants from its historic preservation trust fund, arguing that the policy discriminates on the basis of religion."

North Carolina

Philip Morris Must Pay NC Franchise Tax, Biz Court Rules - Peter McGuire, Law360 Tax Authority ($). "North Carolina's administrative appeals agency was unauthorized to decide the constitutionality of state tax laws when it let Philip Morris USA Inc. avoid paying $300,000 the tobacco company owed the Tar Heel State, according to a business court ruling."

Utah

Utah Justices Rule Property Owner Can't Claim Tax Break - Zak Kostro, Law360 Tax Authority ($). "A Utah property owner failed to invalidate the state Legislature's definition of residential property for purposes of claiming a tax break, the state Supreme Court ruled Thursday, upholding a state Tax Commission decision that the property didn't qualify for the exemption."

Washington

Wash. Offers Interim Guidance For Allocating Capital Gains - Maria Koklanaris, Law360 Tax Authority ($). "Residents who were domiciled in Washington state during any particular year will be assumed to be domiciled in the state when they sold property that year, potentially triggering capital gains tax, the tax agency said in an interim guidance statement."

Enjoy! Taxes, Not Tequila: What You Should Know About Cinco De Mayo - Kelly Phillips Erb, Forbes.

Make a habit of sustained success.