Key Takeaways

- State Impacts to the One Big Beautiful Bill

- Colo. Looks to Exempt Overtime and Tips

- "Small" Win for Small Sellers in Idaho

- Huge Tax Bill for Drop Shipper in Wash.

Welcome to this edition of our roundup of state tax developments. The State Tax News and Views is published biweekly. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

State Revenue Officers Weigh Response to Losses From GOP Tax Law - David Hood, Bloomberg Tax ($):

The tax and domestic spending measure President Donald Trump signed into law earlier this month introduces dozens of tax cuts for individuals and companies that could, in turn, cause a cascade of revenue losses for states, according to early estimates. States could avoid some of these losses by decoupling their code from the federal code.

...

The report shows looming revenue losses that will all but certainly spark conversations about decoupling to save revenue for state programs [...].

Louisiana, Maine, Maryland, and Washington all passed legislation related to taxing digital products and services, Jonathan White, legal counsel for the commission, noted during the group's annual meeting in Salt Lake City. At least half the states tax some portion of the diverse array of digital products in the market, but White said more states are expected to follow as they search for new revenue and consistent tax treatment of tangible and intangible products.

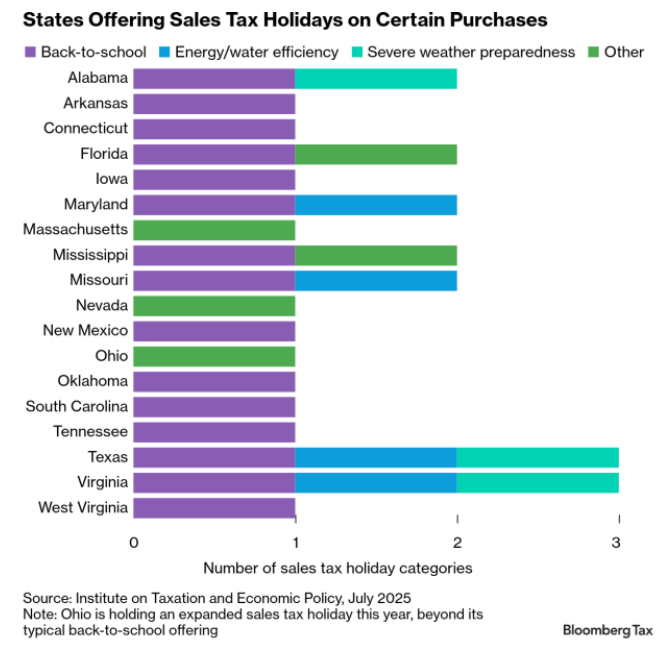

States to Lose $1.3 Billion From Sales Tax Holidays, Report Says- David Hood, Bloomberg Tax ($):

. . .

While sales tax holidays generally offer consumers some relief, they're "poorly targeted" and too short to "meaningfully change the regressive nature of a state's tax system," ITEP [the Institute on Taxation and Economic Policy] said. "If the long-term consequence of sales tax holidays is a higher sales tax rate, low-income taxpayers may ultimately be worse off because of these policies."

Melissa Menter, Eide Bailly: Not only are they of questionable value, sales tax holidays, which are sometimes finalized mere weeks before the holiday takes place, can be burdensome both financially and procedurally for small businesses.

State-By-State Roundup

Colorado

Colorado Ballot Item Would Exempt Overtime and Tips - Emily Hollingsworth, Tax Notes ($):

Initiative No. 119 would amend Colo. Rev. Stat. section 39-22-104 to exclude tips and overtime compensation from state taxable income. According to the Colorado General Assembly, the ballot item is scheduled for a comment hearing on July 22.

Connecticut

Connecticut Provides Credit for Employer Convenience Challenges - Matthew Pertz, Tax Notes ($):

...

Modeled after New Jersey’s remote worker credit, S.B. 1558 will provide a 60 percent income tax credit to residents who successfully sue another state for incorrectly withheld income taxes under that state’s convenience of the employer rule. The bill also waives interest and penalties on past-due tax payments that are late due to the taxpayer receiving a refund from another state that enforces the convenience of the employer rule.

Idaho

Starting July 1, 2025, Idaho's New Tax Rule Could Save Small Sellers Time and Paperwork - Colette Sutton, Eide Bailly LLP:

However, the exemption does not apply to the sale of items such as motor vehicles, alcohol, tobacco, lodging, or entertainment. And if your total sales go over $5,000 in the current or previous year, you’re required to get a permit, start collecting tax, and send it to the state — no exceptions.

Even if you’re exempt, you must still pay tax on the items and materials you purchase, keep records if sales exceed $3,000, and report all income on your tax return. Selling at an event? You'll still need to register with the event promoter — just mark yourself as a “small seller.”

In short: if you're a small Idaho-based seller keeping things casual and under $5K, this new rule could save you a lot of hassle. Just make sure you’re playing by the rules.

Maryland

Maryland Comptroller Issues Update on Digital Ad Tax - Kennedy Wahrmund, Tax Notes ($):

Technical Bulletin No. 59, published July 15 and effective July 11, outlines the types of digital advertising revenue that are subject to the digital advertising gross revenues tax.

. . .

The bulletin also summarizes recent legislative changes to the tax. Companion bills signed into law in 2024 (H.B. 455 and S.B. 677) require taxpayers to electronically file annual and quarterly digital ad tax revenue forms for tax periods beginning on or after December 31, 2026.

New Hampshire

New Hampshire Enacts Amnesty Program - Melissa Menter, Eide Bailly LLP:

New Hampshire Governor Kelly Ayotte signed HB 2 into law, which includes a provision for a general tax amnesty. The amnesty will apply to all "unpaid taxes reported and paid in full between December 1, 2025 and February 15, 2026, regardless of whether previously assessed." This program will relieve taxpayers from the "assessment or payment of all penalties and interest exceeding 50 percent of the applicable interest." Taxpayers with outstanding tax liabilities in New Hampshire should seriously consider participating in this program as the bill specifically mentions that a failure to participate will be a consideration in any future abatement requests whether for good cause or any other reason.

Texas

Texas Offers Tax Extensions for Businesses, Property Owners Affected by Flooding - Colette Sutton, Eide Bailly LLP:

Additionally, property owners in disaster-declared areas may qualify for a temporary reduction in their property's appraised value if the property has sustained at least 15% damage. To receive this exemption, they must apply within 105 days of the disaster declaration.

Taxpayers are encouraged to check the governor’s website for the most current disaster proclamations and updates.

Washington

Washington Pilots Sales Tax Settlements for Foreign Retailers - Michael J. Bologna, Bloomberg Tax ($):

Bryan Kelly, regional audit manager at Washington’s Department of Revenue, previewed his state’s temporary voluntary disclosure agreement program for foreign remote sellers, which will launch on Feb. 1, 2026. Kelly offered few details of the program, but said it would include a one year “look-back period,” meaning sellers would only be required to pay off liabilities going back a single year. Most states’ disclosure programs cover periods between three and five years.

The pilot effort Kelly laid out Monday could have implications for other states that have struggled to get delinquent online retailers to settle their outstanding liabilities and come into compliance with state laws enacted in response to the Supreme Court’s 2018 Wayfair ruling, which permitted states to require out-of-state retailers to collect and remit sales taxes.

Drop Shipper's Sales Were Properly Sourced, Washington Court Says - Christopher Jardine, Tax Notes ($):

In its July 22 decision in Synnex Corp. v. Washington Department of Revenue, the Washington Court of Appeals, Division II, affirmed a lower court’s order denying the company declaratory relief regarding a department rule under which wholesale sellers are subject to B&O tax when the customer receiving the property is located in Washington. The court held that the department did not exceed its statutory authority in enacting the rule.

Tax Bites: Tips, Tricks and Opportunities in SALT

Todd Folle, Manager, Eide Bailly:

Make a habit of sustained success.