Key Takeaways

- IRS funding cut deal survives McCarthy's ouster as speaker.

- IRS Direct File also includes state returns for CA, NY, MA and AZ.

- Taxpayers will need an invitation from IRS to use Direct File; returns will have to be simple.

- 1099-K filings slated to go from 14M to 44M.

- SBA backs off collection of many EIDL Covid-era loans.

- More on extended deadlines for Californians

- Sales tax audit triggers

- Well-educated, poorly-filed.

- Nevada preparer's deductions too good to be true

McCarthy-Biden IRS Deal Stands Despite Speaker’s Fall - Cady Stanton and Doug Sword, Tax Notes ($):

The gentleman’s agreement to cut $20 billion in long-term funding from the IRS is still in force, according to a top Senate appropriator, even though one of the gentlemen, former House Speaker Kevin McCarthy, lost his post.

“This was an agreement with a Republican leader, and the fact of the matter is that it should still stand,” said Sen. Chris Van Hollen, D-Md., who chairs the Senate Appropriations Financial Services and General Government (FSGG) Subcommittee.

IRS to offer a new option to file your tax return - Julie Zauzmer Weil, Washington Post:

In 2024, some taxpayers will have for the first time a new filing option that many advocates have been demanding for years: A free tax preparation software program, like TurboTax or its competitors, created by the IRS.

For its first filing season, the program, Direct File, will be available in only 13 states and won’t be suitable for all taxpayers, the IRS announced on Tuesday. If you want to be one of the first to try it out, you’ll need a special invitation.

Four States Team With IRS for 2024 Direct-File Effort - Jonathan Curry, Tax Notes ($):

A select group of taxpayers from California, New York, Massachusetts, and Arizona will be invited to file their federal income tax returns for free directly with the IRS. Although state income tax return filing won’t be directly integrated into the IRS’s tool, those taxpayers will be referred to a state-level tool for them to file their state income tax returns once their federal returns are completed, the agency said in an October 17 release.

Taxpayers from an additional nine states without a state-level income tax may also be able to use the direct-file tool for their federal returns, according to the IRS. All told, the agency expects several hundred thousand taxpayers to give the direct-file pilot a shot next filing season.

New York, Arizona Jump on Board IRS Direct File Pilot - Erin Slowey, Bloomberg ($). "Only some taxpayers who have “relatively simple” returns will be able to participate in the pilot. Income types like wages on a Form W-2 and tax credits like the earned income tax credit and the child tax credit will be covered by the pilot, though the scope is subject to change, the IRS said."

IRS Predicts 70 Percent More Forms 1099-K Next Year - Jonathan Curry, Tax Notes ($):

The IRS expects to be inundated with 44 million Forms 1099-K in 2024 — an increase of 30 million over this year — as the new reporting threshold kicks in.

That’s according to recently updated data from the IRS’s Statistics of Income division. The projected spike in volume comes as the once-delayed $600 threshold for third-party payment networks like PayPal and Venmo to report transactions takes effect in 2024. By 2031, the number of Forms 1099-K filed could reach nearly 62 million, according to the data.

What does the 1099-K report? From IRS.gov:

Form 1099-K is a report of payments you got during the year from:

- Credit, debit or stored value cards such as gift cards (payment cards)

- Payment apps or online marketplaces (third-party payment networks)

Third-party payment networks are required to file Form 1099-K with the IRS and provide a copy to you when the gross payment amount is more than $600. Form 1099-K should not report gifts or reimbursement of personal expenses you received from friends and family.

The new threshold doesn't make any income taxable that wasn't taxable before. It will make it easier for the tax man to spot it.

U.S. halts collection on some past-due covid loans, sparking federal probes - Tony Romm, Washington Post:

At the height of the coronavirus pandemic, Congress created the Covid-19 Economic Injury Disaster Loan program, known as EIDL, which provided low-interest loans to cash-starved companies. From 2020 until it stopped accepting new applications in May 2022, the initiative disbursed roughly $380 billion to help firms stay afloat and maintain their payrolls amid the worst economic crisis since the Great Depression.

...

Anticipating a wave of defaults, however, the SBA had already decided that it would not take the most aggressive actions possible to pursue borrowers who received loans worth $100,000 or less. The agency said it planned to send out stern letters demanding payments and threatening penalties, and it aimed to prohibit these borrowers from obtaining federal aid again. But the SBA opted against referring all unpaid and delinquent loans to the Treasury Department, which can garnish wages and initiate other collection activities, according to reports, letters and other materials prepared by SBA and its top watchdog that were later reviewed by The Washington Post.

According to the article, the SBA inspector general objected, saying the SBA policy was possibly illegal and "could incentivize other COVID-19 EIDL recipients to stop paying on their loans."

HILL TAX BRIEFING: SALT Makes Cameo in House Speaker Saga - Kim Dixon, Bloomberg ($): "New York Republicans opposed Jordan’s bid, at least in part because he hadn’t made any commitments on adjusting the $10,000 state-and-local tax deduction cap, several said."

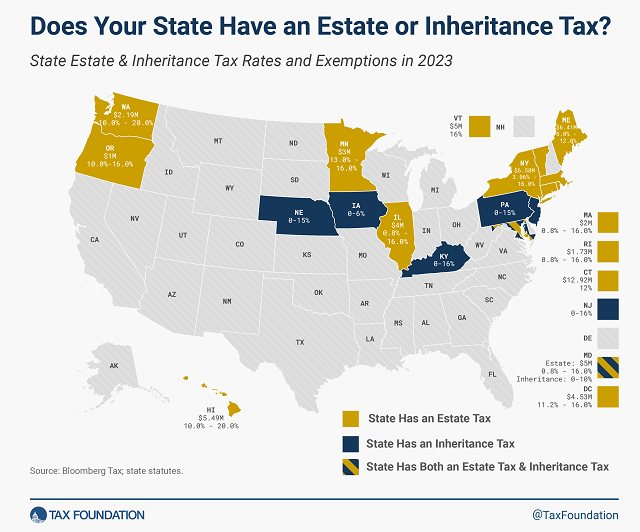

Does Your State Have an Estate or Inheritance Tax? - Andrey Yushkov, Tax Foundation. "Estate taxes are paid by a decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary."

Related: Eide Bailly Wealth Transition Services

Most Californians get another month to file federal and state tax returns - Kay Bell, Don't Mess With Taxes. "As for state tax filings, the California Franchise Tax Board (FTB) has followed the IRS' decision. It has confirmed that most residents now have until Nov. 16 to file and pay their state tax year 2022 returns and any due taxes."

Florida Police Deputies Charged With Stealing Nearly A Half Million Dollars In Covid Funds - Kelly Phillips Erb, Forbes. "We tend to think that police officers are busily enforcing our laws, but prosecutors in the Southern District of Florida allege that more than a dozen officers did just the opposite. Seventeen deputies in the Broward County Sheriff's Office are accused of Covid-19 fraud-related charges totaling nearly half a million dollars."

What triggers a sales tax audit and how do you reduce the risks? - Thomson Reuters Tax & Accounting. "3. Compliance check on a new company. You’re a new or small company selected for an audit by the Department of Revenue to help keep your books and processes in order and maintain compliance with state tax regulations before you grow too quickly or get too big."

Related: Eide Bailly State & Local Tax

Incarcerated Taxpayer Was Not Liable for Misappropriated IRA Distributions - Parker Tax Pro Library. "The court found that the taxpayer's wife, whole used the funds to renovate a home in another state and to support herself and her ailing mother, breached her fiduciary duty under the POA by engaging in unauthorized self-dealing."

Deduction for property gift denied due to lack of charitable intent- National Association of Tax Professionals. "The Office of Chief Counsel determined that the taxpayer’s intent to sell the property to a third party for a higher amount than was offered by the charitable organization and their failure to accept the organization’s lower offer indicates that the taxpayer did not intend to make a gift. The taxpayer accepted the organization’s lower offer as a stipulation to settle litigation. After the parties signed the stipulation, the taxpayer lacked any rights in the property at issue, so it could no longer attribute any value to the property in excess of what was paid."

Individual Had Unreported Income, Fraud Penalty Will Go to Trial - Tax Analysts ($). "The Tax Court refused to vacate an order deeming admitted the IRS’s affirmative allegations in its answer to a petition because the individual failed to respond; the court granted the IRS partial summary judgment regarding unreported income, but there was not clear and convincing evidence that he intended to evade payment of taxes regarding fraud penalties."

One can understand why the IRS might have been unhappy with the taxpayer - who, it turns out, is also a long-time IRS employee (my emphasis):

Petitioner has been an employee of the IRS since 2008. He previously worked as a tax return preparer. He holds five educational degrees, including a master's in business administration and a Juris Doctor with an alleged specialty in international taxation.

Petitioner included with his 2017 and 2018 Federal income tax returns Schedules C, Profit or Loss From Business. He conducted that business under the name “El Virtuoso Enterprise.” He described it as a “professional service business.”

Petitioner claimed numerous deductions in connection with “El Virtuoso Enterprise,” including substantial deductions for home office expenses. For 2017 and 2018 he reported gross receipts of $6,000 and $4,500, respectively, and net losses of $36,515 and $40,124, respectively. His Schedules C for these years reflected his prior practice of reporting gross receipts in round-dollar amounts and expenses that vastly exceeded such receipts. For 2016 he had reported gross receipts of $3,500 and a net loss of $28,429. He has reported a Schedule C loss on every return he has filed since 2012.

It's interesting that an a longtime IRS employee with five degrees would file tax returns with such obvious audit bait. Unfortunately, taking personal expenses as Schedule C business expenses is a favorite ploy of sketchy tax preparers and their clients.

The Tax Court opinion accepted that the IRS agent underpaid his taxes, but said that disputed facts required the case to go to trial to determine whether fraud penalties apply.

The moral? Deducting personal expenses as business expenses is a bad idea, no matter how impressive ones educational background may be.

Nevada CPA pleads guilty to filing false tax returns - IRS (Defendant name omitted, emphasis added):

According to court documents and statements made in court, Defendant, of Henderson, was a certified public accountant (CPA) and founder and manager of an accounting firm, LLB. LLB provided accounting services including tax preparation, audit and consulting services. Defendant also operated a real estate business that developed office buildings and other real property. In connection with Defendant's real estate development activities, he operated and controlled a real estate investment partnership entity.

In 2011, Defendant began offering LLB's high-net-worth clients an "investment opportunity" through which the clients would make a payment to his partnership entity and, in exchange, receive a large tax deduction of approximately five to seven times the amount of money the client "invested." Defendant advised that the clients' payments would entitle them to claim the large tax deduction based on losses derived from the partnership entity even though the tax laws did not permit the sale of such deductions in exchange for an investment or money and the partnership did not incur the losses or depreciation in the amounts Defendant was selling. Defendant also did not report the purported investments as losses on the clients' tax returns as promised. Instead, he caused the clients' returns to report large false deductions for cost of goods sold, professional and consulting fees or nonpassive losses. In total, Defendant's scheme caused a tax loss to the IRS of at least $8 million.

If it's too good to be true, usually it's not true.

Decisions, decisions. It's both National Chocolate Cupcake Day and Hagfish Day.

Make a habit of sustained success.