Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

A 94-Year Old Grandmother Fights Back After Government Sold Her Home—And Kept The Profit - Kelly Phillips Erb, Forbes. "Geraldine Tyler’s case, now before the Supreme Court, could change tax seizure practices in more than a dozen states. It would be a big win for elderly and poor homeowners."

Steady Pursuit of More Corporate Tax Cuts Ripples Across States - Donna Borak, Bloomberg:

States still reaping big budget surpluses from a variety of sources—rising corporate profits, robust sales taxes, and unspent federal pandemic aid—have continued to use this leeway for more tax cuts. Six states started this year with lowered corporate income tax rates, including gradual plans rolling out in Iowa, Pennsylvania, and Nebraska. Idaho and New Hampshire also have freshly minted lower rates. Meanwhile, Arkansas quickly enacted its second rate cut for the year, led by new Gov. Sarah Huckabee Sanders (R).

It isn’t just traditionally low-tax-friendly Republicans sticking to the recent tax-cutting bonanza. The spirit is bipartisan. Newly elected Pennsylvania Gov. Josh Shapiro (D) pressed lawmakers in his budget address to “speed up” corporate tax rate cuts passed last year.

Businesses Seek Shelter From State Taxes on ‘Nowhere Income’ - Michael Bologna, Bloomberg ($):

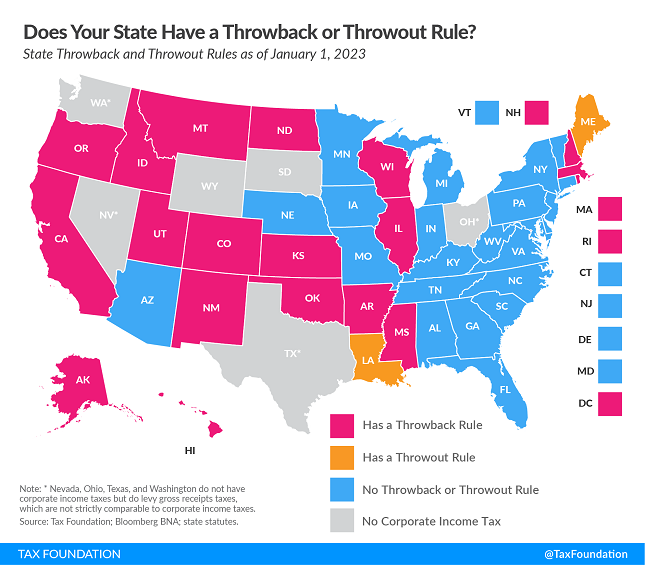

A growing number of states are examining corporate income tax changes waiving levies on so-called “nowhere income”—profit thrown back onto a state’s tax rolls because it isn’t taxed in other jurisdictions.

Oklahoma and Oregon are both considering bills repealing their “throwback rules,” a common feature of state corporate income tax codes that permits a company’s home state to tax profits that aren’t taxed in another state. Arkansas plans to phase out its throwback rule by 2030 under a bill (HB 1045) recently signed by Gov. Sarah Huckabee Sanders (R). Three other states repealed their throwback rules in the last three years.

Related: Does Your State Have a Throwback or Throwout Rule? "When companies sell into a state where they do not have nexus, that destination state lacks jurisdiction to tax the company’s income. This results in what is known as “nowhere income”—income that cannot legally be taxed by the state where the income-producing sale occurs."

State-By-State Roundup

Alabama

New bill to cut sales tax on groceries filed; every senator a co-sponsor - Mary Sell, Alabama Daily News. "Senate Bill 257, filed Thursday by Sen. Andrew Jones, R-Centre, could reduce the tax rate by .5% this fall and every fall until the rate reaches 2%."

Alaska

Alaska's Governor Proposes Statewide Sales Tax - Paul Jones, Tax Notes ($). "Alaska has neither an income tax nor a statewide sales tax, although many localities levy their own sales taxes. But the state — dependent on volatile oil industry tax revenue — is once again confronting a budget shortfall, a problem that has plagued it for years, and the situation has fed into long-standing calls by lawmakers and policymakers to explore reforms to the revenue base."

State sales or income tax? As Alaska lawmakers consider proposals, economists weigh in - Lex Treinen, Alaska Public Media. "For the first time in recent history, Alaska legislators in both parties and the governor are talking about implementing a broad-based tax. New taxes aren’t likely to pass this session, but Alaskans could start paying statewide sales or an income tax in the next few years."

California

California Senate Democrats Propose Corporate Income Tax Increase - Paul Jones, Tax Notes ($):

California’s Senate Democratic majority released its fiscal 2024 budget plan April 26, including a proposal to hike taxes on larger corporations and a new process to defer net operating losses.

But the plan is opposed by Gov. Gavin Newsom (D). “Governor Newsom cannot support the new tax increases and massive ongoing spending proposed by the Senate today,” Anthony York, the governor's senior communications adviser, said in an April 26 statement to Tax Notes. “It would be irresponsible to jeopardize the progress we’ve all made together over the last decade to protect the most vulnerable while putting our state on sound fiscal footing.”

Colorado

Colo. House OKs Tax Break For Post-Wildfire Home Rebuilds - Michael Nunes, Law360 Tax Authorty ($). "The House passed H.B. 1240 by a 44-16 vote Friday. The exemption, according to the bill, would be available for residential structures damaged or destroyed in declared wildfire disasters between 2020 and 2022. Building materials purchased from Jan. 1, 2020, to July 1, 2025, would be eligible. The legislation next goes to the state Senate."

Delaware

Del. To Impose 15% Tax On Recreational Marijuana - Jared Serre, Law360 Tax Authority ($). "H.B. 2, which Democratic Gov. John Carney said Friday would go into effect without his signature, will regulate the retail commerce of recreational marijuana, which will be decriminalized by H.B. 1 — also being enacted without the governor's signature. As part of H.B. 2, a 15% tax — referred to as a marijuana control enforcement tax — will be assessed on the sales of recreational marijuana products."

Florida

Fla. House OKs Biz Rent Tax Cut, Sales Tax Exemptions - Michael Nunes, Law360 Tax Authority ($). "H.B. 7063 passed the House 114-0 and next goes to the state Senate. The bill would lower the state's business rent tax rate to 4.5%, from 5.5% for 13 months. It would also exempt baby products, such as strollers, monitors and playpens; natural gas production machinery and equipment; agricultural fencing; and small private investigative agency services from the state's 6% sales tax."

Disney sues Florida Gov. Ron DeSantis, alleges political effort to hurt its business - Kevin Breuninger, CNBC. "The fight began last year, when Disney came out against a Florida bill limiting classroom discussion of sexual orientation or gender identity, dubbed “Don’t Say Gay” by critics. Soon after, the governor and his allies targeted the special tax district that has allowed Disney to essentially self-govern its Florida operations since the 1960s."

Iowa

Iowa Senate Sends Pass-through Entity Tax To Governor

The Iowa Senate this week approved a SALT-workaround pass-through entity tax. The 46-3 vote for the bill sends HF 352 to the Governor, who is expected to sign.

The optional tax would apply the top individual tax rate on entity income apportioned to Iowa for electing taxpayers. Entity owners would get a refundable credit on their tax returns for their share of the entity tax. The tax is effective for 2022, which will require partnerships and S corporations that have already filed to amend returns to take advantage of it.

Some key aspects of the new tax:

- The election to pay the entity tax is irrevocable for the year and made by the entity. This means there is no opt-out for nonresident owners who might be adversely affected because of their own state's tax rules.

- The election is made annually "on a form and at a time prescribed" by the Iowa Department of Revenue. It remains to be seen whether the Department will require an advance election or whether it can be made when the tax return is due.

- Entities electing the pass-through tax will not be subject to Iowa's composite tax on pass-through income.

- Entities will be required to pay estimated tax for post-2023 tax years.

- There is no qualification requirement based on ownership. Some states limit the entities with only individual entities.

- Only the franchise credit and the PTET credit will apply. Any other credits will apparently pass-through to owners.

- There is no add-back to Iowa taxable income for the entity. The tax will also reduce Iowa taxable income.

Deduction timing issues arise both for cash-basis and accrual-basis taxpayers. Even though the tax will be retroactive to 2022, federal tax accounting rules will defer any benefit to at least 2023.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround

Kansas

Kansas Legislature Fails To Override Flat Tax Veto - Jaqueline McCool, Law360 Tax Authority ($). "The veto was sustained by a 26-14 vote in the state Senate, putting an end to S.B. 169, which would have created a flat income tax rate of 5.15%. Kansas levies a 3.1% tax on income up to $15,000, a 5.25% tax on income over $15,000 and up to $30,000, and a 5.7% tax on income over $30,000. Democratic Gov. Laura Kelly vetoed the bill Monday."

Massachusetts

Massachusetts DOR Publishes Draft Changes to Marketplace Seller Rule - Emily Hollingsworth, Tax Notes. "Draft amendments to a Massachusetts sales and use tax regulation would address advance payment rules and exempt facilitators of cannabis sales from the state's marketplace facilitator requirements."

Minnesota

Minn. House OKs Recreational Cannabis Regulation, Tax - Sanjay Talwani, Law360 Tax Authority ($):

The House approved H.F. 100, sponsored by Sen. Zack Stephenson, D-Coon Rapids, by a 71-59 vote, with amendments. If enacted, possession of up to 2 ounces of marijuana would be legal in August, with licensed retailers to follow at an unannounced date. The

...

The bill goes next to the state Senate, and both Democrats and Republicans predicted differences in two proposed measures would be settled in a House-Senate conference committee. The Senate companion bill, S.F. 73, would set the tax rate at 10%.

Mississippi

Miss. Exempts Coins, Currency And Bullion From Sales Tax - Michael Nunes, Law360 Tax Authority ($):

Republican Gov. Tate Reeves signed S.B. 2862 on Wednesday. Starting July 1, sales of bullion made from gold, silver, platinum or palladium, and coins or currency made from gold, silver, other metals or paper will be exempt from sales tax.

The items, according to the law, must be sold based on their intrinsic value as a precious metal or collectible rather than their value as a medium of exchange. Exempt coins do not include coins that are made into jewelry.

Montana

Mont. Lawmakers OK Optional Tax On Pass-Through Entities - Sanjay Talwani, Law360 Tax Authority. "By a 96-2 vote Thursday, the House passed S.B. 554, sponsored by Sen. Greg Hertz, R-Polson. If enacted, The bill would allow pass-through entities to pay state income tax at the entity level, with owners allowed refundable tax credits for their shares of the taxes paid."

The proposal is set to take effect for 2023.

New York

As New York Boosts Tax Breaks for Movies, Some Critics Pan the Program - Dana Rubinstein and Nicholas Fandos, New York Times

Four years ago, Amazon pulled the plug on its plans to build a headquarters in New York City, amid left-wing outrage over a $3 billion public subsidy package. But New York has hardly cut the company off: Amazon’s film and TV arm has received more than $108 million in state tax credits since then, and the left has raised nary a peep.

...

The proposed expansion to $700 million a year from $420 million has drawn stern rebukes from a range of critics who argue the decades-old program has consistently been a bad deal for taxpayers. But its likely success shows what is possible when powerful political and economic forces align in Albany, and states are increasingly pitted against each other for prestige jobs.

Iowa's version of this program worked out poorly.

North Dakota

North Dakota Governor Approves $515 Million Tax Relief Bill - Michael Bologna, Bloomberg ($).

Burgum signed HB1158, which flattens and reduces the personal income tax and provides a one-time property tax credit to homeowners on their primary residences....

-

The new law collapses North Dakota’s five-bracket personal income tax into a three-bracket structure.

-

Income for joint filers earning less than $74,750 won’t be taxed. A new 1.95% rate will be applied to income between $74,750 and $275,100 for joint filers. A new top rate of 2.5% will apply to income beyond $275,100. North Dakota’s top rate is currently 2.9%.

-

The property tax component grants a tax credit of up to $500 on homeowners’ primary residence. Additional relief targeted to senior citizens will be available under expanded eligibility for the state’s Homestead Property Tax Credit program.

Tennessee

Tennessee Legislature Passes Business Tax Cuts, Single Factor - Matthew Pertz, Tax Notes ($).

Tennessee Gov. Bill Lee (R) is hailing the passage of his 2023 legislative agenda, which includes switching the state to single-sales-factor apportionment and cutting taxes.

H.B. 323 would phase in single-sales-factor apportionment for franchise tax over three years and create a franchise tax credit for businesses that provide paid family and medical leave. It would also establish a $50,000 standard deduction against the excise tax and a $500,000 property exemption against the franchise tax after December 31, 2024.

Washington

Washington State Legislature Adjourns Without Approving New Taxes - Paul Jones, Tax Notes ($). "Despite negotiations over potential tax increases — mainly with an eye toward funding growth of the state's affordable housing — lawmakers announced that they had moved forward with a $69.3 billion two-year budget that relies on existing revenue."

In other news

Are you sure you won't just take a check? Not in ancient Mesopotamia. "A free man, head of his household, owed the government many months of labor service. If he were lucky, his service might entail harvesting the government's barley fields or digging the silt out of canals. If he were unlucky, he had to do military service, leaving the security of home to fight wars abroad, perhaps never to return."

Make a habit of sustained success.