Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

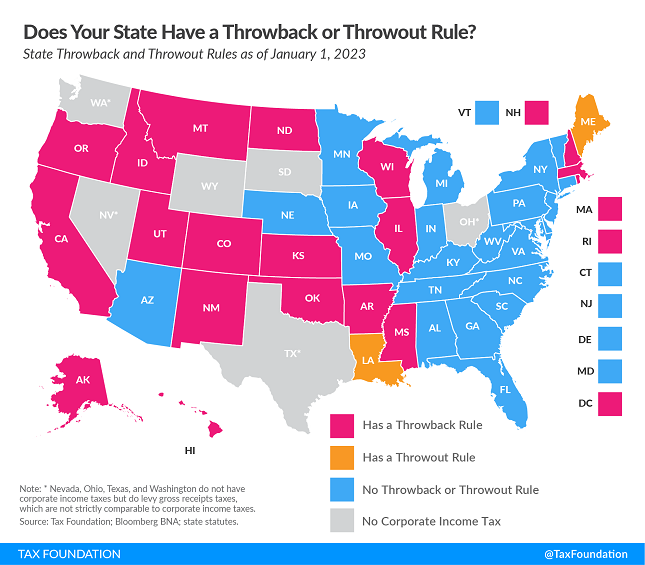

Does Your State Have a Throwback or Throwout Rule? - Janelle Fritts, Tax Policy Blog:

When companies sell into a state where they do not have nexus, that destination state lacks jurisdiction to tax the company’s income. This results in what is known as “nowhere income”—income that cannot legally be taxed by the state where the income-producing sale occurs.

Under throwback rules, sales of tangible property that are not taxable in the destination state are “thrown back” into the state where the sale originated, even though that’s not where the income was earned. This means that if a company located in State A sells into State B, where the company lacks economic nexus, State A can require the company to “throw back” this income into its sales factor.

Not precisely "state and local," but...

Owners of Canadian vacation property face May 1 tax deadline - Eide Bailly Tax News & Views. "Canada has a new 1% annual Underused Housing Tax on the ownership of vacant or underused housing in Canada."

State-by-state Roundup

Alabama

Alabama Tax Tribunal Says Out-of-State Workers Owe Income Taxes - Janelle Fritts, Tax Policy Blog. "The tax tribunal’s decision essentially creates a more aggressive “convenience of the employer” rule in Alabama, which stipulates that an individual’s income is subject to tax if their office is located in the state, even if they both lived, and performed the work, elsewhere. Only five states levy convenience rules—Delaware, Nebraska, New York, and Pennsylvania, plus Connecticut, which only applies the rule retaliatorily against other states with similar rules—so Alabama joins a very short and unenviable list, without the legislature ever taking a vote."

Arkansas

Ark. Lawmakers OK Cuts To Top Individual, Corp. Tax Rates - Zak Kostro, Law360 Tax Authority. "S.B. 549, which passed the state's House of Representatives by an 85-12 vote Wednesday after clearing the Senate by a 30-0 vote Monday, would cut the top individual rate from 4.9% to 4.7% and the top corporate rate from 5.3% to 5.1%, according to the bill text and a legislative impact statement."

California

Calif. Couple Owes More Tax On Stock Sale, Panel Says - Maria Koklanaris, Law360 Tax Authority ($):

In the opinion, published Monday, the OTA said the tax board was correct to calculate the stock basis the husband received from the stock sale as zero, and also to limit the exclusion the couple took for a qualified small business stock gain to $5 million. Each of those calculations, plus adding in applicable gains from the special dividends, boosted the couple's taxable gain to about $24 million, the FTB said in assessing the additional tax. The OTA agreed.

By contrast, the couple had reported about $29 million in taxable gains, but then reduced that to about $14.5 million by applying an exclusion of 50% for their qualified small business stock gain. The FTB said that was not allowable and assessed the additional tax.

Indiana

Indiana DOR Issues Guidance on New Passthrough Entity Tax Law - Emily Hollingsworth, Tax Notes ($):

Passthroughs must annually elect to pay the 3.23 percent tax (or 3.15 percent if the entity’s tax year ends in 2023), using Form IN-PTET or the entity’s tax return. For tax year 2022, passthroughs must make the election before August 31, 2024, or can amend their returns to make the election if they have already filed before the April 18 tax return deadline. For tax years beginning on or after January 1, 2023, the election can be made any time during the tax year, according to the instructions.

Payment for tax year 2022 is due April 18, but penalties and interest will not be imposed if the payment is made before August 31, 2024, the instructions say. Entities electing to pay the tax for years ending on or before June 30, 2023, aren't required to make estimated tax payments. However, for tax years ending after June 30, 2023, and on or before December 31, 2024, they will be required to make a single estimated tax payment by the end of the tax year.

Kansas

Kansas House Passes Bill to Clarify SALT Cap Workaround - Emily Hollingsworth, Tax Notes ($):

The SALT Parity Act allows passthrough entities to elect to pay a 5.7 percent tax at the entity level and take a credit against the tax on their individual income tax returns, enabling the passthroughs to avoid the $10,000 state and local tax deduction cap imposed by the federal Tax Cuts and Jobs Act.

However, vague language on provisions of the act created questions as returns were being prepared for the 2023 tax filing season, according to March 14 guidance from the Department of Revenue. Specifically, K.S.A. 79-32,287(a)’s description of income attributable to Kansas is “unclear and can be interpreted in more than one way,” the DOR said.

The bill passed 124-0.

Kentucky

Kentucky Adopts and Enacts Changes to SALT Cap Workaround Law (PTET) - Becca Stadtner, Eide Bailly. "On March 24, 2023, Kentucky adopted a pass-through entity tax under House Bill 360 thereby allowing a pass-through entity level tax effective tax years beginning on or after January 1, 2022. On March 30, 2023, Kentucky enacted changes under House Bill 5, providing that authorized owners may elect to pay personal income tax on behalf of a pass-through entity among other changes."

Kentucky Enacts Barrel Tax Phaseout, Corrects SALT Cap Workaround - Matthew Pertz, Tax Notes ($):

Kentucky Gov. Andy Beshear (D) has signed a bill phasing out the bourbon barrel tax over 18 years.

...

The bill also makes corrections to Kentucky’s passthrough entity (PTE) tax enacted under H.B. 360 as a workaround to the federal cap on the state and local tax deduction. As enacted, the credit is worth 100 percent of the tax paid by a PTE on behalf of its owners. H.B. 5 clarifies that the election must be made annually and that the credit is refundable.

Mississippi

Mississippi Enacts Changes to SALT Cap Workaround Law (PTET) - Jennifer Barajas, Eide Bailly. "Governor Tate Reeves signed H.B. 1668 into law March 27 after the bill overwhelmingly passed both chambers of the Legislature. The cleanup bill, which retroactively takes effect on January 1, 2023, corrects unintended issues with the PTE tax election under 2022's H.B. 1691."

New Mexico

NM Will Change Pass-Through Entity Exemption To Tax Credit - Jaqueline McCool, Law360 Tax Authority ($). "H.B. 368, signed Wednesday by Democratic Gov. Michelle Lujan Grisham, will allow owners of pass-through entities paying tax at the entity level to claim a credit for the owner's share of the tax. The credit will be refundable, according to the bill. Additionally, the law will bind all owners of a pass-through electing to pay at the entity level, according to the bill's fiscal note."

New Mexico Governor Signs Tax Cleanup Bill - Paul Jones, Tax Notes ($). "Under S.B. 147, the state will transition from origin-based sourcing to destination-based sourcing for the cannabis excise tax as of July 1, 2023. The change will end the burdensome requirement for “cannabis retailers that deliver their product to report the tax to the retail location for cannabis excise tax purposes, but the delivery location for GRT [gross receipts tax] purposes,” according to a legislative staff summary of the bill."

New York

Analysis: A Surprise Accusation Bolsters a Risky Case Against Trump - Charlie Savage, New York Times:

“Pundits have been speculating that Trump would be charged with lying about the hush money payments to illegally affect an election, and that theory rests on controversial legal issues and could be hard to prove,” said Rebecca Roiphe, a New York Law School professor and former state prosecutor.

“It turns out the indictment also includes a claim that Trump falsified records to commit a state tax crime,” she continued. “That’s a much simpler charge that avoids the potential pitfalls.”

New York Tax Tribunal Affirms Empire Zone Tax Credit Reduction - Audrey Fick, Tax Notes ($). A New York tax tribunal upheld an administrative ruling that a qualified Empire Zone enterprise (QEZE) should include only taxes attributable to its in-state income when calculating the tax reduction credit.

Link: Decison.

North Carolina

NC Updates Fed. Code References, Makes Other Tax Changes - Zak Kostro, Law360 Tax Authority ($):

S.B. 174, which Democratic Gov. Roy Cooper signed Monday, updates references to the Internal Revenue Code when defining and determining certain state tax provisions from April 1, 2021, to Jan. 1, 2023, according to a summary of the changes enacted by the legislation.

The bill also clarifies that the statutory method of dividing income between states for multistate partnerships and S corporations also applies to sole proprietorships and that certain individual income tax credits paid to other states aren't refundable, according to the summary.

North Carolina House GOP Budget Priorities Include More Tax Cuts - Matthew Pertz, Tax Notes ($):

Among other provisions, the proposed budget would speed up the scheduled rate cuts to the state's 4.75 percent flat income tax. The rate is scheduled to be reduced to 4.6 percent in 2024 and to 4.5 percent in 2025, but the House budget would reduce the rate to 4.5 percent in 2024.

...

Democratic Gov. Roy Cooper's fiscal 2023–2025 budget, released March 15, takes a different approach: He proposes to split the state’s flat tax into two brackets, one for residents making under $100,000 (or $200,000 jointly) that would be reduced annually until 2027 as scheduled, and one for residents making more than $100,000 ($200,000 for joint filers) that would remain at 4.75 percent.

Wisconsin.

Wis. Panel Says Amazon Flex Drivers Are Employees - Irene Spezzamonte, Law360 Tax Authority ($). "In a unanimous and published opinion, a three-judge panel overturned a lower court's decision that Amazon Logistics Inc. didn't need to classify the drivers as employees, saying the retailer failed to meet the six criteria necessary to treat them as independent contractors. Among the factors leaning against independent contractor status is the fact that the drivers' work was directly related to Amazon, the panel ruled."

Related: Independent Contractor vs. Employee.

In other news:

New York Bill Would Create Pet Adoption Tax Credit - Emily Hollingsworth, Tax Notes ($). "The legislation would create a credit of up to $100 per pet adopted “from a qualifying pound, duly incorporated professional organization or duly incorporated humane society,” capped at three household pets per tax year, the bill said. The credit would be effective for tax years starting on or after January 1, 2024."

I worry about unintended consequences.

Make a habit of sustained success.