Debt-Ceiling Deal Will Cost the IRS Up to $21.4 Billion - Richard Rubin, Wall Street Journal:

The bill, set for votes in Congress over the coming week, would take back $1.4 billion immediately. In addition, Biden and Republicans made a side deal that would take back up to $10 billion in each of the next two years to prevent cuts to other federal programs, including the IRS’s normal operating budget.

...

Last year’s law made the $80 billion available to the IRS through September 2031, designating most of it for enforcement. Given the slow pace of hiring and training auditors, the IRS wasn’t going to empty that account soon. Practically, having $59 billion instead of $80 billion likely wouldn’t change much about the agency’s near-term plans.

IRS to Lose $21 Billion Under Debt Limit Deal - Doug Sword and Alexander Rifaat, Tax Notes ($):

In a document obtained by Tax Notes, the White House said $10 billion will be repurposed in the fiscal 2024 appropriations process and $10 billion in fiscal 2025 will be used “to secure higher resources for non-defense priorities.”

“It might be the case in 5, 6, 7 years there might be a need to ask for more IRS funding,” a White House official said on a background call with reporters.

However, the official contended the cuts will not derail the administration’s plan to overhaul the agency.

Debt ceiling deal: Here is what’s in and what’s out - Jeff Stein and Tobi Raji, Washington Post:

The White House had proposed closing a number of tax loopholes, arguing that any deal to lower the deficit should include increases in federal revenue as well as spending cuts. The GOP ruled those ideas out.

Similarly, House Republicans had fought for repealing some of the clean energy tax credits approved by Democrats last year. The Biden administration objected strongly to that proposal, and they fell out of the final deal.

So:

- Some cuts in IRS funding, mostly unspecified, and most of the money will be spent elsewhere in the federal budget. If the administration is to be believed, it's money that wasn't really needed anyway.

- No changes in the array of tax credits passed in the Inflation Reduction Act.

Will it pass? The Kalshi events market prices passage by June 9 at 85 cents this morning, indicating high, but less than certain, likelihood of passage. Watch today's Rules Committee meeting for the deal's first test.

Debt Ceiling Agreement Lifts Student Loan Pause, Cuts Some IRS Funding - Kelly Phillips Erb, Forbes. "Treasury Secretary Janet Yellen says the U.S. won't have enough money to pay all of its bills unless Congress acts to raise the debt ceiling by June 5—that's next Monday. If that happened, it would trigger the country's first-ever default."

Official Says Info Return Penalty Suits Not Feasible After Farhy - Andrew Velarde, Tax Notes ($):

Jorge Oben of the IRS Office of Associate Chief Counsel (International), who serves as detailee to the House Ways and Means Committee, indicated that requiring the IRS to submit an assistance request to the Justice Department would not work.

“It presents a huge burden on . . . DOJ, and it would be very difficult. When the IRS doesn’t have this specific ability to assess the penalties, there is this general regular course of action at DOJ. But that doesn’t really seem like a feasible option,” said Oben, who spoke May 25 at the Procopio International Tax Conference in San Diego.

The case involves penalties related to international tax disclosures - penalties that start at $10,000.

Uncertainty Clouds Wayfair's Impact On Other State Tax Cases - Maria Koklanaris, Law360 Tax Authority ($). "States as well as businesses have raised Wayfair in cases following the ruling, in which a split decision by the justices upheld South Dakota's sales tax law requiring businesses to collect and remit the tax whether or not they had a physical presence in the state. In some litigation, courts have recognized the case as appropriate precedent. But in others, especially where a state or business has argued Wayfair in a non-sales and use tax matter, courts have been less accepting."

Related: A Sales Tax Reform Game Changer: How Wayfair Changed the Sales Tax Reform Landscape.

Minnesota Conforms to Federal GILTI, Provides Tax Relief for Individuals - Emily Hollingsworth, Tax Notes ($):

H.F. 1938, the estimated $3 billion tax bill for the fiscal 2024–2025 biennial budget, passed the Legislature by narrow margins, with the House approving H.F. 1938 as amended by a conference committee 69 to 63 on May 20, and the Senate passing the bill 34 to 33 the next day. The bill, along with other budget legislation, was signed into law by Gov. Tim Walz (DFL) May 24.

...

First, the bill amends Minn. Stat. section 290.21 to conform with IRC section 951A, which requires GILTI to be included in gross income. That approach is "designed to discourage multinational companies from shifting profits on such easily moved assets as intellectual property rights from the United States to foreign jurisdictions with tax rates below those in the U.S." and will bring in an estimated $437 million, according to a May 17 Minnesota House release outlining the conference committee's agreed-upon language.

The bill also clarifies that the state will continue to decouple from the 50 percent GILTI deduction allowed under IRC section 250.

Neb. Lawmakers OK Tax Breaks For Cash To Scholarship Orgs - Zak Kostro, Law360 Tax Authority ($). "L.B. 753, which passed the state's unicameral Legislature by a 33-11 vote Wednesday, would allow individual and corporate taxpayers that make one or more cash contributions to at least one scholarship-granting organization during a tax year to claim such a credit, according to the bill text. A trust or estate that makes a qualifying contribution could claim a credit of up to $1 million, according to the bill."

This appears similar to Iowa's popular private school tuition organization tax credit.

Common Law Mailbox Rule Rejected by Fourth Circuit - Chandra Wallace, Tax Notes:

The federal statutory mailbox rule in section 7502 — under which tax filings are presumed delivered only when sent by registered or certified mail — entirely replaces the less stringent common law mailbox rule, the Fourth Circuit held.

The decision by a three-judge panel of the Fourth Circuit continues a circuit split on the issue between the Eighth and Tenth circuits, which permit taxpayers to rely on the common law rule, and the Second and Sixth circuits, which don’t.

If you have to worry about whether the common law mailbox rule applies, you have already made trouble for yourself. E-file if you can. If you have to paper-file, use certified mail, save the postmark, and save yourself the headache if if the post office fail to deliver or the IRS loses your filing.

Fourth Circuit Holds Common Law Mailbox Rule Does Not Apply to Prove Delivery, But Taxpayer is Allowed to Attempt to Prove Actual Delivery - Ed Zollars, Current Federal Tax Developments. "For taxpayers seeking both documentation of the postmark date and the presumption of actual delivery, IRC §7502(c) provides a viable solution. The statute outlines one option explicitly (registered mail) and presents two additional options that the IRS has the authority to implement through regulations (certified mail and the use of electronic filing). The IRS has issued comprehensive regulations outlining the specific requirements and procedures to qualify for the protection afforded by each of these methods."

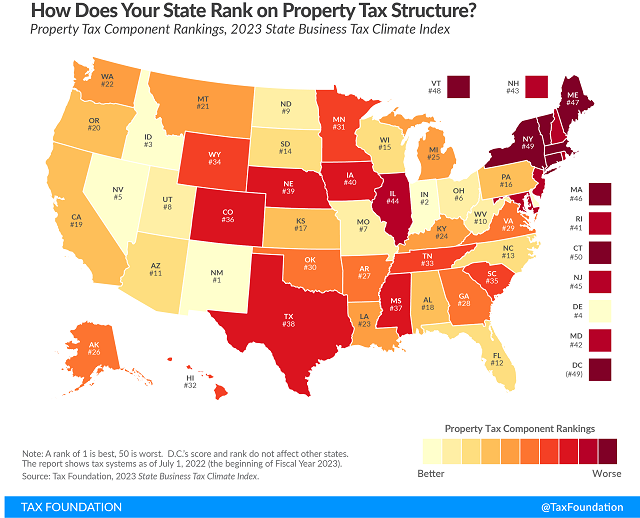

Ranking Property Taxes on the 2023 State Business Tax Climate Index - Janelle Fritts, Tax Policy Blog. "Although taxes on real property tend to be unpopular with the public, a well-structured real property tax generally conforms to the benefit principle (the idea in public finance that taxes paid should relate to benefits received) and is more transparent than most other taxes."

Business owners should look carefully at ERC promotions - Kay Bell, Don't Mess With Taxes. "ERC scammers are employing the usual trick of taking a real tax law and perverting it. The crooks have been aggressively promoting their ERC schemes through broadcast advertising, direct mail solicitations, and online offers."

IRS Provides Initial Guidance on Domestic Content Bonus Credit - Parker Tax Pro Library. "The notice describes rules that the IRS intends to include in the forthcoming proposed regulations regarding the domestic content bonus credit requirements and related recordkeeping and certification requirements; the notice also describes a safe harbor regarding the classification of certain components in representative types of qualified facilities, energy projects, or energy storage technologies. Notice 2023-38."

Under prior law, the exemption was $5 million per individual. After being adjusted for inflation, the anticipated exemption amount may be between $6.5 and $7 million beginning on January 1, 2026. With the upcoming change, now is the time to revisit estate plans. Individuals and families are strongly encouraged to seek the advice of tax professionals to ensure estate plans still align with desired goals while maintaining the flexibility that is key in a potentially changing exemption environment.

Colorado: Let’s Implement a 1207800% Marginal Tax Rate! - Russ Fox, Taxable Talk. "I could have made this illustration even more ridiculous. It truly is a hard cliff: If Joe had $300,000 of wins and losses he would have refunds of $3,238 from the IRS and $490 from Colorado; if Larry had $300,001 of wins and losses he would have the same federal refund of $3,238 but would owe Colorado $11,588. That’s an insane marginal tax rate of 1,207,800% on the additional dollar of income!"

Lesson From The Tax Court: Substantiating Gambling Losses On Per-Casino Basis - Bryan Camp, TaxProf Blog. "The old saying 'you win some, you lose some' is not true for most recreational gamblers. For them, the saying is more like 'you win some, you lose more.' But proving that proves a problem."

Intangibles in the Outback - Alex Parker, Things of Caesar. "The provision perhaps bears a slight resemblance to anti-avoidance rules used in Europe, that target deductions for outbound related-party payments. But it goes much further than any other rule I’m aware of, essentially trying to impose a 15% minimum tax on any royalty income in the world that has a connection to Australia."

Belgium Fights Back! No FATCA Info to IRS – Deep Dive the Belgian Decision - Virginia La Torre Jeker, US Tax Talk. "On May 23, a decision (Decision) by the Belgian Data Protection Authority (BDPA) now prohibits the Belgian tax authorities (the defendant in this case) from transferring to the Internal Revenue Service (IRS) the personal data of Belgian 'Accidental Americans' (and likely other US persons with accounts in Belgium) pursuant to the ”FATCA” Intergovernmental Agreement between the USA and Belgium (IGA). According to the BDPA Decision, the data processing carried out under the IGA does not comply with the principles of the General Data Protection Regulation (GDPR) adopted within the European Union."

As aggressive marketing continues, the Internal Revenue Service today renewed an alert for businesses to watch out for tell-tale signs of misleading claims involving the Employee Retention Credit.

The IRS and tax professionals continue to see a barrage of aggressive broadcast advertising, direct mail solicitations and online promotions involving the Employee Retention Credit. While the credit is real, aggressive promoters are wildly misrepresenting and exaggerating who can qualify for the credits.

The IRS has stepped up audit and criminal investigation work involving these claims. Businesses, tax-exempt organizations and others considering applying for this credit need to carefully review the official requirements for this limited program before applying. Those who improperly claim the credit face follow-up action from the IRS.

Related: How to Account for the Employee Retention Credit.

Hollywood man arrested on indictment alleging he fraudulently sought over $65 million in COVID-19 employment tax credits - IRS (Defendant name removed):

Defendant, who is charged in a federal grand jury indictment with 17 counts of making false claims to the IRS, was arrested Thursday morning by special agents with IRS Criminal Investigation.

In response to the COVID-19 pandemic and its economic impact, Congress authorized an employee retention tax credit that a small business could use to reduce the employment tax it owed to the IRS, also known as the "employee retention credit."

To qualify, the business had to have been in operation in 2020 and to have experienced at least a partial suspension of its operations because of a government order related to COVID-19 (for example, an order limiting commerce, group meetings or travel) or a significant decline in profits. The credit was an amount equal to a set percentage of the wages that the business paid to its employees during the relevant time period, subject to a maximum amount.

...

According to the indictment that was returned on May 11 and unsealed today, from November 2020 to April 2022, Defendant made false claims to the IRS for the payment of nearly $65.4 million in tax refunds for a purported Beverly Hills-based farming-and-transportation company named Elijah USA Farm Holdings.

The IRS issued a portion of the refunds Defendant claimed, and Defendant allegedly used that portion – more than $2.7 million – for personal expenses.

It's hard to make it big in Hollywood. Especially in farming.

But not for claiming ERC. It's National Creativity Day!

Make a habit of sustained success.