Key Takeaways

- High employee turnover rates can lead to increased costs, disruption in operations, and a decline in employee engagement.

- Although there is a cost associated with third-party assistance, it’s often worth it to save time and ensure an efficient and professional hiring process.

- By implementing best practices in recruitment and creating a supportive, flexible work environment, you can reduce turnover, enhance productivity, and improve overall organizational performance.

Employee turnover is a critical issue faced by organizations of all sizes and industries, impacting not only their financial health but also their overall productivity and morale.

The United States has seen an uptick in workers leaving their jobs voluntarily in recent months. According to the Bureau of Labor Statistics, 3.3 million people quit their jobs in October 2024.

High turnover rates can lead to increased costs, disruption in operations, and a decline in employee engagement. However, with the right hiring and retention strategies, you can mitigate these negative effects and optimize your workforce for peak financial and operational performance.

The Negative Impacts of Employee Turnover

Turnover can have several detrimental effects on an organization. Understanding these impacts is crucial for developing effective strategies to address them.

Financial Costs:

Recruiting, hiring, and training new employees require significant investment. The Society for Human Resource Management (SHRM) reports that, on average, it costs a company six to nine months of an employee's salary to replace them. For an employee making $60,000 per year, that could result in $30,000 - $45,000 in recruiting and training costs.

Loss of Productivity:

When experienced employees leave, their knowledge and skills go with them, leading to disruptions and a decline in overall efficiency. This loss can lead to a temporary decline in productivity as new employees take time to get up to speed. Additionally, the remaining employees may experience increased workloads and stress, further impacting productivity.

Decreased Employee Morale:

High turnover can make employees feel uncertain about their job security and become disengaged. This can create a negative work environment and potentially lead to other employees choosing to leave their jobs — and the vicious cycle of turnover begins again.

Effective Hiring Practices to Optimize Your Workforce

Optimizing your workforce begins with effective hiring practices and extends through comprehensive retention strategies. When it comes to setting up your organization’s hiring process, the following best practices can set you up for success:

- Establish a consistent recruitment process to follow each time you have a need to hire

- Include the right people in the interview to ensure the proper questions are asked and essential information is shared

- Utilize a third party to assist you in your search

- We cover everything you need to know about recruiting best practices in our on-demand webinar, Successful Recruitment Strategies.

Systemize Your Hiring Practices

Hiring is one of the biggest investments an organization can make and approaching that investment inconsistently or unprepared can be costly.

The first step in preparing is determining the actual hiring need. A company can’t find the right person if they don’t know what skills or experience they are looking for in the first place. Clear visibility into business operations can simplify this process, giving you a deeper understanding of your organization’s needs.

Data can provide quantifiable measurements of success for your business and can help answer questions such as:

- Are there employees that can be upskilled?

- Are there duties that can be outsourced?

- Are there opportunities to do more with less via automations?

Strong organizations will look at their current workforce to see if there are skills or expertise that can be utilized differently before committing to the costly and time-consuming task of hiring a new employee.

Once you have determined your hiring need, a standardized hiring sequence should include:

- Initial Screening: Review resumes and cover letters to identify candidates who meet the basic qualifications.

- Phone Interview: Conduct a brief phone interview to assess the candidate's communication skills and fit for the role.

- In-Person or Virtual Interview: Use structured interviews to evaluate the candidate's skills, experience, and cultural fit.

- Skills Assessment: Administer relevant tests or assignments to gauge the candidate's abilities.

- Reference Checks: Contact previous employers to verify the candidate's work history and performance.

- Final Interview: Conduct a final interview with key stakeholders to make the final hiring decision.

Include and Prepare the Right People

Including the right people in the interview process is crucial. At a minimum, an organization should include individuals at the peer, management, and executive levels to allow the potential new hire the opportunity to picture themselves working for the company.

Each person involved in the interview should have standard interview questions to ask and specific information to share so that the candidate leaves the interview with an overall picture of the organization and the interviewers leave the interview with information to determine if the candidate is the right fit for the position and organization.

Enlist the Help of a Third Party

Although there is a cost associated with third-party assistance, it’s often worth it to save time and ensure an efficient and professional hiring process. Placement consultants can support you with everything from composing a formal job description and determining an appropriate salary range to searching for and screening candidates.

By understanding the culture and goals of your organization, a trusted placement consultant can help you attract and hire the right candidate for your position.

An employee is a significant investment for a company, so the proper amount of time and energy should be focused on selecting the right candidates the first time. By preparing ahead of time, you are better equipped to identify and find what you need and create a favorable impression of your organization for the candidate.

Strategies to Retain Valuable Employees

Not all turnover can be avoided — at times, it can even be necessary. However, these strategies for limiting turnover and increasing retention can help save you money and increase the engagement of your employees.

Successful and Efficient Onboarding

Retaining great employees starts with their very first day. Effective onboarding should include:

- Orientation: Introduce new hires to the company culture, values, and policies.

- Training: Provide the necessary training to help new employees understand their roles and responsibilities.

- Mentorship: Pair new hires with experienced employees who can offer guidance and support.

- Regular Check-ins: Schedule regular meetings to address any questions or concerns and provide feedback.

Flexibility and Work-Life Balance

Options like hybrid/remote work and flextime are no longer nice-to-have perks. A majority of U.S. workers now consider workplace flexibility a basic element of competitive compensation — one that can make or break a company's ability to attract and retain talent.

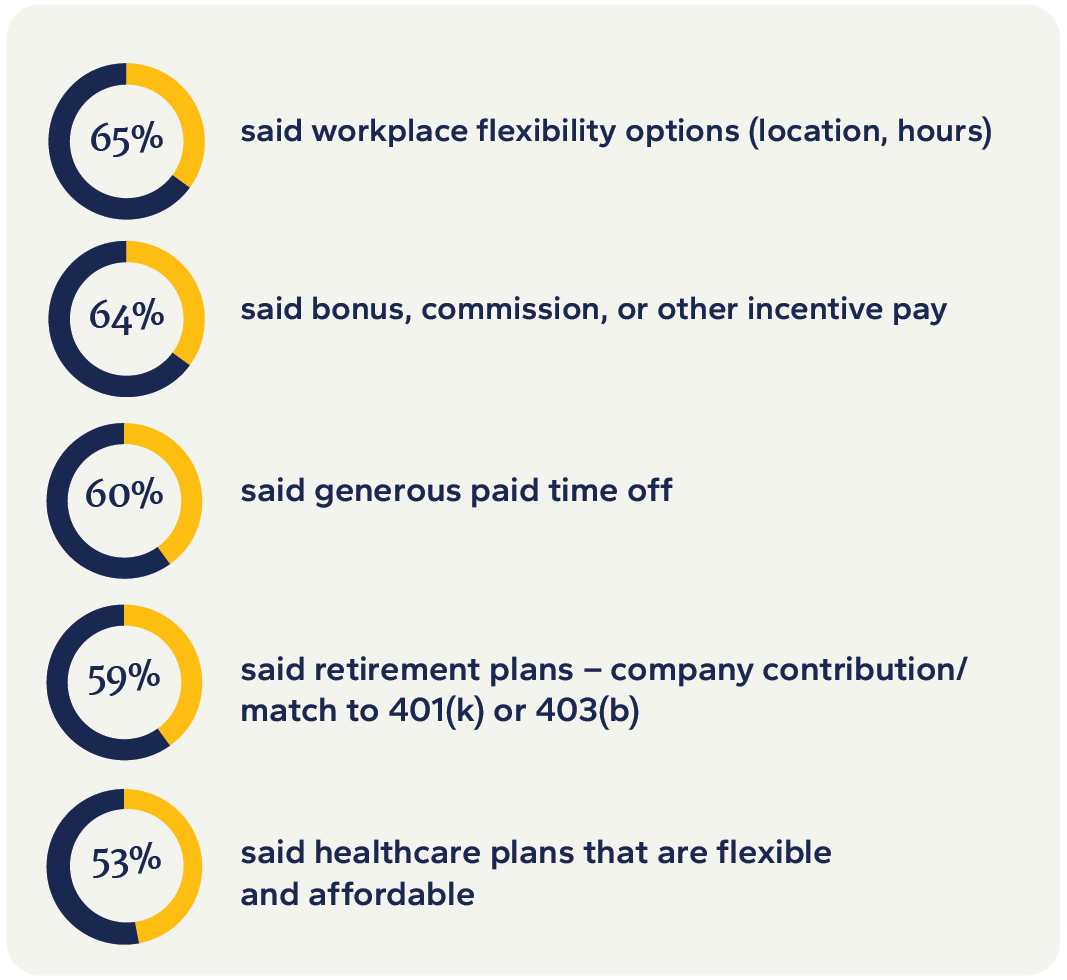

When asked to select the five non-salary compensation elements they considered most important, there was broad consensus among US workers surveyed in September 2023:

Opportunities for Growth and Development

Employees are more likely to stay with an organization that invests in their professional development. Offering training programs, mentorship opportunities, and clear career progression paths can help employees feel valued and motivated to stay.

Business Process Automation

One of the simplest answers to talent retention is making sure your employees are satisfied with their jobs. Are they able to focus on higher-value tasks or are they spending hours (or even days) on repetitive or complicated manual processes? Business Process Automation, or BPA, can help free your employees from manual, time-consuming processes and allow them to focus on work that is more enjoyable and adds higher value to your organization.

Recognition and Appreciation

Employees want to feel valued and appreciated. Appreciation doesn’t have to be formal, but it should be specific. Managers should determine the way each of their direct reports prefers to be appreciated and then follow through with the appropriate type of recognition.

Equitable Compensation

While benefits, career paths, cultural fit, and work-life balance still matter, salary remains one of the most important factors in recruitment and retention.

60% of employees rate compensation as very important to job satisfaction, making it the top contributor to overall employee job satisfaction.

Employee compensation should be reviewed regularly, and that review should include industry standards, geographic market, and specific job responsibilities. Employers should also review internal equity to ensure individuals in similar positions are paid fairly.

Optimize Your Workforce with Professional Support

Optimizing your workforce for financial and operational performance requires a strategic approach to both hiring and retention. By implementing best practices in recruitment and creating a supportive, flexible work environment, you can reduce turnover, enhance productivity, and improve overall organizational performance.

Human Resources Consulting