Key Takeaways

- Trump suit "Legally unsound."

- Former IRS Execs file to intervene in $10B privacy claim.

- Second judge bars IRS - ICE data sharing on privacy law grounds.

- Trump civil service changes and IRS recruiting.

- For individual filers, "patience matters more than ever."

- Tax refunds a "sugar high."

- Bostonian of the Year for 2020 sentenced for fraud.

- Chocolate Day and National Toothache Day.

Webinar Alert! Tomorrow at 2:00 p.m. Central Time, tune in to What Comes Next: Planning to Prosper in Times of Transition, on dealing with turning points in a business. One hour of CPE is available, no charge. Register here.

Trump $10B Suit Against IRS "Legally Unsound;" Former IRS Officials Ask to Intervene

Trump's $10B Tax Leak Suit Legally Unsound, Ex-Officials Say - Asha Glover, Law360 Tax Authority ($):

Trump's complaint seeks at least $10 billion in damages based on a theory that he is entitled to $1,000 in damages for every time a New York Times or ProPublica report about the tax returns was viewed, the former officials and two organizations said in an amicus brief filed Thursday. That allegation is plainly flawed because it means Trump estimates there were 10 million unauthorized disclosures of his returns, said the officials, including former Internal Revenue Commissioner John Koskinen and former National Taxpayer Advocate Nina Olson.

In fact, the group said, Trump has no right to punitive damages because his suit fails to show any actual damages.

Former Tax Officials Raise Ethics Alarm on Trump’s IRS Lawsuit - Erin Schilling, Bloomberg ($):

...

Former IRS Commissioner John Koskinen, former Department of Justice Tax Division Assistant Attorney General Kathryn Keneally, former National Taxpayer Advocate Nina Olson, and former DOJ Tax Division Appellate Chief Gil Rothenberg are on the brief. Two government watchdog nonprofits, Common Cause and Project On Government Oversight, also joined.

The officials said the court should consider issuing an order showing why the case shouldn’t be stayed until Trump leaves office, appointing amici who have expertise in government power separation and tax law, and allow the amici to participate in hearings.

Attorneys Sound Alarm Over Trump’s $10 Billion IRS Lawsuit - Mary Katherine Browne, Tax Notes ($):

Since Trump filed a lawsuit against the very branch of government he is in charge of, tax professionals have expressed incredulity and concern over the consequences of the unprecedented case.

“The president can’t credibly promise to recuse himself from any decisions relating to the case. He spent much of his first term complaining about recusals in that case. . . . This case will be handled by people who were directly subordinate to him and must please him,” David A. Super of Georgetown Law told Tax Notes. “He’s essentially suing himself for his own negligence. I didn’t teach a very good class last Tuesday. Maybe I should sue myself for negligent teaching that harmed my reputation.”

Another Court Rules Against IRS Immigrant Data Sharing

Second Judge Says IRS Can't Share Address Data With ICE - Ganesh Setty, Law360 Tax Authority ($):

After a D.C. federal court blocked the IRS from sharing address information in November, Massachusetts U.S. District Judge Indira Talwani's Thursday order not only agreed with the D.C. court's rationale but also further barred ICE from accessing the 47,000 addresses it's already obtained. ICE's enforcement arm doesn't appear "organizationally capable" of separating address data meant for criminal proceedings versus broader civil enforcement matters, she said.

"Instead of initiating a criminal investigation, determining that prosecution requires a taxpayer's return information, and requesting such information from the IRS, ICE requested taxpayer addresses and then attempted to ascertain which of those taxpayers may have potentially violated a criminal statute," Judge Talwani said.

The taxpayer privacy code section at issue here is the same one whose violation triggered the President's $10 billion lawsuit.

IRS Recruiting Civil Service Protections

Personnel Rule’s Impact on IRS Hinges on Implementation - Benjamin Valdez, Tax Notes ($):

The final rule, published February 5 by the Office of Personnel Management, gives agencies the green light to move staff into a new service category to “quickly remove employees from critical positions who engage in misconduct, perform poorly, or obstruct the democratic process by intentionally subverting Presidential directives.”

While the rule is meant to remove civil service protections for employees in “policy-influencing” roles, the size of that umbrella has been left up to OPM, which is responsible for vetting agencies’ requests for recategorizing employees.

IRS Hiring Efforts Likely Stymied in Trump’s Worker Firing Rule - Erin Schilling, Bloomberg ($):

“With trust in the IRS already at very low levels, this change can only make things worse—making the IRS a ping-pong ball, being whipped back and forth between whichever party is in charge of the Executive Branch,” Nina Olson, former Taxpayer Advocate who’s now executive director of the Center for Taxpayer Rights, said in an email.

The IRS already has faced trouble hiring for the 2026 filing season, onboarding more than 1,000 fewer employees than its goal, according to the Treasury Inspector General for Tax Administration.

Tax Season, IRS Processes, and You

IRS Cuts Could Complicate Tax Time. Here’s How to Avoid Snags. - Ashlea Ebeling, Wall Street Journal:

...

Get an Identity Protection Personal Identification Number. The IRS can issue you an IP PIN, and more than 10 million taxpayers have one. (I’m one of them, and the process took me just a few minutes online.) You’ll need to include your six-digit IP PIN when you file your return.

You get a new number each year. “It’s like adding multifactor protection to your return,” said Tom O’Saben, director of government relations at the National Association for Tax Professionals, a trade group.

You can get one through your IRS Individual Online Account. If you don't have one, you should, and they are not difficult to set up.

How To Pay Less And Stay Safe As The Tax Code Changes And The IRS Crumbles - Kelly Phillips Erb, Forbes:

My advice to taxpayers? Accuracy matters more than speed, and patience matters more than ever. The system still works best for straightforward, 100% correct returns—and it’s much less forgiving if yours isn’t. (Filing for an automatic extension if you can’t make the April 15th deadline, is a better option than getting your 1040 wrong.)

How AI Can, and Can’t, Help With Your Taxes This Year - Laura Saunders, Wall Street Journal ($):

Does that mean AI can do your taxes for you? Generally, no.

Sure, some people may be trying it—but you’re taking lots of risks if you do. And AI can’t file your taxes with the IRS, at least not yet.

Capitol Hill Recap: Budgets, Congress and Tax Filing Season - Alex Parker, Eide Bailly:

For instance, for the Internal Revenue Service, the good news this week is that the agency, and all of the Department of the Treasury, is funded through September, after Congress enacted a spending bill for most of the government on Tuesday. Following a short technical shutdown over the weekend and Monday—which did not affect the agency's workers or services—they won't need to worry about appropriations for the next half-year.

The bad news? The spending bill also included an $11.7 billion cut in the funding originally provided to the IRS for operations support by the 2022 Inflation Reduction Act. (That's more than the overall annual IRS budget of $11.2 billion, which was also cut 10% by the bill.)

Tax Refunds a Mere "Sugar High?"

‘The sugar high will be short lived’: Trump’s big bet on tax refunds might not pay off - Megan Messerly and Sam Sutton, Politico:

While Trump and his top advisers have been banking on the refunds as a pocketbook proof point — a moment when voters would finally feel the economy turning in their favor — those skeptics caution that the money could be quickly swallowed up by stubbornly high prices elsewhere.

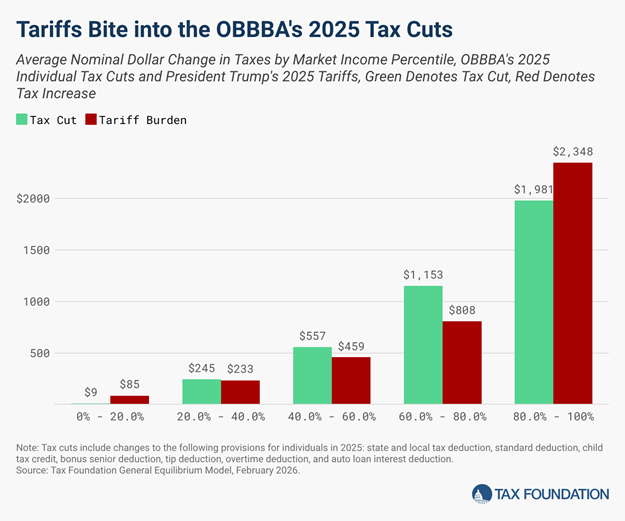

Tariffs Bite into Tax Refunds - Erica York, Supernormal Returns:

State Tax Conformity and Divergence

The State Conformity Puzzle: Updates, Trends, and Legislative Outlook - Melissa Menter and Colette Sutton, Eide Bailly: "Life would certainly be simpler for everyone if states just conformed, but there’s more at stake than simplicity. Unlike the federal government, states must balance their budgets, so a federal change enacted after a state has passed its budget can create significant budget problems."

The State Income Tax Divergence - Jared Walczak, Tax Policy Blog:

Two decades ago, 21 states had top rates between 5 and 7 percent. Today, there are 12. In 2006, 15 states had rates below 5 percent (including those with no tax on wage income); now it’s 26. In 2006, only one state had a double-digit top rate, whereas six do today—a count that could increase under pending legislation.

Blogs and Bits

Place your Super Bowl prop bets, and pay tax on any that pay off - Kay Bell, Don't Mess With Taxes. "They include such game minutiae, such as which team will score first, which player will catch the first touchdown pass, whether a team’s star player will catch or run for a specific number of yards, or what will be the longest field goal kicked."

Tax Court: Taxpayer Made a Bargain Sale, But At an Amount Less Than Deducted - Parker Tax Pro Library. "In so holding, the court rejected the IRS's assertion that the owner was not eligible for a charitable deduction because he did not relinquish dominion and control over the S corporations, submit qualified appraisals, or otherwise make gifts."

'Billionaire' Tax is a Bait-and-Switch To Gouge the Middle Class - Laura Williams, Reason. "From 1914 through 1917, Congress expanded the pool of taxpayers from fewer than 400,000 to 3.5 million and doubled the tax rate on the lowest eligible incomes. The top bracket, who'd been told they would pay only 3 percent, paid an effective rate 5 times that high."

2020 Must Have Been a Rough Year For Boston

Former Bostonian of the Year sentenced for fraud - IRS (Defendant name omitted, emphasis added):

In September 2025, Defendant pleaded guilty to 18 counts: three counts of wire fraud conspiracy; 10 counts of wire fraud; one count of mail fraud; two counts of filing false tax returns; and two counts of failing to file tax returns. In March 2023, Defendant was charged along with her co-conspirator and late husband Clark Grant in a 27-count superseding indictment. Clark Grant’s charges were dismissed in May 2023 due to his death. Defendant and Clark Grant had previously been charged in an 18-count indictment in March 2022.

In 2020, Defendant was lauded as a Bostonian of the Year and social justice advocate, recognized for being a “voice for the community” and social justice advocate.

What was this voice for the community up to?

From 2017 through at least 2020, Defendant represented herself as an uncompensated VIB director to donors and other charitable institutions when, in reality, she and her late husband agreed to utilize their control over VIB’s accounts and funds to pay for personal expenditures through cash withdrawals, cashed checks, wire transfers to personal bank accounts and debit purchases. Defendant also applied for, and certified the applications for, grants offered by public and private entities that included materially false representations. For example, Defendant conspired to use VIB to defraud the Boston Resiliency Fund (BRF), a charitable fund established by the City of Boston to provide aid to Boston residents during the COVID-19 pandemic. After receiving approximately $53,977 in pandemic relief funds, Defendant withdrew approximately $30,000 in cash from the VIB bank account, made deposits of $5,200 and $1,000 into her personal checking account, and made payments on her personal auto loan and car insurance policy. Defendant did not disclose any of these personal expenses to BRF and, instead, falsely reported to BRF that all of its grant funds had been appropriately expended.

Needless to say, these aren't things that officers of exempt organizations get to do.

Related: Eide Bailly Exempt Organization Tax Services; Eide Bailly Fraud Prevention and Detection Services.

What day is it?

It's Chocolate Day! Or National Toothache Day, for those who observe.

Make a habit of sustained success.