Energy Incentives

Energy efficiencies, renewables, and decarbonization can translate into significant cashflow and funding savings.

A trusted advisor can help you benefit from energy efficiency and renewable credits and deductions, including Energy Efficiency Deduction (Section 179D), Residential Home Credit (Section 45L), and Clean Energy Investment Tax Credit (Section 48).

Eide Bailly is the number one accounting firm offering energy efficiency and renewable credits and deductions services. Our team includes professional engineers, energy modelers, and HERS raters, all in-house, to help you maximize energy efficient incentives.

We have worked with hundreds of clients, helping to achieve maximum benefit and equating to millions of dollars saved.

Here are just a few examples of ways we’ve helped clients:

- We worked with a townhome complex owner to obtain the 45L credit. The complex was comprised of 56 units and included energy-efficient mechanical systems and building envelopes. By gathering the necessary information and completing the certification, the client received over $104,000 in credits on their current-year tax return; the maximum credit allowable would have been $112,000 (56 units x $2,000/unit), had the remaining units been occupied.

- We worked with a manufacturing company to obtain the Section 179D deduction. The manufacturing facility underwent a 183,000 square foot expansion, which included installation of both energy efficient HVAC and lighting. By gathering the necessary information and completing the certification, the client received over $325,000 in deductions on their current year tax return.

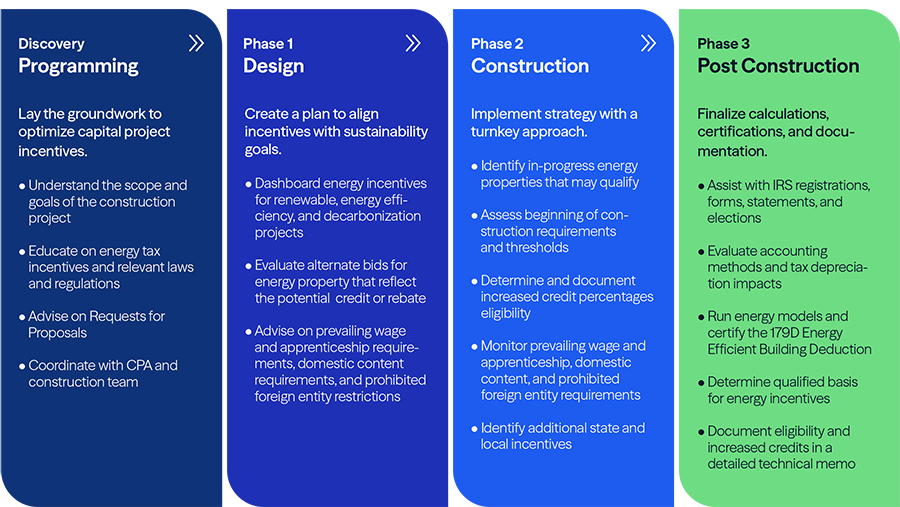

Our Strategic Relationship Framework

Learn More

Learn MoreWhich tax credit or deduction is right for you?

What We Offer

The changes with the Inflation Reduction Act have made this a prime time for businesses, exempt organizations, and nonprofits to take advantage of energy efficient and renewable savings. Our services include:

Changes to Section 48, The Investment Tax Credit (ITC)

Energy Efficiency Deduction (Section 179D)

Energy Efficient Retrofit Study

Energy Incentive Consulting

New Energy Efficient Home Credit (Section 45L)

Other Available Incentives & Renewables

Get started with your energy efficiency tax credits and deductions today.

Energy Incentives Leadership

Kristin GustafsonPE, CEM, BEMP, LEED AP

Principal/Sustainability & Energy Incentives