Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

Recent legislative actions mean lower taxes for retirees in several states - Council of State Governments:

In 2022, Iowa lawmakers approved a sweeping measure (HF 2317) that excludes income from pensions, retirement benefit plans, annuities and IRAs. Nebraska, meanwhile, is ending its taxation of Social Security benefits by 2025 as the result of last year’s passage of LB 873. A proposal to accelerate elimination of the tax also was introduced this year (LB 641).

According to AARP, most Midwestern states already don’t tax Social Security benefits; Nebraska has been one of three exceptions, along with Kansas and Minnesota, where the benefits of some higher-income residents are subject to the state income tax. Along with the recent change in Nebraska, proposals to end all taxation of Social Security benefits have been under consideration this year in Kansas and Minnesota.

SALT Caucus, With New Support, Tries Again to Restore Deduction - Cady Stanton, Tax Notes ($):

The Securing Access to Lower Taxes by ensuring Deductibility Act, or SALT Deductibility Act, introduced by Rep. Andrew R. Garbarino, R-N.Y., has 45 cosponsors in the House, largely lawmakers from New Jersey, California, and New York — high-tax Democratic-leaning states hit harder by the cap.

...

Sen. Susan M. Collins, R-Maine, introduced the first SALT bill in the Senate for the 118th Congress — the SALT Deduction Fairness Act — March 17. But unlike the full repeal in Garbarino’s bill, Collins’s legislation would only double the limitation to $20,000 for joint filers. That would ensure against "a situation where married couples would have been better off financially were they not married," Collins said in a release.

More coverage in the April 14 Eide Bailly Tax News & Views.

State-by-state roundup

Alabama

Ala. House OKs Cuts To Highest, Lowest Income Tax Rates - Michael Nunes, Law360 Tax Authority ($). "The House passed H.B. 115 and H.B. 116 by a vote of 105-0 on Thursday, and they next go to the Senate. H.B. 115 would lower the 5% tax rate on income of more than $3,000 by 0.01 percentage points a year starting in 2024. The rate reduction would end in 2028, when the tax would be 4.95%."

Arizona

Ariz. Blockchain Tax Ban Vetoed By Gov. - Sanjay Talwani, Law360 Tax Authority ($). "Hobbs vetoed S.B. 1236, sponsored by Sen. Wendy Rogers, R-Flagstaff, on Wednesday. If enacted, the bill would have barred cities and towns from levying taxes and fees on the use of blockchain nodes and technology for producing virtual currency."

Ariz. Lawmakers OK Accelerated Small-Biz Tax Cut - Jared Serre, Law360 Tax Authority ($). "Under S.B. 1260, which the state House of Representatives passed 36-21 on Tuesday, Arizona's 3% small-business tax rate would drop to 2.5% starting in the 2023 tax year, two years before previously scheduled."

Arkansas

Ark. Cuts Top Tax Rates, Will Phase Out Throwback Rule - Jared Serre, Law360 Tax Authority ($):

The lower rates take effect for 2023.S.B. 549, signed by Sanders on Monday, will cut the top individual rate to 4.7% and the top corporate rate to 5.1% — both reductions of 0.2 percentage points. The bill passed the state House of Representatives by an 85-12 vote Wednesday.

H.B. 1045, also signed Monday, will phase out the throwback rule — which dictates that taxpayers would not source to Arkansas any sales for delivery outside the state if the business were taxable in the purchaser's state, according to a legislative impact statement — by 2030. Bo

California

After 'Mansion Tax' Begins, LA Real Estate Quivers - Chuck Slothower, Law360 Tax Authority ($). "While it was sold as a "mansion tax," the transfer tax applies to any property valued at more than $5 million, including commercial property, multifamily and land."

California Restaurant's Sales Via Grubhub Are Taxable, OTA Says - Christopher Jardine, Tax Notes ($). "In Matter of YNL Enterprises Inc., the OTA upheld a decision by the California Department of Tax and Fee Administration (CDTFA) denying the company's appeal of a notice of determination and its refund claim, disagreeing with the company's assertion that sales through online food ordering companies are nontaxable online sales for resale. The opinion is dated February 9 but was released the week of April 3."

Colorado

Colo. Senate OKs Extending Home Accessibility Retrofit Credit - Sanjay Talwani, Law360 Tax Authority ($). "By a 34-1 vote, the Senate passed S.B. 196, sponsored by Sen. Faith Winter, D-Westminster, and Rep. Mary Young, D-Greeley. If enacted, the bill would extend the credit for qualifying residential retrofits, currently set to sunset after this year, through tax year 2028."

Hawaii

Hawaii Lawmakers Advance Tax Cuts, SALT Cap Workaround - Paul Jones, Tax Notes ($:

Currently, the income thresholds for the state's tax brackets are fixed in statute. For example, single filers’ income up to $2,400 is taxed at 1.4 percent; over $2,400 and up to $4,800 is taxed at 3.2 percent; over $4,800 and up to $9,600 is taxed at 5.5 percent; and so on up to the top tax rate of 11 percent, which applies to income over $200,000. Under H.B. 954, the $2,400 threshold would increase to $2,563; the $4,800 threshold would rise to $5,126; the $9,600 threshold would become $10,253; and so forth, with the 11 percent rate applying to income over $213,600. Thresholds for other filers would be similarly adjusted, and all thresholds for all rates would then be adjusted for inflation in future years.

...

The Senate also advanced Hawaii’s version of a passthrough entity SALT cap workaround. S.B. 1437 would allow owners of partnerships and S corporations to elect to be taxed at the entity level on their pre-distribution income, applying to that income the tax rate equal to the state's highest individual income tax rate.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround

Idaho

Idaho Property Tax Relief Bill Becomes Law Despite Veto - Emily Hollingsworth, Tax Notes ($). "H. 292, which earmarks general fund surplus and sales tax revenue to offset local property taxes and school levies, became law in spite of Republican Gov. Brad Little’s March 27 veto. The House voted 58 to 12 to override the veto on March 28, and the Senate voted 28 to 7 the next day. The Legislature adjourned sine die on April 6."

Indiana

Indiana House Advances Bill Proposing Various Tax Changes - Emily Hollingsworth, Tax Notes ($):

The income tax measures under S.B. 419 would clarify and change to how NOLs are calculated; provide deductions for qualifying R&E expenditures, both for corporations that receive federal, state, or local grants to expand broadband access, and for taxpayers in healthcare cost-sharing ministries; and allow credits for the rehabilitation of historic sites.

Further, the bill would provide a credit for employers that hire people with disabilities, which would be equal to 30 percent of the employee’s wages for the first year, 40 percent the second year, and 50 percent the third and subsequent years for companies with 50 or fewer employees. Credit amounts would be reduced for businesses with more than 50 employees.

The bill cleared the Indiana Senate 49-0 in February.

Minnesota

Minnesota House Advances Bill to Create New Top Income Tax Bracket - Emily Hollingsworth, Tax Notes ($):

Under H.F. 442, a new tax rate of 10.85 percent would be levied on incomes over $600,000 for single filers; over $800,000 for heads of household; and over $1 million for joint filers. The bill would also raise the income thresholds for the existing income tax brackets for all filers. It was laid over for inclusion in the state’s omnibus tax bill by House Taxes Committee Chair Aisha Gomez (DFL) following an April 11 committee meeting.

...

Beth Kadoun, vice president for tax and fiscal policy of the Minnesota Chamber of Commerce, opposed the bill, which she said would make Minnesota’s top tax rate the fourth highest in the nation, behind only New York (10.9 percent), Hawaii (11 percent), and California (13.3 percent). “This will make Minnesota a tax outlier and negatively impact our state’s businesses and our economic growth,” she said during the committee meeting.

The 2023 top individual income tax rates of states neighboring Nebraska: Wisconsin, 7.65%; Iowa, 6%; North Dakota, 2.9%; South Dakota, 0%

New Mexico

New Mexico Governor Vetoes Most of Omnibus Tax Bill - Paul Jones, Tax Notes ($). "The vetoed provisions include changes to the state income tax brackets and rates to reduce taxation on lower levels of income — for example, a single filer’s income up to $5,500 would have been taxed at 1.5 percent instead of 1.7 percent, and the 3.2 percent rate would have applied to income between $5,500 and $16,500 instead of between $5,500 and $11,000. The package also sought to index the income threshold limiting eligibility for the low-income comprehensive tax rebate and increase the rebate. It also would have provided an indefinite extension of the armed forces retirement pay exemption (currently set to expire in 2026), allowed the exemption to apply to surviving spouses of veterans, and indexed the income threshold limiting who can claim the Social Security tax exemption."

Link: veto message.

New Mexico Governor Approves Changes to SALT Cap Workaround - Paul Jones, Tax Notes ($). "New Mexico approved its SALT cap workaround in 2022, and to ensure that owners of an electing passthrough aren’t taxed twice by the state on their income, it provided an exemption on their passthrough income. But Mark Chaiken, tax policy director of the New Mexico Taxation and Revenue Department, told Tax Notes April 5 that exempting that income created unanticipated problems, leading most states to move to a credit model under which owners receive a tax credit for their pro rata share of the tax paid at the entity level. Lawmakers this session approved H.B. 368 to adopt that approach."

North Dakota

ND Creates Tax Break For Some Feedstock Refinery Materials - Jared Serre, Law360 Tax Authority ($):

North Dakota will exempt the cost of materials used in construction projects of renewable feedstock refineries from sales and use taxes under a bill signed by the governor.

Under H.B. 1430, which was signed into law by Republican Gov. Doug Burgum on Tuesday, owners of such refineries must receive a certificate from the tax commissioner, and then present that certificate at the time of purchase, in order to receive the exemption.

Washington

Washington Appeals Court: No Deduction for Investment Fund Income - Andrea Muse, Tax Notes ($). "Sixteen investment fund limited liability companies are not entitled to a business and occupation (B&O) tax deduction for investment income because the deduction applies only to amounts from investments that are incidental to the main purpose of the business, a Washington appellate court held."

Link: Opinion NO. 573112-I-II

Washington State, Local Leaders Propose Excise Taxes After Capital Gains Ruling - Paul Jones, Tax Notes. "Even if the bill doesn’t pass, it could be followed by similar efforts. Jason Mercier with the conservative Washington Policy Center, who predicted state legislators and local leaders might seek to enact progressive excises that work like income taxes in response to the court’s ruling, wrote in an April 3 blog post that he 'thought we’d have more time before lawmakers took advantage of the court’s decision.' He said the bill may be 'the first of many excise taxes on income introduced in Washington.'"

Tax Policy Corner

Missouri's Big Idea And NY's Online Thought: SALT In Review - David Brunori, Law360 Tax Authority ($):

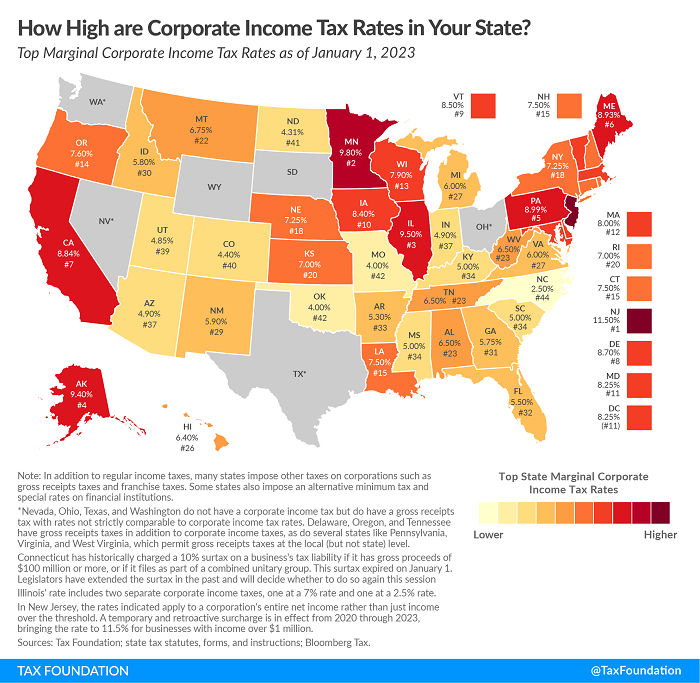

As I have said many times, the state corporate income tax does not work well; it never will. It never raised much revenue; it never will. It imposes burdensome compliance and administrative costs; it always will. Contrary to what my liberal friends believe, the burden of the tax falls largely on workers and consumers. The tax does not make the world more equitable or fair or just. It does enrich tax lawyers, accountants and economic development professionals.

Getting rid of the tax, or reducing the rate to zero, will benefit Missouri. Neighboring Nebraska, Iowa, Illinois and Kansas have stiflingly high corporate tax rates. Combined with the personal income tax reductions, Missouri will become the most competitive state in the Midwest.

(Image source: State Corporate Income Tax Rates and Brackets for 2023, Janelle Fritts, Tax Policy Blog).

In other news:

For those of you engaged in long-term retirement planning, keep in mind that once you reach 100 years of age, you become exempt from New Mexico's state income tax. But don't put off your move too long - there is a six-month residency requirement.

There is no similar exemption from Federal income tax.

Make a habit of sustained success.