Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

Washington State Supreme Court Upholds State Capital Gain Tax - Eide Bailly.

The Washington Supreme Court this morning upheld a capital gains tax. Up until now, the state has had no income tax. The Seattle Times provides background:

Democrats passed the measure, which applies a 7% tax only to profits over $250,000, in 2021, with plans to spend the revenue on early childhood education programs. The tax applies to the sale of financial assets, such as stocks and bonds.

The court said the tax is constitutional under the Washington constitution because it is not an "income" tax:

The capital gains tax is appropriately characterized as an excise because it is levied on the sale or exchange of capital assets, not on capital assets or gains themselves.

For what it's worth, the tax base is capital gains from the federal income tax return.

Link: No. 100769-8

States cranking out even more tax cuts amid cash surpluses - David Lieb, AP via Washington Post:

Two-thirds of states approved some sort of tax relief last year, according to an analysis by The Associated Press.

Those surplus-induced tax breaks were enabled by stronger than expected state tax collections and an influx of federal pandemic aid both directly to states and to businesses and individuals that, in turn, injected more spending into the economy. But those federal payments are winding down, inflation remains persistently high and new challenges in the banking sector have raised questions about the overall economy.

State-by-State Update

Arizona

Ariz. Senate Committee OKs Corporate Tax Rate Cut - Sanjay Talwani, Law360 Tax Authority ($). "The Senate Appropriations Committee recommended passage of H.B. 2003, sponsored by Rep. David Livingston, R-Peoria, by a 7-0 vote Tuesday. If enacted, the bill would cut the corporate tax rate from 4.9% to 4% for tax year 2023, 3.5% for tax year 2024, 3% for tax year 2025 and 2.5% for tax year 2026 and beyond."

Colorado

Colo. House Panel OKs Flexibility In Retail Delivery Fee - Sanjay Talwani, Law360 Tax Authority ($). "The Colorado House Finance Committee voted 11-0 to recommend passage of S.B. 143. If enacted, the bill would exempt businesses with gross annual receipts under $500,000 from the fee and would allow other businesses to collect the fee from customers or simply pay the fee themselves without itemizing it on customers' bills."

Illinois

Illinois Court: Qui Tam Suit to Enforce Chicago Lease Tax Barred - Audrey Fick, Tax Notes ($). "In City of Chicago ex rel. Walton v. Prog Leasing LLC, the Appellate Court of Illinois, First District, affirmed the dismissal of a whistleblower complaint seeking penalties and interest from leasing companies that allegedly failed to collect and remit Chicago lease taxes over a nine-year period. The court concluded that the relator could not state a claim under Chicago’s false claims ordinance because the city’s municipal code bars private civil actions seeking the enforcement of tax ordinances."

Kansas

Kansas Bill Would Amend SALT Cap Workaround Law - Emily Hollingsworth, Tax Notes ($):

A proposed Kansas bill would clarify what constitutes taxable income for purposes of the passthrough entity tax election and would allow entity owners to claim an offsetting individual income tax credit.

...

In guidance issued March 14 for passthrough entities with both Kansas and non-Kansas income and resident owners, the Department of Revenue said section 79-32,287(a)’s description of income attributable to the state is “unclear and can be interpreted in more than one way," and noted that a legislative correction would be required to "address this discrepancy and permit proper administration." The department recommended that filers delay filing Forms K-120S, which are due April 18, until a worksheet is provided to explain the calculation.

Minnesota

Minn. Tax Court Nixes Tax Break After Sale Of Inherited Parcel - Sanjay Talwani, Law360 Tax Authority ($):

The estate of a deceased Minnesota man owes additional state estate tax on inherited property that was sold outside an heir's family because the sale disqualified the parcel from an exemption to the tax, the state tax court said.

In a judgment issued Thursday, the Minnesota Tax Court, Regular Division, upheld an order by the state Department of Revenue that removed the qualified farm property estate tax exemption from one of four inherited parcels. The court agreed with the department that the sale of one of the parcels to a party outside the family of that heir within three years of the man's death in 2019 disqualified that property from receiving the exemption.

COST: Minnesota Retail Delivery Fee Bill Would ‘Hinder’ Economy - Emily Hollingsworth, Tax Notes ($). "H.F. 580, introduced January 19 by Transportation Finance and Policy Committee member Erin Koegel (DFL), Chair Frank Hornstein (DFL), and Vice Chair Brad Tabke (DFL), would impose a fee on deliveries made by vehicles carrying items subject to state sales or use tax. The delivery of clothing would be subject to the fee, despite clothing being sales tax exempt."

Mississippi

Miss. To Exempt Items Shipped Out Of State From Sales Tax - Michael Nunes, Law360 Tax Authority ($). "Republican Gov. Tate Reeves enacted H.B. 549 on Wednesday. The law exempts the sale of property that is transported, shipped or exported from Mississippi and first used in another state from the state's 7% sales tax. It will take effect July 1.

Missouri

Mo. House OKs Halving State's Corporate Income Tax - Michael Nunes, Law360 Tax Authority ($):

The House passed H.B. 816 and 660 by a vote of 110-45. The combined bill, as passed by the chamber, would lower the state's flat corporate income tax rate from 4% to 2% in 2024. The rate would decrease by another percentage point in later years if certain revenue targets are met. The individual income tax rate for the state's highest bracket would also be cut to 4.5% from 4.95%, starting in 2024. Social Security benefits would be exempt from tax under the legislation.

...

A similar bill, S.B. 93 and 135, introduced in the Senate on Jan. 4, proposes lowering the state's corporate income tax to 3.75% in 2024.

New Mexico

Major New Mexico Tax Package Cuts Too Deeply, Warns Governor - Laura Mahoney, Bloomberg ($):

New Mexico lawmakers approved a sweeping tax package with a $1 billion annual price tag that New Mexico Gov. Michelle Luján Grisham (D) has warned is too high.

The package, passed on the last day of session March 18, is a mix of tax increases and tax cuts lawmakers said is aimed at making the overall tax system more progressive and equitable at a time when the state has $5 billion in cash reserves from historic oil and gas production and broad economic growth.

New Mexico Legislature Approves Omnibus Tax Bill - Paul Jones, Tax Notes ($):

New Mexico lawmakers have approved a tax omnibus bill that would provide one-time tax rebates, phase in a reduction to the gross receipts tax rate, reduce income taxes on lower earners, and transition the state to a single-sales-factor apportionment regime.

...

The bill would reduce taxes on lower levels of income by altering rates and adjusting brackets. For example, the rate for a single filer's income up to $5,500 would be reduced from 1.7 percent to 1.5 percent. The brackets for the remaining tax rates would be adjusted so that instead of paying 3.2 percent on income between $5,500 and $11,000, a single filer would pay that rate on income between $5,500 and $16,500; instead of paying 4.7 percent on income between $11,000 and $16,000, the filer will pay 4.3 percent on income between $16,500 and $33,500; and instead of paying 4.9 percent on income between $16,000 and $210,000, the filer would pay only 4.7 percent on income between $33,500 and $66,500, among other changes to the rates.

Ohio

Ohio Updates State Tax Code To Conform To Federal Changes - Zak Kostro, Law360 Tax Authority ($). "S.B. 10, which DeWine signed Wednesday, incorporates into the state's income tax law changes made to the Internal Revenue Code since Feb. 17, 2022, which will affect personal income tax receipts starting with the current tax year, according to a fiscal note. The incorporated changes include those made by the 2022 Inflation Reduction Act and the 2023 Consolidated Appropriations Act, the fiscal note said."

Oklahoma

Okla. House OKs Flat Income Tax With Possible Further Cuts - Jared Serre, Law360 Tax Authority ($). "The House passed H.B. 2285 by a 77-19 vote Monday. The bill would implement a flat income tax rate of 4.5%, which would be further cut to as low as 2.75% if certain revenue conditions are met, according to the bill."

South Dakota

New South Dakota Law Temporarily Reduces Sales Tax Rates - Emily Hollingsworth, Tax Notes ($). "H.B. 1137, signed into law March 21, reduces the sales and use tax rate on a wide variety of goods and services — including the sale of retail items, fuel and utilities, and services ranging from accounting to garment alterations — from 4.5 percent to 4.2 percent. It also reduces the tax rate on the use of services like passenger transportation and mobile telecommunications. The tax reduction will be in effect until June 30, 2027, when sales and use taxes will revert to their original 4.5 percent rate, according to the bill."

Utah

‘Historic’ $480 million tax cut sign by Gov. Cox. Here’s how it will impact Utah taxpayers. - Bryan Schott, Salt Lake Tribune:

Gov. Spencer Cox affixed his signature to the “historic” $480 million tax cut package approved by Utah lawmakers earlier this month. While most of those reductions will be in effect for the 2023 tax year, one big part is on hold until after the 2024 election.

The primary piece of the tax cut puzzle drops Utah’s corporate and personal income tax rate from 4.85% to 4.65%. Those cuts primarily benefit the top 5% of wage earners, or those who make more than $235,000 per year, who will see a yearly state income reduction between $1,000 and $3,000. Utahns who make over $638,000 per year, or the top 1% of earners, will see a reduction between $5,000 and $9,500. Most taxpayers will see their income tax bill shrink by $500 or less annually.

Utah Trims Corporate, Individual Tax Rate, Creates Birth Bonus - Angélica Serrano-Román, Bloomberg ($). "Among other provisions, the new law allows taxpayers with a newborn child to claim the $1,750 personal exemption twice in the year of the child’s birth."

Vermont

Vermont Tobacco Flavor Ban Would Cost Nearly $16 Million Per Year - Adam Hoffer, Tax Policy Blog. "Combining the effects of the decline in cigarette sales and OTP, we estimate Vermont tax collections would fall by $15.6 million. This is before we factor in losses from smuggling or cross border sales."

Other SALT news

States Go for the Gold in Seeking to Exempt Bullion From Taxes - Emily Hollingsworth, Tax Notes ($):

Lawmakers in seven states recently introduced legislation that would exempt bullion or gold and silver coins from sales or income taxes.

...

Peterson and Iowa Rep. Jeff Shipley (R), who introduced exemption bill H.F. 659, both observed that bullion can serve as wealth and alternative retirement investments for taxpayers.

“My goal is to give Iowans the ability to protect their wealth from inflationary monetary policy at the Federal Reserve,” Shipley told Tax Notes March 16.

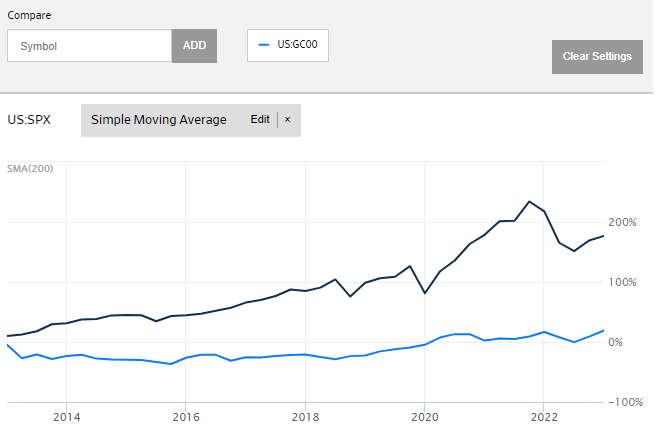

For what it's worth, here is a 10-year comparison of returns for the S&P 500 (black line) vs. gold (blue line), per Wall Street Journal charting.

Be careful out there.

Make a habit of sustained success.