Key Takeaways

- Selecting the right life insurance policy requires careful consideration of individual circumstances and goals.

- Regularly reviewing your life insurance policy allows you to adapt your coverage to your current circumstances, optimize your financial protection, and take advantage of new opportunities.

- Depending on your income and goals, life insurance can play a useful role in tax diversification and, ultimately, a diversified retirement plan.

Each year in America, over 9 million new life insurance policies are purchased. In total, Americans spend over $151 billion in premiums, providing about $3 trillion in coverage.

Proper life insurance is the cornerstone of a family’s financial plan, providing your loved ones with the cash, security, and income they need when you’re no longer able to provide it for them.

The Importance of Life Insurance

While no one likes to think about their own mortality, the reality is that unexpected events can have a profound impact on a family’s financial well-being.

Life insurance acts as a financial safety net for your loved ones. The death benefit they receive can replace lost income, cover outstanding debts, and ensure financial stability during a challenging time.

Life insurance addresses immediate needs – like covering funeral expenses or relieving your family of unexpected financial burdens after your passing. For business owners, life insurance plays a pivotal role in ensuring the continuity of their ventures, providing funds for business-related expenses and debt repayment.

Life insurance also serves as a tool for effective estate planning, allowing for the seamless transfer of assets to heirs while minimizing potential tax implications.

Beyond the financial aspects, life insurance offers immeasurable peace of mind. It acknowledges life’s unpredictability and assures you that your loved ones will be cared for regardless of unexpected circumstances.

In essence, life insurance isn’t just a financial product – it’s a means to safeguard your family’s well-being, leave a legacy, and plan for a future that remains uncertain but is well-prepared for.

Using Life Insurance to Diversify Your Retirement Plan

Today, more individuals are using life insurance for purposes other than its basic offer – to secure a death benefit should something happen to you.

Depending on your income and goals, life insurance can play a useful role in tax diversification and, ultimately, a diversified retirement plan. This type of diversification is similar to that in investment portfolios.

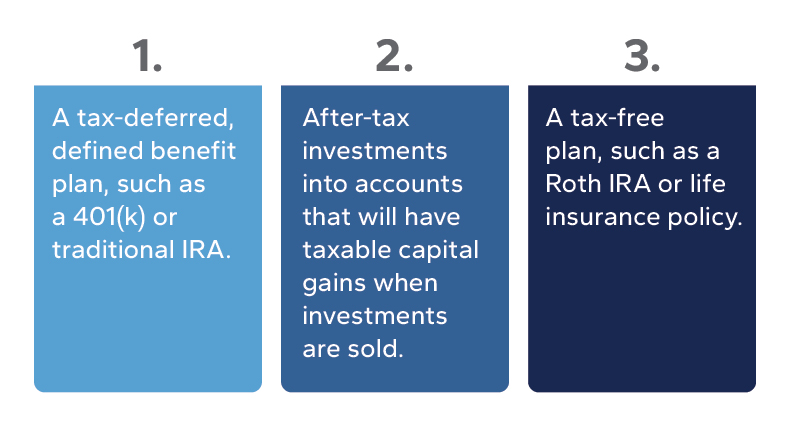

A diversified retirement plan is commonly composed of these three buckets:

A life insurance policy can be an excellent alternative to a Roth IRA for high-income individuals because:

- Roth IRAs have maximums, currently around $6,000 per person.

- Qualifying life insurance policies have no maximums on savings per year.

- Roth IRAs have income limits excluding or limiting those with over $198,000 joint income.

- Qualifying life insurance policies do not have income limits.

To use life insurance as a tax diversification strategy, it must be a permanent cash value life insurance policy, such as whole life and universal life.

Benefits of Using Life Insurance as a Retirement Strategy

One key benefit of this strategy is the ability to supplement your retirement income with tax-efficient withdrawals from your permanent life insurance policies. Unlike other retirement accounts, withdrawals from the cash value of a life insurance policy are generally tax-free up to the amount of premiums paid.

Flexibility is another advantage of using life insurance for retirement diversification. Permanent life insurance policies often allow adjustments in premium payments, enabling higher contributions during your working years to build cash value. In retirement, you can reduce or cease premium payments while retaining coverage and access to the accumulated cash value.

Further, life insurance plans have no early termination policies or penalties for distribution before the age of 59 – and those distributions can come out tax-free if your plan is designed appropriately. Retirement plans typically have strict rules and penalties for such activity.

Choosing the Right Life Insurance Policy

It can be difficult to know what kind of life insurance you need. It can be difficult to know if you have enough coverage. It can be difficult to know if you need any at all.

Selecting the right life insurance policy requires careful consideration of individual circumstances and goals:

Term Life Insurance

Term life insurance is best for those with specific, temporary needs. It provides coverage for a predetermined period, typically 10, 20, or 30 years.

This type of policy is well-suited for individuals who want to ensure their family’s financial security during the years when their dependents are most vulnerable, such as while children are still young or while a mortgage is being paid off.

Premiums are generally lower compared to other types, making it an affordable option for those seeking straightforward protection without cash value accumulation.

Whole Life Insurance

Whole life insurance provides lifelong coverage and includes an investment component that accumulates cash value over time. Premiums remain level throughout the policy’s duration, and a portion of each premium goes towards the cash value, which grows on a tax-deferred basis. Policyholders can borrow against this cash value or even withdraw it.

While whole life insurance tends to have higher premiums than term life, the cash value component can serve as a form of forced savings, offering individuals a financial cushion that can be tapped into during emergencies or retirement.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. It also accumulates cash value, which earns interest based on prevailing market rates or a fixed minimum rate.

Policyholders can adjust premium payments and death benefits within certain limits. This flexibility makes universal life attractive to those looking for a balance between life insurance coverage and cash value growth.

Each type of life insurance has its advantages and considerations. The choice of which policy to select depends on factors such as financial goals, budget, risk tolerance, and individual circumstances. It’s important to carefully evaluate these factors and consult with a professional to determine the most suitable type of insurance for your needs.

Reviewing Your Life Insurance Policy

Reviewing your life insurance policy is crucial to ensure that it continues to align with your evolving financial circumstances and goals. Key components to consider include:

- Life Changes: You might get married, have children, buy a home, or retire. These changes can impact the coverage amount you need to adequately protect your loved ones in case of your passing.

- Beneficiary Updates: It’s important to verify that your policy’s beneficiaries are up to date. Major life events like marriage, divorce, or the birth of children can necessitate changes to your beneficiary designations.

- Policy Performance: You’ll want to ensure that the policy’s cash value is growing as expected and that any loans or withdrawals are managed appropriately to prevent unintended consequences.

- Cost-Efficiency: Insurance markets change over time, and new policies with better features and lower costs might become available. By periodically reviewing your policy, you can determine if you could secure similar or better coverage for a more affordable premium.

Regular policy reviews allow you to adapt your coverage to your current circumstances, optimize your financial protection, and take advantage of new opportunities offered by insurance providers.

Coverage for When Life Doesn’t Go as Planned

You have family or staff who depend on you, and it's a heavy responsibility to protect those you care about. If something unexpected were to happen to you, everything from medical bills and funeral costs to mortgage payments and educational expenses may drain all you've worked and saved for. Proper insurance planning can ensure those you love are prepared when things don't go as planned.

Life Insurance for Business Owners: Planning for the Unexpected

Eide Bailly Wealth

Define what matters to you today while anticipating your needs for tomorrow with a comprehensive plan.