Key Takeaways

- 2026 State Tax Competitiveness

-

States to Get Aggressive with Audits

-

Taxpayers to Rely on State Uniformity in State Challenges

-

California Looks to Raise Taxes on High Earners

-

Growth Opportunities with California Competes Program

Welcome to this edition of our roundup of state tax developments. The State Tax News and Views is published biweekly. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance and incentive needs.

Happy New Year from the SALT Team at Eide Bailly!

Colette Sutton, Eide Bailly

Before we look ahead, let’s take a quick look back at 2025 and the major developments that shaped the SALT environment:

- Income Tax Cuts Accelerate: Many states—except California and Minnesota—continued their race to lower individual income tax rates, with several moving toward flat tax structures.

- Federal Reform Ripple Effect: The One Big Beautiful Bill Act made many TCJA provisions permanent and introduced new deductions. States responded differently based on their conformity approach, creating varied impacts on taxable income. (Related: State Income Tax Impacts of the One Big Beautiful Bill)

- Corporate Tax Changes: Numerous states reduced corporate income tax rates and adopted first-year expensing provisions to encourage investment, while adjusting apportionment and sourcing rules—adding complexity for multistate businesses. (Related: California Finalizes Market-Based Sourcing Changes)

- Sales Tax Expansion: States broadened their sales tax bases to include more services and digital goods. (Related: Washington’s B&O Tax and the Evolving Treatment of Investment Income)

- Nexus and PL 86-272: States like New Jersey and New York narrowed protections for remote sellers, while California’s attempt failed procedurally—underscoring the need for businesses to review online activities.

- Notable Court Decisions: California courts upheld Los Angeles' mansion tax; affirming its constitutionality. (See: California Appeals Court Upholds Los Angeles Transfer Tax)

- Audit Environment: IRS staffing cuts pushed states to recruit former IRS employees, signaling a shift in enforcement dynamics.

What’s on the Horizon for 2026?

We expect these themes to continue, with added focus on:

- More Income Tax Reductions: Effective January 1, 2026, states like Indiana, Kentucky, Mississippi, Montana, Nebraska, North Carolina, Ohio, and Oklahoma are lowering individual income tax rates.

- Tax Base Expansion & Digital Economy: Expect continued efforts to tax more services and digital transactions, such as those enacted by Washington. (Related: Washington State Expands Sales Tax to Tech and Digital Services)

- Revenue Pressures & Enforcement: Slower revenue growth may lead to defensive budgets, aggressive audits, and increased litigation over constitutional limits on state taxing authority.

- SALT Deduction Changes: The cap temporarily rises from $10,000 to $40,400 for 2026 under the One Big Beautiful Bill Act, with phase-outs for high-income taxpayers—impacting planning for residents in high-tax states.

- Federal Conformity Debates: Ongoing discussions around the One Big Beautiful Bill Act could influence state tax bases and apportionment rules.

Throughout the year, we’ll dive deeper into these issues to keep you informed and prepared.

State Tax Issues to Keep an Eye Out for in 2026

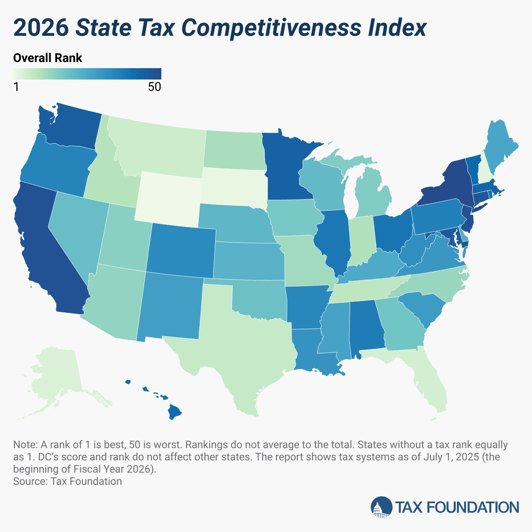

2026 State Tax Competitiveness Index - Janelle Fritts, Jared Walczak, Abir Mandal, and Katherine Loughead, Tax Foundation:

The 10 best states in this year’s Index are:

1. Wyoming

Planning for Aggressive Audits in the Wake of Budget Shortfalls - Craig B. Fields and Melanie L. Lee, Tax Notes ($):

In addition to cutting services and increasing taxes, jurisdictions also work to plug their budget shortfalls by increasing audit activities. In 2026 this task will be easier thanks to a large influx of former IRS auditors who recently joined state and local revenue agencies.

State Tax Changes Taking Effect January 1, 2026 - Nicole Fox and Jacob Macumber-Rosin, Tax Foundation:

Excise Taxes Cannot Replace Property Taxes - Adam Hoffer, Tax Foundation:

[...]

Even though property taxes serve as a relatively effective tax, they remain unpopular. Policy alternatives to property taxes carry tradeoffs, some far worse than others. Perhaps the biggest hurdle to shrinking property tax collections or eliminating them altogether, though, is that there isn’t a great replacement revenue source.

Uniformity, Internet Freedom to Dominate 2026 State Tax Cases - Perry Cooper, Bloomberg Tax ($):

Although arguments relying on state uniformity clauses and federal protections for internet commerce and doing business in other states aren’t new, they’re being used more frequently. And more challenges could be filed before states have a chance to enforce new regulations and statutes.

CALIFORNIA

Florida Gets Support for SCOTUS Lawsuit Over California Tax Reg - Perry Cooper, Bloomberg Tax ($):

The briefs support Florida’s October motion for leave to file a bill of complaint challenging a California Franchise Tax Board rule requiring businesses to exclude proceeds from “substantial and occasional” sales from their state tax returns. Excluding out-of-state sales allows California to tax profits earned elsewhere in violation of the US Constitution’s commerce, import-export, and due process clauses, Florida argued.

Taxes, AI Top California Lawmakers' Plans in Newsom's Final Year - Andrew Oxford, Casey Murray, and Titus Wu, Bloomberg Tax ($):

The state’s finances are likely to dominate the first half of the year at the state capitol. Newsom is set to propose a budget this week, which will kick off months of negotiations over a spending plan formally due by mid-June. California’s current fiscal year budget totals about $321 billion.

NEW JERSEY

Biz Group Asks NJ Court To Nix Tax Rule On Internet Activities - Paul Williams, Law360 ($):

The state Division of Taxation's rule that was adopted in June violated P.L. 86-272 by considering certain activities offered through online means to be in-state, while similar offerings conducted without the internet are considered out-of-state activities, the American Catalog Mailers Association argued in a motion for summary judgment.

SEASONED WITH SALT

Tax Tips, Tricks and Opportunities

Growth Opportunities with Credits and Incentives - Matt Carlson, Eide Bailly

With the start of the new year, many businesses are looking at ways to maximize their investments and reduce costs while still achieving goals related to growth and expansion objectives, especially in a state like California.

One of the ways to do so is with the California Competes Program. This program was designed to help support growing businesses by offering tax credits/incentives that can be utilized in various ways. For example, we recently helped a growing manufacturer establish $3,000,000 in credit allocations over the next 5 years, all of which are tied to their upcoming investment and hiring plans. This program has three application periods per year and is a competitive program with not all projects getting approved, so it’s crucial to be proactive and make sure that all of the process is followed to maximize the incentives available.

Our team is experienced in guiding clients through this and other programs nationwide. If your business anticipates growth in the next 2–3 years, we invite you to discuss the opportunities available.

Make a habit of sustained success.