Key Takeaways

- Colorado's Special Legislative Session yields new tax laws

- Texts are telemarketing in Texas

- The state can use alternative apportionment in Minnesota

- Washington expands taxation of services beginning October 1

- Other developments in California, Hawaii, Indiana and New York

Welcome to this edition of our roundup of state tax developments. The State Tax News and Views is published biweekly. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance and incentive needs.

Rethinking Rolling Conformity - Tyler P. Johnson, Tax Notes ($):

This article argues that rolling conformity is not just a technical choice; it’s a policy lever with real fiscal consequences.

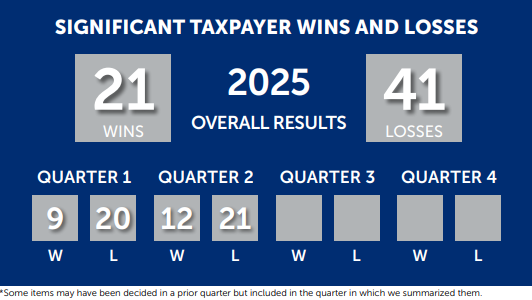

Scoreboard - Q2 2025 - Tax Notes ($):

Experts say it’s an important question for the California Department of Tax and Fee Administration (CDTFA) and other state tax departments to consider as they roll out generative AI.

[...]

Academics and attorneys are concerned that customer service agents using generative AI solutions for taxpayer queries might miss errors in its outputs and provide the incorrect information to taxpayers. Responses from the CDTFA suggest that taxpayers can only challenge incorrect information provided by generative AI if the advice was given in writing

State And Local Tax Takeaways From August - Maria Koklanaris, Law360 ($):

State-By-State Roundup

California

Tax Pros Await Newly Empowered California Tribunal's Next Moves - Casey Murray, Bloomberg Tax ($):

The office’s reach could expand under an opinion issued last month by state Attorney General Rob Bonta that affirmed its ability to strike down regulations issued by the state’s two other tax agencies. The decision had been awaited for more than two years after the office, which is scheduled to deliver its monthly batch of opinions on Tuesday, asked the attorney general in a June 2023 letter to weigh in on its authority.

Colorado

Colorado's Special Legislative Session Yields New Tax Laws - Melissa Menter, Eide Bailly:

H.B. 25B-1001 indefinitely extends the state's current addback of the 20% federal qualified business income deduction. The addback was previously scheduled to sunset at the end of 2025.

H.B. 25B-1002 creates an addback for the federal deduction for foreign-derived deduction eligible income (FDDEI), and, as of January 1, 2026, adds Hong Kong, Ireland, Liechtenstein, Netherlands, and Singapore to the list of foreign countries that are considered to be tax havens.

H.B. 25B-1003 eliminates the reduced insurance premium rate charged to insurance companies with a home office or regional home office in Colorado, restoring the regular 2% rate for those companies.

H.B. 25B-1004 authorizes the Department of the Treasury to sell nonrefundable insurance premium tax credits to qualified taxpayers. Such credits will generate revenue in the current fiscal year and be used to offset insurance premium tax liabilities in future years.

H.B. 25B-1005 Eliminates the sales tax vendor fee effective January 1, 2026. Under the sales tax vendor fee, retailers with total taxable sales of $1 million or less in a given filing period could retain a portion of the sales taxes they collected to cover their expenses in collecting and remitting the tax.

Hawaii

Hawaii Transient Tax Is Unconstitutional, Cruise Cos. Say - Jacqueline McCool, Law360 ($):

In a complaint filed Wednesday, Cruise Lines International Association Inc., Honolulu Ship Supply Co., Kaua'i Kilohana Partners and Aloha Anuenue Tours LLC allege that Hawaii violated the Constitution when it extended the state's transient accommodation tax to cruise ship passengers. The cruise companies said imposing the tax on cruise customers conflicts with the Constitution's tonnage clause and violates the federal Rivers and Harbors Appropriation Act of 1884 and the First Amendment.

Indiana

Indiana DOR Rules Generative AI Chatbot Not Subject to Sales Tax - Emily Hollingsworth, Tax Notes ($):

Revenue Ruling No. 2025-02-RST, published in the August 20 Indiana Register, was in reply to an out-of-state company's request for a determination on whether its chatbot service would be subject to the state's 7 percent sales tax.

According to the ruling's statement of facts, the generative AI chatbot “is trained to respond to plain language prompts in a human-like manner” and can assist customers with writing, analysis, coding, and problem solving. Customers can also obtain the chatbot’s application programming interface key “to integrate advanced language understanding and generation capabilities in their own applications,” the ruling said.

Minnesota

Minnesota Supreme Court Finds Alternative Apportionment Was Appropriate - Chris Martin, Eide Bailly:

Taxpayers can also apply for alternative apportionment in Minnesota and should take notice that the Court was open to alternative apportionment arguments when the receipts were qualitatively different from other business receipts and quantitatively distortive to the sales factor. However, taxpayers need to be careful because these are very fact sensitive determinations.

New York

New York Bill Would Tax Digital Asset Sales and Transfers - Emily Hollingsworth, Tax Notes ($):

[. . .]

The tax would be levied at a rate of .2 percent on digital asset transactions. The bill defines digital assets as assets that are issued or transferred using blockchain technology, including "digital currencies, digital coins, digital non-fungible tokens or other similar assets."

Texas

Texts are now Telemarketing in Texas - Melissa Menter, Eide Bailly:

Effective September 1, 2025, under Texas S.B. 140, texts are now considered to be "telephone solicitation" for purposes of Texas' telemarketing regulations. This change may be relevant to many businesses that engage in marketing to Texas consumers via text messages.

Any business soliciting Texas consumers by text must now annually register with the state, pay a $200 fee, follow record-keeping protocols, and post a $10,000 security bond, among other requirements.

Tax Bites: Tips, Tricks and Opportunities in SALT

Washington To Expand Taxation of Services Beginning October 1 - Elizabeth Gray, Eide Bailly:

Washington is only one in a long line of states to review their tax revenue and find it lacking. If you are adding new revenue lines to your current offerings, considering expanding into new states, or hiring remote workers in states where you have previously not had a presence, it is never too early to begin reviewing the often-conflicting state treatments of ‘nexus’ and ‘taxability’.

Reach out to your Eide Bailly SALT team to help you keep you apprised of these changes, and plan ahead for compliance.

Make a habit of sustained success.