Werfel Says Audit Rates for Non-Wealthy Won’t Exceed 2018 Levels - Doug Sword, Tax Notes ($):

Audit rates for those making less than $400,000 annually hit historically low levels in 2018 and will be used as the benchmark for maximum audit rates for that group “for at least several years,” IRS Commissioner Daniel Werfel said.

If he said that $400,000 number was after tax, or whether it would be adjusted for inflation, it has gone unreported.

The IRS breaks down audit rates by income, but the closest figures available for the sub-$400,000 income group are for those reporting incomes of less than $500,000, which Werfel said could be used as “a proxy” for now. According to data released April 14, 1 in 301 filers in that group was audited in 2018 — far fewer than the 1 in 222 for 2017 returns. Before a long period of flat budgets, the audit rate for the group was 1 in 116 for 2011 filings.

IRS Chief Werfel Pledges 10-Year Details for $80 Billion Plan - Chris Cioffi and Naoma Jagoda, Bloomberg ($):

Another topic that came up was the agency’s backlog of paper tax returns, and delays in processing claims for the employee retention tax credit, a pandemic-era credit to encourage businesses to keep their employees on the payroll.

The agency has been resolving about 20,000 of the credits weekly, Werfel said. And now that tax day has passed and call volumes diminish, the agency can move staff that was working the phones to processing forms.

It appears that one existing IRS agent may be occupied for awhile:

Whistleblower claims administration is mishandling probe of Biden’s son - Matt Viser and Jacqueline Alemany, Washington Post:

An IRS agent who has been overseeing a lengthy, ongoing case involving Hunter Biden’s tax returns is seeking whistleblower protection to testify to Congress about what he asserts is political interference and improper handling of the case by the Biden administration.

...

The Post reported in October that federal agents had gathered what they believe is sufficient evidence to charge him with tax offenses and a false statement related to a gun purchase, according to people familiar with the case. The case has remained unresolved, however, and the next step is for David Weiss, the U.S. attorney in Delaware and a Trump administration holdover, to decide whether to file the charges.

Meanwhile up north:

Big public union strike in Canada could disrupt tax season - Associated Press, Via Washington Post. "Since the strike involves nearly one-third of all federal public servants, both the union and the government have warned of disruptions, including what could amount to a complete halt of the tax season. Most tax returns in Canada are due April 30."

Related: Owners of Canadian vacation property face May 1 tax deadline

McCarthy Debt Limit Bill Would Repeal IRA Green Energy Credits - Cady Stanton, Tax Notes ($):

The rolled-back credits would include the increase in the energy credit for solar and wind facilities placed in low-income communities, the sustainable aviation fuel credit, and the credit for previously owned clean vehicles. The bill would revert the residential clean energy credit to a credit for residential energy-efficient property and would modify many others.

...

The legislation would pause the debt ceiling until March 31, 2024, or until an additional $1.5 trillion is spent. It also would rescind all unused IRS funding from the IRA, except that allocated for customer services and business support modernization — cutting funds for enforcement, operations support, and an independent study into a free-file program for the agency.

Our Jay Heflin covered the politics of this yesterday:

The GOP debt limit bill is not expected to pass the Senate or become law.

...

Democrats in Congress and the White House support a debt ceiling increase that does not include other measures, which is referred to as a “clean” increase.

It is not clear when this issue will be resolved, but it is high unlikely that leaders in Washington will allow the federal government to default on its financial obligations – although the resolution will more than likely come at the last second.

When exactly might the last second be?

Debt-Cap Angst Persists as Tax Day Brings in Just $108 Billion - Alexandra Harris, Bloomberg ($):

“I think it’s going to be close, but we should be able to get past June 15th, which should put the X-date sometime in late-July or early-August,” said TD’s Goldberg.

Up until now, estimates for the so-called drop-dead date have been wide — anywhere from early summer through to the US fall — but detail on the government ’s cash position this week could help investors and officials to refine their views.

So make your summer plans now! And be sure to read Jay's DC roundup tomorrow for the latest budget news.

Electric Vehicle Tax Credit Rules Create ‘Chaos for Consumers’ - Lawrence Ulrich, New York Times:

In August, the law ruled out the full tax credit of $7,500 for electric vehicles and plug-in hybrids assembled outside North America. That may make it harder for consumers to take the financial or psychological leap to buy a battery-powered car.

Enter the loophole:

The rules are already driving big changes in the buying and selling of electric cars. Some automakers whose models are no longer eligible are now pushing leased electric cars. That’s because the law allows leased vehicles to qualify as commercial vehicles, which the Inflation Reduction Act exempts from the restrictions that apply to cars bought by individuals.

Volkswagen becomes first foreign carmaker to qualify for electric vehicle credit - Tanya Snyder, Politico. "The list may expand further as other automakers excluded from the tax break find ways to meet the U.S. eligibility requirements, which include mandates that specific percentages of the batteries’ critical parts or minerals come from the United States or a close trading partner. BMW, Volvo, Hyundai and Nissan were among the companies whose vehicles failed to make the cut this week."

China Benefits Most From US Energy Credits, GOP Says - Stephen Cooper, Law360 Tax Authority ($). "The Inflation Reduction Act , signed into law in August by President Joe Biden, is generating revenues for the Chinese Communist Party and allowing it to maintain its grip on global supply chains, House Ways and Means Committee Chair Jason Smith, R-Mo., said at the hearing."

In Farhy’s Wake, Taxpayer Advocate Renews Call for Penalty Change - Andrew Velarde, Tax Notes ($). "The national taxpayer advocate has been critical of the IRS’s systemic and summary assessment of international information return penalties for several years. Collins's 2020 annual report to Congress identified assessment of international penalties under sections 6038 and 6038A as one of the most serious problems encountered by taxpayers, finding that systemic assessments are a burden to the IRS and taxpayers and are “legally unsupportable.” The advocate's 2021 annual report warned of the potential for future litigation and recommended legislation that would subject international information return penalties to deficiency procedures."

Related: Tax Court Decision may hamper IRS penalty collection for controlled corporations and partnerships.

Chapter 61 Foreign Information Penalties: Part Two: Taxpayers and Tax Administration Need Finality, Which Requires Legislation - Erin Collins, NTA Blog.

Due process requires that matters be resolved according to established rules and principles and that taxpayers be treated fairly. The international information return (IIR) penalty regime under IRC Chapter 61, Subchapter A, Part III, Subpart A does not adhere to this fundamental mandate. Now is the time for Congress to fix this broken system by providing a clear path for implementation of these penalties. This fix, which would provide much-needed clarity and finality, will require legislation."

...

Since assuming the role of National Taxpayer Advocate, I have recommended that the IRS cease systemic assessment of these penalties, and I have requested that Congress enact legislation providing the IRS the ability to utilize deficiency procedures for IIR penalties. Among other things, deficiency procedures allow for judicial review in the Tax Court prior to the assessment and payment of the asserted penalties.

The IRS approach to international tax paperwork foot-faults of shoot first, ask questions later has led to horrific results. Unfortunately, Congress encourages bad IRS behavior by implying that everyone who has an overseas activity is suspicious. The whole area is overdue for reform.

Big Win for Taxpayers with Foreign Assets: IRS Lacks Authority to Assess & Collect Penalties for Failure to File Foreign Information Returns - Virginia La Torre Jeker, US Tax Talk. "I do not think the taxpayer euphoria will last very long, so taxpayers who have issues should make hay while the sun shines and get those forms filed while the IRS is essentially powerless to hit them with penalties."

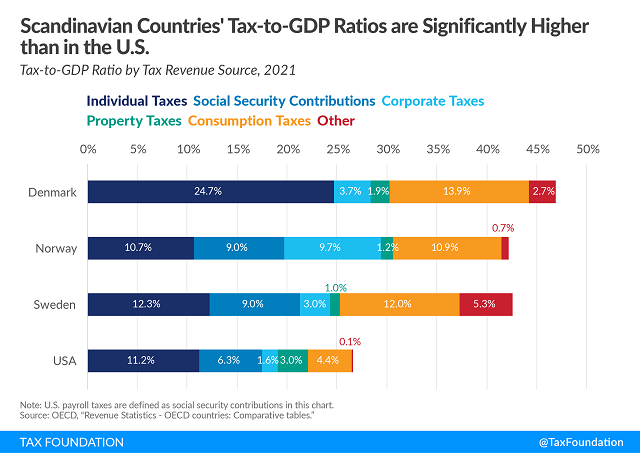

Insights into the Tax Systems of Scandinavian Countries - Daniel Bunn, Sean Bray, and Joost Haddinga, Tax Policy Blog.

Scandinavian countries tend to levy top personal income tax rates on (upper) middle-class earners, not just high-income taxpayers. For example, Denmark’s top statutory personal income tax rate of 55.9 percent applies to all income over 1.3 times the average income. From a U.S. perspective, this means that all income over $82,000 (1.3 times the average U.S. income of about $63,000) would be taxed at 55.9 percent.

...

In comparison, the United States levies its top personal income tax rate of 43.7 percent (federal and state combined) at 8.5 times the average U.S. income (at around $530,000). Thus, a comparatively smaller share of taxpayers faces the top rate.

The best summary I've yet seen comparing Scandinavian taxes to U.S. taxes. If the U.S. goes in that direction, it's not just the rich who will see a tax hike.

Cannabis Culture On 4/20—A Look At Efforts To Legalize And Tax America’s Most Controversial Crop - Kelly Philips Erb, Forbes. "The IRS was fairly quiet about the taxation of cannabis until 2011 when it made clear that it would disallow expenses for medical dispensaries. The justification? Section 280E of the Tax Code..."

4 moves to make now if you didn't file on Tax Day - Kay Bell, Don't Mess With Taxes. "1. File a return."

Penalty for Frivolous Filings Applies to Returns Made on Behalf of Other Taxpayers - Parker Tax Pro Library. "The Tax Court held that a taxpayer who, in his capacity as the trustee of a grantor-type trust, filed frivolous income tax returns for a taxpayer, was liable for penalties under Code Sec. 6702(a)."

At a Loss - Alex Parker, Things of Caesar. "For those who’ve been following these debates for a while, it’s turning into a recurring theme–minimum taxes and other anti-avoidance regimes don’t like losses. They have a tendency to scramble the formula and create distortions."

Fixing The IRS Will Require Much More Than Hiring Additional Staff - Howard Gleckman, TaxVox. "The IRS still will need more people to fulfill its promise of increasing audit rates for high-income households and corporations. And it will need more data scientists and computer geeks to build and maintain those new systems. But it may need fewer staff wielding red pens flyspecking paper returns by hand."

Plan On Having The Death Tax Live On - Peter Reilly, Forbes. "So the planning is to use the exemption before it is chopped in half. Remember it is not just the estate tax it is also the gift tax and the generation skipping tax. The idea is to make a mega gift before 2026. The sooner the better really, because a gift removes not only the assets from the ultimate estate, but also the future growth."

Sigourney man pleads guilty to mail fraud and defrauding the IRS - IRS (defendant name omitted):

According to court records, Defendant engaged in a scheme to defraud and obtain money from 2015 to 2018 concerning sales of grain as organic, when in fact, the grain was grown in violation of the United States Department of Agriculture (USDA) National Organic Program (NOP). NOP is a federal regulatory program governing organic agricultural products. Key among Defendant' NOP violations were the use of treated seed, which is prohibited by NOP. Defendant concealed his NOP violations from the Iowa Department of Agriculture and Land Stewardship (IDALS), the organic certifier. The grain was then sold by Defendant to a number of unwitting purchasers.

Defendant also conspired to impede and obstruct the Internal Revenue Service (IRS) in the assessment and collection of income taxes. Between April 2017 to April 2019, Defendant obtained false invoices, backdated checks, and exchanged checks to give the appearance of an expense that was not in fact incurred. This conduct increased Defendant' expenses and decreased Defendant' federal income taxes.

This ties into another case we have covered, where a farm supply dealer admitted to generating phony invoices and accepting backdated checks. Don't do that.

Munch much? It's National Cheddar Fries Day!

Make a habit of sustained success.