Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

New K-1 for Colorado must be separately submitted – don’t be caught off-guard! - Eide Bailly National Tax Office:

Colorado recently released new form DR 0106K (“Colorado K-1”) to be used for 2022 tax filings. Previously, Colorado did not have a specified state K-1 form.

The new form must be submitted to owners on or before the due date of the Form DR 0106. Also, copies of the form must now be filed with the Department of Revenue on or before the due date of Form 0106, the Colorado partnership return.

Uniquely, each partner’s or shareholder’s Colorado K-1 must be submitted by the pass-through entity to the Department of Revenue separately from the Colorado pass-through entity return (Form 106). The forms may be electronically submitted in spreadsheet or XML form or entered manually online. Paper copies can be filed with the Annual Transmittal of DR 0106K – Colorado K-1 Forms cover sheet (Form DR1706) by mail.

Hold Off on Filing Your Return, IRS Tells Millions of Taxpayers - Ashlea Ebeling, Wall Street Journal (see update below):

California sent out more than 16 million special Middle Class Tax Refund payments, worth $9 billion, to help counter inflation and high gas prices last year. It is still unclear if those payments should be treated as taxable federal income, as taxpayers are starting to file their 2022 tax returns.

The IRS said in a Friday statement it will provide guidance this week on the tax status of California’s and other states’ payments. Meanwhile, it is advising those who received these payments to await further instructions.

State relief recipients awaiting IRS decision on potential federal tax cost - Kay Bell, Don't Mess With Taxes. "The payments were distributed in California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Massachusetts, New Jersey, New Mexico, New York, Pennsylvania, South Carolina, and Virginia."

UPDATE, 2/11/2023: The IRS late yesterday issued guidance (IR-2023-23) that provides most of the state payments will not be considered taxable "in the interest of sound tax administration and other factors."

State-by-state update

Arizona

Of note:

- AZ has a unique calculation in that only Schedule K lines 1 and 2 are included in the starting point for calculating the PTE tax

- Special allocations are not allowed for S corporations but are allowed for partnerships

- Composite payments cannot be converted to PTET estimated income tax payments

Link: Arizona Publication 713.

California

Newsom Targets Trusts Set Up to Avoid California Income Tax – Laura Mahoney, Bloomberg ($): "The Democratic governor’s proposal could apply to about 1,500 Californians who have set up a specific type of trust in a state without an income tax. If enacted, the levy would bring California only a small revenue gain—$30 million in the first year and about half of that in future years as this type of trust is used less. California also would join New York in ending a tax planning strategy the wealthy have used for about 20 years."

California OTA: Nonresident’s Share of Gain Is Apportionable to the State - Andrea Muse, Tax Notes ($):

SOSV LLC (Holdco) was directly owned by three members. The taxpayer in this case, L. Smith, owned an indirect membership interest in the company. The LLC's sole purpose was to hold its 50.5 percent membership interest in Shell Vacations LLC, which was in the business of acquiring, developing, and selling timeshare and vacation interests and vacation club memberships. Shell Vacations conducted business within and outside California, while Holdco had its principal office in Illinois and reported no payroll, expenses, sales, or tangible property at the beginning or ending of the year on its final 2012 California LLC tax return.

...

But the California Franchise Tax Board concluded that Holdco and Shell Vacations constituted a unitary business and that Holdco’s gain from the sale was thus apportionable business income.

Related: Eide Bailly Sell-Side Advisory Services.

Calif. Repairs For Nonstate Clients Are Taxable, Panel Says - Maria Koklanaris, Law360 Tax Authority ($). "A medical and scientific equipment company was required to pay use tax on parts for repairs performed at a California facility, even for non-California customers, the state Office of Tax Appeals ruled."

Link: OTA Case No. 19125560

Colorado

Colo. Panel OKs Repeal Of 10 Infrequently Used Tax Breaks - Zak Kostro, Law360 Tax Authority ($). "H.B. 1121, which the committee approved by a 10-0 vote with one member excused, would repeal a variety of infrequently used tax breaks from the state's individual and corporate income tax, insurance premium tax and severance tax, according to a fiscal note. The bill would get rid of a corporate condemnation capital gains income tax deduction, a mining and milling impact assistance corporate income tax credit, an oil shale severance tax rate reduction and other expenditures, according to a summary."

Connecticut

Connecticut Governor to Propose First Income Tax Reduction in Decades - Matthew Pertz, Tax Notes ($). "Under current law, single filers pay 3 percent on their first $10,000 ($20,000 for joint filers) of income and 5 percent on additional income up to $50,000 ($100,000 for joint filers). Lamont wants to see those rates reduced to 2 percent and 4.5 percent, respectively, starting in 2024. The tax cut would save taxpayers an estimated $440 million, according to a February 6 statement from Lamont's office."

Idaho

Idaho Lawmakers OK Conformity With 2023 Federal Tax Code - Zak Kostro, Law360 Tax Authority ($). "H.B. 21, which passed the state Senate by a 32-3 vote Wednesday after having cleared the House last month, would conform state tax laws to the Internal Revenue Code as amended and in effect Jan. 1, 2023, according to the bill text. However, Internal Revenue Code Section 85, relating to unemployment compensation, would be applied as in effect on Jan. 1, 2020, the bill said.

Iowa

Iowa Bill Seeks Individual, Corp. Income Tax Cuts – Michael Nunes, Law360 Tax Authority ($). “Iowa would lower its individual income tax rates, adopt guidelines for further reductions and reduce the revenue thresholds needed to decrease the adjusted corporate income tax rate under a bill introduced in the state Senate.”

Link: SSB 1126.

Kansas

Kan. Senate Bill Seeks Flat Tax Rate - Jaqueline McCool, Law360 Tax Authority ($). "S.B. 169, introduced Tuesday by the Committee on Assessment and Taxation, would impose a flat income tax rate of 4.75% on income over $5,225 for individual filers and income over $10,450 for joint filers. Currently, income up to $15,000 is taxed at 3.1%, income over $15,000 and up to $30,000 is taxed at 5.25% and income over $30,000 is taxed at 5.7%."

Kentucky

Kentucky Senate sends income tax cut bill to governor – Erin Kelly, Spectrum News:

Republicans wrapped up work Wednesday on making a deeper cut in Kentucky's individual income tax rate, sending the bill to the Democratic governor in the midst of an election campaign.

Link: HB 1.

Maryland

Four-Day Work Weeks Would Earn Tax Breaks With Maryland Proposal - Chris Marr, Bloomberg ($): "Legislation pending in Maryland (HB 181 / SB 197) would offer employers a tax incentive for testing out a four-day week with at least 30 employees and letting the state’s labor department collect research on their experience. It also would encourage state and local government agencies to try out the alternate work week."

Link: HB 181

Michigan

Mich. Panel Backs Rebate Check That May Block Tax Cut - Paul Williams, Law360 Tax Authority ($). "The bill, H.B. 4001, would provide residents with $180 rebate checks, structured as an advance refundable income tax credit, increase tax deductions for retirement income over the next four years, and raise the state's earned income tax credit from 6% of the federal credit amount to 30%. Married taxpayers would each receive a $90 rebate, according to a summary of the bill."

Link: HB 4001

Missouri

Mo. Sen. OKs Capital Gains Exemption For Gold, Silver Sales - Jared Serre, Law360 Tax Authority ($). "Gold and silver would also be categorized as legal tender, according to the bill, and the state treasurer would be required to keep at least 1% of the state's funds in an amount of gold and silver."

Link: SB 100.

Mo. Senate Tax Writers OK Halving Corp. Income Tax Rate - Paul Williams, Law360 Tax Authority ($). "The bill, S.B. 93, would cut the state's corporate income tax rate, currently at 4%, by half of a percentage point annually from 2024 to 2027, when the rate would fall to 2%. As initially filed, the bill would have phased out the tax completely over those years by reducing the rate by a full percentage point each year, but the Senate Economic Development and Tax Policy Committee amended the measure to halve the rate instead before approving it.

Minnesota

Minnesota DOR Issues Information on 2023 Federal Conformity for Income Tax – Bloomberg ($). “The Minnesota Department of Revenue (DOR) Feb. 1 issued information on federal conformity for income tax.”

Link: 2023 Federal Conformity for Income Tax. "This may impact you if you filed a Minnesota income tax return between 2017 and 2022 with a nonconformity schedule."

Minn. House Panel OKs Expanded Health Program, Tax Credit - Sanjay Talwani, Law360 Ta Authority ($). "H.F. 96, advanced Wednesday by the House Commerce Finance and Policy Committee, would allow small employers an income tax credit worth 50% of qualified employee health care expenses in tax years 2023 through 2025. The bill, sponsored by House Majority Leader Rep. Jamie Long, D-Minneapolis, would remove the income caps and other restrictions on eligibility for the state's MinnesotaCare program starting in 2026 and direct the establishment of a sliding premium scale."

Montana

Montana House Passes Tax Rebate Legislation - Emily Hollingsworth, Tax Notes ($). "Under the bill, single, head of household, and separate filers would receive $1,250 or their tax year 2021 individual income tax liability amount, whichever is less. Joint filers would receive the lesser of $2,500 or their tax liability amount for tax year 2021."

Oklahoma

Okla. Gov. Pitches Income Tax Cut, Grocery Tax Elimination - Michael Nunes, Law360 Tax Authority ($). "Republican Gov. Kevin Stitt said he supported reducing the top individual income tax rate to 3.99%, from 4.75%, telling lawmakers that the state has a $1.8 billion surplus at the start of this legislative session."

Puerto Rico

Puerto Rico Governor Pierluisi Proposes Sweeping Tax Reform - Jim Wyss, Bloomberg. "Under the proposal, Puerto Rico’s maximum tax rate for individuals would be reduced from 33% to 30%. The marginal corporate tax rate, now 37.5%, would change to between 17% and 33%, depending on the size of the business."

Tennessee

Tennessee Governor Proposes Sales, Business Tax Relief - Matthew Pertz, Tax Notes ($). "Lee also proposed to establish a $50,000 standard deduction for the business excise tax and raise the filing threshold for business tax from $10,000 to $100,000. His plan would earmark an additional $64 million to conform with the federal bonus depreciation provisions of the 2017 Tax Cuts and Jobs Act."

Washington

Washington Proposes Gross Margins Tax - Melissa Menter, Eide Bailly. "Legislators in Washington have proposed replacing the current business and occupations tax, which is a tax on income, with a margin tax on gross receipts."

Link: SB 5482

West Virginia

West Virginia Senate suspends rules, approves $600 million tax cut plan -Roger Adkins, Charleston Gazette-Mail:

The West Virginia Senate approved a tax-cut plan Wednesday that favors what senators are calling a more fiscally conservative and multi-faceted approach over the governor’s proposed 50% reduction in the personal income tax.

Link:Senate Bill 424.

Other State Tax Items

In Vogue Vacancy Taxes Show Modest Returns - Chuck Slothower, Law360 Tax Authority ($):

Cities with high housing costs have enacted vacancy taxes in recent years to deter investors from buying properties and keeping them empty. Tax supporters pointed to wealthy foreign buyers who may choose to park their money in North American real estate without bothering to rent it out and to speculators who look to flip properties.

...

"Probably the only good thing that's happened with the taxes is it's given us some really good data — and there aren't really that many vacant homes," said Brendon Ogmundson, chief economist for the British Columbia Real Estate Association.

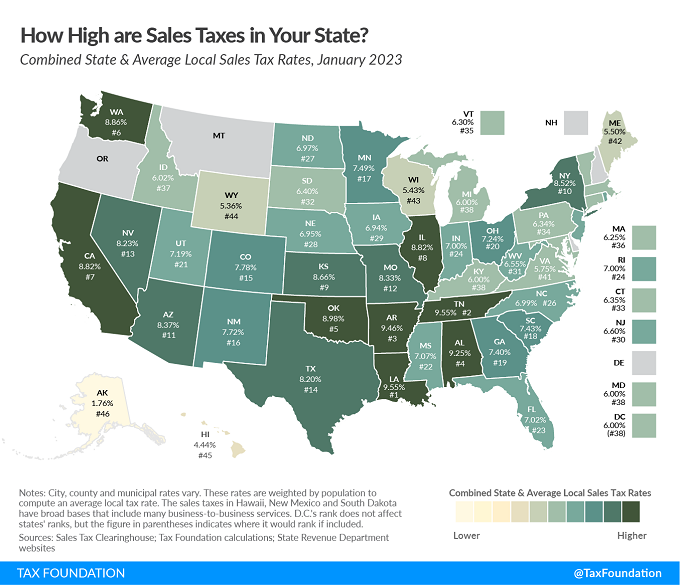

State and Local Sales Tax Rates, 2023 - Janelle Fritts, Tax Policy Blog. "The five states with the highest average combined state and local sales tax rates are Louisiana (9.550 percent), Tennessee (9.548 percent), Arkansas (9.46 percent), Alabama (9.25 percent), and Oklahoma (8.98 percent). The five states with the lowest average combined rates are Alaska (1.76 percent), Hawaii (4.44 percent), Wyoming (5.36 percent), Wisconsin (5.43 percent), and Maine (5.50 percent)."

Make a habit of sustained success.