Key Takeaways

- State Implications to the One Big Beautiful Bill

- Local Taxes Are Often Overlooked

- Colo. Reacts to OBBB

- Penn. Still Struggles to Find PTET Workaround

Welcome to this edition of our roundup of state tax developments. The State Tax News and Views is published biweekly. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

Webinar Alert: Eide Bailly is hosting a webinar "Annual State and Local Tax Update" on Tuesday, August 12, at 12 p.m. CST. No charge, 1 hour CPE. Register here.

State Tax Implications of the One Big Beautiful Bill Act- Jared Walczak, Tax Foundation:

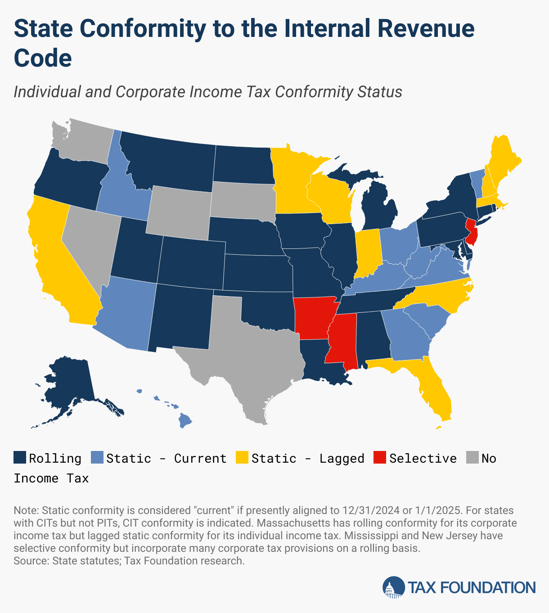

Most states use the IRC as the basis of their own individual and corporate income tax codes, so changes to the federal tax code can adjust state tax codes as well. But all states decouple from certain IRC provisions and modify others, and states vary on how current their alignment with the IRC is. While some states automatically conform to the current version of the federal code, others conform to it as it existed at some earlier date and thus may not bring in the new provisions for quite some time, if ever.

There is a trend of local jurisdictions attempting to craft ordinances with inherently broad standards stipulating that if a company or business has nexus within the state, they automatically have nexus with the local jurisdiction, said Jamie Szal, partner at Brann & Isaacson. She was speaking at the New York University School of Professional Studies' Intermediate State and Local Taxation forum, held in New York City and online.

If a business has no physical presence in a state and doesn't make any sales into a city, the business may nonetheless have nexus with the state because it has a consumer base in another city, Szal said.

New Int'l Tax Rules Heighten Discrimination Worries In States- Paul Williams, Law360 ($):

The budget reconciliation bill's replacement of global intangible low-taxed income with "net CFC tested income" will expand the amount of foreign income that can be subject to state tax without offering the higher amount of foreign tax credits that will be available at the federal level. Tax practitioners suggested that states that follow the new NCTI rules will risk running into more constitutional hurdles than they did when conforming to GILTI.

"Since states don't take into consideration foreign tax credits, their provisions for taxing foreign-sourced income are completely divorced from what's going on at the national level," Karl Frieden, vice president and general counsel at the Council on State Taxation, told Law360. "These were concerns with states' adoption of GILTI, and they're even bigger concerns now."

Related: Major U.S. Tax Reform: Key International Changes

State-By-State Roundup

Arkansas

Arkansas Redefines Texas Franchise Tax as Creditable Income Tax - Bob Johnson, Tax Notes ($):

California

California Tax Appeals Panel Limits “Occasional Sale” Exemption for Dental Practice Sales - Colette Sutton, Eide Bailly:

Between June and September 2018, Coast Dental sold its California dental practices and related equipment through 25 separate contracts with 15 different buyers. While the company argued these were simply steps in one large sale of the business, the California Department of Tax and Fee Administration (CDTFA) determined that only the first two sales qualified for the occasional sale exemption under Revenue and Taxation Code section 6367. The remaining 23 sales were deemed part of a taxable series of substantial transactions requiring a seller’s permit.

Recently, the OTA upheld CDTFA’s position, finding no evidence that the multiple contracts were interdependent or negotiated as part of a single, integrated transaction involving all parties. Intent alone, the OTA said, was not enough to meet the exemption’s requirements.

California Bakery Sales Denied Food Products Exemption - Christopher Jardine, Tax Notes ($):

In Matter of La Baguette LLC, the OTA determined that La Baguette LLC is unable to claim the food products exemption for food items that were sold cold and consumed in seating areas connected to the business. The opinion, dated May 20, was released August 4.

Colorado

Colorado Calls Special Legislative Session to Consider OBBB - Melissa Menter, Eide Bailly LLP:

The Governor has proposed several measures to address the fiscal shortfall including decoupling from select OBBB provisions and allowing the state to sell tax credits to certain taxpayers. Additional proposals include expanding the foreign listed jurisdictions in which a C corporation is presumed to be incorporated for tax avoidance purposes, and adjusting certain sales tax vendor fees. The special session will also address policy concerns related to health care, food security and artificial intelligence.

Massachusetts

Massachusetts DOR Adopts Real Estate Withholding Rule - Tax Notes ($):

Michigan

COST Asks Mich. Justices To OK Nationwide's Unitary Tax Win - Paul Williams, Law360 ($):

The Council on State Taxation backed entities of Nationwide in the Michigan Supreme Court on Wednesday, saying the justices should affirm an appellate court's decision that said the insurance company's affiliates are entitled to file their taxes as a combined group of businesses.

Michigan's tax laws don't explicitly carve out insurance companies from the state's combined filing mandate that applies to a unitary business group, or UBG, COST said in an amicus brief supporting Nationwide Agribusiness Insurance Co. and its affiliates. COST said the state justices should reject the Michigan Department of Treasury's arguments that the state's tax laws treat insurance companies differently from other corporate taxpayers and require each entity to file separate returns.

Oregon

Delta Air Owes Property Tax On Intangibles, Ore. Justices Say - Sanjay Talwani, Law360 ($):

In a unanimous opinion, the high court reversed and remanded an August 2023 Oregon Tax Court ruling that taxing Delta's intangible property in tax year 2019-2020 violated the U.S. and Oregon constitutions. The state justices said the state law mandating taxation of the intangible property owned by businesses subject to central assessment did not violate the uniformity clause of the Oregon Constitution or the equal protection clause of the U.S. Constitution.

Pennsylvania

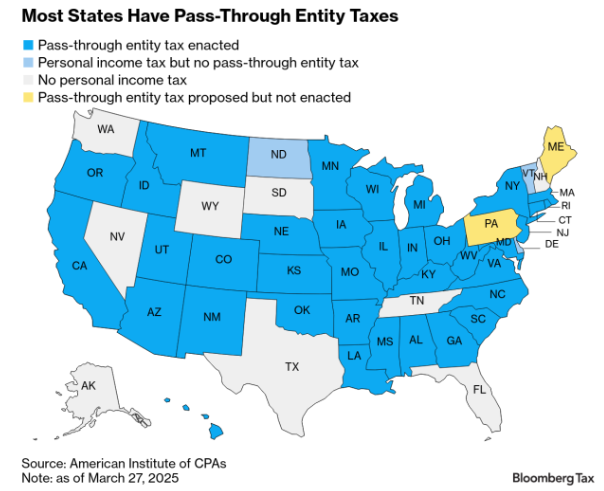

SALT Cap Fix in Pennsylvania Stalled by Tax Complexity, Budget - David Hood, Bloomberg Tax ($):

The stalled work on a SALT cap workaround means Pennsylvania taxpayers will keep waiting for tax relief that is already available in the majority of other states, including all the commonwealth’s neighbors. The new federal tax law President Donald Trump signed in July increased the cap, but didn’t fully negate taxpayers’ interest in a way to bypass it.

Philly Waives Estimated Payments For Formerly Exempt Co.s - Paul Williams, Law360 ($):

Businesses that weren't required to file or pay the tax, the BIRT, in the last three years because they didn't have more than $100,000 in gross receipts won't need to make an estimated payment when they file their first return in 2026, the department said in a statement....

Philadelphia eliminated the BIRT's $100,000 exemption threshold as part of the budget it passed in June amid concerns from city officials that the exemption for small businesses violated Pennsylvania's uniformity clause.

Tennessee

Tennessee Judges Parse Nature of Software in SAP Tax Dispute - Perry Cooper, Bloomberg Tax ($):

Tennessee Commissioner of Revenue David Gerregano wants the court to overturn a 2023 opinion holding that SAP’s software is intangible property that isn’t subject to taxation under the state’s business tax act. The company challenged the department’s $485,000 assessment of tax, interest, and penalties for tax years 2014-2018.

Courts around the country have grappled with how to classify software for tax purposes now that it’s no longer delivered by CD-ROM or floppy disk. Tribunals in Arizona and New York recently held companies responsible for sales tax assessments on software.

Texas

Texas Rules Telehealth Services Are Not Subject to Sales Tax - Colette Sutton, Eide Bailly:

In a Private Letter Ruling, the Texas Comptroller concluded that a company offering telehealth services—including online health questionnaires, medication profiles, educational content, and at-home test kits—is not required to collect sales tax on its Full Access Plan offering.

The taxpayer provides telehealth services focused on gastrointestinal care through a bundled plan sold to employers. The plan includes access to healthcare professionals, proprietary educational content, and test kits provided at no additional charge.

The Comptroller ruled that:

- Telehealth services are not a taxable service under Texas law.

- Educational content (e.g., articles, videos, and webinars) created by the company and included in the plan does not qualify as a taxable “information service.”

- At-home test kits, while tangible personal property, are not sold separately and are used in delivering the nontaxable services. As such, the taxpayer is the end user and should pay sales tax on the purchase of the kits.

This ruling supports the idea that when telehealth services involve professional expertise and are bundled with educational and clinical support, they may not be considered taxable under Texas sales tax law.

Utah

Wyoming Man Liable for Utah Taxes Under State Domicile Law - Caitlin Mullaney, Tax Notes ($):

In a July 25 decision in Tischmak v. Utah State Tax Commission, the Utah Supreme Court upheld state income tax liabilities against Terry Tischmak, who resides in Wyoming but was married to a Utah resident student, rejecting his claim that Utah's domicile statute is unconstitutional.

Eide Bailly's SALT team regularly advises on residency and domicile matters. Don't hesitate to contact the team if you need guidance in this area.

Tax Bites: Tips, Tricks and Opportunities in SALT

Felisha Kernizan, Manager, Eide Bailly:

Wisconsin continues to support its manufacturing sector with one of the most generous tax incentives in the country; the Manufacturing and Agriculture Credit (“MAC”). This credit allows eligible manufacturers to offset up to 7.5% of qualified production income, effectively reducing their state income tax liability to as low as 0.4% for corporations and 0.15% for individuals.

Make a habit of sustained success.